Pros And Cons Of A Sole Proprietorship

One of the most significant benefits of making your business a sole proprietorship is simplicity. Its relatively quick and inexpensive to start your business officially. You can also avoid the bureaucracy and negotiation of corporate ownership. Whatever you want to do with your business, the power is in your hands to decide and make it happen.

Itll also be simpler to file your tax return with a sole proprietorship. You dont have to file anything extra for your business outside of your personal return. It would be best if you still were sure to keep a record of your expenses and income so that you claim corresponding business deductions on your tax return.

The most obvious downside of a sole proprietorship is the liability. The business doesnt exist apart from you as an individual, so if your business goes into debt, you go into debt. If someone sues your business, theyre suing you directly. LLCs and other corporation types give you some degree of protection from financial and legal risk.

Why Sole Proprietorship Is Popular Causes Of Popularity Of Sole Proprietorship

Sole proprietorship appears as the most common form of business owners because of the ease of formation and the relatively low cost with which it can be formed.

It is because:-

- Risk.

- Strategy.

Companies that dont formally organize as another type of business entity will automatically be treated as a sole proprietorship.

Can I Pay Myself A Salary As A Sole Proprietor

In theory, yes. But it wont make a difference in how youre taxed. As a sole proprietor, all of your businesss income is considered your personal income. So even if you had a separate business bank account that you drew a salary from, all of the money your business madenot just the salary youre choosing to withdrawwould be taxed as your personal income.

Recommended Reading: What Is A Federal Tax Credit For Solar

When To Consider Converting A Sole Proprietorship To An Llc

Some business owners love the flexibility and ease of a sole proprietorship. However, as your business grows, you might want to share the management, bring on investors, or limit the risk to your own personal finances. In this case, the logical next step may be to become a limited liability company. Becoming an LLC requires the business owner to register with the state and become an incorporated business.

An LLC is a separate legal entity from its owner. This distinction separates the business from your own personal finances and can have many advantages, including:

- Eliminating personal liability. Your personal finances are safe from lawsuits, debts, or other claims against your business.

- Sharing management. Most businesses with more than one owner cannot be a sole proprietorship and are automatically considered a general partnership where all owners are personally liable. Consider an LLC or LLP if you want your business to exist as a separate entity and eliminate all personal liability.

- Adding investors. It is impossible to bring on investors with a sole proprietorship.

Choose A Business Name

To begin, you need to come up with a business name. Brainstorm a few different names that are unique and succinctly describe your business. You can also have your business name be the same as your personal namewell discuss more in the next section.

Once you have some business name ideas, check the United States Patent and Trademark Office to see if theyre available. Once you find an available business name you like, you can move onto registering your business name.

Read Also: How Many Solar Panels Can I Have On My Roof

Does Your Business Name Need To Be Registered

State regulation of LLCs include required words which must be included in an LLC namefor example, “LLC” or “limited liability company” might be required at the end of an LLC’s name. Registering your LLC does give your name protection within your state.

Sole proprietors don’t face the same requirements. However, if the business owner plans on operating under a company name, instead of under their own name, they will need to register for a “fictitious business name,” or DBA , in their home state.

Sole Proprietor Vs Single

New entrepreneurs have a long list of to-dos when starting their businesses. Among the tasks to check off that list is deciding their business structure. For small businesses with a sole owner and no employees, the two most popular options are:

- Sole proprietorship

- Single-member LLC

So, which one might be the best choice for your business?

I advise you to consider talking with an attorney and accountant to dig into the advantages and disadvantages of each for your specific situation.

Recommended Reading: Are Solar Panels Cost Effective

How A Sole Proprietor And Single

Establishing the Business

Sole ProprietorBy default, a business owned by a solo individual will be regarded as a sole proprietorship. When entrepreneurs include their first and last names in the business name , they dont have to register their name with the state. If they choose to use a fictitious name Some states also require that business owners run advertisements in a local and/or a legal newspaper to inform the public of the person who is responsible for the business operating under the fictitious name.

Single-member LLCDocumentation called Articles of Organization are required by the state when forming an LLC. In most states, the form is relatively simple, but to make sure youre completing it accurately, you can gain peace of mind by talking with an attorney or asking an online document filing service to assist you. When registering an LLC, the business name is automatically registered, as well, so theres no need to file for a fictitious name.

BothRegardless of the business structure, certain requirements are the same for sole proprietors and single-member LLCs. For example:

- Obtaining an EIN to open a business bank account

- Applying for any necessary licenses and permits

- Withholding payroll taxes from employees wages or salaries

Personal Liability

Income Tax Treatment

Ongoing Business Compliance

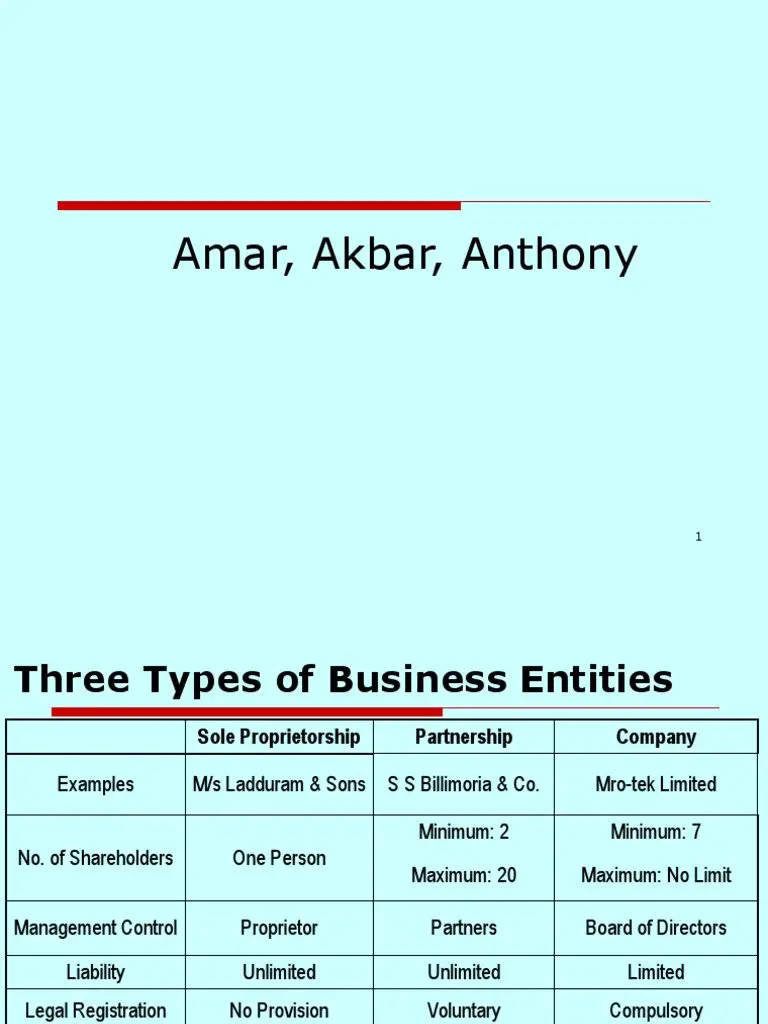

Sole Proprietorship Vs Partnership Key Differences

The key difference between Sole Proprietorship and Partnership are as follows

Don’t Miss: How To Connect Bluetooth To Sole Treadmill

Which Is Better: An Llc Or A Sole Proprietorship

For liability purposes, an LLC is better than a sole proprietorship. The limited liability company provides you, as the business owner, with limited personal liability. Meaning your liability is limited to your investment in the company. Your personal assets are off-limits to company creditors. Its unlike a sole proprietorship when you enjoy no liability protections. Your company and your personal assets are all at risk.

What About Personal Liability Protection

With an LLC, your personal assets are considered hands-off when it comes to business debt collection or other claims if your company is sued. In most cases, creditors can’t touch your home, car, or personal bank accounts.

In a sole proprietorship, there is no separation between you and the business. You are entitled to all of the profits, along with all of the debts and obligations. You can even be held responsible for liabilities caused by your employees.

Recommended Reading: How Does Pool Solar Work

Pros And Cons Of Incorporation

When you incorporate your business, youre creating a separate legal entity. And one of the biggest advantages is the liability protection that comes with this.

When you incorporate, youre not held personally responsible for any debts or lawsuits incurred by the business. If any legal claims are brought up against the business, then youre not personally responsible for them.

When you incorporate your business, you may be taken more seriously as a business owner. Incorporating can also make it easier to apply for business financing in the future.

However, theres a lot of work that comes with incorporating your business. You have to file your articles of incorporation, hold shareholders meetings and track corporate minutes. If youre a new business owner, you may not be ready to commit to all of that.

Reasons For Survival Of Sole Proprietorship Why Most Small Scale Firms By Sole Proprietors Is Thriving

A sole proprietorship is considered as the seedbed of large scale enterprise.

In addition to that proprietorship is surviving along with medium and giant joint effort due to the following reasons:-

- Close supervision.

- The economy in the management.

- Close contact with customers.

- Greater adaptability to Changes.

Read Also: What Is The Best Retirement Plan For A Sole Proprietor

Capital Requirements Of A Sole Proprietorship

The ability to raise capital for a business is limited by the nature of the business organization. The immediate and long-term financial needs of a business are very important factors in selecting a business organization. Sole proprietorships are the most limiting form of business organization in terms of raising capital. The principal source of capital is the proprietor’s personal wealth or personal credit-worthiness for borrowing purposes.

What Is A Limited Partnership

- A partnership composed of both general and limited partners.

- This type of partnership allows each partner to determine and/or limit his or her personal liability.

- Unlike general partners, limited partners are not responsible for the partnerships actions, debts and obligations.

- General partners have the right to manage the business. Limited partners do not.

- Both general and limited partners benefit from the businesss profits.

- Contact an attorney or an accountant to determine if this structure works for you.

Don’t Miss: Can You Run Pool Pump With Solar Cover On

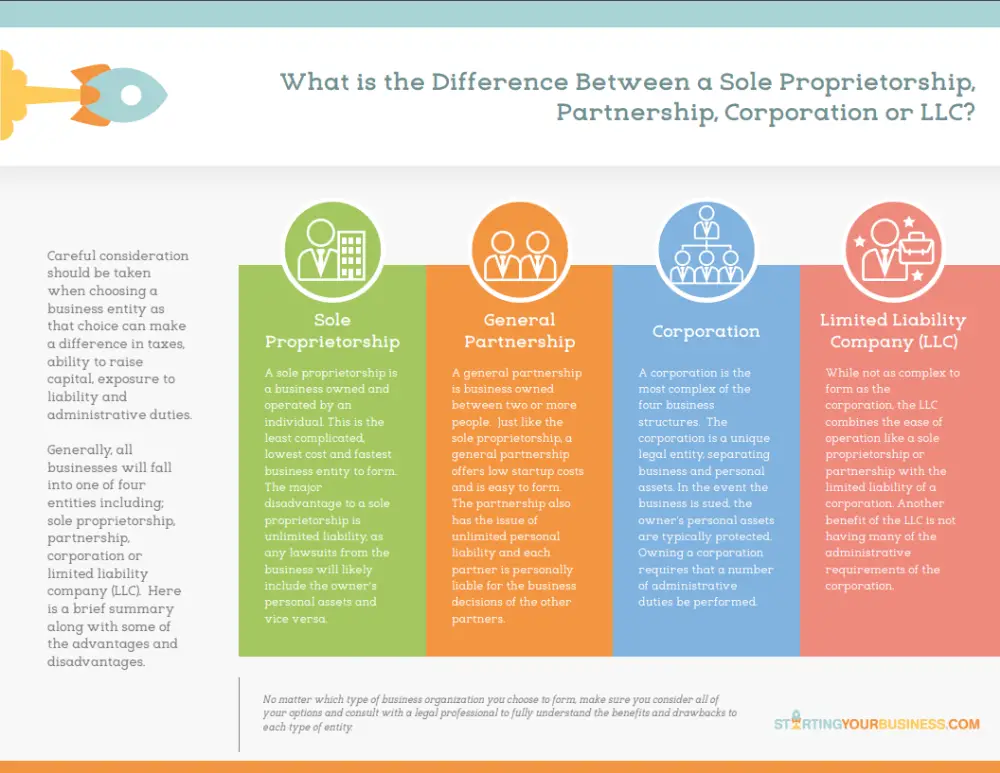

What Is A Limited Liability Company

- A limited liability company is similar to a corporation, but with slight differences.

- Like a corporation, it offers limited personal liability.

- An LLC is not required to hold regular stockholder or management meetings, and there are no requirements to comply with other corporate formalities.

- Contact an attorney or an accountant to determine if this structure works for you.

Get One Step Closer To Being Your Own Boss

Once you know how to start a sole proprietorship, youll discover its an affordable and relatively easy way to launch your own business. There are few barriers to entry and it allows you to truly be your own boss. However, it does come with some risks, like being vulnerable to unlimited liability.

Determine if a sole proprietorship is the right fit for your business endeavor. When youre ready to move forward, check out these six questions to ask yourself when starting a business.

Read Also: Can I Change My Ein From Sole Proprietorship To Llc

Sole Proprietorship Vs Partnership Differences

Many small business owners face a tough decision when starting a business. Will they start the business all on their own, or will they seek others to help in their venture? This ultimately comes down to whether they want to pursue a sole proprietorship or a partnership.

- A sole proprietorship is an unincorporated entity that does not exist apart from its sole owner. A partnership is two or more people agreeing to operate a business for profit.

- The Partnership firm is governed by the Partnership Act and a Sole Proprietorship is not governed by any specific statutory body.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Sole Proprietorship vs Partnership

In a Sole Proprietorship, the owner is entitled to all profits of the business but is also personally liable for all obligations. Whereas in case of Partnership, each partner is jointly and severally liable for all obligations of the partnership.

There is dependably vulnerability with respect to the term of the sole proprietorship as it can wind up whenever if the proprietor retires or Dies or on the off chance that he ended up awkward to maintain a business. Then again, Partnership can be broken up whenever, in the event that one of the two Partners resigns or dies or ended up indebted, yet in the event that there are in excess of two Partners, it can proceed at the tact of the rest of the Partners.

What Is A Corporation

- A corporation is an independent legal entity that exists separately from the people who own, control and manage it.

- It does not dissolve when its owners die because it is considered a separate person.

- A corporation can enter into contracts, pay taxes, transact business, etc.

- The owners have limited liability.

- Contact an attorney or an accountant to determine if this structure works for you.

Recommended Reading: How Much Can A Solar Farm Make

Registration And Licensure Of A Sole Proprietorship

When a sole proprietor conducts business under an assumed name, that name must be registered with the Utah Division of Corporations and Commercial Code using an application available from the Division. Also, be certain to obtain all required local and municipal business licenses before commencing business.

Do Partnerships Pay More Taxes Than Sole Proprietorship

In a partnership, two or more individuals who are shareholders share ownership. Each partner is responsible for his or her share of the risks. Taxation of the business is not due since the business is not an entity of its own. partner reports their own personal income, losses, gains, and deductions on their taxes.

Also Check: What Does Solar Energy Mean

Sole Proprietorship Vs Partnership Head To Head Differences

Lets now look at the head to head difference between Sole Proprietorship and Partnership

| Basis of Comparison | ||

|---|---|---|

| Scope of raising capital is limited. | Scope of raising capital is comparatively high. | |

| Freedom | Owner can make all the decisions regarding the operation of the enterprise without having to seek the approval of others. | Infighting and differing opinions may prevent the business from moving forward and could jeopardize its existence if the partners cannot resolve their differences. |

Sole Proprietorship Vs Incorporation

If youre new to running a business, then you may not fully understand the difference between a sole proprietorship and incorporation. According to the IRS, a sole proprietor is an individual who runs an unincorporated business on their own. Its the easiest and most common way to start a business in the U.S.

Thats because theres no paperwork for you to fill out or dues to pay when youre just getting started. As long as youre the only owner, youre automatically granted the status of sole proprietor without having to do anything.

In comparison, incorporation is the legal process of forming a company. Youre forming a business entity and creating a legal separation between your personal assets and the businesss assets. Most businesses either incorporate as an S corporation or a C corporation.

A corporation may be able to take advantage of certain business deductions that arent available to sole proprietors. However, both business models require a lot of paperwork to get set up.

Recommended Reading: How To Get The Most Out Of Solar Panels

Llc Vs Corporation Vs Sole Proprietorship Which Should You Choose

Now that you know what each legal entity type is like, lets take a look at which is the best for you.

As you look at the table below, keep in mind that you should choose a business entity type that best fits your particular situation. For instance, if you believe that your business is high risk and you have ample start-up funding, you may consider incorporating it. On the other hand, if its unlikely to face lawsuits and you have little start-up funding, you may want to consider a sole proprietorship model.

| Consider a sole proprietorship if your business… | Consider an LLC if your business… | Consider a corporation if your business… |

|---|---|---|

| is low risk | ||

| is less likely to face lawsuits | has a possibility of facing lawsuits | has a high possibility of facing lawsuits |

| is less likely to incur a large debt | is more likely to incur some debt | is likely to incur debt |

| benefits from a simple tax structure | benefits from a flexible tax structure | can handle double taxation |

How To Form A Sole Proprietorship

Unlike many business types, you do not need to register a sole proprietorship with the federal or state governments. That means its a lot cheaper to form, as you dont need to pay any incorporation fees. As far as tax law is concerned, you and your business are not separate entities. Your business income is your personal income.

Starting a sole proprietor business is as simple as picking a name and setting up shop. However, there may be licensing requirements depending on your location and what you plan to do as a business. Here are the key steps to follow in setting up your business:

- Pick your official name and business address.

- Connect with your city or local government to file for a license and check for other legal requirements.

- Register with the state if youre going to be selling taxable goods or services.

- Request an employer identification number from the IRS if youre going to hire employees.

You May Like: How To Get Solar Rebate