What Is The Solar Tax Credit

The Solar ITC is a 26% tax incentive on your gross solar system cost.

The only requirements are that you:

Note, if your 26% tax credit is $6,000 total, and you only have $5,000 in personal income taxes one year, you can rollover the remaining $1,000 credit to your next years taxes. The federal government has already extended the incentive expiration date three times before. The most recent extension in 2020 added a 26% extension until 2022 and step down schedule that gradually phases out the credit over a few years. As of January 2021, we are now in the first slab of the tax credit step down with a 4% reduction from 30% to 26%.

What Exactly Is Solarapp+

Despite the somewhat misleading name, SolarApp+ is not an app that you download onto your smartphone – its actually an online application portal for solar permitting. The National Renewable Energy Laboratory , part of the U.S. Department of Energy, created the SolarApp+ to simplify the permitting process for residential solar system installations.

Before installing solar panels on your roof, you need to get permits approved by your town. This process varies between locations and is one of the most time-consuming steps of the solar installation project timeline.

These delays cause backlogs and add costs to solar installs, which can be up to a $1.00 per watt in permitting fees to the average solar system. While installers do handle the paperwork, it can be a headache for homeowners who want their systems up and running as soon as possible.

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

Don’t Miss: Can You Use Pine Sol On Wood Floors

Turbotax Can Help You Claim The Solar Tax Credit

Dont worry about how to claim the solar tax credit. TurboTax will ask you simple questions and help you claim the energy tax deductions and credits youre eligible for based on your answers.

If you have questions you can connect live via one-way video to a TurboTax tax expert or CPA. TurboTax Live tax experts and CPAs are available in English and Spanish and can also review, sign, and file your tax return.

What Is The Federal Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes placed in service, but the IRS has equated it with completed installation.

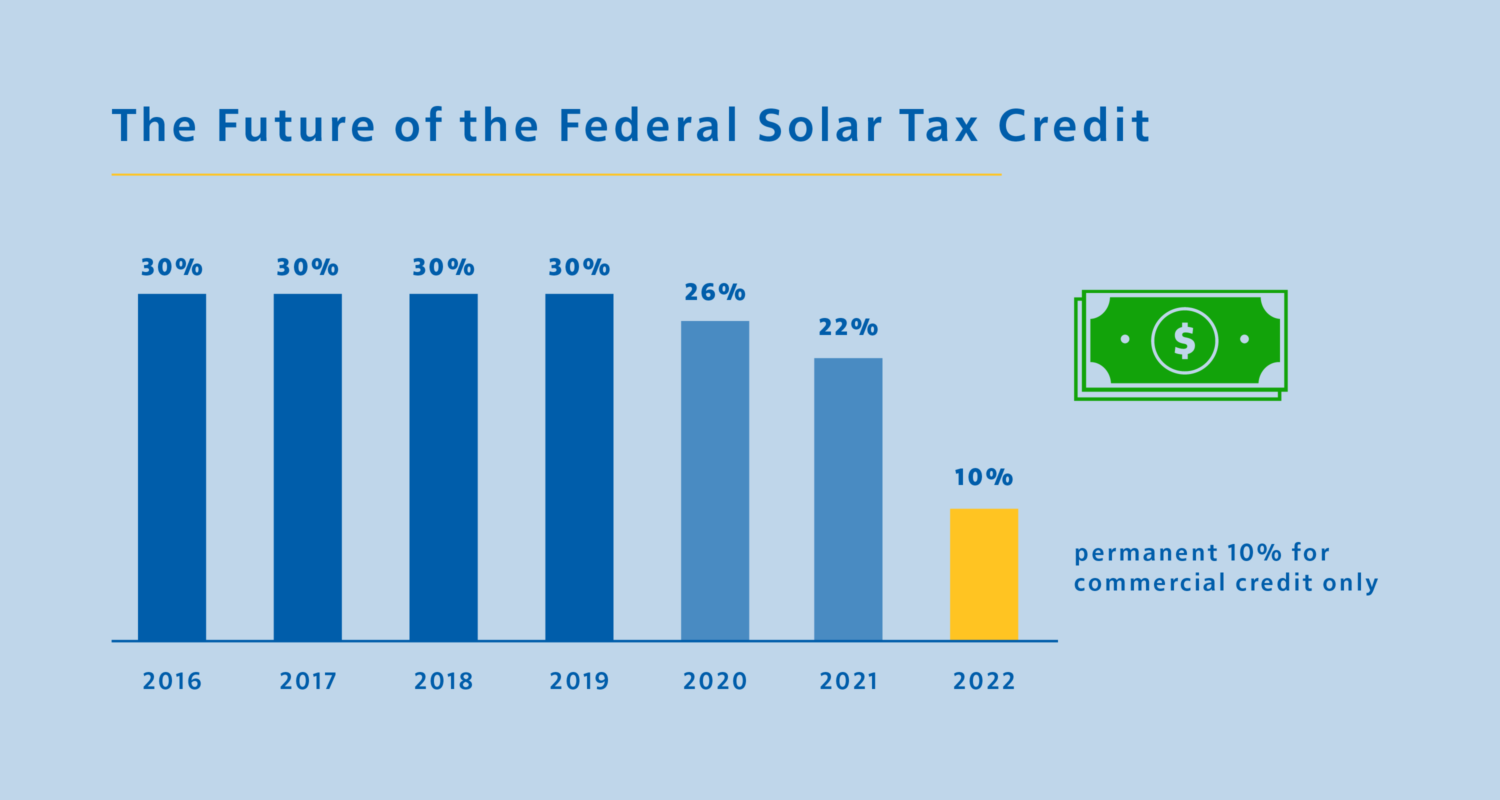

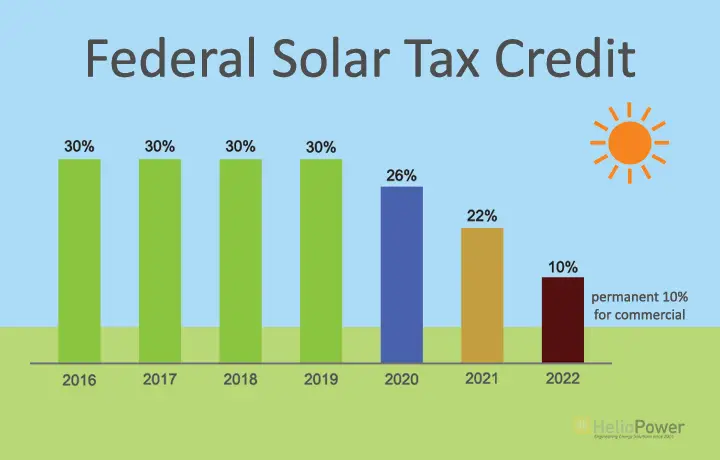

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be claimed.

Recommended Reading: Does Solar Work In Winter

Solar Federal Tax Credit: What Is And Isnt Eligible

Guest post written by Randy M. Lucas, CPA at Lucas Tax + Energy Consulting

The first few weeks of the Duke Energy solar rebate program appears to be having a positive effect on the residential and commercial building owners. Duke Energys new solar rebate program along with the 26% Federal Investment Tax Ccredit have sparked a renewed interest in solar across the state for homeowners and business owners alike.

I often contend that Stephen Dubner and Steven Levitt were spot on in their 2005 best seller Freakonomics that Incentives Matter and consumers are definitely motivated by incentives. With all this market excitement and incentive motivation for solar in North Carolina, we wanted to take a moment to clarify for consumers in this market through this guest blog post to emphasize what qualifies for the Federal solar investment tax credit. The rules for non-business solar and business solar are governed by two distinct Internal Revenue Code Sections §25D and §48, respectively.

Solar Tax Credit For : What You Need To Know

When the solar tax credit was passed in 2005, it was initially set to expire within two years by the end of 2007. The program had enjoyed a considerable measure of success, though, so lawmakers granted a series of extensions that promised to keep the program alive until the end of 2016.

As it turns out, they were right: The U.S. solar industry has grown by more than 8,600% since the ITC emerged in 2006.

When lawmakers passed the 2016 federal spending bill, they took the existing solar tax credit and extended it for five years to 2021. This effort made solar power more affordable for Americans who wanted to install residential or commercial systems.

Solar Tax Credit Extension

The ITC has since been revisited several times, most recently in December of 2020, when Congress extended the ITC at the rate of26% through the end of 2022. It was originally set to decrease to 22% in 2021.

Under the most recent extension, rates will decrease to 22% in 2023. In 2024, benefits will end for residential properties, and drop to 10% for commercial properties.

If youre interested in reading the solar tax credit extension bill in its entirety, you can find it here. You can also view updated information regarding the current status of the ITC in the Database of State Incentives for Renewables and Efficiency.

Its also important to note that the ITC reflects the date when your system goes into service, not when you purchase it.

Read Also: How Many Inverters Per Solar Panel

History Of The Federal Solar Tax Credit

The solar tax credit was originally created through the Energy Policy Act, which was signed way back in 2005. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

How Will Solarapp+ Help The Future Of Solar

NREL has some lofty claims for the potential success of SolarAPP+. They claim it will lead to an increase of 2.4 million rooftop solar installations and 30,000 solar jobs, though they did not specify over what time period. And that really might be true, since SolarApp+ will make solar cheaper and permitting times quicker, leading to more people being able to afford solar power and enjoy its cost-saving benefits.

In fact, during the pilot program in Tucson, Arizona, SolarApp+ reduced the average permitting time for solar projects from 20 days to zero.

But as we enter 2022, the future of solar is on ever-increasingly thin ice. Net metering is being challenged in California, while federal incentives are not being expanded, as the Build Back Better plan remains on hold. We hope that easing solar permitting will lead to more solar installations, but it is only one part of the puzzle.

Find out if going solar is worth it in your area

Read Also: What Type Of Batteries For Solar Lights

How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To be on the safe side, your solar project should be fully installed and paid for before 2022 to be absolutely certain that you can claim the tax credit in 2022s taxes.

This isnt a concern in early January 2021, but the urgency increases towards the end of 2022.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

Therefore, to be 100% sure that you can claim the 26% ITC, the sooner you move forward with your project, the better.

Towards the end of 2022, as word begins to spread about the incentive stepping down, solar installers will likely get busier and busier, meaning your installation may be scheduled farther out than normal.

How Is The Federal Solar Tax Credit Calculated

The gross system cost can include any improvements needed to facilitate the solar installation. This includes any electrical work needed for the installation such as a panel box upgrade, and also includes roof work under the solar array. Please speak to your tax advisor for specific advice for your given circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. Many clients mistakenly believe that getting a tax return would make them ineligible for the ITC, but this is not the case. As long as youve been paying taxes in some form throughout the year, if you get a tax return and claim your ITC in the same year, your ITC is simply added to the amount of your tax return .

You May Like: Do Solar Panels Need Cleaning

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC. In this case, its the company that leases the system or offers the PPA that collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Also Check: What Is A Solo 401k Vs Sep Ira

Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

How Does The Solar Tax Credit Work And How Much Will I Save

Right now, the Solar Investment Tax Credit is worth 26% of your total system cost. This includes the value of parts and contractor fees for the installation.

As mentioned before, if it costs $10,000 to buy and install your system, you would be owed a $2,600 credit.

You are only allowed to claim the credit if you own your system. This is why were strongly opposed to solar leasing if you can avoid it. If another company leases you the system, they still own the equipment, so they get to claim the incentives.

Youll still get the benefits of cheap, renewable energy if you lease. But missing out on the tax credit is a huge blow to getting a positive ROI from your system.

It makes more sense to take advantage of solar financing instead. Youre still on the hook for a loan, but you retain rights to the incentives that help make solar such a sound investment.

You May Like: How Much Does A 4kw Solar System Cost

Q Is A Roof Eligible For The Residential Energy Efficient Property Tax Credit

A. In general, traditional roofing materials and structural components do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing, serving both the functions of solar electric generation and structural support and such items may qualify for the credit. Components such as a roof’s decking or rafters that serve only a roofing or structural function do not qualify for the credit.

What Is The Federal Investment Tax Credit

Think of the ITC like a coupon for 26% off your home solar installation, backed and funded by the federal government. In the year that you install solar, the ITC can greatly reduce or even eliminate the taxes that you would have otherwise owed to the federal government.

The ITC was originally created by the Energy Policy Act of 2005, and was set to expire just two years later at the end of 2007. Thanks to the ITC, the growth of the solar industry helped create hundreds of thousands of jobs, injected billions of dollars into the US economy, and was a significant step towards cutting down on greenhouse gases, so it was very popular.

According to the Solar Energy Industries Association , The ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006. As a result, Congress has extended the expiration date multiple times to continue supporting that growth, including the latest extension that was part of the COVID relief bill and sets the expiration date at the end of 2023.

Don’t Miss: Can Solar Panels Damage My Roof

Everything You Need To Know About The Federal Solar Tax Credit

The federal solar tax credit is the personal tax credit available to homeowners who purchase a new solar system. Currently, homeowners receive 26% of the cost of their system in a federal tax credit. For most homeowners that means a $4,000 to $6,000 tax credit for going solar. The actual credit will depend on a few factors like the size of your system.

In practice the solar tax credit would look like this:

Cost of solar system = $20,000

Solar tax credit = $5,200

Price of the solar system after tax credit = $14,800

All US residents can receive the federal solar tax credit. This tax credit deducts 26% of the cost of installing a solar energy system. This credit is available for both residential and commercial systems. The sooner you take advantage of this credit the better because as time goes on the amount of the credit diminishes.

Do I Qualify For The Solar Tax Credit

If you installed solar panels or will install them by December 31, 2022, and you own your solar energy system and property, you will likely qualify whether you have a residential or commercial system. If you lease your system, you wont be eligible for the tax credit.

To qualify for the 2022 tax deduction rate, you must begin your solar project by Dec. 31. What does that mean? The IRS defines the beginning of construction for energy tax deductions in two ways. The first way to qualify is if significant physical work is underway by the deadline. In solars case, that might look like the beginning of panel installation or preparing a roof to bear new panels.

The other way to prove construction has commenced is if the taxpayer completes the Five Percent Safe Harbor, meaning they have put 5% down toward their solar panels. If using physical work or a 5% down payment, you will need to continue making steady progress on construction. Either way, this rule makes it incredibly easy to take advantage of the 26% deduction before the end of the year.

To get the incentive, you will need to keep the receipts for the system and claim the credit on your taxes, just as you might claim any deduction. If you cannot claim the whole credit in one tax year because you do not have enough liability, you can rollover the credits into future years, as long as the solar tax credit remains in effect.

Don’t Miss: How To Clean Solar Panels On Garden Lights

Abbreviations And Definitions Used

2.1 The following abbreviations are used in this Chapter and have the meaning contained in the Act:

CCA capital cost allowance

CCEE cumulative Canadian exploration expense as defined in subsection 66.1

CEE Canadian exploration expense as defined in subsection 66.1

CEE Canadian renewable and conservation expense included in paragraph of the definition of CEE in subsection 66.1

CRCE Canadian renewable and conservation expense as defined in subsection 66.1 and subsection 1219 of the Regulations

FTS flow-through share as defined in subsection 66. For more information refer to the CRA web page Flow-through shares

PBC principal-business corporation as defined in subsection 66. For more information refer to Income Tax Folio S3-F8-C1,Principal-business Corporations in the Resource Industries and

UCC undepreciated capital cost as defined in subsection 13.

2.2 The term primarily is usually considered to be a threshold of more than 50%. In establishing whether a particular property is used primarily for the purpose of a given activity, different factors are examined such as the proportion of time that it is used in this activity or the relative proportions of the output that is generated from the property. In addition to this quantitative test, the circumstances may require a qualitative assessment of the taxpayers main purpose in using the property.

2.3 Generally, the phrase all or substantially all means at least 90%.