State Of Hawaii Incentives

Hawaii Renewable Energy Technologies Income Tax Credit

The Hawaii Department of Taxation oversees the Hawaii Renewable Energy Technologies Income Tax Credit.

Database of STATE Renewable Energy and Energy Efficiency Incentives Available in Hawaii

The Database of State Incentives for Renewables & Efficiency , maintained by the North Carolina Clean Energy Technology Center and originally funded by the United States Department of Energy, is a free and open resource providing a searchable database of incentives and policies available for clean energy in each state.

Hawaii Enterprise Zones

Currently, wind energy producers may be eligible for this incentive that provides a 100% general excise tax exemption as well as reductions in state income taxes in exchange for demonstrated job growth. This incentive is available statewide in designated geographic areas.

Hawaii Foreign Trade Zone

Hawaiis Foreign Trade Zone Program supports manufacturing and small business activity in Hawaii by encouraging companies to compete in export markets and providing growth to new companies that import and export merchandise, including renewable energy and energy efficiency equipment.

Renewable Fuels Production Tax Credit

What Expenses Are Eligible For The Solar Tax Credit

According to the Department of Energy and the new laws language, the same expenses covered under the old law are eligible for this new solar tax credit:

- Solar photovoltaic panels.

- PV cells used to power an attic fan .

- Contractor labor for onsite preparation, assembly, or original installation.

- Permitting fees, inspection costs, and developer fees.

- All equipment needed to get the solar system running, including wiring, inverters, and mounting equipment.

- Storage batteries.

- Sales taxes on eligible expenses.

In a change from the old law, eligible battery storage units that you install must store at least 3 kilowatts.

Why Should You Act Now

With the solar panel tax credit, you could save thousands of dollars on the cost of a solar system when compared with waiting a year and losing out on the chance for the incentive. In addition, switching to solar comes with many benefits. The costs of energy are lower, and you become less dependent on the power grid.

In addition, to qualify for the tax credit, your system must be installed by December 31, 2022. If you install it after that date, the percentage you get in tax credits will be smaller. Keep in mind, too, that installing a system can take some time.Get a Custom Quote Now

If you decide later in the year you want solar power, you may not have enough time to start the installation. In addition, other homeowners and business owners may be working to get their own panels and systems installed and it may be more difficult to find someone able to take on the work.

If you are ready to go solar and save money, contact us at KC Green Energy to talk about solar panel installation. We are a leader in the installation and design of solar electric energy systems. Started in 2008 as a division of the family-owned Kautz Construction, KC Green Energy is made up of experts dedicated to solar energy. We have accredited project engineers who will conduct a free site analysis at your property so we can custom design a system thats best suited for you.

You May Like: How Does A Solar Ppa Work

The Federal Solar Tax Credit Has Been Extended Through 2023

Ecohouse Solar was excited to learn the federal solar investment tax credit was extended at the end of 2020. The ITC, which was initially going to begin phasing out at the end of 2020, received a much-needed two-year extension.

The extension will provide an extra incentive for going solar until 2023.

Here are a few core points you should know about the Investment Tax Credit :

- The ITC is the federal policy which allows solar system owners to be refunded some of their solar installations cost from their taxes.

- The solar ITC is the primary financial incentive to go solar in the U.S.

- In some cases, it can be used for battery storage as well.

The extension gives everyone more time to take advantage of the Federal solar tax credit.

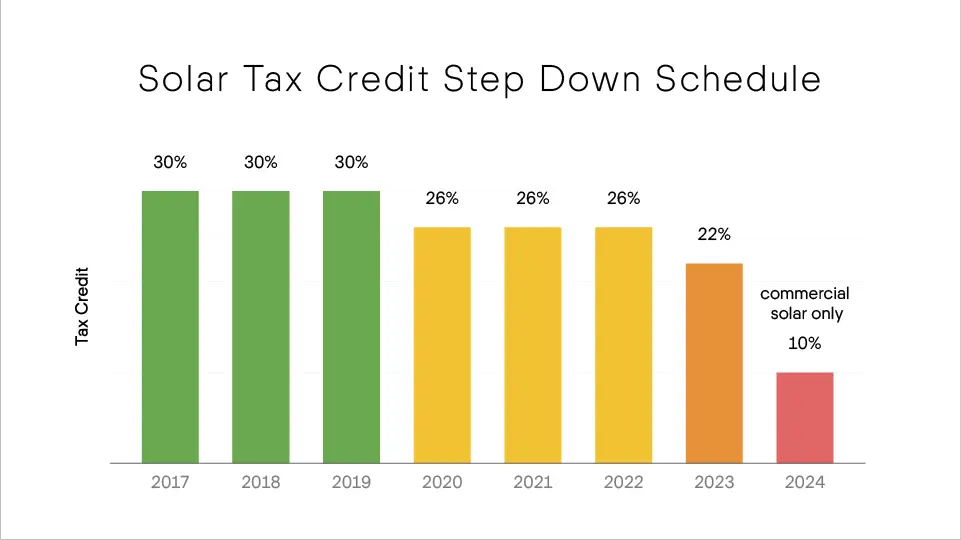

Instead of dropping to 22% at the end of 2020, the tax credit has been frozen at 26% for all solar projects which commence construction between Jan. 1, 2021 and Dec. 31, 2022. This extension includes residential, commercial, industrial, and utility-scale arrays.

The current plan mandates that in 2023, the tax credit for all solar projects will drop to 22%.

Beginning in 2024, residential projects will no longer receive a tax credit. However, commercial and utility solar projects will retain a permanent 10% credit.

Please contact us for a free proposal:

Understanding Solar Tax Credit In 2022

The Solar Tax Credit 2022 is a valuable incentive that can help reduce the cost of solar energy systems.

According to the Solar Energy Industries Association, solar has seen 42% annual solar growth as a result of the Solar Investment Tax Credit .

To qualify for the solar tax credit, certain requirements must be met. In this blog post, we will provide an overview of the solar tax credit and what you need to know to take advantage of this incentive.

Here at Tax Savers Online, were experts on business, finance, and taxes so were ready to give you all the details on Section 25D of the Internal Revenue Code.

Contents

Also Check: How To Form A Sole Proprietorship In Florida

Is The New Solar Tax Credit A Tax Refund

Solar advocates had hoped that the reconciliation bill would include a refundability clause for the Federal Solar Investment Tax Credit. The final bill doesnt include this provision, however, meaning that homeowners without a significant tax liability cannot claim the tax credit as a cash refund.

As per the current law, if your tax liability doesnt meet or exceed the amount of the solar ITC, youll miss out on its full value.

The good news is that the credit can still be rolled over to a subsequent year. This means that some homeowners will be able to better plan their tax installments and overall liability to take greater advantage of the credit.

The bill does include a direct pay provision, though, which will allow some solar developers to get more out of the tax credit. Under the new rules, a solar energy developer with little or no remaining tax liability can treat the credit as an overpayment of tax. This would result in a cash payment refund come tax time.

There are also adders to the ITC. These depend on who is installing solar, whether panels and other components are American-made, and where the array will be set up. For some projects, the 30% base rate plus adders could amount to a 50% tax credit, cutting in half the cost of going solar.

Start Your Solar Journey Off On The Right Foot

On top of all these excellent solar incentive programs, our home solar plans, with or without battery storage, start at $0 down. What’s more, Pacific Gas and Electric , Southern California Edison , San Diego Gas & Electric , and other California utility companies offer net energy metering programs. These NEM programs could let you earn credits on your electric bill for the excess solar energy you produce.13 Net metering in California could help you save money on future energy costs.

Now could be an ideal time to make the switch with a California solar company like Sunrun. To check if our solar and storage products and services are a good fit for your home energy needs, use Product Selector or request a quote to get one-on-one service from our expert Solar Advisors.

Don’t Miss: What To Wash Solar Panels With

Extensions To Insurance Subsidies On The Marketplace

In 2021, Congress passed new subsidies aimed at low- and middle-income Americans who buy insurance on marketplaces created by the Affordable Care Act but those subsidies were ready to expire at the end of this year. The new law will extend those subsidies by three years.

This will help keep more people insured and keep premiums lower for people who purchase insurance on the marketplace, as opposed to employer-sponsored healthcare plans. After the new subsidies were added by Congress in 2021, a record number of people signed up for health insurance through the marketplace, and premiums fell by 19 percent between 2021 and 2022, according to the Department of Health and Human Services. An estimated 3.1 million people would lose their healthcare plans if Congress had let the subsidies expire, according to an Urban Institute analysis.

The Property Is Your Primary Or Secondary Residence

The solar equipment must be used at either your primary residence or secondary home in the United States. The following types of homes qualify for the deduction:

- Cooperative apartment

Rental properties cannot be claimed for the ITC unless you live there for part of the year and rent out the property whenever you arent residing there. However, you can only claim the credit for the amount of time that you live at the property. For example, if you only live at the rental property for six months, you would qualify for 50% of the deduction versus a 100% deduction .

Don’t Miss: How Long Is The Federal Solar Tax Credit Good For

Federal Solar Tax Credit Guide

In this article: What is it?| How does it work?| Do I qualify?| What does it cover?| The bottom line|FAQs

Since 2005, the federal government has incentivized homeowners to switch to solar through the solar investment tax credit , also known as the federal solar tax credit. Currently, this tax credit lets you claim 26% of the total cost of your solar system installation on your federal taxes. However, this perk may not be here to stay. Unless Congress extends the ITC, it will decrease to 22% for systems installed in 2023 and will end in 2024.

To help you take advantage of this perk while it lasts, we at the Home Media reviews team have conducted in-depth research and analysis on the best solar installation companies in the United States. This guide covers how to qualify for the federal solar tax credit and how to file for it so you can save more on your solar power system.

Get a Quote on Your Solar Installation in 30 Seconds

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

Disclaimer: This guide provides an overview of the federal investment tax credit for those interested in residential solar photovoltaics, or PV. It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, or tax decisions, or when executing other binding agreements.

Read Also: How Much Do Solar Panels Cost For A Tiny House

Who Is Eligible For The Solar Credit

You are eligible for the solar credit if you meet the following requirements.

- Completed installation in an eligible year.

- Own the home as a primary or secondary residence.

- Installed at your home or as part of a community project. If part of a community project, the system cant provide more electricity than you need for your home.

- Paid for the solar system with cash or by financing. Leases or arrangements to purchase electricity from a system you dont own are not eligible.

- Be a new installation .

Tax Credits For Drivers Who Buy Electric Cars

The bill includes a credit to help consumers purchase an electric vehicle but it has some major caveats.

Any individual who makes less than $150,000 or $300,000 for married couples can take advantage of a $7,500 credit to buy a new EV or up to $4,000 for a used version. But the bill specifies that the EV batteries must be sourced in certain amounts from North America and the United States trading partners. These requirements are being phased in over time, but even right off the bat, the Alliance for Automotive Innovation estimates that of the 72 currently available EVs, only 20 to 25 of them would be eligible. Over the next few years as the sourcing requirements ramp up, the Alliance says that none of the models would be eligible.

These specifications might push the industry to change its practices and phase down its reliance on Chinese materials and labor faster, but for the moment it does seem to leave many consumers out of luck.

Read Also: How Much Does It Cost To Register A Sole Proprietorship

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC the company that leases the system or offers the PPA collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Kelly McCann, an attorney at a law firm that specializes in real estate and construction law in Portland, Oregon, said these tax credits can be a huge bonus for taxpayers when they understand how they work.

McCann offered the following example:

Suffice it to say, tax credits are better for the taxpayer than are tax deductions, McCann said.

Are Solar Batteries Covered By The Solar Investment Tax Credit

The Internal Revenue Service specifies that battery installations for which all energy that is used to charge the battery can be effectively assured to come from the Solar Energy System are eligible for the full solar tax credit.

In other words, yes, solar batteries like the Tesla Powerwall and the LG Chem are eligible for the solar tax credit if they are charged by solar energy more than 75% of the time.

This means that if you install a battery with a new solar system, you will save 26% on the total combined cost.

Read Also: Is Solar Really Worth It

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of 2021.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must have been used for the first time. You only get to claim this credit once, for the original installation of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you wont be able to claim a second credit.

Guide To Solar Incentives By State

When it comes to buying solar panels for your home,weve got good news and better news: the cost of solarpower has fallen over 70 percent in the last 10 years,and there are still great solar rebates and incentivesout there to reduce the cost even further.

The first and most important solar incentive to knowabout is the federal solar tax credit, which can earnsolar owners 26% of the cost to install solar panels backon their income taxes in the year after installation.

States and utility companies also offer several types of solarincentives, and whether you qualify to claim them depends onwhere you live and other factors like your tax status.

On this page, you can learn about the different types of solarincentives available to homeowners. You can also choose yourlocation below to discover the exact mix of solar incentivesoffered by your state and utility companies in your area.

Read Also: Ppa Solar Pros And Cons

How To Get Started With Solar And Claim Your Investment Tax Credit

If youve ever considered going solar, and thought about how to get your solar tax credit, then theres never been a better time to get started! The Solar Investment Tax Credit allows you to get money back on your solar energy system, and going solar now will ensure you get the biggest return on your investment while the solar tax credit is still available.

Over the years, the ITC has played an important role in influencing federal policy incentives for clean energy in the United States. The long-term stability of the ITC has allowed businesses to continue driving down costs and investing in their own growth, and by investing in solar, you will be helping create jobs and strengthen the economy, while saving yourself money in the process.

Get started today with a savings estimate from Palmetto, to learn more about how the solar power federal tax credit can help reduce your out-of-pocket expenses. Solar panels are a great way to offset your energy costs and reduce the environmental impact of your home, while giving you energy independence and control over your familys future. Now is the time to install solar and take advantage of the Solar Investment Tax Credit while you still can!