Do I Qualify For The Solar Panel Tax Credit

As long as you own your solar energy system, you are eligible for the solar tax credit. Even if you dont have enough tax liability to claim the entire credit in one year, you can roll over the remaining credits into future years for as long as the tax credit is in effect. However, remember that if you sign a lease or PPA with a solar installer, you are not the owner of the system, and thus you cannot receive the tax credit.

Energy Storage And The Federal Solar Tax Credit

The primary requirement is that you own your home solar system. When homeowners add a home battery, it must be charged at your home by an on-site renewable energy system like solar . This is necessary for the home battery to be considered renewable, and for its cost to be eligible for the tax credit.

So, for your battery cost to be included in the tax credit, you must show that its only charged by renewable energy. To earn the tax credit for your battery cost, Sunruns solar guides can easily help you document how your home battery is charged solar.

Frequently Asked Questions About The Solar Tax Credit

Calculating the cost of going solar can be complicated as it is, let alone incorporating other financial incentives and tax credits into your estimate. Check out a few other commonly asked questions related to the ITC for more clarification:

How much is the federal solar tax credit for in 2021?

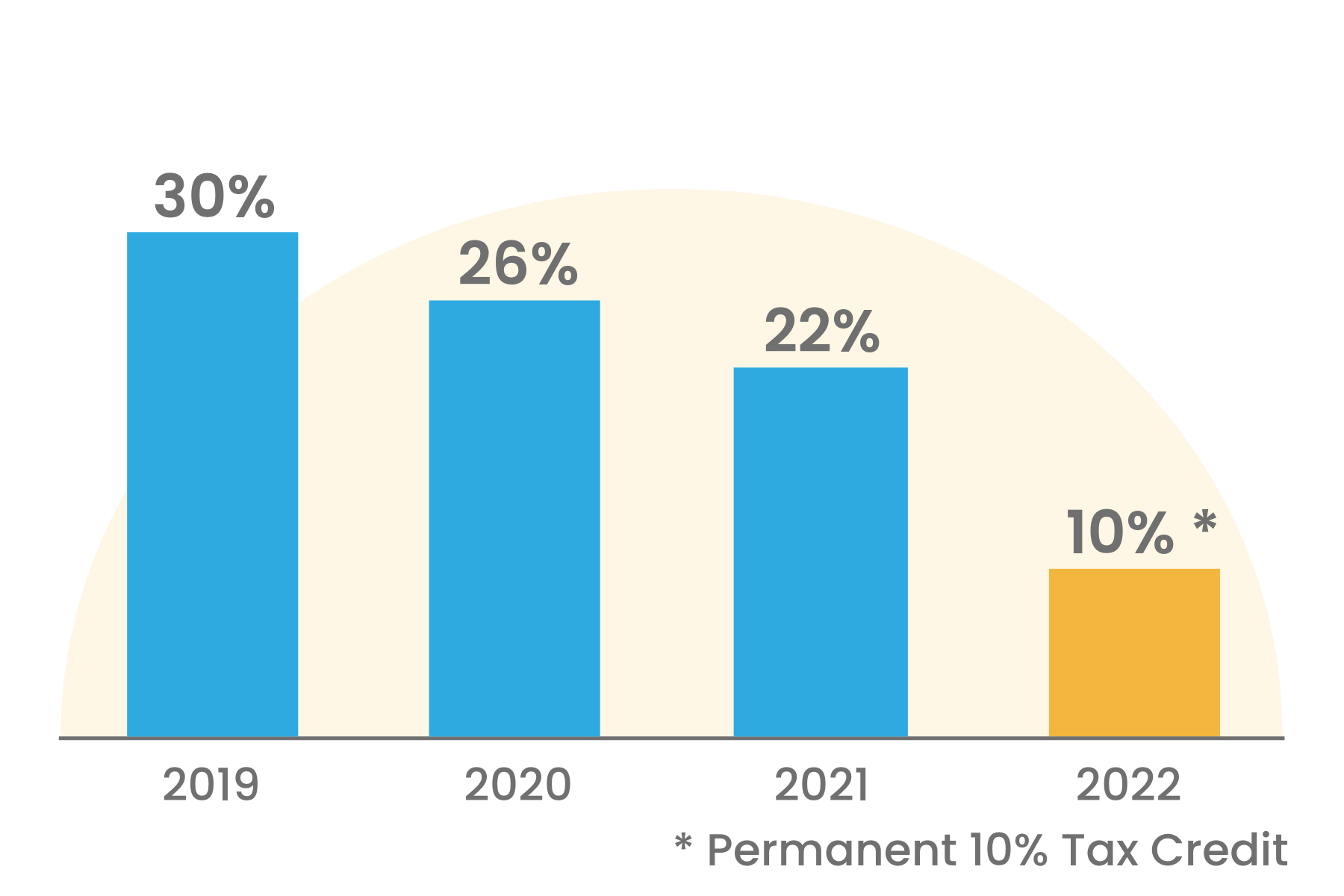

In 2021, the federal solar tax credit will deduct 26 percent of the cost of a system for eligible residential and commercial tax payers. After 2022, new residential and commercial solar customers can deduct 22 percent of the cost of the system from their taxes.

Is the solar tax credit a one-time credit?

Right now, the ITC is a one-time credit. But, you may carry over the excess credit to the next year if you cant use it all when you file. For example, if you only owed $6,000 in taxes but received the $6,200 solar tax credit, youd pay $0 in taxes for the year when you placed the claim. Then, youd also get to reduce next years taxes by the remaining $200.

Will the solar tax credit increase my tax refund?

The solar tax credit will not increase your tax refund. Rather, The ITC amount is applied against your tax liability, or the money you owe the IRS.

Recommended Reading: How To Be A Solar Technician

What Is The Solar Panel Federal Tax Credit

First, lets take a short walk down memory lane. The Solar Investment Tax Credit was first offered via the Energy Policy Act of 2005. Thanks to its popularity and its contribution toward renewable energy goals, the ITC has been extended multiple times. While it was originally set to expire in 2007, the current federal solar tax credit extension is set to expire in 2024. Homeowners can use the federal tax credit for battery storage, installing new systems, and more.

Alright, now how does the solar tax credit work? If you want a basic overview of solar incentives without wading through the tax jargon, youre in the right place.

The bottom line is this: When you install a solar power system between 2020 and 2022, the federal government rewards you with a 26% tax credit for investing in solar energy. In short, 26% of your total project costs can be claimed as a credit on your federal tax return for that year.

A quick but necessary disclaimer: were solar experts, not tax accountants! We do our best to give accurate advice, but please check with a professional to be sure youre eligible to claim the credit.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. $1 credit = $1 less you pay in taxes. Its that simple. If you spend $10,000 on your system, you owe $2,600 less in taxes the following year.

Looking To Go Solar In Northern California Turn To Sandbar

After more than 16 successful years, Sandbar Solar maintains its position as the most established, locally owned solar company in Santa Cruz. Our solar panel installation projects reduce your energy bills and increase your propertys market value. Solar panels for your home or business also make you an important part of the green solutions that help preserve our planet.

Our Santa Cruz solar services include free estimates, custom design, and expert installation. Our portfolio features thousands of residential and commercial solar panel installations across the region. Were proud of our reputation for designing and installing the most efficient solar panels for the Central Coast including Santa Cruz and Monterey counties as well as San Jose and the Bay Area.

If youre thinking of going solar and you live on the Central Coast or in the South San Francisco Bay area, contact us today to get a quote for your project.

About the Author

Scott is the founder of Sandbar Solar & Electric. With a Bachelors Degree in Economics from UC San Diego, Scott has an NABCEP certification, and has lectured on and taught many high-tech construction practices and solar PV technical concepts to education institutions, including Stanford University and state-recognized electrician apprenticeship programs. Scott enjoys sharing his knowledge of the evolving renewable energy space and making a difference in his community.

Recommended Reading: Does Pine Sol Kill Lice

Can I Claim The Itc If I Purchase My Solar Power System With A Solar Loan

Yes, even if you purchase your solar power system with a solar loan, you can still claim the full value of the Solar Tax Credit, and if you have enough tax liability, you can receive the full tax credit in the first year. With a solar loan, its possible to pay as little as $0 down when your solar power system is installed, while still receiving the valuable tax credit thats based on the full value of your solar power system.

Solar Tax Credit For : What You Need To Know

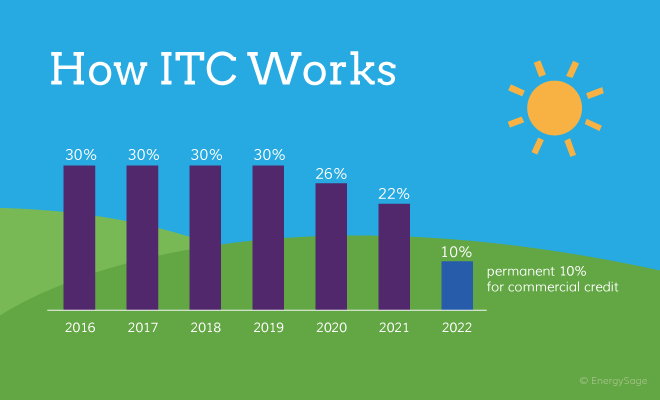

When the solar tax credit was passed in 2005, it was initially set to expire within two years by the end of 2007. The program had enjoyed a considerable measure of success, though, so lawmakers granted a series of extensions that promised to keep the program alive until the end of 2016.

As it turns out, they were right: The U.S. solar industry has grown by more than 8,600% since the ITC emerged in 2006.

When lawmakers passed the 2016 federal spending bill, they took the existing solar tax credit and extended it for five years to 2021. This effort made solar power more affordable for Americans who wanted to install residential or commercial systems.

Solar Tax Credit Extension

The ITC has since been revisited several times, most recently in December of 2020, when Congress extended the ITC at the rate of26% through the end of 2022. It was originally set to decrease to 22% in 2021.

Under the most recent extension, rates will decrease to 22% in 2023. In 2024, benefits will end for residential properties, and drop to 10% for commercial properties.

If youre interested in reading the solar tax credit extension bill in its entirety, you can find it here. You can also view updated information regarding the current status of the ITC in the Database of State Incentives for Renewables and Efficiency.

Its also important to note that the ITC reflects the date when your system goes into service, not when you purchase it.

Read Also: How Long Until Solar Panels Pay Off

Federal Solar Investment Tax Credit 2020

Going solar is great for the environment and even better for your electric bill. But did you know that going solar can greatly reduce the amount you owe the IRS in federal income taxes?

If you live in the Southwest, then youve probably seen tons of solar being installed on residential or commercial property. Obviously, solar makes sense for a lot of people but you might be thinkings, I know there are environmental benefits to solar, but can I afford it and will it save me money? While the cost of solar has dropped over the years, there is a lot of financial support through local, state, and federal tax incentives. If you are a taxpayer and home owner, installing solar could be a great way to save you money!

Does The Solar Tax Credit Cover Battery Backup Installations

At the moment, the ITC will only apply to battery backup installations when connected to a solar PV system. If you have an existing solar PV system, and are considering adding a battery backup system, we recommend that you consult your tax professional to determine if the 26% ITC will apply to the battery retrofit portion of your project.

You May Like: Can You Make Money On Solar Panels

What Does The Solar Investment Tax Credit Cover In 2021

The renewable energy ITC applies to qualified expenditures and allows you to reduce your overall tax liability. In plain English, this means that you can calculate the amount of your claim based on costs such as:

- Preparing the installation site, including conducting service upgrades to existing electric panels, and replacing a section of the roof to hold the solar array

- Installing wiring to the solar panel system

- Assembling and installing the system

- Adding solar PV cells or panels to power attic fans in a home

- The costs of labor for onsite preparation, installation, assembly, and more including developer and permitting fees and inspection costs

- The cost of equipment like wiring, mounting materials, and inverters

- Sales taxes on some expenses

Currently, the solar ITC is a one-time credit. One of its cooler features, however, is that you can carry over the excess to the next year if you cant use it all when you file.

For example, imagine that you only owed $5,000 in taxes but received the $5,200 home solar credit from the previous example. Youd pay $0 in taxes for the year when you placed the claim. Youd also get to reduce your next years taxes by the remaining $200.

First Is A Battery Necessary

This first question that you want to ask yourself is whether or not getting a battery is needed. Each homeowner will have different reasons for getting their system, and a battery brings a lot of additional value to a solar system. Having a battery does not mean you will not qualify for the federal solar tax credit, but it requires additional research to make sure you maintain your federal solar incentive.

If you do not think the battery is necessary, it could save you time and money to simply go with a more traditional, grid-connected system. For either situation, here are the details about what type of batteries will still qualify your solar panel system for the federal solar tax credit.

Don’t Miss: How To Apply For Federal Solar Tax Credit

Exceptions To Claiming Your Battery With The Itc

Although the decisions made by the IRS indicate that there should be no problem with qualifying for the federal solar tax credit, there are still a few exceptions that may lead to you losing this incentive.

If you have a dual-use battery , then there is a chance that you may not qualify.

To qualify, the first thing you need to do is make sure that you have a system that can accurately track both sources of energy. After that, you must ensure that the energy stored from non-qualified sources does not exceed 25% of the total energy input each year. Secondly, dual-use equipment also must adhere to a recapture rule.

Check this video that walks you through the process for claiming the solar tax credit.

Take Control Of Your Electric Bills By Going Solar Now

Put the sun to work for you. When you purchase a Sunrun home solar system, the 26% federal solar tax credit is cut directly off the cost of your solar installation. Thats a reduction of thousands of dollars from the total price.

To receive the greatest tax credit benefit, go solar today. Youll lock in long-term lower electricity prices and make the earth a healthier place for everyone. Plus, you dont have to worry about researching incentives and filling out extra tax forms. Weve got you covered.

Additionally, Sunruns home solar service plan is designed for your home characteristics, lifestyle, energy use, and financial goals. Well guide you through the process every step of the way from the tax credit and installation to maintenance and monitoring.

Sunrun is the leading home solar installer in the United States. We’ve been providing renewable energy to homes for more than a decade, and every year the future gets brighter. Together, we’re building an affordable and sustainable energy system for the whole nation, and next generation.

When youre ready to talk about solar for your home, Sunruns team is here for you. Contact us for a complimentary quote. Make a brighter tomorrow by starting today.

See if you qualify for the26% federal tax credit

Also Check: How Many Solar Panels For 1500 Kwh

History Of The Federal Solar Tax Credit

The solar tax credit was originally created through the Energy Policy Act, which was signed way back in 2005. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Will A Battery Qualify For The Itc

The ITC allows project owners and investors to qualify for the federal tax credits for the installation of energy property, which includes the materials and equipment used to generate electricity from solar energy. Further, storage tanks are classified by Treasury Regulations as a qualifying piece of equipment for a solar system. The Treasury Regulations also state that

solar energy property includes equipment that uses solar energy to generate electricity and includes storage devices, power conditioning equipment, transfer equipment and parts related to the functioning of those items. Treas. Reg. § 1.48-9

From the available information, it is valid to conclude that the Treasury Regulations includes all types of storage systems, which also means electric systems like batteries. Other sources that lead to this conclusion are the multiple legislative actions that have taken place around this issue.

Read Also: Does Tesla Install Solar Panels

What Qualifies For The Solar Tax Credit

- The entire bill for a qualified system, minus the sales tax. That includes solar panels labor costs for on-site preparation, assembly, and installation of the system and piping or wiring to connect the system to your house.

- Installation of a solar system in a primary or second house.

- Systems purchased outright or with a loan.

- Solar roofing tiles, like those being sold by Tesla.

- Solar installed in a property that you live in for at least part of the year. That could cover, for instance, a second home that you rent out when youre not there. The credit is prorated based on how much time you spend in the residence. For a multifamily home in which you live but also collect rent, you may be eligible for either the residential or business tax credit, depending on how much of the property is used for business. Check with a tax expert for details.

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

Don’t Miss: Should You Clean Solar Panels

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

How Long Is The Federal Solar Tax Credit Available For Use

Currently, the residential solar tax credit is set to expire in 2024. If youre thinking about adding solar energy to your home, now might be the right time to act. The tax credit expires unless Congress renews it.

There has never been a better time to take advantage of this credit. The Federal government wants to encourage Americans to invest in solar energy.

Also Check: How Much Do Solid Wood Kitchen Cabinets Cost

Ready To Start Your Commercial Solar Project

As you can see, if youre buying a solar energy system, timing is everything.

We know investing in solar energy is an important financial decision for your business, and our team is here to help guide you through the process.

Fill out the contact form below or call 844.732.7652 during business hours, and one of our solar energy advisors will talk to you about your ITC eligibility.