Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to tax year 2022.

- If you failed to claim the credit in a previous year, you can file an amended return.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Increase your tax knowledge and understanding all while doing your taxes.

Final Tips To Homeowners Considering Solar

What do you think? Will going solar be your 2021 New Years resolution?! Were happy to help.

Federal Solar Energy Tax Credits

Established in the federal Energy Policy Act of 2005, the solar energy tax credit provides a 30% federal income tax credit for solar energy equipment and installation expenditures associated with qualified commercial systems, such as solar photovoltaic and solar water heating systems as well as certain solar lighting systems. The federal tax credit is a dollar-for-dollar reduction of federal income tax liability.

Qualifying equipment will use solar energy either to generate electricity, to heat/cool or provide hot water to a structure, to provide solar process heat, or to illuminate the inside of a building by means of fiber-optic distributed sunlight. Public utility property, passive solar systems, and pool heating equipment are not eligible for tax credits.

In order to qualify for the solar energy tax credit, the original use of the equipment must begin with the taxpayer or it must be constructed by the taxpayer. Also, the equipment must meet any performance and quality standards in effect at the time the equipment is acquired.

The solar energy system must be operational in the year in which the tax credit is first taken. The solar energy tax credits can be used to reduce Alternative Minimum Tax within the limitations of the Internal Revenue Code’s Passive Activity Rules.

For eligible equipment installed and “placed in service” from January 1, 2006 through December 31, 2016, the investment tax credit is set at 30% of solar technology expenditures.

Don’t Miss: How Much Do Solar Panels Cost For A Tiny House

Does The Federal Solar Tax Credit Apply To Me

If you purchase a solar generator before the programs expiration, you qualify for the Federal Solar Tax Credit. Since its a tax credit, youll need to owe U.S. federal taxes on some level. If you do, then youll be able to take up to 26% of the solar generators cost off your tax bill.

Here are the three basic requirements to get the tax deduction on your solar generator:

- Purchase the generator after January 1, 2006.

- Make sure you complete your purchase by December 31st of the current tax year.

- Be a resident of the United States.

As long as you meet these three requirements, you should be able to claim the purchase of your solar generator when you next go to file your taxes.

Similar: Bluetti EP500 & EP500Pro Review Longest-Lasting Solar Generators

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

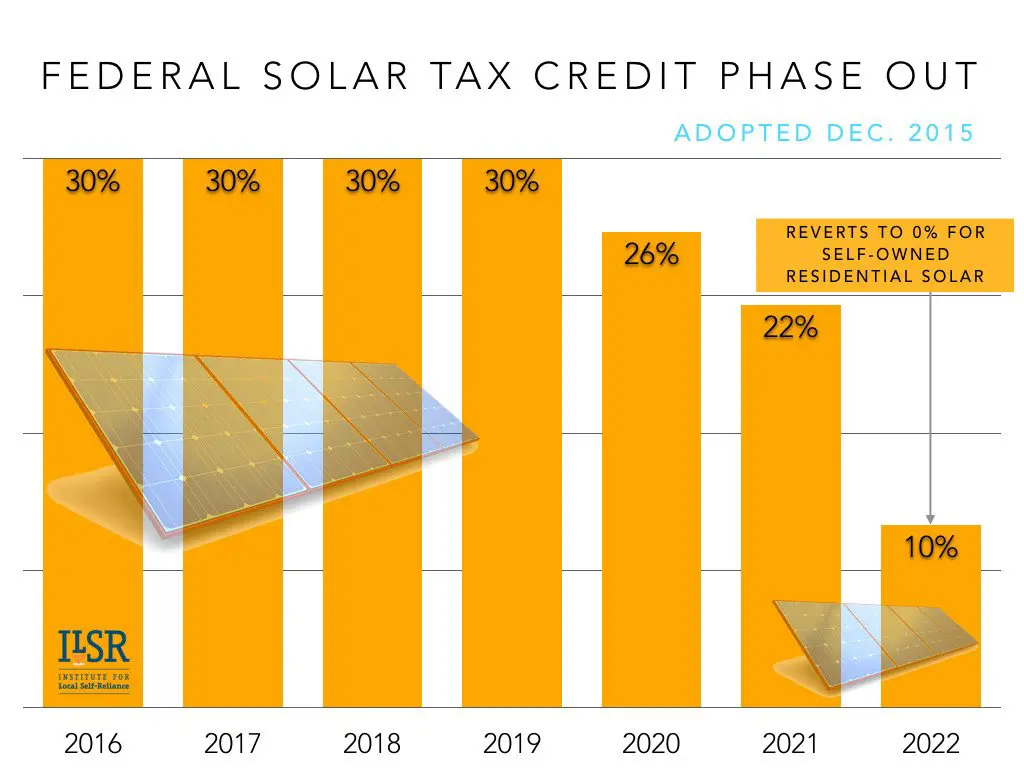

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC. In this case, its the company that leases the system or offers the PPA that collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Don’t Miss: How To Ground Solar Panels

What Exactly Is Solarapp+

Despite the somewhat misleading name, SolarApp+ is not an app that you download onto your smartphone its actually an online application portal for solar permitting. The National Renewable Energy Laboratory , part of the U.S. Department of Energy, created the SolarApp+ to simplify the permitting process for residential solar system installations.

Before installing solar panels on your roof, you need to get permits approved by your town. This process varies between locations and is one of the most time-consuming steps of the solar installation project timeline.

These delays cause backlogs and add costs to solar installs, which can be up to a $1.00 per watt in permitting fees to the average solar system. While installers do handle the paperwork, it can be a headache for homeowners who want their systems up and running as soon as possible.

Who Can Claim The Federal Tax Incentives For Solar Power

The federal solar tax credit is available to residential solar adopters as well as commercial entities anywhere in the United States. Although the majority of residential adopters are homeowners, you can also claim the ITC if you are a âtenant-stockholder at a cooperative housing corporationâ or have membership in a condominium. Per the U.S. Office of Energy Efficiency & Renewable Energy, your tax credit will encompass âthe amount you spend contributing to the cost of the solar PV system.â

Homeowners can claim the ITC if they install solar panels on a secondary residence . You will be unable to claim the federal solar tax credit, however, if the property is primarily a rental unit.

Finally, you are not eligible for the federal solar tax credit if the refund exceeds your tax liability for the year. However:

âHomeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayerâs total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.â

Read Also: What Can You Run Off A 400 Watt Solar System

Solar Investment Tax Credit Extension In 2022

Starting in 2022, solar tax credits will be phased out over the next three years until they are gone entirely. So what does that mean for you?

In 2022 the tax credit fell from 30% to 26%, then in 2023 it will fall again to 22% and finally, in 2024 it will drop to 0% for residential use and 10% for commercial use.

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

You May Like: Does A Solo 401k Need An Ein

Start Your Solar Journey Today With Energysage

EnergySage is the nations online solar marketplace: when you sign up for a free account, we connect you with solar companies in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to EnergySage each year to learn about, shop for, and invest in solar. .

How Can I Estimate The Portion Of My Solar Roof That Could Receive The Tax Credit

Your Solar Roof Purchase Agreement provides an estimated allocation of components that may be eligible for a tax credit. This estimated allocation is not intended as tax advice you should discuss this allocation with a tax professional to determine the appropriate tax credit amount in your circumstance.

*The Consolidated Appropriations Act of 2021 signed December 27, 2020, provided a two-year extension of the Investment Tax Credit for solar. The dates above reflect the extension.

Also Check: Is Ground Mounted Solar Cheaper

How Much Is The Federal Solar Tax Credit

Did you know that the Federal tax credits for approved solar panel installations could refund you up to 30% of the total installation cost?

The full value of the credit was only available through to the end of 2019. Every year, afterward, the value of the credit decreased in increments, before stopping at the end of 2021. This means you do not have long before it expires completely.

Qualifying equipment includes units powered by solar energy which either heat water or generate electricity.

The credit is available for improvements made to a primary residence or secondary residence.

Since it is a tax credit not a tax deduction, the value of the credit can be taken off your tax payment directly. There is no maximum dollar limit on the credit.

Can I Claim The Federal Solar Tax Credit For Fiscal Year 2021

Any solar-energy system installed after Jan. 1, 2006, is eligible for the one-time credit.

If your system was installed and generating electricity in your home last year then, yes, you can claim it. But if you buy and install one this year, you’ll have to wait until next tax season to deduct the credit.

Bring your home up to speed with the latest on smart tech, security, utilities, environmental issues and more.

Also Check: What Are Solar Panels Used For In Homes

Solar Panel Tax Credit Faqs

WHAT IF THE SOLAR PANEL TAX CREDIT EXCEEDS MY TAX LIABILITY? WILL I GET A REFUND?

This is a nonrefundable tax credit, meaning you will not get a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carryover any unused amount of the solar tax credit to the next tax year.

CAN I USE THE SOLAR PANEL TAX CREDIT AGAINST THE ALTERNATIVE MINIMUM TAX?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax credit.

HOW DO I CLAIM THE SOLAR TAX CREDIT?

HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE?

Sadly, the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg. In 2022, the tax credit will be 26% and in 2023 it will step down to 22%. Starting in 2024, the tax credit is scheduled to be removed altogether.

The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

|

Year |

Have more questions about the federal solar tax credit? Check out our TOP 10 FREQUENTLY ASKED QUESTIONS ABOUT THE FEDERAL SOLAR TAX CREDIT blog for additional information!

MORE QUESTIONS

Internal Revenue Service, located at 1111 Constitution Avenue, N.W., Washington, DC 20224, and phone at 829-1040.

Now is the time to take advantage of the solar investment tax credit. Contact our team of dedicated solar experts today!

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

You May Like: How Good Is Solar Power

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

Do States Offer Their Own Solar Energy Tax Incentives

Many states offer their own upfront rebates and tax credits that can be used in addition to the federal ITC.

New York’s Solar Energy System Equipment Credit, for example, is equal to 25% of your qualified solar energy system equipment expenditures, up to $5,000.

Ecowatch named New York one of the top 10 states for solar power tax incentives, along with Colorado, Connecticut, Iowa, Maryland, Massachusetts, New Hampshire, New Mexico, New Jersey and Rhode Island.

Even though solar panels increase property values, at least 36 states have property-tax exemptions for solar energy. If you live in one of those states, your real estate taxes won’t go up if you add a solar-energy system.

And in many states, solar equipment is exempt from sales tax.

Recommended Reading: Can An Llc Be Considered A Sole Proprietorship

How To Claim The Solar Tax Credit

You can claim the federal solar tax credit when you complete IRS Form 5695 for residential energy credits. This form uses details from your Form 1040 or Form 1040NR federal income tax return.

You can expect this step-by-step process to claim the solar credit:

You report your total energy credit on Schedule 3 on your Form 1040. A tax preparer or online tax software can walk you through the process to claim an accurate solar tax credit.

Does The Residential Solar Tax Credit Apply To New Home Purchases

If you buy a new home that already has solar installed, you can still claim the Solar Investment Tax Credit in the year that you move in, regardless of when the house was originally built or sold. For example, if your home was built in 2019, and then you bought it in 2020, but didnt move in until 2021, then you would claim the ITC on your 2021 taxes.

Keep in mind, the ITC can only be claimed once, so youll want to check and make sure that your builder hasnt already claimed the credit. If your builder has claimed it, then you may be able to ask for a reasonable allocation for those costs, and factor that into the final purchase price.

Read Also: What Size Solar Panel To Charge 50ah Battery

What Is The Federal Solar Investment Tax Credit

Is your organization considering commercial solar?

If so, heres some great news: The Internal Revenue Code provides an Investment Tax Credit for investments in commercial solar.

That means your company may be able to qualify for an ITC that can be used as a dollar-for-dollar reduction to its U.S. federal income tax.

So, if you or your organization is interested in investing in solar and would like to take advantage of the solar ITC, the time to act is now.

Keep reading to learn more about the solar ITC and how your business may be able to qualify for it.