How To Form A Sole Proprietorship

Sole proprietorships are the easiest type of business to establish because there is very little government regulation.

Owners of a sole proprietorship can either do business under their own name or they can register a Doing business as or DBA to operate under a business name.

The owner then needs to file for a business license either under their own name or their DBA with the city or county in which they plan to operate. If operating from home, some counties require that the business owner request permission.

The final step is to open a business checking account. It is very important to keep business and personal spending separate for tax purposes.

Here Are Some Important Factors To Consider When Assessing The Main Pros And Cons Of A Sole Proprietorship Versus An Llc

Create your LLC with Nolo

Need time on your business name?

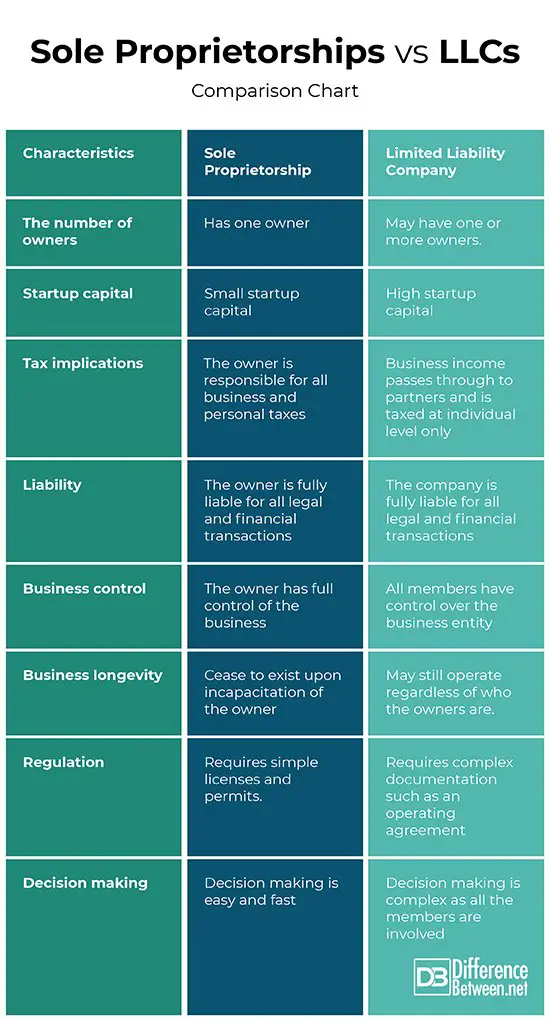

As a budding entrepreneur, you may face the issue of whether to start out as a sole proprietorship or a limited liability company . There are key advantages and disadvantages to each form of business and the nature of your enterprise and other business and personal circumstances may impact your choice. Here are some important factors to consider when assessing the main pros and cons of a sole proprietorship versus an LLC.

The Small Business Administration provides general information about starting and managing your new business at www.sba.gov/category/navigation-structure/starting-managing-business. You can also check out information about small business loan and grant programs at www.sba.gov/category/navigation-structure/loans-grants.

| Take our business formation quiz for help deciding the best structure for your business. |

1-800Accountant can prepare and file your application for the SBA disaster loan. Get a free consultation to see if you qualify.

Where Should You Form An Llc

If you determine you want an LLC, you also have to decide what state will be the home base for your business. For most people, this is a fairly easy decision as they want the company to register where they are doing business. Other people prefer to file in a different state, like Delaware, even if they are not based there. Delaware is the state of choice for many investors. While the process is a little more expensive as you need someone to act as your local registered agent, it can be an important choice if you plan to raise capital for your business. It’s also important to point out if you form your LLC in one state and plan to do business in another state, you will need to register in other ones where you do business, which will increase your startup costs.

Also Check: What Is The Best Direction To Face Solar Panels

What Is The Difference Between An Llc And An S Corp

A limited liability company is easier to establish and has fewer regulatory requirements than other corporations. LLCs allow for personal liability protection, which means creditors cannot go after the owners personal assets. An LLC allows pass-through taxation, meaning business income or losses are recorded and taxed on the owners personal tax return. LLCs are beneficial for sole proprietorships and partnerships. An LLC with multiple owners would be taxed as a partnership, meaning each owner would report profit and losses on their personal tax return.

An S corporations structure also protects business owners personal assets from any corporate liability and passes through income, usually in the form of dividends, to avoid double corporate and personal taxation. S corporations help companies establish credibility as a corporation since they have more oversight. S corps must have a board of directors who oversee the management of the company. However, S corps can have100 shareholders and pay them dividends or cash payments from the companys profits.

Recommended Reading: Can Solar Panels Damage My Roof

Is An Llc Better For Taxes

An LLC can have tax advantages that arent available to sole proprietors, but any benefits will depend on your specific situation and it isnt necessarily always the case, especially when you factor in the fees associated with operating an LLC. Whether an LLC is better for taxes depends on multiple factors, including your profit, expenses, and the type of work you do.

Don’t Miss: How Big Is A 1000 Watt Solar Panel

How Do I Form A Sole Proprietorship

Unlike an LLC or other forms of business entities, no legal documents need to be filed with the Arizona Secretary of State to create a sole proprietorship. Rather to create a sole proprietorship, a business needs to do the following: choose and file a business name with the Arizona Secretary of State, obtain licenses and permits and finally obtain an employer identification number.

Even though no legal documents need to be filed with the Arizona Secretary of State to create a sole proprietorship, documents will need to be filed to efficiently and legally run the business. This means that obtaining state licensure as well as required permits are a necessity to ensure your business runs smoothly.

More About Sole Props

- Management structure: The business owner manages the business and is responsible for debts, losses, and liabilities. They report taxable income earned from business activity on their personal tax return.

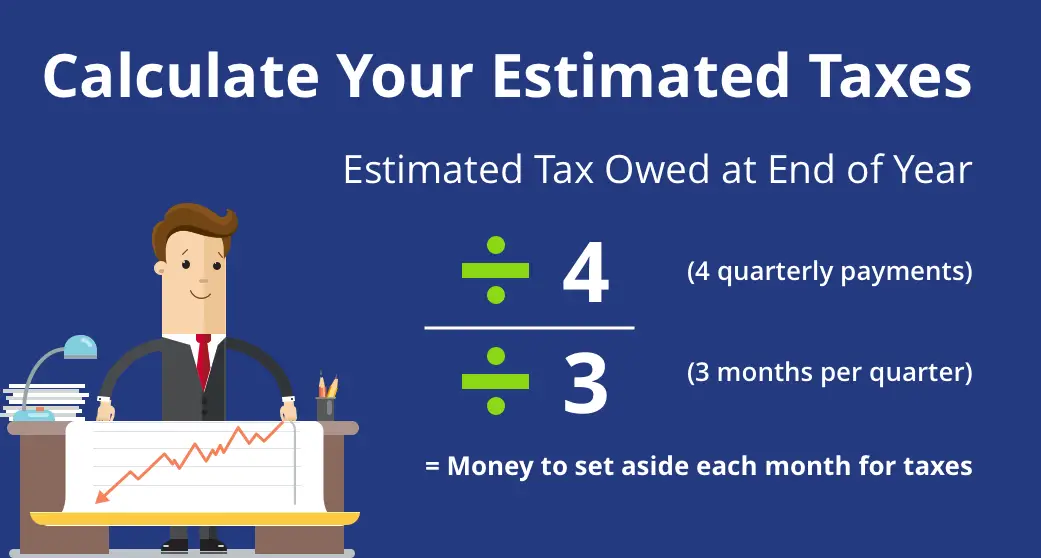

- How do sole props file taxes? Sole proprietors complete a 1040 personal tax return to report business earnings and pay tax on taxable income.

- Legal protections sole props: There are no legal protections when running a business as a sole proprietorship as the business owner is personally liable for all financial responsibilities.

- Do sole props need to register their business name? Depending on a states registration requirements, they should complete the paperwork to register a DBA with their county or state.

Recommended Reading: What Is The Efficiency Of Tesla Solar Panels

How The Business Is Formed

When starting your small business, the process you take to form an LLC is different than if you wanted to be a sole proprietor.

When starting an LLC, a business owner will need to name a “registered agent.” A registered agent is a person close to the business owner, such as a spouse, lawyer, or friend, who agrees to accept legal communications or other official documents in the business owners absence.

Once a small business owner names a registered agent, they need to prepare an “operating agreement.” An operating agreement details how the business will operate, who will have the power to make decisions , how profits will be allocated, and more.

Keep in mind that not all states require an operating agreement to be filed. If you’re a small business owner starting an LLC, check with your Secretary of State’s office to make sure that you’re following the state’s specific laws around filing your operating agreement.

Once an operating agreement is drafted, the small business owner typically must file “Articles of Organization” with the state, which is a collection of documents, such as the registered agents information, a business plan, and more.

There is a filing fee to register your small business as an LLC. The fee amount differs, depending on which state you’re in, and can usually range from $45 to $500.

Forming a sole proprietorship looks a little different.

If he were to invoice a customer, the small business signature would read: John Doe, DBA. Doe’s Carpentry.

Ability To Raise Capital

Sole proprietors may have more difficulty raising capital than an LLC. This is because potential investors cannot purchase stocks in a sole proprietorship, and banks are wary about lending to businesses that started sans any formal registration process.

Because LLCs can have as many owners as they want, they can offer ownership opportunities to investors in order to raise funds to grow their business.

Read Also: How Long Does Solar Take To Pay For Itself

Only Llcs Can Choose Corporate Tax Status

A key difference between LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can choose how they want their business to be taxed. They can either stick with the defaultpass-through taxationor elect for the LLC to be taxed as an S-corporation or C-corporation. An S-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a corporate income tax at the federal level .

LLCs can sometimes save money by electing corporate tax status. When a company is taxed as a corporation, dividends from the business are usually taxed at a lower rate than ordinary business income. Plus, retained earnings in a corporation arent subject to income tax. In contrast, LLC members cant treat income as dividends and must pay taxes on all profits of the business, whether retained in the company or not. A corporation is also eligible for more tax deductions and credits.

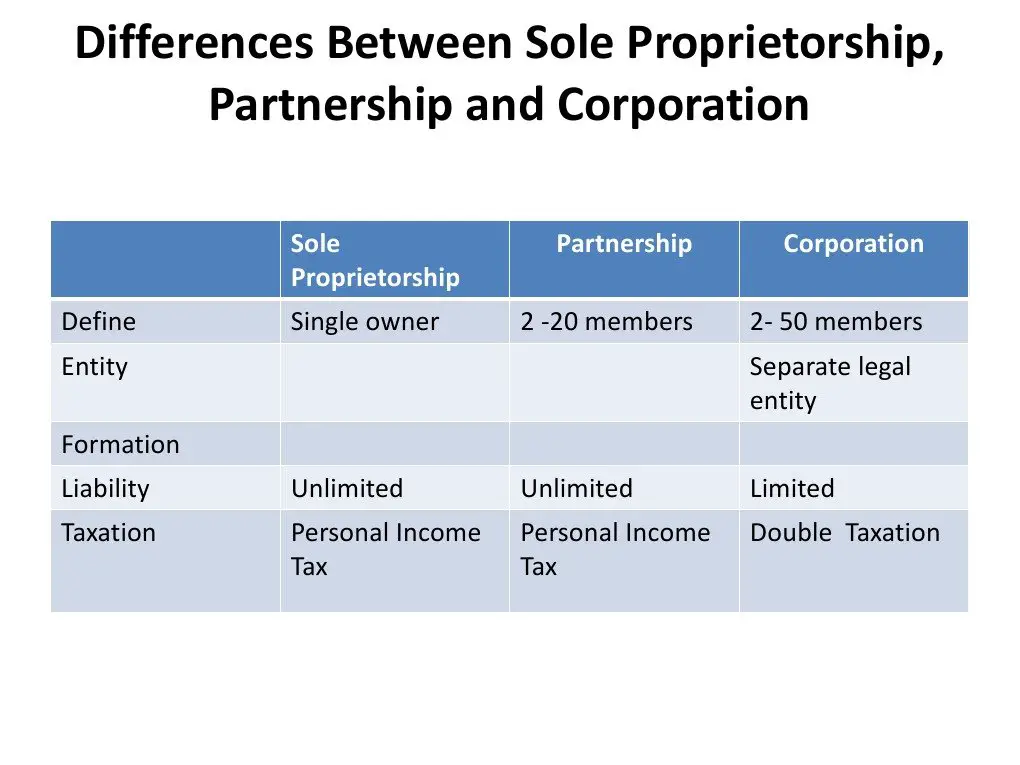

Llc Vs Sole Proprietorship Vs Corporation

Both sole proprietorships and limited liability companies are relatively simple to form and maintain. But some companies need a more formal structure than either of these entity types can provide. In that case, the business might consider incorporation.

When you incorporate your new business, you have the option of structuring your business as a C corporation or an S corporation. You may also elect to have your LLC taxed like a C corporation or an S corporation.

Also Check: How Many Solar Panels To Run An Rv Air Conditioner

Differences Between Llcs And Sole Proprietorships

Now its time to compare the differences between LLCs and sole proprietorships. There are more differences between these business structures than similarities. Rather than just listing bullet points, well take a closer look at various categories you should evaluate. This will make it much easier for you to decide which one is right for your business.

Management Structure Of S Corporations

In contrast, S corporations are required to have a board of directors and corporate officers. The board of directors oversees the management and is in charge of major corporate decisions, while the corporate officers, such as the chief executive officer and chief financial officer , manage the company’s business operations on a day-to-day basis.

Other differences include the fact that an S corporations existence, once established, is usually perpetual, while this is not typically the case with an LLC, where events such as the departure of a member/owner may result in the dissolution of the LLC.

LLCs and S corporations are business structures that impact a company’s exposure to liability and how the business and business owner are taxed.

Recommended Reading: What Insurance Companies Cover Solar Panels

Llc Vs Sole Proprietorship: Now You Know The Difference

When it comes to LLC vs sole proprietorship, theres a lot that goes into it. Theres a lot to know about the advantages of why you might need one.

For example, if youre a freelance or work by yourself as a consultant, you may not need an LLC. Theres little risk in the work you do.

However, if you have a major business entity and there is more risk involved, you should consider an LLC.

If you want step-by-step help with building a company, then you can apply to be a part of our school for startups.

Similarities Between Llcs And Sole Proprietorships

When comparing LLCs and sole proprietorships side-by-side, its important to recognize that these two business structures share some commonalities.

Heres a quick list of the similarities between LLCs and sole proprietorships:

- Income and expenses must be reported in Schedule C Form 1040.

- Net income is taxable, regardless of whether or not cash is withdrawn from the business.

- They have similar rules for tax deductions .

- An EIN must be obtained if employees are hired.

- Any industry-specific business licenses and permits at the state and federal levels are still required.

- LLCs and sole proprietors both have the option to register a DBA name.

As you can see, from taxation to paperwork filing, LLCs and sole proprietorships do have a handful of things in common.

Don’t Miss: How Much Is Solar Panel Cleaning

Core Differences Between Sole Proprietorship And Llc

Here are the highlights of a sole proprietorship vs. LLC comparison:

- Taxes. From an income tax standpoint, sole proprietorships and single-member LLCs are generally taxed the same unless certain elections are made with respect to the single-member LLC.

- Liability. LLCs grant more protections in terms of personal liability.

- Costs. Sole proprietorships are free to start. LLCs require registration and ongoing fees.

- Funding. Its generally easier to get external financing for an LLC than for a sole prop.

- Management and control. Sole proprietorships offer more control than LLCs, but with that comes more responsibility.

What Are The Disadvantages Of A Sole Proprietorship

- The owner is personally liable for any debts or obligations of the business

- Lawsuit claimants or creditors have to ability to collect from the owners personal accounts

- There can only be one owner. If the ownership grows, the sole proprietorship will need to be dissolved and a new business entity will need to be made

In the case that a sole proprietorship will need to be dissolved, it can easily be converted into an LLC due to the state licenses and employer identification number that were obtained.

You May Like: Does A Sole Proprietor Need A Business License In Washington

Why Sole Proprietorships And Partnerships Are The Most Expensive

A business entity is one of the most commonly used asset protection instruments. There are different kinds of business ownership types, such as sole proprietorships, general partnerships, corporations, and limited liability companies. Sole proprietorships and general partnerships are typically the easiest and most cost-effective business entities. However, they offer little by way of effective asset protection. Thus, when someone sues the business, they are by far the most costly.

What Is An S Corporation

An S corporation simply got its name from Subchapter S of the IRS code. It is a type of corporation that protects its shareholders from personal liability in the event that the corporation engages in some sort of misconduct. Unlike an LLC, however, an S corporation provides certain tax advantages that an LLC does not. For instance, LLC members are required to pay taxes on the businesss entire net income. Shareholders of an S corporation are only required to pay income tax on their share of wages.

If you need help deciding how to structure your business, you can post your legal need on UpCounsels marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Don’t Miss: How Much Do Solar Panels Save The Average Household

How To Activate Each Structure For Your Business

Forming an LLC requires you to file articles of organization, sometimes called a certificate of organization, with the state. Requirements vary by state.

Typically, an LLC operating agreement is drawn up to document the members’ and managers’ rights and duties.

You should also expect to file certain forms with your state agency, usually the Secretary of State, and pay an initial filing fee that can range from $50 to $500. LLCs also have to file annual or periodic reports and pay a required filing fee in most states.

Unlike an LLC, no formal action is required to form your sole proprietorship if you are operating under your own name. If you want to use a different name, you will need to file for a DBA.

You may also need to acquire any mandatory licenses or permits, and these requirements vary by region, state, and industry.

Whether you’re looking for the liability protection and flexibility of an LLC or the less formal, unlimited control of a sole proprietorship, now you have the tools to make a more informed decision for your business and your future.

LegalZoom can help you start an LLC quickly and easily. Get started by answering a few simple questions. We’ll assemble your documents and file them directly with the Secretary of State. You’ll receive your completed LLC package by mail.

Which Business Structure Is Right For You

It depends. Were not legal consultants or financial advisers, so we cant decide for you. We can only present the facts and let you come to an ultimate decision for yourself.

A sole proprietorship is undoubtedly the easiest to set up, as it doesnt require any paperwork. Yet it lacks liability protection. An LLC requires filing Articles of Organization with the state, but itll protect your personal assets should you get sued .

Regardless of which entity type you choose, there are a few best practices thatll help you out:

- It might not be required, but its best practice . Keep your finances separate from the get-go to make tax season a breeze. Plus, itll be a godsend in the off chance you get audited.

- Come up with a good business name: Take the time to research and create a name youll be proud to put on your website, social media profiles, and potentially building signage.

- Get your permits: Dont wait to get in trouble. Do your due diligence and obtain the necessary licenses and permits relevant to your industry and geographic location.

Recommended Reading: Does Home Depot Sell Solar Panels

Is An Llc Good For A Small Business

Starting a limited liability company is the best business structure for most small businesses because they are inexpensive, easy to form, and simple to maintain. An LLC is the right choice for business owners who are looking to: Protect their personal assets. Have tax choices that benefit their bottom line.

Professionally Drafted Corporation & Llc

The corporation is a legally drafted business vehicle. It is set up in such a way that it can continue in perpetuity that is, unless the existing board dissolves it or by failure to pay the annual renewal fee. The limited liability company, or LLC, is a versatile vehicle that is often a staple in many asset protection plans. An experienced asset protection professional will examine the nature of your business. They will look at the types of assets you wish to protect. Then, they will determine the degree of liability protection for those assets before making recommendations.

If properly drafted, a corporation or LLC can protect you from lawsuits. If not properly structured, there is little to no protection. So, be sure to hire a professional. Our organization was established in 1906, so we have seen our finely-tuned and crafted entities protect our clients on hundreds of occasions. Give us a call at 1-800-830-1055 to discuss your needs.

Don’t Miss: Is It Better To Own Or Lease Solar Panels