What Is The Solar Tax Credit

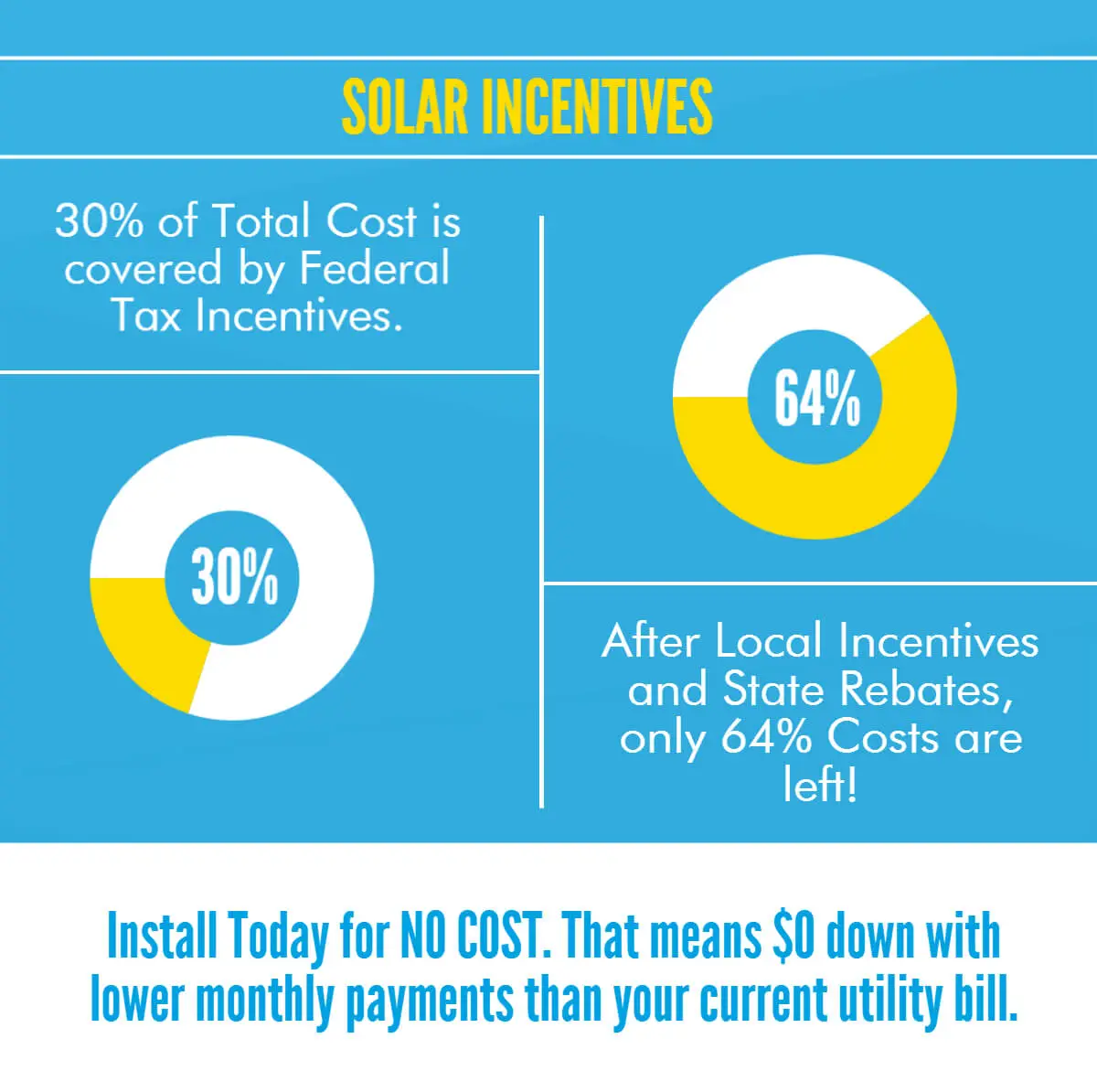

If you install solar energy equipment in your residence any time this year through the end of 2032, you are entitled to a nonrefundable credit off your federal income taxes, equal to 30 percent of eligible expenses. Theres no dollar limit on those expenses youre entitled to that 30 percent tax break whether you spend $20,000 or more than $100,000 on costs associated with a residential solar system.

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Heat Pump Clothes Dryer Incentives

Heat pump clothes dryers are more efficient than conventional dryers and create water as a byproduct instead of exhaust. That means no dryer exhaust smell, no hole in your house, and no wrestling the machine from the wall to clean the exhaust pipe.

In 2023, theyll come at a significant discount for qualified households.

- Households with income less than 80% of AMI: $840 rebate up to 100% of equipment and installation costs

- Households with income between 80-150% AMI: $840 rebate up to 50% of equipment and installation costs

- Households with income at or above 150% AMI: N/A

Don’t Miss: How To Pigeon Proof Solar Panels

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

Solar Tax Credit Eligibility Checklist For 2022

If youre not sure the ITC applies to you and your home, here is a checklist of criteria to keep in mind:

- Your solar photovoltaic system was installed between January 1, 2006 and December 31, 2034.

- Your solar PV system was installed on your primary or secondary residence in the United States.

- For an off-site community solar project, the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS allows a taxpayer to claim a section 25D tax credit for purchasing a portion of a community solar project.

- You own the solar PV system, meaning you purchased it outright or financed it with a loan. You did not sign a lease or PPA.

- Your solar PV system is new or being used for the first timethe credit can only be claimed on the original installation of the solar equipment. For instance, if you bought a house that came with a solar system already installed, you would not be eligible for the credit.

Don’t Miss: How To Power A Solar Panel Without Sunlight

How Will The Solar Tax Credit Save You Money

The credit lowers your federal taxes. So if you spend $24,000 on a system, you can subtract 30 percent of that, or $7,200, from your federal taxes. If, say, you would owe $7,000 in taxes before the credit, a $7,200 credit would drop what you owe to zero. You cant get a tax refund for the $200 remainder, however. But you can carry forward that remainder into a later tax year.

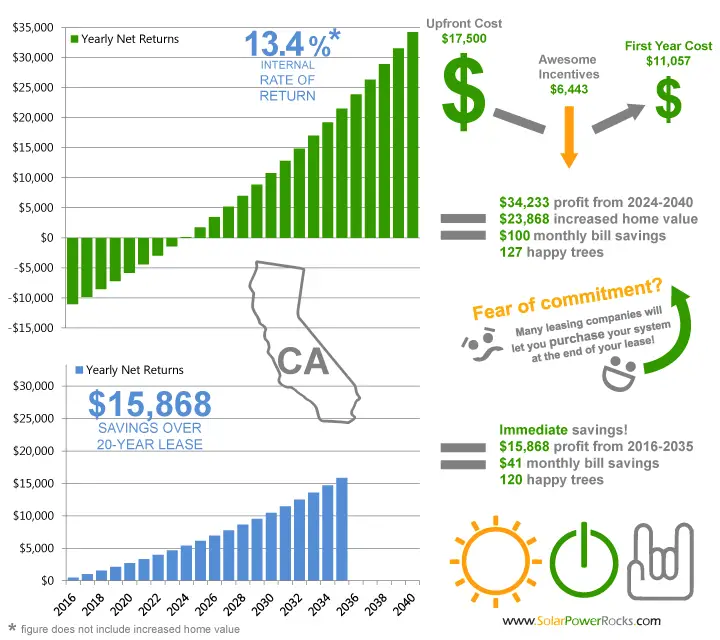

Youll save, too, in lower electricity bills. How much youll save depends on a number of factors, including how much electricity your household uses, the size of your solar system and the amount of sunlight it gets, and local electricity rates. Real estate experts say a purchased solar systemas opposed to a leased onecan raise the value of your home when you sell.

Is There A Tax Credit For Solar Panels

Is There A Tax Credit For Solar Panels? As a homeowner, youre always looking for ways to savemoney on your taxes. So you may be wondering if there are tax credits for solar panels? The answer is yes, there is! Keep reading to learn more about the tax credits for solar panels and how you can take advantage of them.

Read Also: Are Solar Panels Renewable Energy

What Does The Federal Solar Tax Credit Cover

According to the EERE, the federal solar tax credit covers the following items:

- Panels: The credit covers solar PV panels or PV solar cells.

- Additional equipment: The credit covers other solar system components, including the balance-of-system equipment and wiring, inverters and other mounting equipment.

- Batteries: The ITC covers storage devices, such as solar batteries, charged exclusively by your solar PV panels. It also covers storage devices activated in a subsequent tax year to when the solar energy system is installed. Beginning on Jan. 1, 2023, stand-alone energy storage that doesnt charge solar panels exclusively will qualify for the ITC credit.

- Labor: Labor costs for on-site preparation, assembly or original solar installation are covered. This includes permitting fees, inspection costs and developer fees.

- Sales tax: The credit also covers sales taxes applied to these eligible expenses.

Can Increase Home Rv Or Boat Value

For all of the reasons weve discussed and more, solar power systems are an increasingly desirable feature of homes, RVs, and boats. Whether its the reduced energy bills, a desire to help the environment, or a need for off-grid power, buyers see solar panels as a bonus.

Youll find that, in many cases, youll get much of the money you spend on the system back in increased value if you eventually sell. With this in mind, your system provides an even better return on investment than it appears!

Learn how to install solar panels on a sailboat.

You May Like: How Much Cost Solar Panel Home

Taxes: Solar Power And The Federal Tax Credit

Daily headlines remind us of how unreliable and vulnerable our traditional power grids are, which is why more and more accountants are exploring the possible taxpayer savings of solar power for their clients. When the suns rays beat down on solar …

Daily headlines remind us of how unreliable and vulnerable our traditional power grids are, which is why more and more accountants are exploring the possible taxpayer savings of solar power for their clients. When the suns rays beat down on solar panels, they produce electricity that can be used and stored. With solar panels people can actually own their energy, bringing them potential savings on monthly electric bills, while having access to power during outages.

Furthermore, clients will benefit more when solar power is installed with a battery backup system to prevent monetary losses due to spoiled food, medication, or the inability to work from home. Thats because stored solar energy can keep the lights on and coolers running.

Unfortunately, solar power tax benefits are too often only communicated in the bigger conversation of eco-friendly green initiatives, so not enough accountants are aware of the details. Below are 4 things you need to know when advising your clients:

When it started and what it means now.

How the tax credit rollover factor works.

State & local tax credits.

Potentially higher property value without higher property taxes.

Homeowners can sell solar energy back.

=======

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Also Check: Solar Panels In Parallel Vs Series

How Does The Solar Tax Credit Work

The solar investment tax credit applies to people who own their solar energy systems. If you dont have enough tax liability to claim the entire credit in one year, you can roll over any remaining credits into future years as long as the tax credit is still available. This is currently set to go through 2034 for residential solar panel systems.

If you sign a lease or power purchase agreement , someone else owns the system. This means youre renting the system in order to enjoy the benefits of solar energy, but you dont own the system and therefore cant claim the tax credit.

Finally, there is no income limit on the ITC program taxpayers of all levels may be eligible.

What Are The Tax Breaks For Getting Solar Panels

Investment tax credits will allow solar energy users to deduct 30% of their installed power system costs from your federal taxes. With average systems costing anywhere between $25-35,000, this can mean savings of $7,500-10,500!

The Solar Investment Tax Credit also has no maximum claim amount, allowing you to recover the full 30% no matter the cost as long as your system was placed in service during the current tax year. The tax credit covers expenses including solar panels, contractor labor costs, permit and inspection fees, mounting equipment, wiring and any other solar system equipment.

Depending on your location, further state and local tax benefits might also be available check in with your tax advisor to find out if you can save even more.

Fill out our sign up form to get all the current news on tax breaks and incentives now.

How long do you think those tax breaks for solar are going to last? Im still considering switching to solar, but I definitely dont want to lose out on $10,000.

You May Like: How Much Energy Can A Solar Panel Generate

What Costs Qualify For The Federal Solar Tax Credit

Most, if not all, of the costs associated with installing solar panels are eligible to be covered by the federal solar tax credit. Qualified costs include:

- Equipment: The cost of the solar panels, racking, wiring, and inverters.

- Contractor labor: The cost of labor associated with site preparation, installation, and planning, as well as the cost of any permitting fees and inspections.

- Sales tax: Any sales tax associated with the above costs is also covered by the tax credit.

Technically, the tax credit isn’t just for solar installations. Other clean energy systems can also get the tax credit, including solar water heaters, fuel cell systems, geothermal heat pumps, and even small wind energy systems!

Earning Tax Breaks For Installing Solar Panels

- Post published:September 26, 2022

- Post category:Cost of Solar Energy/Solar Panels

Alternative energy solutions have been a topic of much science and debate over the years, and many Americans are choosing to install solar panels in their homes to reduce electricity and home energy costs. The recent Inflation Reduction Act is now giving even more incentive to do so, offering major tax breaks for installing solar panels. With the new legislations Residential Clean Energy Credit, you can subtract 30 percent of the cost of installing solar heating, electricity generation, and other solar home products from your federal taxes.

There has never been a better time to switch to solar! Heres how it works:

Also Check: How To Apply Solar Tax Credit

Heat Pump Water Heater Incentives

Water heating is another area of major energy savings potential. The IRA creates substantial incentives that put heat pump water heaters in reach for Americans at all income levels.

- Households with income less than 80% of AMI: $1,750 rebate up to 100% of equipment and installation costs

- Households with income between 80-150% AMI: $1,750 rebate up to 50% of equipment and installation costs

- Households with income at or above 150% AMI: 30% tax credit worth up to $2,000 per year

The tax credit also applies to biomass stoves and boilers and is an exception to the $1,200 yearly limit.

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

This webpage was updated September 2022.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics . It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

Read Also: Can I Put Solar Panels On My Rental Property

Federal Solar Tax Credit August 2022 Update

When you install a solar system in 2022, 30% of your total project costs can be claimed as a credit on your federal tax return.

If you spend $10,000 on your system, you owe $3,000 less in taxes the following year. To claim the credit, your system must be fully installed. Solar systems take weeks to design, ship and install so now is the time to start if you want to meet the deadline.

The Federal Solar Tax Credit In 2022

For homeowners and business owners going solar in 2022, there are a variety of solar incentives available from the federal government, state agencies, and local governments to help reduce the upfront cost. One of the most significant ones is the Federal Solar Investment Tax Credit that has contributed to solar growth for over a decade.

Known to industry professionals simply as the Solar ITC, this incentive is a direct dollar-for-dollar tax credit from the U.S. government that is designed to drive down the cost of installing solar projects on residential and commercial properties. The Solar ITC allows solar customers to claim a one-time tax credit if they finance their solar photovoltaic systems with cash or loans.

The good news is that the solar ITC also benefits households and businesses that do not purchase a home solar system outright. Because it can apply to any system owner, including project financiers, it also translates to benefits for customers that enter a solar lease agreement or a solar power purchase agreement framework.

Recommended Reading: How To Calculate Solar Power Needs

The Solar Investment Tax Credit Explained

Solar energy is one of the fastest-growing industries in the country, but many people arent aware of the tax credits and deductions they qualify for that can help offset their costs when installing panels. If you are familiar with the tax credit, you may be wondering where it stands today, what you are eligible for, and how long you will be eligible to take advantage of the benefits. In this article, we will review the current status as of October 1, 2022.

The Solar Investment Tax Credit , also known as the federal solar tax credit, now offers a 30% tax break for purchasing and installing a solar energy system. The recent passage of the Inflation Reduction Act made the ITC jump back up to 30% in 2022 and is set to extend through 2032. It is important to note that any system installed in 2022 will qualify for the 30% tax credit, even if it was installed before the IRA was passed.

The 30% tax credit will be available through 2033 and will again be reduced to 26% before it drops to 22% and then goes away entirely. The ITC applies to both commercial and residential systems, and there is no cap on the amount of money it can save. Keep in mind that the timeline for commercial systems and the eligibility to receive a tax credit is different from the residential timeline.

Now lets explore everything you need to know about the Investment Tax Credit .

Should I Buy Solar Panels Or Lease Them

The main difference between buying and hiring solar panels is who owns the solar panels.

When you buy solar panels, you make a long-term investment and get all the financial benefits of owning your solar panel system.

You also have more decision-making power regarding your system, such as maintenance and monitoring.

Hiring solar panels require no upfront investment and are often seen as a more straightforward way to go solar.

Instead of buying your solar panels outright, you make monthly payments to a solar leasing company.

The leased panels stay on your roof, and at the end of the lease term, you have the option to buy the system, purchase a new lease, or have the panels removed.

While hiring solar panels can be a good option for some homeowners, there are some drawbacks.

First, you dont have as much control over your system since the leasing company owns it.

Second, you may pay more over time since most leases include a price escalator.

And third, if you decide to sell your home, you may have to transfer the lease to the new owner or buy out the remainder of the lease.

So, should you buy or lease solar panels? The answer depends on your situation.

If you want to maximize your financial benefits and have more control over your system, buying solar panels is the better option.

But leasing may be the way if you want a more straightforward way to go solar with no upfront costs.

To help you decide, lets take a closer look at the pros and cons of each option.

Recommended Reading: Active Solar Vs Passive Solar

Home Energy Audit Incentives

Maybe you dont know where to start with upgrading your homes energy efficiency. Thats ok, you use a home energy audit to figure out the best bang-for-your-buck.

- Households with income less than 80% of AMI: 30% tax credit up to $150 per year

- Households with income between 80-150% AMI: 30% tax credit up to $150 per year

- Households with income at or above 150% AMI: 30% tax credit up to $150 per year