How Can I Estimate The Portion Of My Solar Roof That Could Receive The Tax Credit

Your Solar Roof Purchase Agreement provides an estimated allocation of components that may be eligible for a tax credit. This estimated allocation is not intended as tax advice you should discuss this allocation with a tax professional to determine the appropriate tax credit amount in your circumstance.

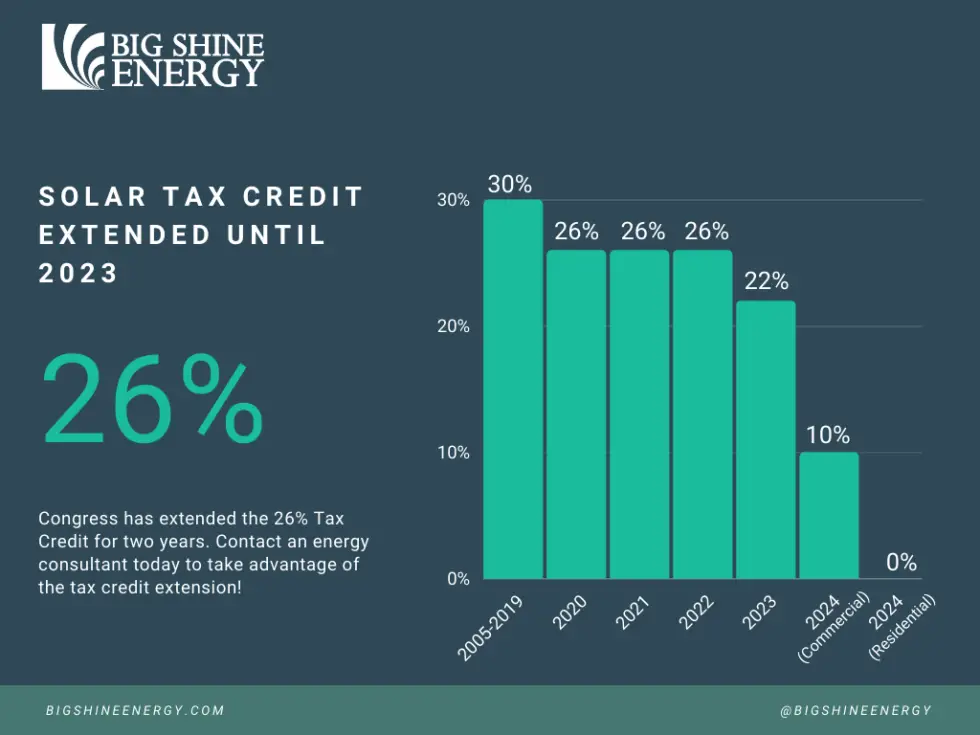

*The Consolidated Appropriations Act of 2021 signed December 27, 2020, provided a two-year extension of the Investment Tax Credit for solar. The dates above reflect the extension.

What Is The Itc

The ITC is a 26% federal tax credit for solar installations on both residential and commercial properties, reducing the tax liability for individuals or businesses that purchase qualifying solar energy technologies.

The ITC drives growth in the industry and plays a vital role in creating new high-wage jobs, spurring economic growth, ensuring U.S. global competitiveness, and lowering energy bills for consumers & businesses. As a stable, multi-year incentive, the ITC encourages private sector investment in solar manufacturing and solar project construction. The solar ITC is the cornerstone of continued growth of solar energy in the United States.

History Of The Solar Itc

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

You May Like: How Much Do Solar Panels Save On Electricity Bills

Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home, rental or otherwise, to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 26% credit would be $2,600, and you could claim 25% of that, or $650.

- $10,000 system cost x 0.26 = $2,600 credit amount

- $2,600 credit amount x 0.25 = $650 credit amount

How It’s Applied & Who Qualifies

With the federal tax credit , you can deduct 26% of the cost of your solar energy system from your business taxes. This is a dollar-for-dollar credit toward the income taxes that would otherwise go to the federal government. To qualify, the business must have a tax liability upon filing. In other words, if the business owner is going to receive money back from their tax return, then the credit will not be applied for that year and will simply roll forward to the next. The amount deducted is calculated by multiplying 26% by the “tax basis,” which is the amount invested in eligible property. For solar installations, eligible property can include solar panels, installation costs, racking, circuit breakers, energy storage devices, and sales and use tax on the equipment.

Don’t Miss: What Is Pine Sol Good For

How Do Solar Loans Affect Solar Tax Credit

There are two types of loans in solar as it relates to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to them for this monthly payment. If you do not, this will initiate another loan in the tax credit amount at the same APR.

The second type of solar loan is where youll have a different payment for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit youll have the option to submit your federal tax credit which will re-amortize your loan to lower monthly payments. You can also keep the federal tax credit and your payments will remain the same. Solar.com can help you figure out which of these options are best for you.

Applying For The Solar Tax Credit Is As Easy As 123

Applying for the Solar Tax Credit doesnt need to be hard!

If youre considering a new solar system, youve probably heard about the federal solar tax credit, also known as the Investment Tax Credit . The Federal ITC makes solar more affordable for homeowners and businesses by granting a dollar-for-dollar tax reduction equal to 26% of the total cost of a solar energy system.

The average national gross cost of installing a solar panel system in 2021 is $16,860. At that price, the solar tax credit can reduce your federal tax burden by $4,618 and thats just one of the many rebates and incentives that can reduce the cost of solar for homeowners.

Step 1:Determine if you are eligibleMake sure you pay federal income tax in order to be able to use the federal ITC against your total taxes.

Step 2:Complete IRS Form 5695This form validates your qualification for renewable energy credits, and can be obtained online. Click HERE to view Form 5695.

Step 3:

Recommended Reading: How To Get Solar Energy Without Solar Panels

Contact The Kc Green Energy Team About Installing Or Updating Your Solar Panels

The KC Green Energy team specializes in the design and installation of solar electric energy systems. We custom-design each system to suit your needs and maximize your ROI. As a family-owned operation, who also specializes in roofs, you can trust us to focus on quality craftsmanship. Contact us for a free site analysis or to learn more about our services today!

First Things First: Am I Eligible For The Solar Tax Credit

You are eligible for the Federal ITC as long as you own your solar energy system, rather than lease it. If you sign a lease agreement, the third-party owner gets the solar tax credit associated with the system. This is also true for the vast majority of state and local incentives for solar, although in some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates . You are also eligible even if the solar energy system is not on your primary residence as long as you own the property and live in it for part of the year, you can claim the solar tax credit.

If your federal tax liability is lower than the total amount of your ITC savings, you can still take advantage of it by carrying over any remaining credits to the following year.

Heres an example: You pay $20,000 to install a solar system on your home in 2021, which means you are eligible for a $5,200 federal solar tax credit. If your federal tax liability for 2021 is only $4,500, you will owe no federal taxes that year, and in 2022, you will reduce your tax liability by $700.

Recommended Reading: Is S Corp Sole Proprietorship

Can I Claim The Federal Solar Tax Credit Twice

Technically, you cannot claim the solar tax credit twice if you own a home. The unused amount of the credit will continue to roll over year to year for up to five years. If you own more than one home with solar, you might be eligible, and we recommend you consult a tax expert to determine whether you can take advantage of this.

Solar Tax Credit Cost Savings

The solar tax credit has not only helped consumers to save on the cost of solar panels, it has also fueled the growth of the renewable energy market. According to the Solar Energy Industries Association , since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000%. By taking advantage of the 2022 solar tax credit this year, you can join the over half a million homes and businesses that have taken the step towards energy independence, encouraged job creation in the solar market, and saved on their energy bills.

The solar ITC can make installing solar panels a strategic investment, but it wont mean getting your solar energy system entirely free. You will still have either upfront or monthly payments, depending on if you finance your system, purchase your system upfront, or lease your solar panels.

If youve been thinking about joining the thousands of people that already benefit from solar energy, using the solar tax credit in 2022 is a great way to lower the cost of a solar system. The average solar panel system costs between $15,000$25,000, which would make the 26% tax credit worth anywhere from $3,900$6,500.

The ITC is expected to lower to 22% in 2023 and expire in 2024. The good news is that if you start now, you still have ample time to do your solar research without feeling like you have to make an impulse buy. Make this year the one where you benefit from this exclusive IRS tax credit by getting solar for your home.

Recommended Reading: How Does Solar Energy Benefit The Environment

How Does This Tax Credit Work

Say your solar system was quoted at $20,000. Where I live in Louisiana, this would be about an 8-kilowatt system, which is medium in size. A 26% credit would save you $5,200 on your federal returns. The tax credit rolls over year after year, should the taxes you owe amount to less than the credit you earn.

The federal solar tax credit can be claimed by any U.S. homeowner, so long as the solar system installed is for a residential location based in the United States.

The system must be placed in service during the tax year. So, if you install and begin using a residential solar system during the year 2022, youll claim the credit on your 2022 tax filing. If you start a solar panel installation in December of 2022 but dont turn the system on until January of 2023, youll claim the credit on your 2023 filing.

Am I Eligible To Claim The Solar Investment Tax Credit In 2022

You might be eligible for the solar investment tax credit if you meet all of the following criteria:

- Your solar PV system was placed in service between January 1, 2006, and December 31, 2021.

- The solar PV system is located at a residential location in the U.S. .

- You own the solar PV system

- The solar PV system is new or being used for the first time. The ITC can only be claimed on the originalinstallation of the solar equipment.

Don’t Miss: How To Install Off Grid Solar Power System

How To Claim Solar Tax Credit

- Improve a Qualified Home

- Determine Solar Tax Credit Amounts

- File IRS form 5695, etc

The official name of the Federal Solar Tax Credit is the Investment Tax Credit . This tax credit was part of the Energy Policy Act of 2005 during the Bush administration. This act incentivized alternative forms of energy, such as those that avoid creating greenhouse gases. The ITC itself was set to expire just two years later, but it became an incredibly popular program, so Congress kept extending the expiration date. It will remain in effect until 2024.

One of the more commonly accessible forms of clean energy or renewable energy is solar power, especially for residential homeowners. A solar energy property is recognizable for the solar array on its roof or on its grounds. These black panels are filled with solar PV cells, which convert sunshine into usable electricity. You may have already noticed a few solar customers in your neighborhood. This is because the solar industry has grown in recent years, facilitated by the ease of installing a solar panel system and perhaps a solar incentive offered by state and local governments.

Certainly, there is the solar incentive of energy efficiency to lower ones monthly utility bill by supplementing their imported electricity with ones that are home-grown. And in some cases, if a solar property produces more electricity than needed, a net metering program may offer payment or credit for electricity added to the grid.

Apply The Amount Found In Form 5695 To Your Tax Bill On Form 1040

- Last step! Write the amount from Form 5695 line 15 into line 53 of Form 1040.

Example: 6,000

You did it!

Of course, this walked you through filing for a pure solar panel installation tax credit. If you had other solar or renewable systems installed, like a new geothermal or solar water heaters, there would be more to add in.

Hopefully, this gave you a clear idea of the steps involved and it demystified the process. Read more about the ITC and its qualifications here. Also, check this video that walks you through the process for claiming the solar tax credit.

If you have any questions, give us a call at 888-454-9979. Or connect with one of our solar specialists through chat or email. Were happy to share more solar tax credit info.

Don’t Miss: Is Solar Worth It In Florida

Applying Online Through Cactas

To request a Solar Energy System Tax Credit, you are required to complete an application. The application must be received by May 1 following the year of the installation of the solar energy system or the application will be denied. Once your application is reviewed, it will either be denied or updated to waitlisted status. An application in waitlisted status shall not constitute a promise binding the state the credit is contingent upon availability of tax credits for that particular year.

The application for the tax credit is available online within the Tax Credit Award, Claim & Transfer Administration System . The system is designed so that once you have submitted an application, you can later sign into the system to track its status. The electronic process will create efficiencies in the review and approval of the hundreds of applications received for the Solar Energy System Tax Credit each year. All applications must be entered into CACTAS paper applications are no longer available.

To learn about the amount of tax credits awarded under the program cap, select the Solar Energy System Tax Credit drop down option from the home page. you do not need to sign into CACTAS.

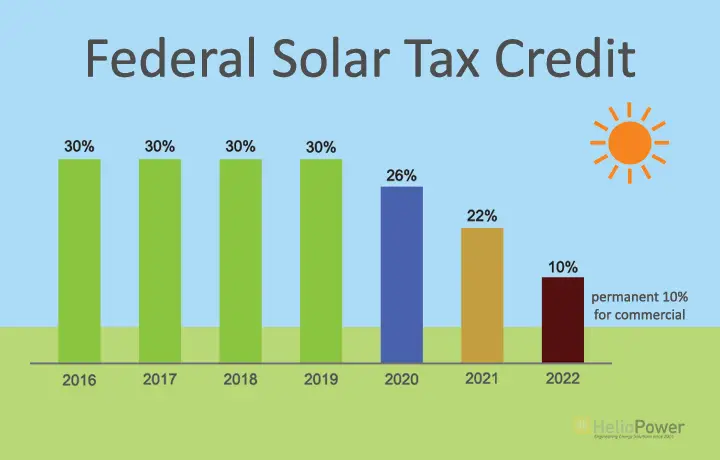

Was The Federal Solar Tax Credit Extended

Yes, the solar investment tax credit was extended at the 26% rate for an additional 2 years. It was originally going to drop to 22% in 2021, but now with the new legislation being passed, it will remain at the 26% rate until the end of 2022.

This is great news for homeowners thinking about solar, as the tax credit was voted as the single most important financial incentive in the largest home solar survey.

Also Check: How Much Power Does A Single Solar Panel Generate

Solar Tax Credit Step Down Schedule

2019 was the last year to claim the full 30% credit. As of 1/1/2021, the credit has dropped down to 26%.

Heres the full solar Investment Tax Credit step down schedule:

*From 2024 onward, the residential portion of the Solar Tax Credit will be eliminated entirely. A 10% tax credit will remain for commercial, industrial, and utility scale projects only.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Also Check: What Are Solar Panels Used For In Homes

How To Get Started With Solar And Claim Your Investment Tax Credit

If youve ever considered going solar, and thought about how to get your solar tax credit, then theres never been a better time to get started! The Solar Investment Tax Credit allows you to get money back on your solar energy system, and going solar now will ensure you get the biggest return on your investment while the solar tax credit is still available.

Over the years, the ITC has played an important role in influencing federal policy incentives for clean energy in the United States. The long-term stability of the ITC has allowed businesses to continue driving down costs and investing in their own growth, and by investing in solar, you will be helping create jobs and strengthen the economy, while saving yourself money in the process.

Get started today with a savings estimate from Palmetto, to learn more about how the solar power federal tax credit can help reduce your out-of-pocket expenses. Solar panels are a great way to offset your energy costs and reduce the environmental impact of your home, while giving you energy independence and control over your familys future. Now is the time to install solar and take advantage of the Solar Investment Tax Credit while you still can!