Why Choose One Over The Other

An S Corp, either as an LLC or a corporation, protects you and your loved ones from the liabilities of your business, such as debts or lawsuits. Instead of placing the risk of liability on your own personal assets, owning an LLC can prevent you from losing your retirement funds, home, or other assets. LLCs with an S election are especially easy to set up and provide the personal protection you need in todays litigious world.

If you are a sole proprietor who wants to minimize your personal liability, speak with your attorney about business structures and how to mitigate the risks in your particular field.

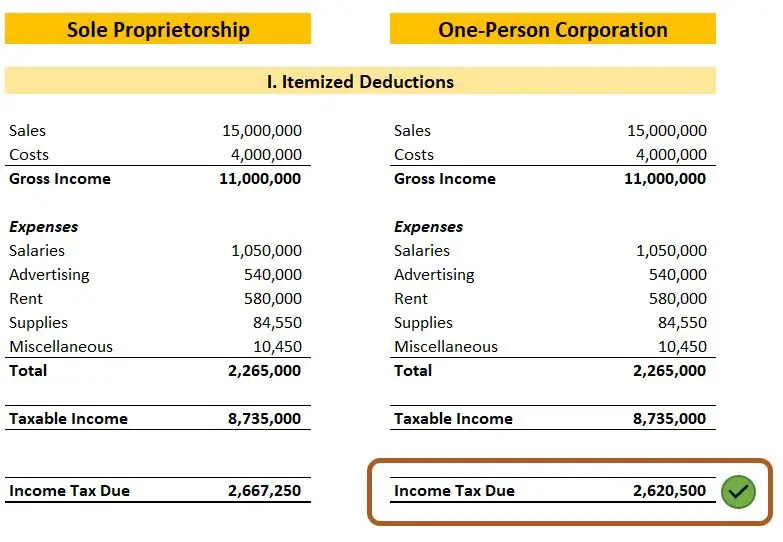

Who Pays More Taxes

Sole proprietorships must report all income earned by the business as income earned by the taxpayer. In addition, the sole proprietor must pay self-employment taxes, which are contributions to Social Security and Medicare. S corporations do not pay self-employment taxes. According to CPA firm Brinker Simpson, taxes are a major benefit to incorporating as an S corporation.

If an S corporation distributes profits to a shareholder, the shareholder reports the income on his tax return and files IRS Form K-1. However, the IRS requires S corporations to pay employees a reasonable salary for services rendered. The salary is subject to employment taxes. A single-member S corporation cannot simply avoid paying himself a salary, but at the same time accepts distributions from the corporation. The IRS may look at the distribution as reasonable compensation, and require employment taxes.

What Is An Llc

A limited liability company, or LLC, legally separates business assets and personal assets because it is considered independent of its owner. It must be registered in the state it does business in. Profits and losses are shared among its members. The biggest drawback of an LLC is that every owner is considered self-employed, meaning they are responsible for the self-employment tax.

Recommended Reading: How Solar Panels Help The Environment

Characteristics Of An S Corp: 8 Perfect Elements Of An S Corp

S Corp Advantages: 4 COMPELLING Reasons Why S Corps Are GREAT

Advantage #1: Protected Assets

Probably the biggest advantage of an S Corporation is the fact that it protects your personal assets. The fact that it is created as a new entity tells us that your personal assets will be protected from business creditors.

Truth be told, all sorts of corporations and LLCs also shield your personal from any litigations or contracts.

Advantage #2: Pass-Through Tax

When you choose that your corporation should be taxed as an S Corporation, you are free from getting taxed 2x . This means that your corporation will not get taxed at the corporate level.

If you were to elect to have your corporation as a C Corporation, your business would get taxed at the corporate level as well .

Advantage #3: Easy To Transfer Ownership

Another advantage that S Corps have is that it is easy to transfer ownership of your corporation. Because your S Corp is an entity separate from you, personally, it can exist forever.

Meaning, even after you, the owner, of the corporation has passed-away, the entity of the corporation can still exist.

In order to transfer ownership of your S Corp, all you have to do is sell your to others.

Advantage #4: More Credibility / More Professionalism

Probably the MOST underrated advantage that an S Corp has is the credibility that comes with it. It is simply more professional to have a corporation.

S Corp Disadvantages: 4 GREAT Reasons Why S Corps SUCK

Weve gotta be honest here.

The Difference Between Llc And S Corp

As a business-of-one, youve probably heard the terms LLC and S Corp a ton. Youve probably heard them used incorrectly a ton, too.

Theres a lot of confusion among new business owners around business entities, so lets get this important distinction straight about an S Corp versus LLC:

- An LLC or Limited Liability Company is a legal structure for a business that separates your personal and business assets and protects your personal property from business liabilities.

- An S Corp or S Corporation is a tax election not a legal structure for a business that determines how it is taxed at the federal and state levels..

When you work as a solo operator or freelancer, you are the business. Theres no distinction. That means you pay personal taxes on everything you make through your business, and all of your personal assets are fair game if youre sued or owe debts.

As your business grows, formalizing it as a legal structure could help you take advantage of the legal and tax benefits that come with separating yourself from your business. The legal structure is the first step to doing that.

LLC is the most common legal structure for a small business other options include partnership or corporation. To set up an LLC, you first choose a business name and file paperwork with the state. That establishes your business as a separate legal entity.

Read Also: How To Know If Solar Panels Are Worth It

How To Choose The S Corp Designation

If you do decide that an S corp is the right way to go for your business, youll need to take a few steps. First, youll need to create a business entity most likely an LLC. You do so by registering your business with your state, which is a process that varies greatly from one place to another. Fortunately, an attorney can help you with this or likely has already if your business is currently operating.

Next, verify that your company is eligible for S corp status. To qualify, you need to be a domestic US company with no more than 100 shareholders. If youve issued stock, you may only have one class of it.

If youre eligible and ready to proceed, file IRS Form 2553 to make the S corp election with the federal government. Once you have, youll want to put another call into your lawyer to see if your state has any S corp filing requirements. New Jersey, for example, requires businesses choosing the S corp designated to file the states Form CBT-2553. California, however, does not recognize the S corp designation and does not require you to file any state paperwork.

Which Entity Type Should You Choose

Going back to the fictitious companies introduced at the beginning, which entity type should they choose?

FreeBooks

As a classic technology startup hoping to receive VC or PE funding, they have little option but to be a C corporation. The other types of entities wouldnt allow for the complex share class and ownership structures these types of companies require.

The only other possible consideration would be to form first as an LLC then cut over to C status when the corporate investors become a reality. This structure would be simpler early on and potentially allow the early investors to deduct losses on their personal tax returns.

Brilliant Ideas

With losses this year, and $250,000 of profits next year, Bill and Ashley appear to be perfect candidates for forming an LLC and electing to be taxed as a proprietorship or partnership this year, then electing S corporation status next year. That way they can use this years business losses to offset wages or other income. Next year they will draw wages from the S corporation and the remaining profits will not be subject to FICA.

Joes Mowing

JBD Group

Don’t Miss: How Much Solar Offset Do I Need

How To Form An Llc

Below are several of the steps involved in forming an LLC. However, please check with your local state since they may have additional forms and requirements.

It’s important to note that the above list is not comprehensive since each state may have additional requirements. Once established, many states require LLCs to file an annual report, which the state may charge a fee. These fees can sometimes run in the hundreds of dollars per year.

Check Eligibility For S Corp Status

To elect S corp status, all of the following must be true of your company:

- Form 2553 was filed on time by an eligible business entity. Eligible business entities include corporations, LLCs, and partnerships, among others.

- Your company has no more than 100 shareholders.

- Your company has issued only one class of stock.

- Every shareholder has consented to the S corp election.

Read Also: How Much Does A 8kw Solar System Produce

Sole Proprietorships And The Irs

One area of concern for a sole proprietorship is taxes. As far as the Internal Revenue Service is concerned, the owner of the business and the business itself are one and the same. The income that the business earns or the losses incurred are the responsibility of the owner. If the business earns a profit, that amount is added to the owners income for a tax year. Then all of the income is taxed at your personal income rate.

The Internal Revenue Service considers a sole proprietorship a disregarded entity. An owner files no tax return for the business. The recent Tax Cuts and Jobs Act passed by Congress may make sole proprietorships eligible for a 20% income tax deduction. An owner of a sole proprietorship should have a professional tax preparer or a tax attorney advise them on whether they are eligible. As a sole proprietor, you dont have to pay payroll taxes or withhold income tax from your pay because you are not an employee.

Which Is Better An Llc Or S Corp

An LLC is better for a single-owner and likely better for a partnership. An LLC is more appropriate for business owners whose primary concern is business management flexibility. This owner wants to avoid all, but a minimum of corporate paperwork does not project a need for extensive outside investment and does not plan on taking her company public and selling the stock.

In general, the smaller, simpler, and more personally managed the business is, the more appropriate the LLC structure would be for the owner. If your business is larger and more complex, an S corporation structure would likely be more appropriate.

You May Like: What Is The Lifespan Of A Solar Panel

Tax Return Filing Guidelines For A Limited Partnership

- Every limited partnership that is formed in California or registered with the California Secretary of State must file California Form 565, Partnership Return of Income even if it has no income from California sources.

- Every limited partnership that engages in a trade or business in California or earns income from California sources must file an informational return, Form 565.

- Generally, the due date of the Form 565 is the 15th day of the 3rd month after the close of the partnershipâs taxable year.

- A limited partnership must pay an annual tax of $800 to California.

- The limited partnershipâs items of income, deductions, and credits flow through each partnerâs limited partnership to its partners and are reported on each partnerâs California Schedule K-1 , Partnerâs Share of Income, Deductions, Credits, etc. even if they are not actually distributed.

- The limited partnership provides each partner with a Schedule K-1 that states the partnerâs distributive share of the partnershipâs items of income, deductions, and credits.

Key Features Of A Sole Proprietorship:

- It is inexpensive to start a sole proprietorship.

- A sole proprietorship consists of an individual or a married couple. creates a partnership.)

- The business and the owner are one. There is no separate legal entity.

- The owner of the sole proprietorship controls the entire business.

- The sole proprietor is personally liable for all debts and actions of the business. Personal assets may be used to pay the debts of the business.

- The life of the sole proprietorship continues to exist until it goes out of business, or as long as the business owner is alive. Once the owner dies, the sole proprietorship no longer exists.

Read Also: How To Clean Solar Panels Diy

Converting From A Sole Proprietorship To An S Corp

S corporations require that all shareholders unanimously elect to become an S corporation. Once everyone has voted, the business must perform the following steps to convert from a sole proprietorship to an S corporation:

File Your Llcs Articles Of Organization

Your LLCs Articles of Organization is the necessary formation document that needs to be filed with the appropriate state agency. The Articles of Organization are also known as a Certificate of Formation or Certificate of Organization.

You can complete and file the Articles of Organization yourself online or through the mail. Alternatively, you can hire an LLC formation service to do this.

Filing the Articles of Organization costs about $100, but fees vary by state.

You May Like: Should I Do Solar Panels

Should I Make My Llc An S Corp

If you’re a sole proprietor, it might be best to establish an LLC since your business assets are separated from your personal assets. You can always change the structure later or create a new company that’s an S corporation. An S corporation would be better for more complex companies with many people involved since there needs to be a board of directors, a maximum of 100 shareholders, and more regulatory requirements.

How To Convert A Sole Proprietorship To An S Corporation

As your sole proprietorship grows, you may start to consider other business structures that could be more suitable.

An S corporation has several advantages over a sole proprietorship, including tax savings and limited liability protection.

In our How to Convert a Sole Proprietorship to an S Corporation guide below, we will help you understand the key differences between a sole proprietorship and an S corp, why you would choose one over the other, and how to convert your sole proprietorship to an S corp.

SKIP AHEAD TO

2021-09-23

Also Check: How Expensive Is Solar Panel Installation

What Does It Mean To Be A Sole Proprietor

Many people who work for themselves dont even realize theyre sole proprietors. This could be partly because you dont have to file any special paperwork with your state to gain sole proprietor status.

Basically, any time you perform work for hire , youre a sole proprietor in the eyes of the IRS. If youre running a solo IT business, youre probably a sole proprietor.

Sole proprietorships are known as pass-through entities. This means all business income goes straight to you, the business owner. You then report profits, losses, and business expenses on your individual tax return.

This structure cuts down on paperwork and lets you pay taxes as an individual rather than as a corporation two of the tax advantages of sole proprietorship. This setup may save you money, but legally, it also means that you and your business are one and the same.

Business liability is probably the biggest drawback to a sole proprietorship. Since there is no legal line drawn between the assets of the owner and the business, collectors can come after your personal income and property if there are any losses or debts. If a lawsuit is involved, the stakes can get even higher.

While IT is a relatively low-risk field overall, all businesses face some risk. Its important to be aware of the risk you take on as a sole proprietor.

How To End An Llc

- File California Form 568, Form 100, or Form 100S for the last taxable year, check the box that indicates that it is a final return, and write “Final” on top of the return.

- File California Form 568, Form 100, or Form 100S for all delinquent tax years.

- Pay all outstanding tax liabilities, interest, and penalties.

- Domestic LLCs file the appropriate Certificate of Dissolution and/or Certificate of Cancellation, with the California Secretary of State.

- Foreign LLCs file the appropriate Certificate of Cancellation with the California Secretary of State.

- Notify all creditors, vendors, suppliers, clients, and employees of your intent to go out of business.

- Close out business checking account and credit cards.

- Cancel any licenses, permits, and fictitious business names.

- Consider publishing a statement in a local newspaper of general circulation near the principal place of business that the limited liability company is no longer in business.

- Refer to FTB PUB 1038, Guide to Dissolve, Surrender, or Cancel a California Business Entity, for more information on how to cancel an LLC.

Don’t Miss: How To Build A Solar Panel From Scratch