How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system installed in 2022 cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

* 0.30 = $5,100

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit. Note: A private letter ruling may not be relied on as precedent by other taxpayers.

Rebate from My State Government

$18,000 * 0.30 = $5,400

State Tax Credit

Solar Energy System Property Tax Exclusion

Statewide

The California State Board of Equalization has approved the Active Solar Energy System Exclusion. So if you install a new home solar system in California or build a house with a solar panel system, your property taxes wont increase until the end of the 2024 fiscal year.

This is a property tax incentive for installing an active solar energy system in the form of a new construction exclusion. It is not an exemption. Therefore, installing a solar PV system will not result in either an increase or a decrease in the assessment of the existing property.

In general, a solar system also helps increase your propertys value. For example, according to a recent study in the Appraisal Institute, the value of California homes can increase by around $6,000 for each kilowatt of solar capacity.

How To Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . Your solar provider should supply the proper documentation and instructions upon your demand. We have listed the essential steps in claiming the credit here:

Also Check: How Much To Add Battery To Solar

Does California Have A Net Metering Incentive

Under Californias net energy metering incentive, investor-owned utilities are required to buy homeowners excess solar electricity at close-to retail rates.

The NEM 2.0 program, passed by the Public Utilities Commission in 2018, guarantees that homeowners going solar will be able to sell the excess solar electricity – typically produced during midday – for a period of 20 years.

This is an extremely valuable incentive selling your electricity to the utility at a good value is the easiest way to pay off your solar panel purchase quickly.

As we mentioned above, NEM 2.0 will end some time in 2022. The reason there isnt a firm date is that the California Public Utilities Commission has to vote on a final version of NEM 3.0, which will take effect 120 days after that vote.

Learn more:

California Solar Panel Incentives And Rebates

Even though the cost of solar panels has decreased in the last two decades, it’s still a substantial investment. But several solar tax credits and incentives make solar more affordable, especially in California.

The Residential Clean Energy Credit is a federal solar tax incentive offered in California that credits 30% of the cost of a solar system back to consumers who buy solar panels. This solar tax credit was increased and extended due to the Inflation Reduction Act, passed in August. This tax credit alone could save as much as $6,580 on the average solar panel system in California. There is no cap on the federal tax credit, so you can claim the entire 30% regardless of the size of the system.

You can apply for the Residential Clean Energy Credit by filling out IRS form 5695 . The IRS provides instructions on how to fill out this form. Once the IRS approves your form, you will receive your savings in credit when you file your federal tax return for the year.

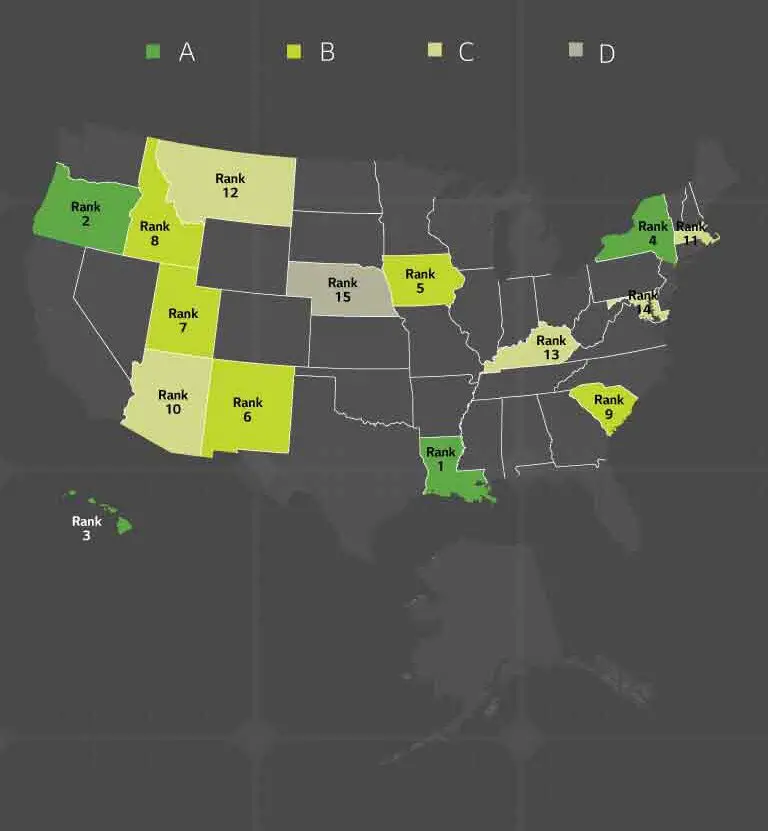

There are various state and local solar incentives available in California, too. You can find a more comprehensive list through the Database of State Incentives for Renewables and Efficiency. Here are just a few you should know.

Recommended Reading: How Much Does Solar Energy Cost Per Month

Take Advantage Of Solar Incentives Today

The time to install a solar energy system is now. Take advantage of the ITC before it drops down in 2023 by reaching out to the solar experts at Mega Power. We proudly provide state-of-the-art solar energy equipment and best-in-class service to make sure your sustainability journey is as smooth and rewarding as possible. Our team serves both residential and commercial properties of all sizes, so no job is too big or too small for us to take on.

Our solar energy services include:

Solar Tax Credits And Incentives In California

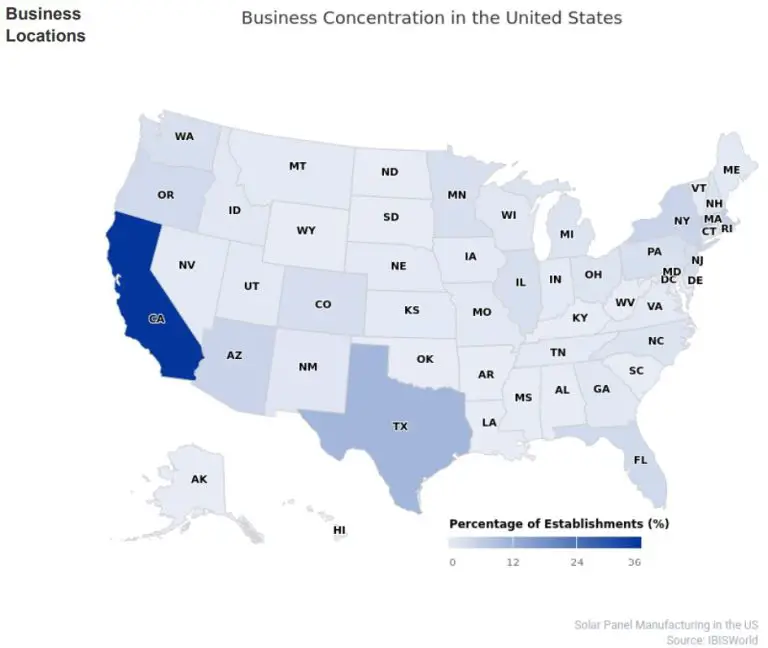

If youre a solar installer operating in California, you know how competitive and busy the solar market has been in the last few years. With a closer eye on climate change, and a new government set to reduce emissions in any way possible, it has never been a better time for solar contractors and homeowners alike to be involved in the industry and what it has to offer in the Golden State.

Here are all the must-know solar tax credits, incentives, and programs offered in California for 2022 so you can stay in the loop and make sure that youre offering your clients the best possible deal on their solar panels so that you win the bid every time.

Don’t Miss: How To Be A Sole Proprietor

Net Metering In California

Net energy metering , or net metering, is an agreement you enter with a utility company. This agreement allows the utility company to track any excess energy generated by your solar panels and sends that energy back into the local power grid. The utility company takes the metered amount of excess energy and reduces your energy bill based on that amount.

Most solar PV systems generate more energy than a typical home consumes. Selling that surplus power back to a utility company provides you with savings on your electricity bills above and beyond the solar rebates and credits weve already listed. You also help your community move closer to clean, renewable energy and lower the demand for grid-supplied electricity from nonrenewable and finite energy sources.

Currently, California offers a statewide net-metering incentive for homeowners with solar panels, but the exact amount of credit you receive varies based on your local utility company. We have listed some of the major utility providers in the state of California below so you can investigate their net-metering retail rates:

Solar Power Tax Credits In California

Living in the southern part of California, maybe you have thought about solar power, or know of someone thats talked about getting solar panels installed. Solar power has many benefits and advantages ranging from environmental to economical. Not to mention, California offers Solar Power Tax Credits, so why havent you gone solar yet?

To begin, solar power is readily available because it uses the sun which is free, and for the most part, limitless. By installing a solar home energy system, homeowners will experience significant savings on energy.

Also Check: Solar Tube Before And After

California Solar Tax Credit

While some states still offer their own state tax credits for solar energy, California doesnt anymore.

However, Golden State policymakers have enacted a property tax exemption for solar PV which is still going strong. This is a great perk, since solar panels will increase the value of your home by roughly 70% of system costs. So while the value of your home will go up, your property taxes wont.

Example: If your solar system costs $20,000, your estimated property value increase of $14,000 will be tax exempt.

What Is A Tax Credit

Tax credits are a powerful tool that can help you reduce your taxable income and directly impact your annual tax bill. A dollar-for-dollar reduction of the income tax you owe, a tax credit can reduce the amount of tax you owe or increase your tax refund. They also differ from deductions and exemptions.

Don’t Miss: Government Program For Solar Panels

How Can I Find A Solar Installer In California

With many solar installers available throughout the state, it can be tricky to choose the right company. If you’re searching for a California solar installer, take the time to thoroughly review your options, read customer testimonials and get multiple quotes from different installers. You can also review CNET’s picks for the top solar companies.

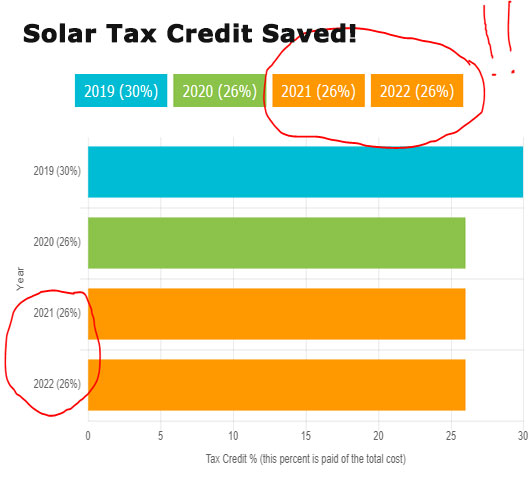

Federal Solar Tax Credit

To maximize your solar savings, you should also consider the federal solar investment tax credit . The federal solar tax credit lets you claim 26% of the total cost of your solar system installation on your federal taxes. It is not a tax deduction. Instead, it reduces the amount of money you owe in taxes as a credit.

The federal solar tax credit helps with most installation costs for a solar PV system. Best of all, there is no maximum amount that you can claim. However, this benefit is not here to stay. The credit amount will decrease to 22% for systems installed in 2023 and end in 2024 unless the federal government extends the ITC.

You May Like: How To Make A Solar Cell From Scratch

The Federal Solar Tax Credit

Dont forget about federal solar incentives! With the Investment Tax Credit , you can reduce the cost of your PV solar energy system by 26 percent. Keep in mind that the ITC applies only to those who buy their PV system outright , and that you must have enough income for the tax credit be meaningful.

Accurate Solar Panel Prices

We have a network of over 80 solar company partners in California. Most are long-established, family-owned installers with excellent customer reviews. We use the average of these companies prices to generate our online cost estimate and to calculate the savings you will get from the federal solar tax credit.

You can choose to have 1-4 of these companies view your roof online and provide an exact bid which will show you the exact value of the tax credit – if you choose to accept their bid.

How many solar panels do you need to offset 100% of your electric bill?

Recommended Reading: What Is The Difference Between Sole Proprietorship Llc S Corp

How Do I Qualify For The Itc

- Have sufficient tax liability .

- Your solar or energy storage project must be installed and made operational within the year that you claim the tax credit.

- You own the solar or energy storage project. A financed system is also considered eligible, as is one purchased outright.

- Home batteries are included in the credit, if all the stored energy is generated by solar panels.

- The solar or energy storage system is not being re-used or re-installed.

- For solar installations that require new roofing, SOME of those costs are also covered by the Federal Solar Tax Credit. Youll need to contact a tax professional to determine your eligibility for these circumstances.

What Solar Rebates And Incentives Are Available In California

Rooftop solar panels have long proved a reliable and savvy financial investment for Californians, and many buyers are able to secure a speedy return on investment .

However, because of the already cost-effective nature of solar in the state, there is currently no statewide solar tax credit to help residents with the upfront cost of solar panels in California.

That said, all Californians are eligible for the federal solar tax credit, and the state offers several additional solar incentive programs and rebates aimed at further increasing access to reliable, affordable solar energy.

Also Check: Post Cap Solar Lights 4×4

Is There A California Tax Credit For Solar Panels

Yes. The Federal government in California offers the best incentives to solar panel investors, making it more affordable for them to install panels on their roofs. In addition, this encourages the investors to go solar. TheCalifornia solar incentivescome in the form of rebates and tax benefits and can give you a 25-50 percent discount.

Solar in Orange Countyis your best option given the all-round sunny climate in Southern California. Enlightened Solar is the leading solar installation company in Orange County. We have supported homeowners transitioning into solar, and they have attested to the numerous benefits they continue to experience by working with our team.

2021 has seen remarkable changes in residential solar in the Golden State. For example, the building codes made in 2020 demanded the installation of solar in every new home.

The residents of Orange County are making big considerations for going solar. The COVID-19 effects and the continuous blackouts experienced across Northern and Central California in 2019 have influenced the move. Every homeowner in California yearns for the independence that comes with investing in solar panels and California solar panel rebatesare also something to look forward to as you go solar.

How do solar incentives work?

Lets focus on the following:

A Tax Credit Is Different From A Tax Refund You Must Owe Money To The Irs To Use The Tax Credit

An IRS credit reduces the Federal income taxes you owe. So if you owe the IRS $10,000 in Federal taxes and you have a credit of $9,000 for solar, then you will only owe $1,000 in Federal taxes.

If you dont have any income, you wont get any money from the IRS because you dont owe them anything. You need to have some tax liability.

Recommended Reading: How Much Is A Complete Solar System

Ac System With A Back

This comprehensive system is the best option if youre looking for completely off-grid solar systems. The average cost for this type of system ranges from $40,000 to $70,000. An AC system with a back-up generator is typically designed to handle all of your homes energy needs as such, the size will vary based on the size of your home and your energy consumption.

Compare Quotes From Top-rated Solar Panel Installers

Select a State To Get Started With Your No Commitment, Free Estimate

Can A House Run On Solar Power Alone

Yes. Even large-sized homes can run completely off the power grid thanks to todays advanced solar technology. Large solar energy systems require many solar panels, which can be housed on a roof or even on a ground-level platform . Several backup batteries can be purchased and wired to ensure energy levels remain consistent, even in poor weather conditions. And with the federal solar tax credit, homeowners are finding they can save money on solar energy systems, which make them a better investment.

Don’t Miss: How To Hook Up Solar Panel To Boat Battery

Solar Tax Credit Eligibility

You can qualify for the ITC as long as your solar system is new or being used for the first time between January 1, 2006 and December 31, 2023. Unless Congress renews the ITC, it expires in 2024.

Other requirements include:

- You must own the system outright

- The system must be located in the United States

- The system must be located at your primary or secondary U.S. residence or for an off-site community solar project

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers dont want to take over a 25-year lease.

Recommended Reading: Does Solar Increase Property Taxes

The 2022 Inflation Reduction Act And The 30% Tax Credit Explained

For solar, the Investment Tax Credit is the primary federal incentive to encourage the installation of residential solar and/or energy storage systems and can put thousands back in your pocket. The Inflation Reduction Act increases the current ITC from 26% to 30% of the solar and/or energy storage contract price. For an average system, this adds up to an average of $1,500 in additional tax credit savings that is available to you today!

The IRA has many parts to it, but a key focus is to address future energy needs and the cost of energy in America. Households that make energy-efficiency focused upgrades will get more than just the direct benefits of lower electric bills. Financial incentives are available to home and business owners to get indirect financial benefits. This includes a tax credit for:

- New and used electric vehicles

- The extension and increase of the 30% tax credit for going solar

- A tax credit for home energy efficiency projects

- Home energy rebates for a reduction in your energy consumption

- Rebates for energy-efficient appliances