What Are The Benefits For Customers

For customers, recurring payments mean less paperwork while still receiving services or products on a regular basis . The subscription model also allows customers to pay in convenient installments without worrying about late fees or overdraft charges. In addition, recurring payments help customers stay organized and avoid the hassle of going through several invoices every month to reconcile their accounts.

Opening A Bank Account In The Name Of Your Sole Proprietorship

Most banks have their own criteria for opening of a bank account.

Although all the above 3 ways of registering a sole proprietorship are legally valid, some banks still dont accept Udyog Aadhaar or Registration under the Shop and Establishment Act.

Banks insist on a GST Registration. If the GST Registration is not there, some banks are willing to accept the Income Tax Return as a proof of registration provided your Trade Name is mentioned in your previous yearâs ITR.

Some banks do not accept Udyog Aadhaar or the Registration under the Shop and Establishment Act and therefore, it is advisable that if your sole purpose of registering is to open a bank account in your name, you should first check with your banker on what are the documents which they need.

Make This Tax Year Simplewith Wise Numbers

- Fill out your tax forms for your business based on your financial statements.

- Fill out your personal tax forms claiming any personal tax credits you are eligible to.

- Ensure all of your business expenses and business tax deductions are recorded on your tax return.

- File your taxes with the Canada Revenue Agency.

- Provide you with the final balance you can expect to pay or be refunded by the CRA.

Recommended Reading: What Can A 120 Watt Solar Panel Run

Can A Sole Proprietor Hire Employees

There is some confusion about this and yes a sole proprietor or self-employed individual can hire employees and there is no limit on the number of employees that can be hired. Just as with any other entity, the owner is responsible to withhold state and federal withholdings pay payroll taxes and purchase workers compensation insurance.

Setting up a new business as a sole proprietorship is a good choice for many businesses. Its important to remember that the business entity can be changed whenever it is appropriate. If the business outgrows the sole proprietorship, the business can change to a corporation or LLC relatively easily. For other businesses, its better to spend a little extra and form a corporation or LLC to have liability protection. Read more about the pros and cons on each of the business entities.

Check On Other Permits Or Licenses

The fees associated with not having the correct licenses or permits can be debilitating to a young business. Be sure that youve gotten the correct federal licenses and permits and state licenses and permits. These might include:

- A health department permit for preparing or serving food

- A federal license for transporting animals

- A health and safety training for opening a daycare

- A certification exam to become a financial advisor

- A zoning permit to operate your business from home

- Registration with the state tax authority if you have employees or collect sales tax

Do the legwork up front and find out what licenses and permits you need. The fees youll pay during this process are nothing compared to the fines youll pay if you havent filed the right paperwork.

Don’t Miss: Does Tesla Powerwall Need Solar Panels

Compliances Required For Sole Proprietorship Firm Registration

Sole Proprietorship has minimal compliances as it is not a separate legal entity from a proprietor. Main compliances are tax related and annual compliances.

Following are the compliances a sole proprietorship india needs to follow:

1. Sales Tax Returns:

These are to be filed in every quarter of the assessment financial year, on the following prescribed dates

- For April to June – July 25

- For July to September – October 25

- For October to December – January 25

- For January to March – April 25

2. Service Tax Returns:

These are filed on half yearly basis, on the following due dates of the assessment financial year

- For April to September – October 25

- For October to March – April 25

3. Income Tax Returns:

ITR is filed on yearly basis, on the following dates depending upon the necessity of financial/tax audit

- When audit is not necessary under any law – July 31 of the assessment financial year

- When audit is compulsory under any law — September 30 of the assessment financial year. This gets applied when the annual turnover of the proprietorship firm is over INR One Crore Or the Service Turnover is more than INR 25 Lac.

How Do I Look Up A Sole Proprietorship In California

If you are looking for a specific sole proprietorship in California, you can sometimes search by the entity number , the identification number provided by the California Secretary of State. Sole proprietors dont always need to obtain an EIN and often use their private social security numbers instead.

Read Also: How Solar Energy Works Step By Step

Making Estimated Tax Payments

Estimated tax payments are mandatory for businesses that anticipate owing $1,000 or more over the course of a year. To avoid getting hit with a hefty tax payment come April, sole proprietors need to set a portion of their income, interest and dividends aside each month in order to submit estimated tax payments four times a year. Failing to submit estimated quarterly tax payments could leave your business on the hook for fees and penalties from the IRS.

Not sure what your estimated tax payments should be? Use the previous years tax return to estimate annual income. Then, divide this amount into four even payments to be sent to the IRS in mid-April, mid-June, mid-September and mid-January. Sole proprietors who fail to make estimated payments may be subject to an IRS underpayment penalty in addition to the tax burden they already owe.

How Do I Transfer A Sole Proprietorship To A Family Member

Also Check: How Much To Replace Solar Panels

How Bench Can Help

If you need a little help staying on top of your deductions as a sole proprietor, Bench can help. Your personal bookkeeper keeps your financial reporting up-to-date, giving you access to important and accurate information on your businessâs financial health. Then, when tax season rolls around, a CPA or tax professional uses your Bench-generated financial reports to get your taxes filed. Looking for an even more hands-off tax solution? Bench can file for you and advise you on tax-cutting actions you can take as part of your subscription. Learn more.

Taxes And Sole Proprietorships

A sole proprietor pays federal and state income taxes on all the net income of the business , even if you don’t have cash on hand to pay these taxes.

Your business income is included with your personal income on your personal tax return. The tax rate you pay may on your business income can be hard to determine because it’s all combined. The corporate tax rate is a flat 21% for all corporate income levels, so your tax rate might be higher or lower, depending on your personal tax rate.

And don’t forget the self-employment tax. Sole proprietors must pay self-employment tax on the profits of their business. This withheld from your business income, so you’ll probably have to make quarterly estimated tax payments for this and your business income tax.

The IRS publishes a Tax Guide for Small Business, which you might find helpful in dealing with federal taxes.

Read Also: How Long Do Solar Roofs Last

Sole Proprietorship Taxes: How Are Sole Proprietorships Taxed

The decision whether to operate your small business as a sole proprietorship or corporation has some major tax implications. Do you know what they are?

Selecting the right business structure for your new enterprise can have far-reaching tax implications, so its important to understand how sole proprietorships are taxed. The most common business entity is a sole proprietorship business, which is owned and run by one person.

If youre thinking of starting a sole proprietorship, here are a few things to keep in mind about sole proprietorship taxes when April 15 rolls around.

Sole Proprietor Taxes

How are sole proprietorships taxed? Sole proprietorships are not taxable entities under Internal Revenue Service guidelines. Rather, revenue passes through the business andthe sole proprietor reports all income and expenses on Schedule C Profit or Loss From Business or Schedule C-EZ Net Profit From Business and submits this along with their federal Form 1040 when they file their personal tax returns, also called pass-through taxation.

One of the most common mistakes that sole proprietors make is not reporting all earned income. For example, if a freelance writer makes $600 or more from a single client in a given year, that client is required to send the writer a Form 1099-MISC. However, even if you dont receive a Form 1099-MISC from a client, youre still required to report to the IRS any income you receive from that client.

Estimated Quarterly Taxes

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Recommended Reading: How To Start A Sole Proprietorship In Arizona

How To Start A Sole Proprietorship In India

Starting a sole proprietorship business in India is a fairly easy affair. You just need to take care of the following before thinking of how to open a proprietorship firm in India.

1, Decide on a suitable business name

Federal And State Estimated Taxes

Estimated taxes arent a separate class of tax by themselves. When you pay estimated tax, youre actually paying money ahead toward what you think youll owe for income and self-employment tax at the end of the year. Normally, an employer would withhold money from your paychecks to be applied to your tax liability. But if youre a self-employed sole proprietor, youll have to do this yourself.

Federal and state estimated taxes are due in January, April, June and September. The first tax payment of the current tax year is in April. As a result, the last is due in January of the following year. Filing deadlines are typically the 15th day of their respective month, unless the 15th falls on a holiday or weekend. In that case, the filing deadline would be the next regular business day. You can file these taxes with Form 1040 ES. However, you also have to file your income taxes for the previous year in April.

Its important to make sure youre paying enough in estimated taxes each quarter. Shorting your estimated taxes could trigger an underpayment penalty if you end up owing more in taxes at the end of the year.

You May Like: How Much Do Solar Cells Cost

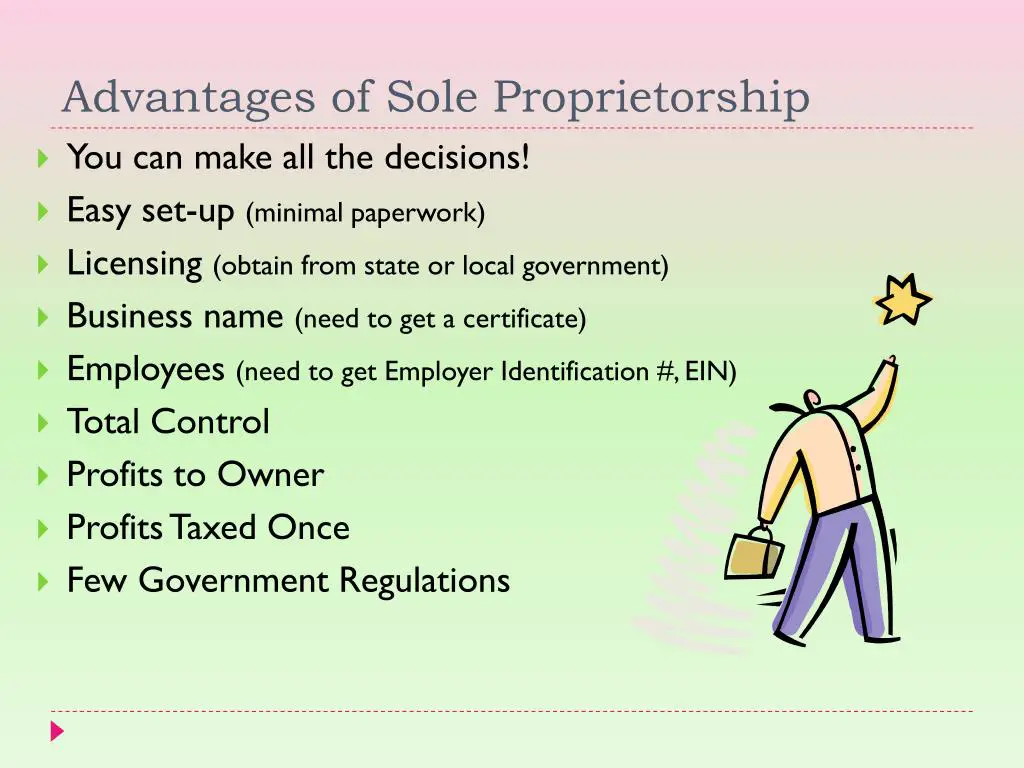

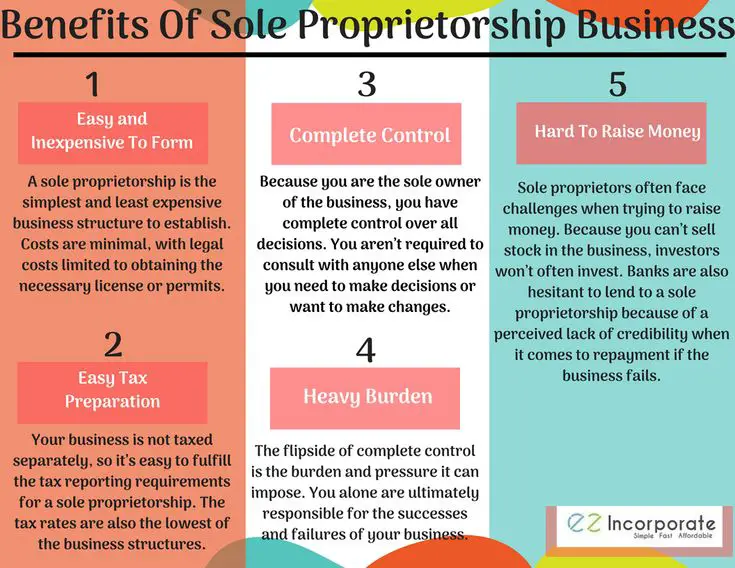

Barely Any Paperwork Compared To Other Structures

There are few legal requirements to start a sole proprietorship, so theres barely any paperwork. And that enables you to legitimize your business and begin trading quickly.

For instance:

- You donât need to file an article of organization with your state

- No need to write an operating agreement

- Or provide end-of-year business reports

However, you might need to get a license or permit depending on your state and business type.

Stamp And Company Account Is It Necessary

There is really no requirement to get a company stamp or create a company account. Nevertheless, it is better to try it out. A stamp is always useful we will use it on invoices or contracts, sometimes it may also happen that some contractors next to the signature will require it. It should contain the most important information: company name, entrepreneurs name and surname, registered office address, REGON and NIP number.

It is similar with a company account private is enough, but it does not look professional. Anyway, its important to separate private and business expenses. This is especially important when we are inspected by the tax office it will only see the costs of our business activity, and will not have access to others.

Our own company will allow us to develop, feel that we are implementing the plans on which we it depends. And although it is not easy to establish a solid position on the market, it is worth the effort. As you can see, the first step, i.e. registering your business, encourages you to act because it doesnt seem too burdensome.

You May Like: What Are The Pros And Cons Of Having Solar Panels

Ways To Register A Sole Proprietorship In India

Select your email service

A sole proprietorship is the most common form of a business entity where one person is the owner and is personally liable for all the debts and liabilities of the business. It is the most simple form of an entity with minimal compliance procedures.

Sole Proprietorship Registration can be done in 3 ways:

Sole Proprietorship Registration Through Gst Registration

GST registration is another way of getting your sole proprietorship registered. You can apply for GST registration if you are dealing in any kind of exchange of goods and services. It has replaced the old VAT and Service tax registration.

GST registration is a great method of getting an identity for your sole proprietorship concern. However, there are certain important considerations that must be evaluated before opting this method.

Under GST registration, the only drawback is that after registration it is mandatory to meet all the compliances. Every registered business has to compulsorily collect the tax from the customers and file the GST returns.

If a sole proprietor has a turnover of less than Rs. 20 Lakhs, it is not mandatory for him to get registered and collect GST. But if he still chooses to register in order to register his sole proprietorship then he will have to go through unnecessary added compliances which he could have avoided.

GST Registration Process for Sole Proprietorship RegistrationTo know about the registration process and other details with respect to GST registration, please refer here.

Recommended Reading: How Much Does It Cost To Go Solar In Florida

When Can We Speak Of A Business

It is easy to distinguish a sole proprietorship from other activities that may only indicate running a business. Here you know when you can talk about it. First of all, it is profit-oriented, it is conducted in an organized and continuous manner, and all activities are repetitive. A sole proprietorship is a task performed on ones own behalf and with full responsibility. It is not managed by a third party or other person. It is characterized by a certain degree of risk, because its success depends on many factors not only our initiative, but also the market situation or competition.

File For An Employer Identification Number

In most cases, your Social Security number will serve as your tax ID number. However, youll need an employer identification number if you decide to hire employees or set up a retirement plan. An EIN is what you provide to the Internal Revenue Service when you file your taxes. Obtaining your EIN is a free, easy process that can be done on the Small Business Administrations website.

Also Check: Is Solar Worth It In Southern California

Purchase A Website Domain Name

Once youve settled on a business name and have registered it with your state, its time to purchase your website domain name. Your domain name is what identifies your site. It looks something like this: www.example.com.

Its best to set your domain name as the same name of your business to avoid any confusion. If the domain name you want isnt available, come up with a variation that is still similar to your business name. Its alright if youre not ready to build your website just yet. You can still reserve your domain to ensure no other business takes it.

Get a free Yelp Page

Promote your business to local customers.

Sole Proprietorship Registration Benefits

Registering a sole proprietorship has two major benefits:

- Business Identityâ

A separate identity of the business which is available in the case of other entities such as Partnership and Company.

- Ease in opening the bank account in the name of businessâ

The major concern in case of a sole proprietorship is getting a bank account in the name of the business. Since a sole proprietorship does not have a Government identity it becomes difficult to prove the existence of a business. After registration it becomes easier to open a bank account for a sole proprietorship since it gets a valid Government identity.

Disadvantages of a sole proprietorship concern

The biggest disadvantage of a sole proprietorship is unlimited liability.

A sole proprietorship does not have any governing law to protect the rights of a sole proprietor. The owner is personally liable for all the debts and liabilities of the business. If the business does not have enough assets to pay off the debts and liabilities then the owner will be personally liable for it. His personal can be taken to settle the external claims.

Tax on Sole Proprietorship

Recommended Reading: How Much To Add Battery To Solar