Solar Tax Credit Eligibility Checklist For 2022

If youre not sure the ITC applies to you and your home, here is a checklist of criteria to keep in mind:

- Your solar photovoltaic system was installed between January 1, 2006 and December 31, 2034.

- Your solar PV system was installed on your primary or secondary residence in the United States.

- For an off-site community solar project, the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS allows a taxpayer to claim a section 25D tax credit for purchasing a portion of a community solar project.

- You own the solar PV system, meaning you purchased it outright or financed it with a loan. You did not sign a lease or PPA.

- Your solar PV system is new or being used for the first timethe credit can only be claimed on the original installation of the solar equipment. For instance, if you bought a house that came with a solar system already installed, you would not be eligible for the credit.

The 3 Steps To Claiming The Solar Tax Credit

There are three main steps youll need to take in order to benefit from the ITC:

For the purposes of this article, lets assume the gross cost of your solar system is $25,000.

Disclaimer: This article is intended to provide an informational overview of the Federal Solar Tax Credit for interested homeowners. It is not intended to serve as official financial guidance. Readers interested in installing solar products should use their best judgment and seek advice from a licensed professional before making any purchase or investment.

How Is The Federal Solar Tax Credit Calculated

The equation for figuring out how much your solar tax credit is worth is simple.

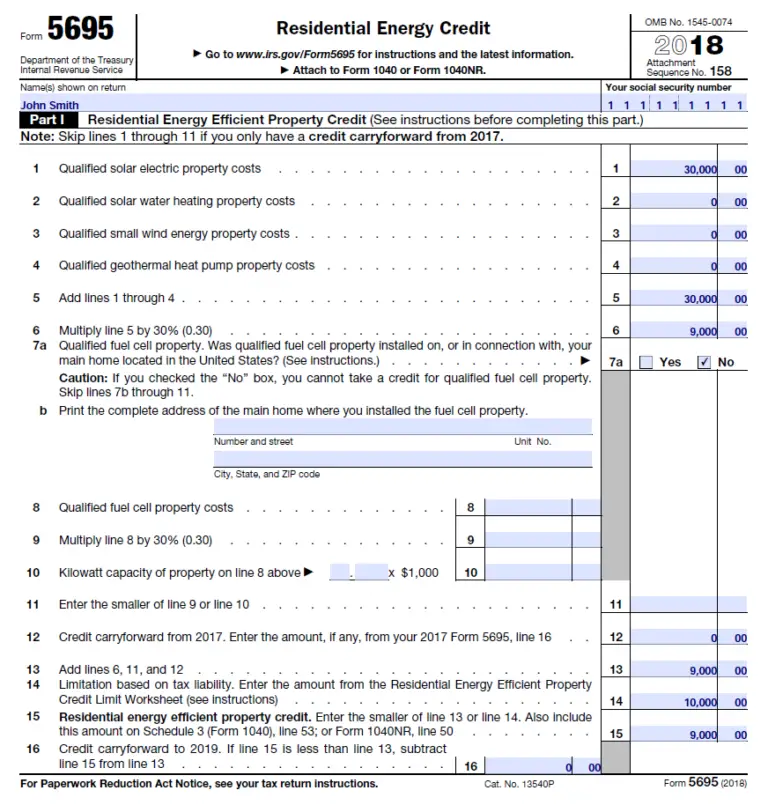

Gross cost of project x 0.30 = tax credit value

So if your project costs $30,000, your tax credit will be worth $9,000 .

The gross system cost may include improvements needed to facilitate the solar installation, such as electrical box upgrades. However, its best to speak to your tax advisor about your unique circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. It also means that you have to pay and file taxes in the same tax year order to receive the credit.

Now that we know how to calculate your solar tax credit, lets go over how to claim it.

Also Check: When Is Tesla Solar Roof Available

Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

The Solar Energy Credit: Where To Draw The Line

How much of the cost of a roof replacement can be included in calculating the credit?

To encourage investment in solar energy , the Internal Revenue Code offers a credit to taxpayers who install solar energy equipment. Specifically, the taxpayer may take a 30% credit for the costs of the solar panels and related equipment and material installed to generate electricity for use by a residential or commercial building.

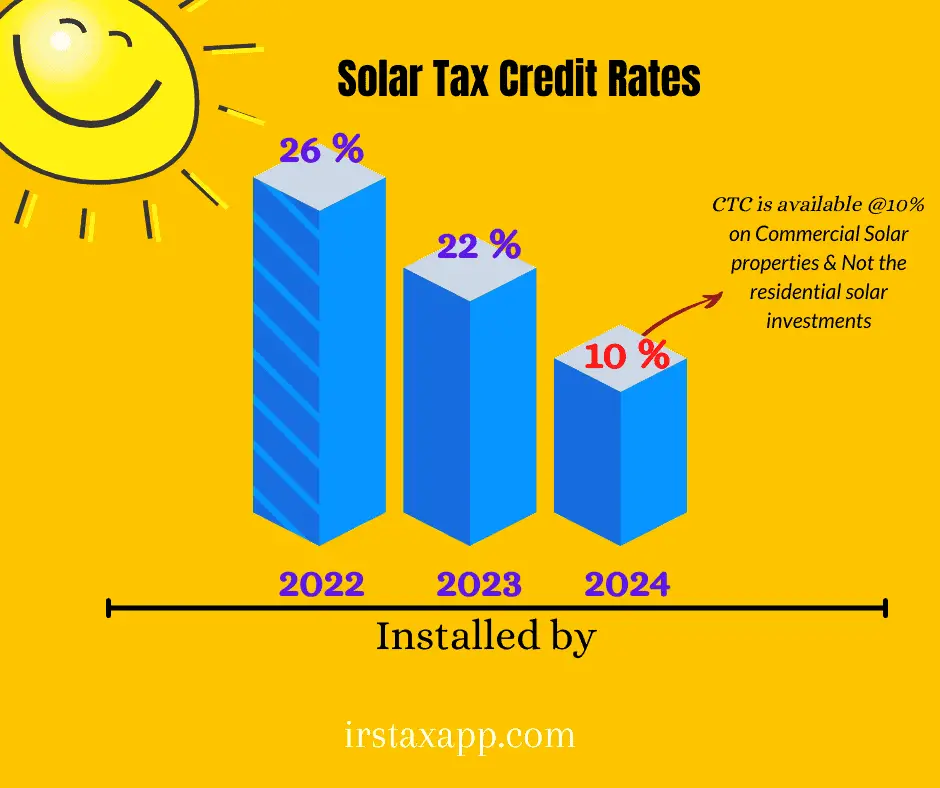

Sec. 25D provides a credit of 30% if the property was placed in service in a residence before Jan. 1, 2020, a 26% credit if the property was placed in service after Dec. 31, 2019, and before Jan. 1, 2021, and a 22% credit if the property was placed in service after Dec. 31, 2020, and before Jan. 1, 2022. Sec. 48 provides a 30% credit for solar energy equipment in commercial property if construction begins before Jan. 1, 2022.

This credit raises the question as to how much of the equipment and materials are properly includible for purposes of calculating the credit. Can a taxpayer include the entire cost of a new roof being installed in conjunction with the solar panels? Does it matter whether the roof is undamaged or in need of repair?

Sec. 25D Residential energy credit

Lastly, Notice 2013-70 provides two useful questions and answers:

A-21: The taxpayer may request that the homebuilder make a reasonable allocation or the taxpayer may use any other reasonable method to determine the cost of the property that is eligible for §25D.

. . .

What’s included?

Recommended Reading: How Much Solar Energy Do I Need For My Home

Now Is The Time To Install Solar To Take Advantage Of The Solar Tax Credit

Any tax advisor will tell you that the government creates tax credits to motivate taxpayers to behave in a certain way, whether its giving to charity, purchasing a home, or installing solar panels on the roof of their residence. Often these actions benefit the greater community as a whole, so the government has its own motivation to provide incentives.

Renewable energy or clean energy is once such area, and the government provides an incentive for homeowners to bite the bullet in terms of paying to install solar energy , which otherwise might be cost prohibitive, by providing these homeowners with a tax credit.

Is installing solar panels worth it for the tax credit? According to some estimates, the average cost of installing solar panels on a personal residence was around $16,860, which would currently result in a tax credit of $4,618. Of course, that means you still have to pay thousands of dollars to have solar energy equipment installed, so a better question might be to consider whether or not the energy savings are worth it over time. According to some estimates, your solar panels will pay for themselves in three years. The answer really depends on your location, how much energy you use, and your energy bill. No matter the answer to any of those questions, the tax savings that solar panel installation can provide you with dont seem to have a cloud in sight.

Bonus Video

Read Also: Veranda 5×5 Solar Post Cap

Is Solar Tax Credit Refundable

Not really! The federal solar tax credit is non-refundable and can only be used to offset your current tax liability. Any extra carries over to future years, as long as the credit still applies in future years. In other words, the portion of the credit that is not allowed because of this limitation may be carried to the next tax year and added to the credit allowable for that year.

Currently, the credit is allowed through 2023. So, a question unclear at this point in time is if solar tax credit that is still left to be adjusted at the need of the year 2023 will be allowed to be set off with tax liability for the year 2024

Read Also: Which Solar Company To Choose

Is The 26% Itc Refundable

So what happens if you are eligible for the ITC, but you dont owe any taxes for that year? Will you receive a refund check for $5000 from the IRS, according to the example above? Sadly not, as the 26% ITC is not a refundable credit. Thankfully, according to Section 48 of the Internal Revenue Code, the ITC can be carried back 1 year and forward 20 years. Which means that if you had a tax liability last year but dont have one this year, you are still entitled to claim the credit. However, if you havent had any tax liability for the past year and for this year, you are entitled to keep the credit on your records and can use it over the next 20 years.

Needless to stress out this again, we are not tax attorneys, so make sure you confirm with your tax representative for the most up-to-date ITC information.

Recommended Reading: Can I Have An Llc And A Sole Proprietorship

How Much Can I Claim For A Small Wind Turbine On My Tax Return

You can qualify for 30% of the cost for a small wind turbine put into service by the end of 2019, but that percentage declines for turbines installed after 2019:

- 30% for systems placed in service by 12/31/19

- 26% for systems placed in service after 12/31/19 and before 01/01/23

- 22% for systems placed in service after 12/31/22 and before 01/01/24

Discover more home improvement tax credits and energy-efficient appliance rebates:

Recommended Reading: How Do I Find Out Who Installed My Solar Panels

When And For How Long Can I Claim The Solar Tax Credit

If youre eligible for the ITC, but you dont owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. The 30 percent ITC is not refundable. However, the ITC can be carried forward as long as it remains in effect . Therefore, if you have a tax liability next year, but dont have any this year, you can still claim the credit.

Am I Eligible For A Windows Doors And/or Skylights Tax Credit

This tax credit has been extended through December 31, 2021, and you may take advantage of it even if you replaced your windows, doors, or skylights before 2021. If you were eligible and did not claim it on your return as far back as 2017, you can refile your return for the appropriate year to take advantage of the savings. Consult your tax professional to find out if refiling is right for you.

- This must be for your primary residence .

- This must not be for a new home or a rental.

- The replacement windows, doors or skylights must be ENERGY STAR-certified products.

- You must have a copy of the Manufacturer’s Certification Statement to qualify.

- More eligibility requirements can be found here.

Recommended Reading: How Does A Sole Proprietorship Work

Irs Solar Tax Credits:

Solar panels collect light energy from the sun and convert it into electricity for your home and solar hot water heaters use the sun to provide hot water to your home. Heres what you need to know to find out if you qualify for home energy improvement tax credits for installing solar panels or solar hot water heaters. Find out more about how solar energy works on our blog.

Am I Eligible For A Solar Hot Water Heater Tax Credit

- The water heater may be installed in your primary residence or a secondary home.

- Existing and new homes qualify rentals do not.

- Solar panels must help power the residence and meet the necessary fire and electrical codes.

- At least half the energy generated by the solar hot water heater must come from the sun.

- The system must be certified by the Solar Rating and Certification Corporation.

- The water heated by the solar water heater must be used inside the home.

- More eligibility requirements can be found here.

You May Like: How To Set Up A Sole Proprietorship In Illinois

How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To qualify for the 30% Residential Clean Energy Credit, youre solar system needs to be installed and deemed operation by a city inspector in any of the tax years 2022-2032. The 30% credit applies retroactively to systems installed in 2022 when the credit was still at 26%.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

While you dont have to worry about the tax credit stepping down for another 10 years, there are plenty of reasons to install solar sooner rather than later. First, the sooner you install, the sooner you will see a return on investment. Second, net metering policies are subject to change over time, so its best lock net metering while its available.

Am I Eligible For A Non

This tax credit has been extended through December 31, 2021, and you may take advantage of it even if you installed your new water heater before 2021. If you were eligible and did not claim it on your return as far back as 2017, you can refile your return for the appropriate year to take advantage of the savings. Consult your tax professional to find out if refiling is right for you.

- This must be used for your primary residence .

- It cannot be used for a new home or a rental.

- Electric heat pump water heaters qualify for the home improvement tax credit only if they have a Uniform Energy Factor of at least 2.2.

- Natural gas, oil or propane hot water heaters must have a Uniform Energy Factor of at least 0.82 or thermal efficiency of at least 90%.

- You must have a copy of the Manufacturer’s Certification Statement to qualify.

- More eligibility requirements can be found here.

Read Also: How To Make A Gravel Driveway Solid

How It’s Applied & Who Qualifies

With the federal tax credit , you can deduct 26% of the cost of your solar energy system from your business taxes. This is a dollar-for-dollar credit toward the income taxes that would otherwise go to the federal government. To qualify, the business must have a tax liability upon filing. In other words, if the business owner is going to receive money back from their tax return, then the credit will not be applied for that year and will simply roll forward to the next. The amount deducted is calculated by multiplying 26% by the “tax basis,” which is the amount invested in eligible property. For solar installations, eligible property can include solar panels, installation costs, racking, circuit breakers, energy storage devices, and sales and use tax on the equipment.

Federal Solar Tax Credit Guide

In this article:What is it?| How does it work?| Do I qualify?| What does it cover?| The bottom line|FAQs

Since 2005, the federal government has incentivized homeowners to switch to solar through the solar investment tax credit , also known as the federal solar tax credit. The rate of this credit has fluctuated over the years, but currently lets homeowners claim 30% of their total solar system installation costs as a deduction on their federal taxes. The ITC will decrease to 26% in 2033 and drop to 22% in 2034. It will end in 2035 unless Congress renews it.

We at the Home Media reviews team have researched the best solar installation companies in the United States to understand the industry and available incentives. This guide covers how to qualify and file for the federal solar tax credit and how to file for it so you can save more on your solar power system.

Get a Quote on Your Solar Installation in 30 Seconds

Recommended Reading: What Is Solar Home System

How Does This Tax Credit Work

Say your solar system was quoted at $20,000. Where I live in Louisiana, this would be about an 8-kilowatt system, which is medium in size. A 30% credit would save you $6,000 on your federal returns. The tax credit rolls over year after year, should the taxes you owe amount to less than the credit you earn.

The federal solar tax credit can be claimed by any U.S. homeowner, so long as the solar system installed is for a residential location based in the United States.

The system must be placed in service during the tax year. So, if you install and begin using a residential solar system during the year 2022, youll claim the credit on your 2022 tax filing.

If you start a solar panel installation in December of 2022 but dont turn the system on until January of 2023, youll claim the credit on your 2023 filing.

What Do You Need To Do To Claim The Federal Tax Credit

Lets look at the steps you need to follow if youre filing your own taxes. First, we recommend that you use online tax filing to use the correct forms and not make any mistakes.

To claim the tax credit, youll need to file Form 5695 with your tax return. This is the form designed for residential energy tax credits.

You May Like: What Is The Cost Of Tesla Solar Roof Tiles

The Federal Investment Tax Credit

At the federal level, youll qualify for the federal solar Investment Tax Credit . In 2021, the ITC will provide a 26% tax credit on your solar panel installation costs, provided that your taxable income is greater than the credit itself.

For most homeowners, this effectively translates to a 26% discount on your home solar system. So, if your system costs $20,000, the ITC would enable you to claim around $5,200 as a credit on your taxes.

Solar Tax Credit Carryover In 2022

If you are interested in claiming the Solar Tax Credit, you will need to do so for the same tax year that your solar system is installed. This means that if you purchased solar panels at the end of 2021 and the installation isnt complete until January 2022, you will claim the Solar Tax Credit on your 2022 tax return.

So, what if the value of the Solar Tax Credit is more than you owe in income taxes? While you cant use the tax credit to receive money back from the IRS, the Solar Tax Credit rollover lets you roll the tax credit back one year and carry the credit forward for up to five years. So, if you didnt owe federal taxes last year, you can still claim the Solar Tax Credit on this years tax return. And if the Solar Tax Credit offers you more than you owe in federal taxes, you will receive the difference in the next tax year until the credit is fully claimed.

For example, if the Solar Tax Credit credits you $3,000 when you owe $2,500 in taxes, that extra $500 from the credit would roll over into the next tax year. That means you wouldnt have to pay anything in the current tax year, and you will receive a $500 credit on next years taxes as well.

You May Like: How Many 100 Watt Solar Panels Do I Need

Read Also: How To Create Solar Power