Solar Featured In New State Of American Energy Report

Monday, Jan 05 2015

WASHINGTON, DC – Signaling the growing importance of solar energy to Americas future, the widely read and cited annual State of American Energy Report released today by the American Petroleum Institute includes, for the first time ever, a comprehensive section on the rapid growth of the U.S. solar energy industry and its impact on our nations economy and environment.

According to the report, which included an assist from the Solar Energy Industries Association , solar is now the fastest-growing source of renewable energy in America. Today, the U.S. has an estimated 20.2 GW of installed solar capacity, enough to effectively power nearly 4 million homes in the United States or every single home in a state the size of Massachusetts or New Jersey with another 20 GW in the pipeline for 2015-16.

The report went on to say, Solar energy is now more affordable than ever. According to SEIA/GTM Research, national blended average system prices have dropped 53 percent since 2010. Today, the solar industry employs 143,000 Americans and pumps more than $15 billion a year into the U.S. economy. This remarkable growth is due, in large part, to smart and effective public policies, such as the Solar Investment Tax Credit , Net Energy Metering and Renewable Energy Standards .

About SEIA:

Media Contacts:

Ken Johnson, SEIA Vice President of Communications, 556-2885Samantha Page, SEIA Press Officer and Communications Manager, 556-2886

Solar Power Energy In The United States

- Post category:Blog

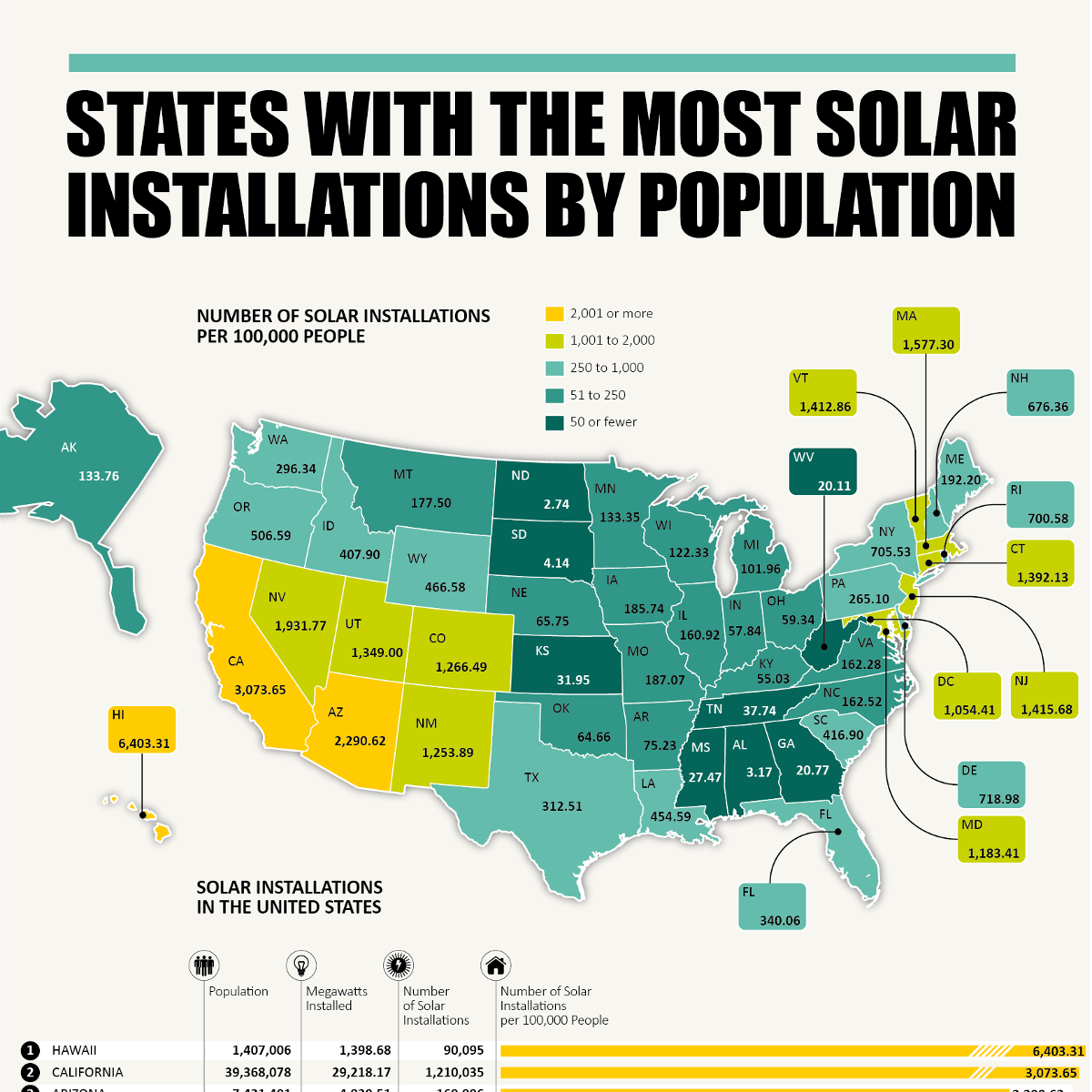

Today, we are talking about solar power energy in the United States. As everyone wants to know about solar power in the United States. United States had over 71.3 gigawatts at the end of 2019.

In 2017 United States ranked as 2nd country in the world and china ranked as 1st in solar power. Do you know that 2.30% of the electricity in the United States came from solar power in 2018?

Now, people are transferring their homes towards solar power. They are installing solar panels in their homes. Day by day, solar power energy demand is increasing in the United States. In recent years, solar power has rapid growth than wind power in the United States.

The United States comes in the top countries in the world that generate electricity by the sun. Currently, the united states make tens of billions of dollars through solar power and employ 242,000 people in the solar industry. Solar PV has expected to grow faster than all renewable energy from now to 2050.

Total installed PV will double in the United States over the next five years. Solar PV installer wage will increase to 42,000 USD dollars till 2028 according to the US Bureau of Labor Statistics.

Solar power is a very big scope for employment and for business. There is no competition in solar power in the United States. But soon companies will enter in the solar industry.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes.You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes.A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence

The solar PV panels are on my property but not on my roof?

Don’t Miss: Solar Tax Credit 2021 California

Solar Industry Research Data

Solar Industry Growing at a Record Pace

Solar energy in the United States is booming. Along with our partners at Wood Mackenzie Power & Renewables and The Solar Foundation, SEIA tracks trends and trajectories in the solar industry that demonstrate the diverse and sustained growth of solar across the country.

Below you will find charts and information summarizing the state of solar in the U.S. If you’re looking for more data, explore our resources page. In addition, SEIA Members have access to presentation slide decks that contain this data and much more. Not a SEIA Member? Join today!

Massive Growth Since 2000 Sets the Stage for the Solar+ Decade

In the last decade alone, solar has experienced an average annual growth rate of 33%. Thanks to strong federal policies like the solar Investment Tax Credit, rapidly declining costs, and increasing demand across the private and public sector for clean electricity, there are now more than 130.9 gigawatts of solar capacity installed nationwide, enough to power 23 million homes.

Solar as an Economic Engine

As of 2021, more than 255,000 Americans work in solar at more than 10,000 companies in every U.S. state. In 2021, the solar industry generated nearly $33 billion of private investment in the American economy.

Growth in Solar is Led by Falling Prices

Supply Chain Constraints Lead to Price Increases

Solar’s Share of New Capacity has Grown Rapidly

The U.S Solar Industry is a 50-State Market

Residential Market Continues to Diversify

How We Use Solar Energy Today

When multiple solar panels are wired together, they form whats called a solar array. The more panels you have, the more electricity youll generate. And depending on how big your array is, the solar energy that you capture has three applications: utility, commercial, and residential.

Commercial solar arrays are smaller than the utility-size plants. Theyre usually installed by commercial property owners on vacant land, rooftops and parking structures in order to provide electricity to the businesses that occupy their buildings. Depending on weather conditions and the size of the commercial solar installation, the business may even generate more solar energy than they need on a given day, which they can sell back to the local utility.

Recommended Reading: How Much Does Solar Energy Cost Per Kwh

Solar Energy Resources Vary By Location

The availability and intensity of solar radiation on the earths surface varies by time of day and location. In general, the intensity of solar radiation at any location is greatest when the sun is at its highest apparent position in the skyat solar noonon clear, cloudless days.

Latitude, climate, and weather patterns are major factors that affect insolationthe amount of solar radiation received on a given surface area during a specific amount of time. Locations in lower latitudes and in arid climates generally receive higher amounts of insolation than other locations. Clouds, dust, volcanic ash, and pollution in the atmosphere affect insolation levels at the surface. Buildings, trees, and mountains may shade a location during different times of the day in different months of the year. Seasonal variations in solar resources increase with increasing distance from the earths equator.

The type of solar collector also determines the type of solar radiation and level of insolation that a solar collector receives. Concentrating solar collector systems, such as those used in solar thermal-electric power plants, require direct solar radiation, which is generally greater in arid regions with few cloudy days. Flat-plate solar thermal and photovoltaic collectors are able to use global solar radiation, which includes diffuse and direct solar radiation. Learn more about solar radiation.

S Of Solar Power Generation

There are two basic methods for generating electricity from solar power. The first method uses photovoltaic solar panels to generate electricity directly from sunlight. The second method is known as concentrating solar power and converts sunlight into heat to produce steam, which is then fed through conventional steam-turbine generators to generate electricity.

Read Also: How To Determine If Solar Panels Are Worth It

Gain Energy Freedom & Control With A Solar Lease

Your roof has the power to protect. Now, give it the power of the sun. With BrightSave Monthly, Sunrunâs monthly solar leasing plan, you can enjoy clean, renewable energy for as little as $0 down.

Lock in low, predictable monthly payments, enjoy worry-free performance and maintenance, and receive industry-leading service when you choose our most popular solar plan to power you forward.

Energy Independence Can Be Yours With A Monthly Solar Loan

Take control of your energy with a monthly solar loan that puts the power in your hands. Now, you can finance your solar system with low, fixed monthly loan payments, a competitive interest rate, and little to no upfront cost. Keep the tax credits, build equity in your home,1 and claim your slice of the sun with BrightAdvantage.

| BrightSave Monthly |

|---|

Read Also: When Will Solar Panels Be Affordable

Connecticutambitious Renewable Energy Goals

Connecticut aims to procure 30% of its energy needs from renewable sources within its own borders by 2025. More than 130,000 homes are already powered by solar.

On top of a solar sales tax exemption, property tax exemption, and net metering, Connecticut offers two other strong solar incentives:

Residential Solar Investment Rebate: A homeowners rebate of $0.463 per watt of installed solar capacity.

Energy Conservation Loan Program: Allows residents to borrow up to $25,000 for 10 years when they purchase a new solar system with interest rates as low as 0% and no higher than 6%.

Donât Miss: What Is Government Community Cloud

What Is Solar Energy And How Is It Used

-

Most U.S. solar energy is produced by photovoltaic cells the fundamental elements of solar panels which produce electricity from sunlight. Individual photovoltaic cells are at most a few inches across and made from silicon or other materials.

-

Other solar technologies use heat from the sun to warm buildings directly or indirectly, or to heat water or other fluids that can in turn spin electricity-generating turbines.

-

U.S. solar energy consumption multiplied nearly six-fold between 2012 and 2018.

Don’t Miss: Do It Yourself Solar Panel

Solar Energy Currently Accounts For 5% Of All Energy Production In Texas

ByMichael Karlis onSun, Sep 25, 2022 at 9:36 am

Stay on top of San Antonio news and views. Sign up for our Weekly Headlines Newsletter.

The Investment Tax Credit

The Solar Investment Tax Credit is a federal tax incentive enacted into law to encourage the deployment of solar energy in the United States. This federal tax credit is claimed against the tax liability of residential, commercial, and utility-scale investors in solar energy projects. When a homeowner purchases a residential solar energy system, the tax credit is applied against the homeowners personal income tax. For commercial and utility-scale projects, as well for residential projects owned by third parties, the tax credit is claimed by the business that owns the solar energy system.

The amount of the tax credit is determined based on the capital investment required to build a solar project. The credit provides a dollar-for-dollar reduction in the income taxes a person or company would otherwise pay to the federal government.

The solar ITC was first established in 2005 as a tax credit of 30 percent on eligible properties. Several legislative extensions have kept the ITC in place over the past two decades. The ITC was most recently extended in the Consolidated Appropriations Act enacted in 2020.

Currently, the ITC provides a 26 percent tax credit for projects that begin construction through 2022. In 2023, the ITC will step down to 22 percent. In 2024, the commercial and utility-scale tax credit will drop to 10 percent, while the residential credit will be eliminated.

Recommended Reading: Is Solar Power Worth It In Michigan

How Does Home Solar Power Work

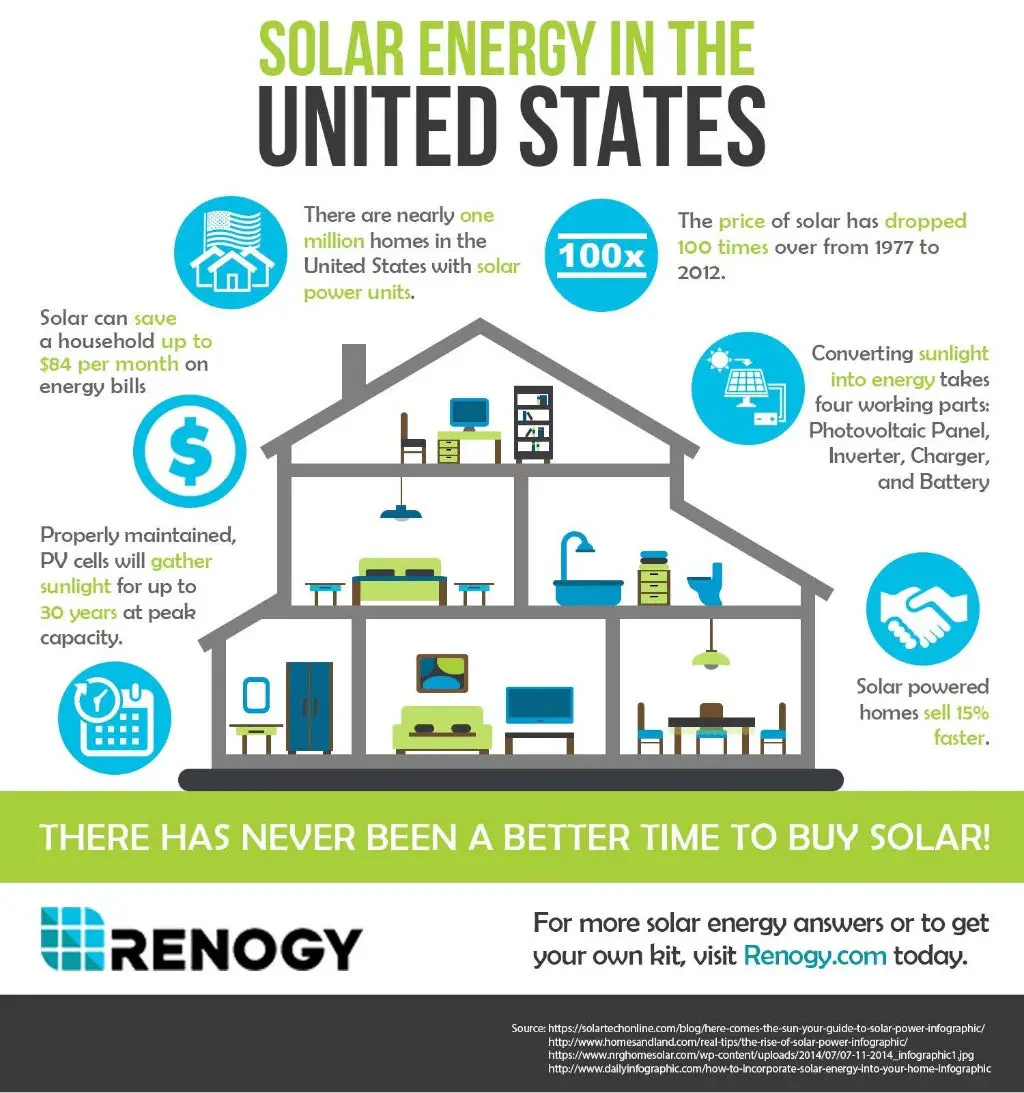

Solar panels are made of photovoltaic cells that convert sunlight to direct current electricity . As long as sun rays are hitting your roof, rain or shine, your panels are converting solar radiation into DC electricity. But in order to get the kind of power needed to turn the lights on in your living room, youll need an inverter.

The inverter is a device that takes the DC electricity produced by your solar panels and turns it into alternating current electricity . Its typically installed on an exterior wall of your house, or in the garage.

Your Sunrun meter monitors your system production and sends the information to Sunrun through a wireless signal. Since it tracks your energy production 24/7, it will automatically alert Sunrun if it detects problems or irregularities.

Solar electricity from your inverter flows to the electrical panel, and then into to your home where it powers your lights and appliances. Or, if you generate more solar energy than you use, it flows into the utility grid while you rake in the solar credits.

Speaking of solar credits, the net meter measures the amount of electricity you draw from the grid, and how much excess solar electricity you push into it. So when you use less electricity than you make, you get credit from the utility company. Sounds pretty sweet, right?

Can I Claim Incentives If I Sign A Solar Lease / Ppa

No. Under solar leases and PPAs, the solar installer owns the system, renting out the power it produces. As the owner of the system, the installer is entitled to claim any available solar incentives for themselves.

Missing out on solar tax credits and incentives puts a major dent in the ROI of your solar panel system. To maximize your energy savings, we recommend buying over leasing if the option is available to you. Learn more in our article: Is leasing solar panels worth it?.

Read Also: How Much To Add Solar Panels To Your House

Solar Power Is The Future Of American Energy

The United States can source 40% of the nations electricity supply by 2035 and 45% by 2050 with solar energy, a new U.S. Department of Energy study finds.

The study illuminates the fact that solar, our cheapest and fastest-growing source of clean energy, could produce enough electricity to power all of the homes in the U.S. by 2035 and employ as many as 1.5 million people in the process, Secretary of Energy Jennifer M. Granholm said on September 8 in marking the release of the 2021 Solar Futures Study.

As the United States commits to reducing carbon emissions 50%52% by 2030, achieving carbon-free electricity by 2035 and going carbon neutral by 2050, studies like these pave the way for bold action at both state and federal levels.

New Jerseyan Energy Leader With Robust Solar Financing

New Jersey boasts enough solar capacity to power over 600,000 homes. The state established its Renewables Portfolio Standards back in 1991 and aims to achieve 50% renewable power consumption by 2030. Electricity providers are penalized if they do not meet the states solar RPS.

Like other states on this list, New Jersey offers a property tax exemption, sales tax exemption, and net metering. It also has a renewable energy certificate program:

Solar Renewable Energy Certificates : One SREC is issued per MWh of solar power produced. Solar System operators can sell the credits to generate income or finance their solar projects.

You May Like: How Do Solar Pool Heaters Work

Net Metering Program Design

Net metering policies usually include the following details:

- Eligible Technologies: Net metering policies stipulate which renewable energy sources can be net metered, typically including solar PV, wind, geothermal, biomass, and fuel cells.

- System Size Caps: Net metering policies will often specify the maximum allowable system size that can be net metered. These size caps can either be in terms of total capacity or percentage-based .

- Program Size Caps: Net metering policies usually set a size cap on the total amount of net metering systems installed in a particular region or utility territory. When these programs size caps are reached, many states reevaluate the net metering policies, often acting to increase the program size cap.

- Customer Type: Net metering policies specify which electricity customers are eligible .

- Net Excess Generation: Net metering policies establish how the customers will be billed for excess electricity distributed to the grid .

- Ownership of RECs: Most net metering policies allow customers to maintain ownership of the RECs associated with their electricity output.