What Are The Advantages Of A Sole Proprietorship

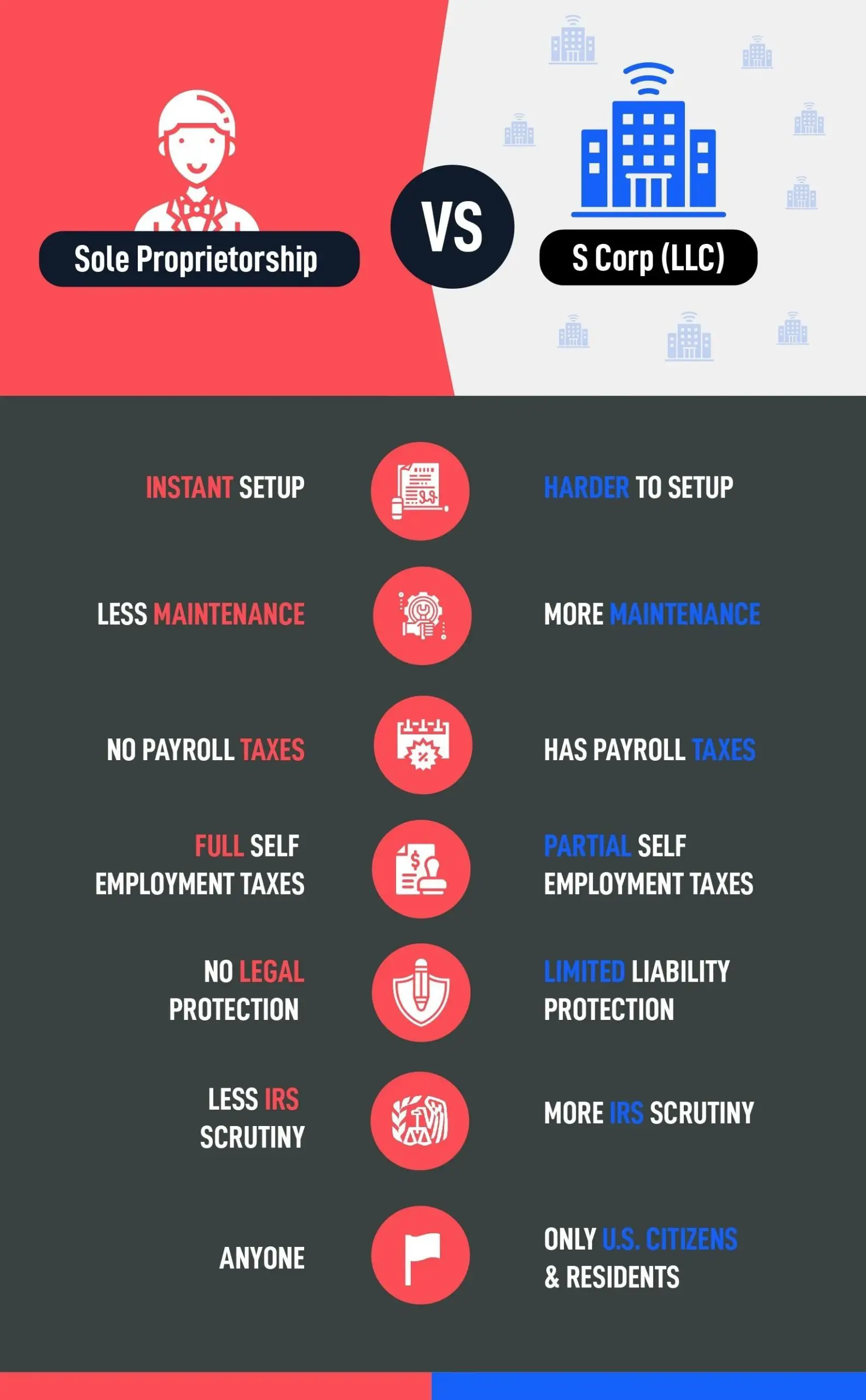

The main advantage of a sole proprietorship is that theyre very straightforward and cheap to form. The most legal costs youll have to pay will be for any licenses or permits that you need to operate your business. Youll also have complete control over everything to do with your business. Taxes are much simpler as a sole proprietor because you dont have to file separate taxes, and the tax rates are the lowest out of any business structure.

On the other hand, since there is no separation between the business owner and the business itself you are much more vulnerable to liability as a sole proprietor. If you have any employees, this risk includes them. Its also harder to raise money when you have a sole proprietorship, as you cant sell any stocks, which limits your ability to attract investors. Banks may also be very wary of lending to sole proprietors because of the liability risks.

Can A Corporation Own A Sole Proprietorship

No, by its very nature, a sole proprietorship is a business owned and operated by a single person, so a corporation cannot own a sole proprietorship.3 min read

Can a corporation own a sole proprietorship? No, by its very nature, a sole proprietorship is a business owned and operated by a single person, so a corporation cannot own a sole proprietorship. However, if you own a sole proprietorship, you do have the option of converting your business to a corporation, which provides several benefits.

How To Change An Llc To An S Corp

First, consider whether electing S corp status is right for your LLC. An S corp election could save about 17% on your share of company distributions if:

- The business can pay the owner a “reasonable salary.

- There are substantial distributions of at least $10,000 per year.

- There is a positive return on investment for payroll service costs.

- The business meets S Corp eligibility requirements.

To elect S corp status, an LLC must file Form 2553 with the IRS. This involves three steps:

Read Also: Which Solar Company To Choose

Become A Business And Not Just An Ebay Seller

eBay selling is often discussed as if it were a simple “start immediately” kind of business, and in some ways, it can bebut if you’re serious about eBay selling and long-term success, it’s important to treat your eBay selling as a business. If you’re not already an entrepreneur familiar with the ins and outs of starting a business, here are some steps to start you off on the right foot.

Bottom Line: Should I Form An Llc Or A Sole Proprietorship

As a sole proprietor or a single-member LLC, the IRS would treat you as an unincorporated entity. But if youre a partnership member, the benefits of registering as an S corporation type LLC are quite a few.

Namely, you can gain legal liability for any debts made by your company. This also makes sure that your business is incorporated and formalized. So if you ever decide to expand, bring in other people as partners or transfer ownership, you can do it without much hassle. Still, switching from a sole proprietor to an LLC is quite easy, too.

Is a sole proprietorship or an LLC the best structure for your business? This is one of the first choices to make as an entrepreneur. Weigh all the pros and cons before embarking on a decision.

Read Also: How Much Is The Tesla Solar Panels

Converting From A Sole Proprietorship To An S Corp

S corporations require that all shareholders unanimously elect to become an S corporation. Once everyone has voted, the business must perform the following steps to convert from a sole proprietorship to an S corporation:

General Liability Insurance For Your Small Business

Whether youre a sole proprietor or the owner of an LLC, general liability insurance is crucial. General liability insurance covers company assets and is often required to sign contracts. If you are a sole proprietor, liability policies can also help shield your personal assets if you are held liable for an injury or property damage.

General liability insurance can cover the legal fees associated with a lawsuit and provide general protection for property damage and injury of non-employees, product liability, and even advertising injury protection in the event of a lawsuit for slander, libel, or accidental copyright infringement.

Also Check: Is My House Solar Compatible

What Is An S Corporation

An S corp is a tax status that the owner elects by filing a form with the IRS. Only LLCs or corporations can elect S corp status.

If the LLC or corporation owner makes this election, their business will benefit from the tax advantages offered by an S corp.

A sole proprietorship must become an LLC or C corp before making the S corp election. You can read more about this in our How to Change From a Sole Proprietorship to LLC guide.

S Corp Taxes

The owner of an S corp is considered an employee of the company for tax purposes. As a result, they pay both income tax and self-employment Federal Insurance Contributions Act tax on their reasonable salary.

However, S corp owners only pay income tax on distributions. Although the resulting tax savings can be significant, they will be at least partially offset by additional payroll taxes and accounting expenses.

Llc Vs Sole Proprietorship: Legal Protection

In a sole proprietorship, theres no legal separation between the business and the owner. The owner is personally responsible for the businesss debts. If the business goes bankrupt, the sole proprietor has to file for personal bankruptcy, and both personal and business debts will be included in the bankruptcy proceedings. In addition, someone who sues a sole proprietorship can name the owner personally in the lawsuit and come after their personal assets.

One of the best ways to protect your personal assets is to form an LLC. Since an LLC is a legally separate entity from the owner, the owner isnt personally liable for the businesss obligations. If the business fails, the owners can file for business bankruptcy, and they dont have to pay business creditors out of their own pockets. And with some exceptions, someone who sues an LLC cant personally sue the owners. Of course, owners in an LLC can be held personally liable for fraud, negligence, or personally guaranteed debts. Theres no business structure that offers absolute protection for owners for liabilities connected to the business.

Also Check: How Much Does It Cost For 1 Solar Panel

Which Is Better: A Sole Proprietorship Or Llc

As with so many questions like this, the answer is: it depends. While obtaining funding or financing can be challenging for any business, the advantages and protections you can enjoy with an LLC cant be understated.

Keep in mind your business goals and what you want to achieve. Dont be scared to get advice or help from seasoned professionals.

This article was originally written on December 3, 2019 and updated on July 21, 2021.

Sole Proprietorship Vs Dba

When comparing a sole proprietorship vs DBA, its important to recognize that a sole proprietorship is a type of business formation whereas a DBA is more like a title.

DBA, or doing business as, just lets the business operate under a different name. Any type of business entity can file one or more DBAs to use a different name than their legal registered business name to do business.

With a sole proprietorship, legally, your business if your legal given name. If youd like to operate a business with any other name other than your name, you should file a DBA.

If you dont file a DBA and collect money under any name other than your own, you may face fines and penalties.

Filing a DBA is easy, and I can help you get this completed in just one day. Email me at today to get started.

Recommended Reading: How Many Amps Does A 300 Watt Solar Panel Produce

Powerful Reasons Why Llc Is Better Than Sole Proprietorship

As a brand new entrepreneur ready to face the world, you are going to find yourself going head-to-head with a lot of challenging decisions.

One of the most challenging question youre going to face is whether you should start your business as a sole proprietorship or LLC

This is a question I hear quite a LOT as a business lawyer.

Its a hot topic because, and entrepreneur, like you, should get the right information to make the smart decision.

In summary, sole proprietorship is the simplest business entity, but it requires that you take personal responsibility for all business matters.

On the other hand, LLC protects your personal assets from business debts and lawsuits. What this means is that if something happens to your business then your personal assets such as personal bank account, car, and home will be protected.

The first thing successful entrepreneurs do is form an LLC and as a Business Lawyer for Entrepreneurs, I highly recommend having a registered LLC before you start your business.

If youre still not sure about whether LLC is right for you, email me at with some information about the business youre looking to start and I will tell you whether LLC is the right choice for you.

How To Convert A Sole Proprietorship To An Llc

How to change from a sole proprietorship to LLC? You first need to file the relevant documentation to bring the LLC into existence.

From there it is just a matter of dissolving your sole proprietorship and going through the rest of the process to officially form your LLC and to start doing business in your state of choice.

You May Like: How Much Does Solar Panels Cost In Ghana

Limited Liability Company Versus A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Can I Go From A Dba To Llc

Yes, you can. A DBA can be transferred to an LLC. Its just a matter of transferring the registration from yourself to a new business.

But what is a DBA exactly?

Some states require you to have a Doing Business As registration if your brand name is different from your official business name. Take note that not every state has this, so it may be irrelevant to you.

There is a process involved, but it is usually just a matter of filling in a form to transfer the registration. Your sole proprietorship may even have to write a letter of permission permitting the LLC to use that name.

In all cases, you will have to form the LLC before you can move forward with transferring the DBA.

Also Check: How Long Will Solar Panels Last

Check Your Business Name

When you are converting a sole proprietorship to an LLC, you need a unique business name. Your current business name might already be registered to another LLC in your state. If thats the case, you cannot operate as an LLC under that name, even if youve been using it as a sole proprietorship.

Check if the name is available by contacting your states secretary of state office. Many states have an online database for registered business names. You can also have a legal professional help you propose a name for your LLC.

Once youre sure no one in your state uses your business name, make sure it doesnt infringe on anyones trademark. Use the United States Patent and Trademark Offices database to search trademarks.

You must include Limited Liability Company in your business name. Or, you can use an abbreviation like LLC, Ltd., or Liability Co.

Usually, you dont need to register your LLC name. The name is automatically registered when you file paperwork to form the LLC. State rules differ, so double check with your state.

Potential Benefits Of Changing To An Llc

So, whats wrong with operating as a sole proprietorship? Well, possibly nothing but it depends on the situation. No entity type is ideal for every business!

There is no legal or financial separation between the business owner and the company in a sole proprietorship. Therefore, if someone sues the business or the company runs into money troubles, the owner is personally responsible for any legal claims and debts. That puts the owners home, cars, bank accounts, retirement savings, and much more at risk of being taken to settle those obligations.

By forming an LLC, business owners can help protect their personal assets and property. An LLC is a separate legal entity from its owners. So, under most circumstances, an LLCs owner is not personally liable for the legal and financial debts of the business.

Also, an LLC provides tax flexibility. By default, an LLC is taxed the same as a sole proprietorship, with all profits and losses flowing through to the owners individual income tax returns. However, LLCs that meet the IRSs eligibility requirements may elect to be taxed as an S Corporation to help alleviate some of the self-employment tax burdens on their members.

Don’t Miss: Can I Install Solar Myself

Llc Vs Sole Proprietorship: Which Should You Choose

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

How To Convert A Sole Proprietorship To An S Corporation

As your sole proprietorship grows, you may start to consider other business structures that could be more suitable.

An S corporation has several advantages over a sole proprietorship, including tax savings and limited liability protection.

In our How to Convert a Sole Proprietorship to an S Corporation guide below, we will help you understand the key differences between a sole proprietorship and an S corp, why you would choose one over the other, and how to convert your sole proprietorship to an S corp.

SKIP AHEAD TO

2021-09-23

Read Also: Is It Better To Lease Or Buy Solar

Sole Proprietor Vs Single

New entrepreneurs have a long list of to-dos when starting their businesses. Among the tasks to check off that list is deciding their business structure. For small businesses with a sole owner and no employees, the two most popular options are:

- Sole proprietorship

- Single-member LLC

So, which one might be the best choice for your business?

I advise you to consider talking with an attorney and accountant to dig into the advantages and disadvantages of each for your specific situation.

S Corporations Pros And Cons

There are distinct advantages and disadvantages to establishing and operating an S corporation. Some of the advantages include:

ProsAn S corporation usually does not pay federal taxes at the corporate level. As a result, an S corporation can help the owner save money on corporate taxes. The S corporation allows the owner to report the taxes on their personal tax return, similar to an LLC or sole proprietorship.

An established S corporation can help boost credibility with suppliers, investors, and customers since it shows a commitment to the company and to the shareholders. S corporations allow the owner to benefit from personal liability protection, which prevents personal assets from being taken by creditors to satisfy a business debt. Also, employees of an S corp are also members, which means they’re eligible to receive cash payments via dividends from the company’s profits. Dividends can be a great incentive for employees to work there and help the owner attract talented workers.

There are also some disadvantages to establishing and operating an S Corporation.

ConsAlthough most states allow the income generated from an S corporation to be taxed on the owner’s personal tax returns, some states do not. In other words, some states choose to tax an S corporation as if it was a corporation. It’s important to check with your local Secretary of State office to determine how S corporations are taxed in your state.

You May Like: Is 14k Solid Gold Real