Which Solar System Is Right For Your Home

To determine which solar system is right for your home, consider the amount of sunlight that hits your home, the roofs condition, and regulations by local authorities and your homeowners association. You also want to consider how youll pay for the system.

Compare Quotes From Top-rated Solar Panel Installers

Free, No-commitment Estimates

Solar Power Tax Credits In California

Living in the southern part of California, maybe you have thought about solar power, or know of someone thats talked about getting solar panels installed. Solar power has many benefits and advantages ranging from environmental to economical. Not to mention, California offers Solar Power Tax Credits, so why havent you gone solar yet?

To begin, solar power is readily available because it uses the sun which is free, and for the most part, limitless. By installing a solar home energy system, homeowners will experience significant savings on energy.

State Local And Utility Incentives

Depending on your location, state and local utility incentives may be available for electric vehicles and solar systems. Most rebates can either be claimed after purchase or reflected as a reduction in the price of your purchase.

Many states also offer non-cash incentives for electric vehicles, such as carpool lane access and free municipal parking.

Some communities and utility companies also offer additional incentives through cash back, discounted rate plans and other credits.

Read Also: How To Keep Pigeons Away From Solar Panels

California Solar Property Tax Exemption

The state of California has an exclusion, not an exemption. The Active Solar Energy Exclusion is a new construction exclusion. This means that solar panel installation will not be assessed for tax purposes. The exclusion is set to end on January 1, 2025, and does not apply to solar swimming pool heaters, hot tub heaters, or wind energy systems.

Rebates Incentives And Tax Credits

Homeowners and Businesses which install solar energy systems may be eligible for a variety of rebates, incentives, and tax credits.

Rebates & Incentives

Rebates for PG& E and for SCE customers have been exhausted and the program is closed.

These programs are administered through Southern California Edison in conjunction the State of California .

- The Energy Upgrade California also includes a link on the main page to find a qualified contractor. Residents are not required to use the contractors listed here but it is important that the contractor you utilize is a State Licensed Contractor. You can check to see if a contractor has a valid license with the Contractors State License Board .

- New California Solar Thermal This newly announced program offers cash rebates of up to $1,875 for solar water heating systems on single family homes. For more information visit the Go Solar California CSI Thermal Site .

Tax Credits

A Federal Tax Credit of up to 30% of the cost is currently available for solar systems for a principal residence . For more information visit the Go Solar California website and consult a qualified tax professional.

Don’t Miss: How Big Is A 1000 Watt Solar Panel

Not Everyone Is Eligible For The Federal Solar Tax Credit

As a homeowner looking to install solar panels in your home, you are about to experience a stress-free life. Solar panels will save you a lot of energy in the long run. Most homeowners invested in solar panels have testified to the numerous benefits, especially on lower electric bills.

However, not every homeowner can claim the federal solar ITC. It is because not every person is eligible for the California tax incentive.

To benefit from the ITC, you have to owe federal income taxes. If you dont, then you will not be eligible. As the policy stands, the ITC gets rolled over to the future tax years. So with a tax liability in the coming year, you will have the ability to claim the 30% credit.

A great advantage to note is that it is possible to carry forward ITC to the future tax years. Therefore, if you have a tax liability next year, you will be eligible to claim a 30% credit. It would be advisable to talk to your tax accountant about maximizing solar tax credit in California.

Enlightened Solar has contributed to the growth of solar installations in Orange County over the years. We have a vast knowledge ofCalifornia solar tax credits and can advise you as you install your residential solar panels. Check out our wide range of services in regards to solar installation in Orange County.

Contact us to request a quote and start the process of getting you into thesolar tax credit California program. You need to enjoy all the benefits that come with going solar.

What Rebates Are There For Low

Californians with lower incomes might have some trouble during the early part of 2022. The states long-running SASH and MASH programs ended as of December 31, 2021. There are currently no low-income solar incentives in California other than those described in the section about SGIP battery rebates, below.

Thats not the end of the story, though. The NEM 3.0 proposed decision included the broad outlines for new low-income solar programs in the state, committing $150 million per year for four years to a yet-to-be-determined incentive program, and exempting customers who qualify for subsidized utility rates from many of the additional charges proposed in NEM 3.0.

Stay tuned to this website for future updates on California low-income solar incentives.

Don’t Miss: Why An Llc Vs Sole Proprietor

California Public Utilities Commission Propose Tax For Solar Users

More Videos

SAN DIEGO Despite strong opposition, the California Public Utilities Commission recently announced it is again proposing a tax for solar users.

The proposal also slashes the credit customers get for their solar energy sent back to the grid. Right now, solar users pay a monthly fee to SDG& E for special programs and wear and tear on the grid, but this tax is more than that.

The CPUCs latest solar tax proposal would tax users $300-$600 a year. In fact, the less electricity you use, the more solar tax you would pay.

Karinna Gonzalez works for a clean energy non-profit organization in San Diego. She added solar panels back in December when she heard of CPUCs first solar tax proposal for all new solar customers.

The proposal also affects current customers. They would get the tax after 15 years.

It’s really discouraging when we’re trying to do our part for the environment and get solar energy and then we’re penalized for it, said Gonzalez. It’s like charging people who air-dry their clothes instead of putting it in the dryer. It goes against every principle of conservation.”

The utilities argue it fixes a cost shift where solar owners do not pay their fair share of grid maintenance costs, which are then shifted to non-solar customers. But the solar industry argues solar lowers the cost of infrastructure because rooftop solar doesnt require expensive long distance power lines that cost so much to build and maintain.

But on May 9, the CPUC made a new proposal.

Ready To Reap The Rewards Of Solar Installation In Orange County Its The Best Time To Go Solar

So, how much is the solar tax credit for California in 2021?

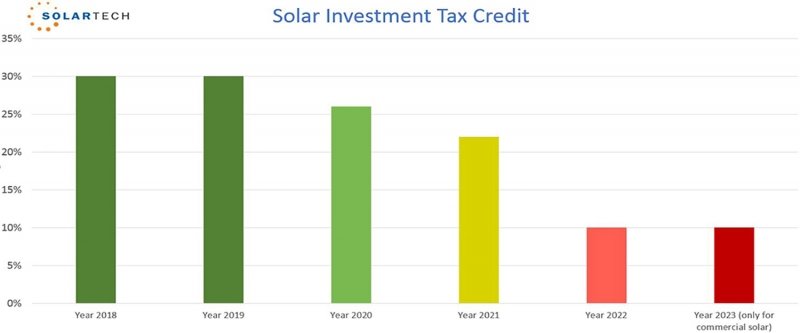

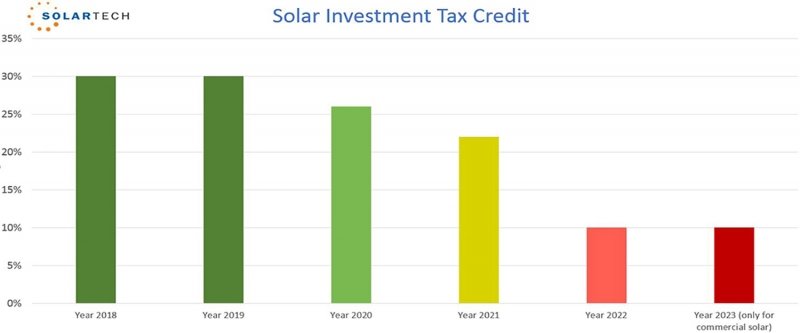

If you are a residential owner installing solar panels in California, you will receive a 26% tax credit upon the purchase. When we talk of California tax credit, we refer to the federal solar tax credit applicable to all homes in the US, inclusive of California.

As a homeowner looking to invest in solar panels, you should note that the federal solar tax credit sums up 26% of the system cost until 2022. After that, it will drop to 22% in 2023.

As a homeowner in California, you are eligible for different California solar incentives should you have solar installed in your home.

Is there a California tax credit for solar panels? Its a significant concern that our clients ask when seeking solar installation services. We have been transforming homes to go solar in Orange County, and we have seen the comfort experienced by our clients with their reduction in monthly electric bills.

In the article above, you have been able to note down the eligibility for California solar panel rebates.

How do solar incentives work? At Enlightened Solar, we have all the information. Being a premium solar panel installation company, we care about your energy needs. Investing in solar panels will save you money and time. Contact us today for further consultation.

Also Check: How Much Solar To Run Rv Ac

San Francisco Solar Incentives

GoSolarSF is a rebate program that gave substantial incentives for San Francisco Power and Hetch Hetchy customers that were installing rooftop solar. Unfortunately, that program is fully subscribed and no longer available for most categories.

The one exception is the Disadvantaged Communities-Single-Family Affordable Solar Homes category, which is a rebate for rooftop solar aimed at low income residents. If your household income is below the cityâs median income, you may be eligible for a very substantial rebate of $3,000 per kilowatt. If you are a CalHome participant, thereâs a good chance youâll qualify.

The non-profit solar installer Grid Alternatives outlines the qualification criteria:

To qualify for DAC-SASH, homeowners must live in one of the top 25 percent most disadvantaged communities statewide using the CalEnviroScreen, and be a billing customer of Pacific Gas & Electric , Southern California Edison , or San Diego Gas & Electric . Homeowners must also meet income qualifications as denoted by annual CARE and FERA guidelines. See the CPUC website for more information about income limits.

Check the program handbook for more details.

California Solar Initiative Residential Rebates

In 2006, the California Public Utilities Commission set aside $2.3 million of financial incentives for homeowners installing solar. As the CPUC only has authority over investor owned utilities working in the state , incentives are only available to customers of the big three utilities: Pacific Gas & Electric, San Diego Gas & Electric, and Southern California Edison.

The incentives were divided among three programs all under the California Solar Initiative badge: the general market program, the Multi-family Affordable Solar Housing program, and the Single-family Affordable Solar Housing program.

General Program

While now defunct, under the general program, any homeowner in the state who installed solar was eligible for an upfront rebate for their installation. The program was extremely popular and as of 2017 all funding for the program has run out, so homeowners who go solar in the future will not be eligible for these incentives.

However, incentives are still available for the low-income multi- and single-family housing programs!

Affordable Housing Programs

Of that $2.3 million, the California Solar Initiative set aside a certain amount for both the Multi-family Affordable Solar Housing and the Single-family Affordable Solar Housing programs. Both programs offer one-time upfront rebates for solar installations for low-income families and both are administered by GRID Alternatives, a solar non-profit organization.

Don’t Miss: Does A Solar Panel Have To Be In Direct Sunlight

What Are The Benefits Of Going Solar In California

California is a pioneer in solar energy production and a leader in residential solar in the U.S. Its weather is ideal to maximize year-round benefits from this clean energy source.

There has been a significant drop in the price of equipment and installation over the last five years, and it is expected that Californias electricity generation will come 100% from clean and renewable energy sources by 2045.

There You Have It: Solar Panel California Incentives And Why Solar Panels Are Worth It In California

All that being said, its pretty easy to see why going solar in California is worth it. Not only do you get to power your home with all that sunshine, you also get more control over your homes energy and rising electricity costs. Not just now, but forever!

And in case you needed any more reasons, heres more!

Protection from blackouts.

California has the most amount of blackouts in the nation, clocking in over 4,000 in the last decade, and climbing .

Solar is the new normal.

As of 2020, solar is now mandatory on every new home build in California. Dont be left in the dark when everyone else on your block is harnessing the power of the sun, especially during all those blackouts.

Offset your carbon footprint.

Renewable energy is good for the environment: it produces no waste in the air, oceans or land, unlike harmful oil and gas. California is one of the most progressive states in the nation for renewable energy policies, and ranks second only after Washington for installed renewable energy capacity.

Solar technology advancements.

Recommended Reading: How Many Solar Panels Would I Need

What Solar Tax Credits And Rebate Programs Are Available To Californians

Rooftop solar panels have long proved a reliable and savvy financial investment for Californians, and many buyers are able to secure a speedy return on investment . However, there is currently no statewide California solar tax credit to help residents with the upfront cost of solar panels in California.

That said, all Californians are eligible for the federal solar tax credit, and the state offers several incentive programs and solar rebates aimed at further increasing access to reliable, affordable solar panels.

| California Solar Incentive | |

| This incentive ensures the addition of a solar panel installation doesnt raise homeowners property taxes. | |

| Single-Family Affordable Solar Homes Program | The California Solar Initiative launched SASH to provide fixed, up-front incentives on qualifying affordable single-family housing. |

Residential Equity Resiliency Storage

Low-income homes that are located in either a Tier 3 or Tier 4 fire district, or that are in areas that have experienced two or more planned safety power shutoff events can qualify for an even higher incentive when they install battery storage on their home – this is known as the equity resilience incentive.

Projects that qualify for the equity resiliency incentive program will receive a rebate of $1,000/kWh of storage installed. This covers almost the entire cost of a solar battery system.

Learn more: Californias SGIP battery rebate program in 2022

Also Check: How To Use Pine Sol On Wood Floors

How Solar Tax Credits Work

Solar tax credits were enacted in 2008 as part of the Emergency Economic Stabilization Act, which includes $18 billion in incentives for clean and renewable energy technologies as well as for energy efficiency improvements.

The 2008 legislation extended the solar investment tax credit through December 31, 2016, and made other modifications to the tax credits. Legislation in late 2015 renewed these credits for five years with an incremental de-escalation of the credits. The solar ITC offers:

Before you can claim the California solar credit like most credits, rebates or deals- there are eligibility requirements.

Whether youre incorporating solar into your residence or your business. Below is a list of the requirements that you make eligible for the solar investment tax credit:

California Sales Tax And Property Tax Exemptions

An often overlooked incentive is sales tax relief for solar equipment. California Assembly Bill AB 398 gives partial relief from sales tax for the purchase of solar energy equipment. This is a 3.9375% reduction in sales tax, which can add up to a few hundred dollars in savings. Read this article for an analysis of this bill, or ask your solar installer about it.

Another significant incentive is Californiaâs property tax exclusion for solar equipment. Normally, when you make improvements that increase the value of your home, your property tax assessment increases as well, which raises the tax you pay. This program can mean a tax savings of around a couple hundred dollars or less per year. On a yearly basis this isnât huge, but when you think of the expected 25 year lifespan of a solar PV system, this tax relief can be really significant over time.

This incentive is set to expire in 2025, but it has been extended before, and might be again. Check out the DSIRE website for more details.

TAGS

Read Also: Latest Solar Panel Technology 2021

Things To Know About The Residential Solar Itc

The tax credit is not a refund, it is a credit. The federal government will not send you a check in the amount of the credit but rather the IRS allows you to deduct 26% of the cost of your solar system from what you owe in taxes.

You need tax liability to benefit from this incentive.

The IRS allows a carryover of unused solar tax credits to subsequent years, up to five years. For example, if your 26% credit is worth $6,000, and you only owe $3,000 on your 2019 taxes, you can apply the remaining $3,000 to your 2020 tax liability. CALSSA recommends consumers always consult with a tax professional for tax advice.

Simply purchasing a residential solar system by the end of the year is not enough to claim the full tax credit. The IRS says the system must be placed in service before the end of the year, meaning the system is installed and capable of being used. The process of signing a contract and installing a system can sometimes take several weeks.

If a solar system is placed in service in 2022, you will qualify for a 26% tax credit instead of 22%.

You must purchase the system to claim the ITC. Consumers may not claim the tax credit for leases or Power Purchase Agreements . Paying cash or financing the system through a loan or PACE does allow you to claim the ITC.

California also provides rebates for home battery systems. This incentive is in addition to the tax credit but consumers need to account for the rebate when claiming the tax credit.

What Is The Federal Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes placed in service, but the IRS has equated it with completed installation.

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be claimed.

You May Like: Is Tesla Installing Solar Roofs Yet