Limited Liability Company Versus A Sole Proprietorship

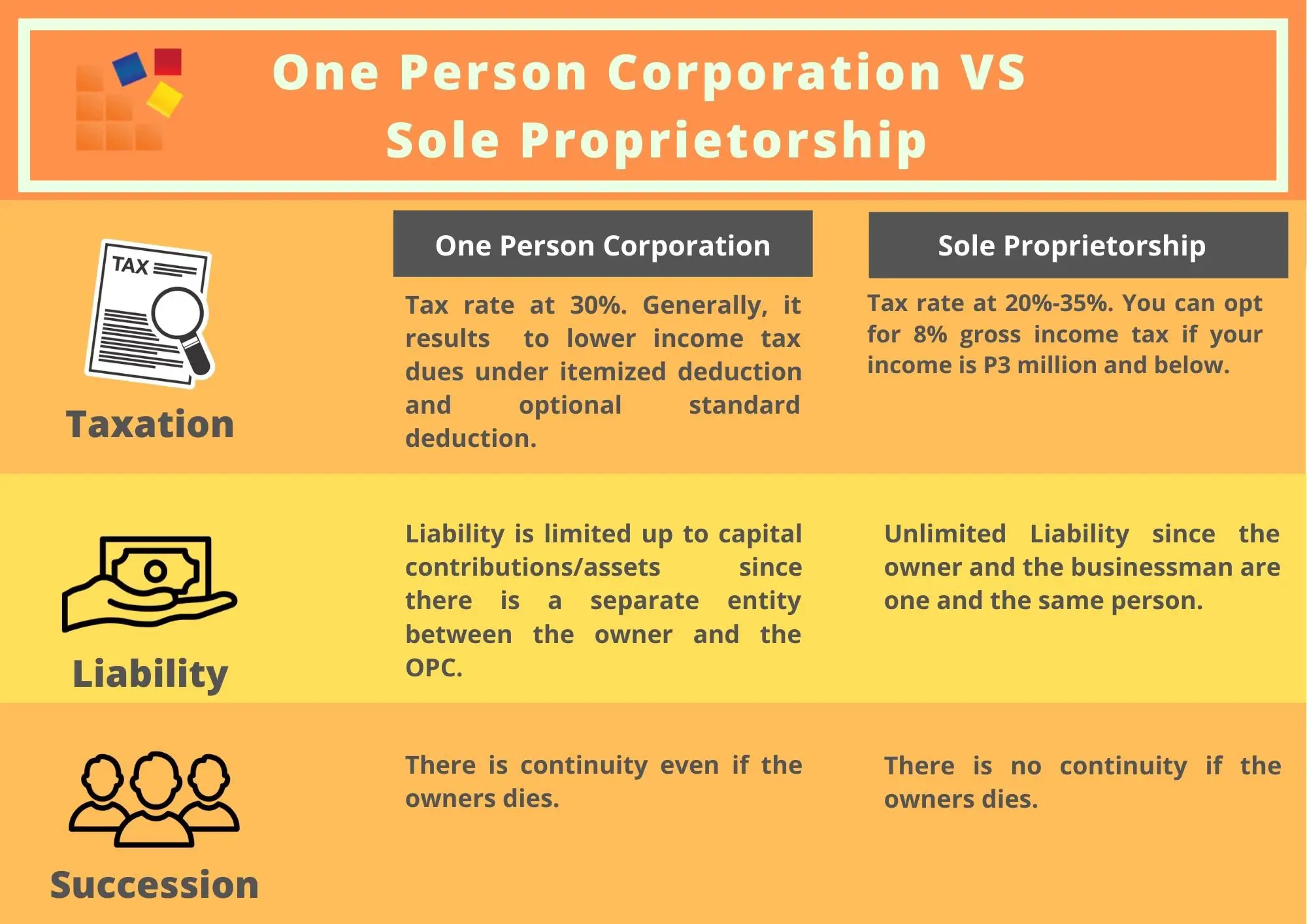

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Default Income Tax Treatment

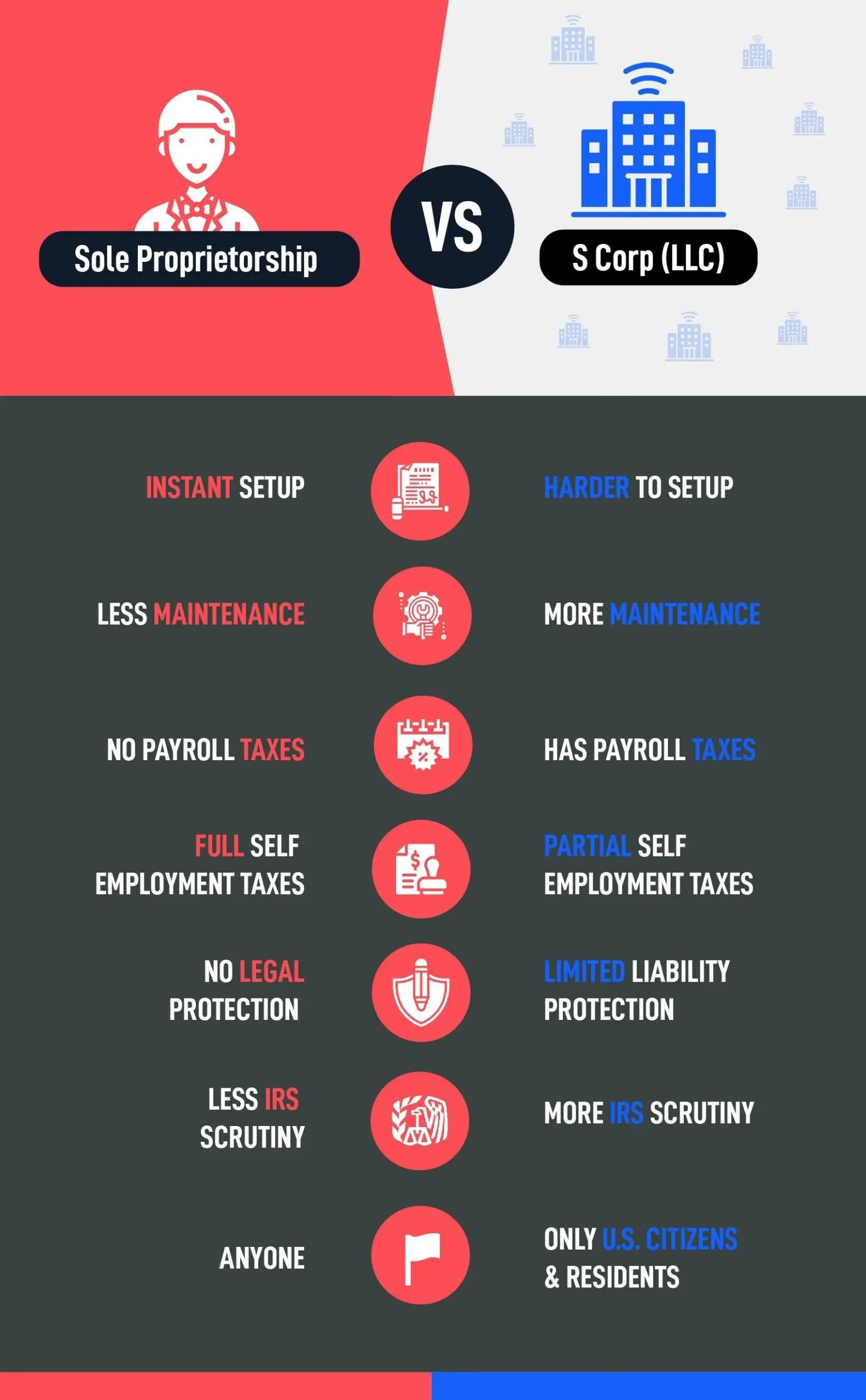

Sole Proprietorship The business is not recognized as its own tax-paying entity its income and losses get passed through to the owners personal tax return via IRS Schedule C . Tax rates for individuals are applied to a sole proprietors taxable business income. Business income is also subject to self-employment taxes . Because sole proprietors income tax, Social Security, and Medicare arent deducted from a paycheck from an employer, business owners usually must make quarterly estimated tax payments to the U.S. Treasury, the state, and sometimes the local tax authority.

Limited Liability Company The business, unless the owner makes a special tax election, is considered a disregarded entity. It is not recognized as its own tax-paying entity. Business tax obligations flow through to the LLC owner.

Dont Make Things Unnecessarily Complicated

You mightve been around the Google block searching for this and that about saving money. You may have stumbled across some tips telling you to incorporate your business in a different state, like Delaware. Sadly, that tip doesnt really apply to you.

Those tax benefits refer to publicly traded or multi-state corporations. If youre forming an LLC, theres no reason to form it in another state. Incorporate your business in the state you live and operate in to keep things simple.

You May Like: Can I Use Solar Panels To Heat My Pool

Llc Vs Sole Proprietorship: Operations And Management

A sole proprietorship has a simple operational and management structure because theres just one person at the top. That owner can make any business decisions as they see fit, without input from any third party. Of course, most sole proprietors decide to hire employees, legal experts, accounting experts, and other individuals to help with the day-to-day management of the business. But a sole proprietor only has to ensure their business is operating safely and legally and that theres enough profit to cover business debts.

An LLCs operational and management structure is more complex and is typically outlined in an LLC operating agreement. Though only a handful of states require an operating agreement, most LLCs have one, particularly those with multiple members. The operating agreement outlines each members ownership stake in the business, voting rights, and profit share. An LLC can be collectively managed by the members or managed by an appointed manager.

Usually, LLC members decide on company matters in proportion to their ownership stakecalled membership unitsin the business. For example, a 33% owner would have a one-third vote on company matters, and a 25% owner would have a one-quarter vote. Profits generally are divided in line with ownership percentages. In the previous example, the 33% owner would receive one-third of the business profits, and the 25% owner would be entitled to one-quarter of the business profits.

Taxes For A Sole Proprietorship Vs Llc

With both an LLC and a sole proprietorship, the profit of the business passes through to the owners personal tax return. But LLCs have more flexibility in how they are taxed, which may result in tax savings.

Sole proprietors typically report their business income and expenses on Schedule C. This form is filed with the owners personal tax return. The net profit from the business indicates the net profit of the business and it passes through to the owners personal tax return.

Pass through entities like LLCs and sole proprietorships may benefit from the Qualified Business Income deduction that allows them to deduct 20% of QBI. Not all business income qualify, so talk with a tax professional.

Single-member LLCs are automatically treated as sole proprietors for tax purposes, but may elect to be taxed as an S Corporation or C Corporation. This may provide tax savings but will also carry additional requirements. Check with your tax professional to choose the right filing status for your business.

Dont forget about self-employment tax! The current self-employment tax rate is 15.3%. Normally this is split between the employer and the employee, but when you are the employer you pay the full amount yourself.

Read Also: How To Get Solar Energy Without Solar Panels

Advantages And Disadvantages Of Sole Proprietorships

Like the LLC or SMLLC, sole proprietorships have their own advantages and disadvantages as well.

- It is considered one of the easiest and least costly business types thanks to the absence of filing fees and the need for formal agreements.

- Sole proprietorships are popular for people who want to be their own boss.

- A potential disadvantage is that courts have ruled that doing business under another name does not qualify as creating a separate and distinct legal entity from the owner.

- Insurance coverage might be pricey for sole proprietors.

- Sole proprietorships do not have access to venture capital.

- Sole proprietorships can be limited in scope and their lifetime, which means they end if the business is discontinued or the owner passes away.

Sole Proprietorship Limited Liability Or Corporation

Ok, so youve done some research, picked a great name, web domain and phone number to back it up, but now its time to get legally recognized as a business.

Sole proprietorship, limited liability , or corporation ? These are all ways that the government can understand what sort of business you are so they can tax you accordingly.

These categories werent that meaningful before you wanted to start your own business, but now youre scratching your head thinking about what they mean!

You May Like: Can You Run Pool Pump With Solar Cover On

Llc Vs Sole Proprietorship: Legal Protection Of Personal Assets

The legal protection for personal assets is the number one reason that most people suggest forming an LLC over a sole proprietorship. When run properly, a single-member LLC will protect both a small business owner and their business in ways that a sole proprietorship cannot.

Before I continue, this is not legal advice. I suggest talking to a lawyer to help you create and run an LLC in a way that guarantees these benefits. Liability protection works in the following ways:

- When running an LLC properly, your business assets cannot be included when a court considers your personal assets, but your income and profit can be if run as a pass-through entity.

- When running an LLC properly, liability protection prevents your personal assets from being included when a court considers your business assets, as long as you were not personally responsible for the behavior that caused the court judgment.

- The debts of the business and any personal debts are separate if you follow the requirements to provide liability protection.

Legal protection is accomplished because the business structure creates liability protection, as long as certain rules are followed. Small business owners should be aware of the following practices when seeking legal protection through an LLC:

You can also run a multi-member LLC using the tax code for partnerships or as a corporation.

Looking at this section, LLC takes the win!

Lets look at the differences in the formation of an LLC vs. sole proprietorship.

Advantages Of Sole Proprietorships:

- It’s the easiest type of business to form the second you sell a product or service, you are a sole proprietor.

- As sole owner, you are entitled to all the profits of the business.

- No partners or members to deal with you make all decisions when it comes to your business, which means complete control and flexibility.

- No annual filing fees, state licensing fees, etc.

- Don’t have to pay corporate tax.

Also Check: A Solid Line On The Road Pavement Means

About Llc Vs Sole Proprietorship

Limited Liability Company is a separate legal entity run by its members with limited liability, and it is required to register an LLC, whereas a Sole Proprietorship is a business arm of an individual that is not separate from its owner, and thus its liabilities are not limited, and there is no requirement to register a Sole Proprietorship.

The owner of a Sole Proprietorship manages the business individually. However, in the case of an LLC, the members may run the firm or appoint a few managers to handle it.

The most significant benefit of an LLC is that a members responsibility is restricted to the investments an individual has made. In the case of a Sole Proprietorship, however, the whole liability rests with the firm owner.

A Sole Proprietorship firm owner does not have to be concerned about money. It is considered business money if he has his own funds and invests them in his firm . However, in the case of an LLC, the members must preserve records to ensure that personal cash and corporate funds are not mixed together.

Estimated Taxes And The Self

LLC members, who ensure its everyday active functioning, are not considered to be employees. The law defines them as self-employed individuals, which imposes the requirement to pay the corresponding tax. Hence, the owners of an LLC pay self-employment tax and estimated taxes in the same manner as a sole proprietorship. The single difference lies in the fact that the sum of the tax is based on each owners share of the profit. The funds payable as a self-employment tax should be listed on Schedule SE attached to the personal income tax return.

Additionally, one should not forget that not all participants may want to engage in the management of the venture. Some of them prefer to simply invest to make a regular profit. Such participants are called inactive and may be exempt from the self-employment tax.

The tax advantages of an LLC have much in common with sole proprietorships, from the ease of filing to the wide range of tax deductions. However, LLC taxes are likely to be more expensive. Plus, the taxation procedure for multi-member LLC members can be somewhat confusing. In this case, it may be worthwhile to enlist the help of a specialist.

Also Check: How Much Does The Government Subsidize Solar Panels

Advantages Of A Sole Proprietorship

When you form a sole proprietorship, you have the following benefits:

- No required state paperwork, unless theres specific licensing such as an occupational license and/or business license.

- No required annual state filings to complete, unless theres specific industry filings required by your industry.

- All profits/losses are passed through to the owners personal tax return. These are typically reported on a Schedule C tax form that is filed with owners personal tax return.

- May enjoy the tax benefits of being self-employed, from deducting certain business expenses , utilizing self-employed retirement plans like Simplified Employee Pension Individual Retirement Accounts , writing off regular business expenses such as , writing off business travel costs, writing off costs to entertain clients and more.

Try The Incorporation Wizard

Its pretty difficult to choose which business structure is right for you. One of our favorite resources in BizFilings Incorporation Wizard, which allows you to input some information about your company to help determine what structure is right for you. Every business is different, which is why we highly recommend hiring an accountant or lawyer to help you make the decision thats right for you.

You May Like: How Good Is Solar Power

Save Time And Money On Your Taxes

Doing business as either a sole proprietor or an LLC means you pay tax on all of your business income when you pay your personal tax return the business income simply passes through to your personal tax return. However, a sole proprietor without any separate financial accounts could be wasting too much time juggling business and personal paperwork at tax time. You might be missing out on business-related tax deductions due to your combined personal and business bank statements.

When you have an LLC with a separate business bank account, business credit card, business line of credit or other financial tools for your business, you will have an easier time managing your business finances and keeping track of tax-deductible business expenses to maximize your tax deductions.

Forming an LLC can also help you minimize your tax burden, compared to a sole proprietorship. Thats because LLC owners have the option of choosing to have their LLC file taxes as an S Corporation, which has different tax treatment for business income and can potentially reduce the amount of money that you have to pay in self-employment taxes.

Use this free S Corporation tax calculator for more details. Depending on how much you earn, how much you pay yourself in salary and other details, you might be able to save thousands of dollars per year in taxes by forming an LLC and filing taxes as an S Corporation.

Forming An Llc Is Easier Than You Think

With all the advantages that forming an LLC can offer, you may be worried that it is a complicated and expensive process. However, forming an LLC can actually be done fairly easily and inexpensively.

To learn more about how to form an LLC for your business, visit our step-by-step How to Form an LLC guide and choose your state from the drop-down menu.

Read Also: How To Use Pine Sol

Llc Vs Sole Proprietorship: Legal Protection

In a sole proprietorship, theres no legal separation between the business and the owner. The owner is personally responsible for the businesss debts. If the business goes bankrupt, the sole proprietor has to file for personal bankruptcy, and both personal and business debts will be included in the bankruptcy proceedings. In addition, someone who sues a sole proprietorship can name the owner personally in the lawsuit and come after their personal assets.

One of the best ways to protect your personal assets is to form an LLC. Since an LLC is a legally separate entity from the owner, the owner isnt personally liable for the businesss obligations. If the business fails, the owners can file for business bankruptcy, and they dont have to pay business creditors out of their own pockets. And with some exceptions, someone who sues an LLC cant personally sue the owners. Of course, owners in an LLC can be held personally liable for fraud, negligence, or personally guaranteed debts. Theres no business structure that offers absolute protection for owners for liabilities connected to the business.

Do I Need An Llc If I Am A Sole Proprietor

Technically speaking, you do not need an LLC if you are a sole proprietor. Sole proprietorships represent a basic type of business structure, and allow you to conduct your business without necessarily registering a license as a business owner.

However, while you may not necessarily need it, it is still worth considering this option. Sole proprietorships are good for business owners who want to keep their business small, and want to do the work as a “side gig”. In that case, you do not necessarily need an LLC.

However, if you plan on growing your business, turning it into the main gig and increasing trust with your clients, then you might need an LLC .

LLCs are higher than sole proprietorships, so people will be more likely to collaborate with you if they see you raising the LLC flag.

You also need a sole proprietorship if you are afraid that your personal assets are going to be seized. Sole proprietors are not usually protected from debt collectors, and if your business goes bad, then your home, car, or personal bank account may be seized. With that in mind, LLCs do not carry that risk, and your assets usually get personal liability protection.

Don’t Miss: Where To Buy Solar Cells

Ease Of Raising Money

Sole proprietorships have more difficulty raising money than an LLC. For starters, a sole proprietorship may be viewed as having less credibility, since the business owner did not take the time or pay the expense to incorporate or form an LLC. Lack of credibility makes it harder for a sole proprietorship to get loans, and could force the business owner to rely on business assets and personal credit history to raise funds for the business.

LLCs may offer ownership interest in the business in exchange for money which will help finance the company’s expansion. When a sole proprietor offers ownership in the business to another business or person, the company will no longer be treated as a sole proprietorship.

S Corporations Pros And Cons

There are distinct advantages and disadvantages to establishing and operating an S corporation. Some of the advantages include:

ProsAn S corporation usually does not pay federal taxes at the corporate level. As a result, an S corporation can help the owner save money on corporate taxes. The S corporation allows the owner to report the taxes on their personal tax return, similar to an LLC or sole proprietorship.

An established S corporation can help boost credibility with suppliers, investors, and customers since it shows a commitment to the company and to the shareholders. S corporations allow the owner to benefit from personal liability protection, which prevents personal assets from being taken by creditors to satisfy a business debt. Also, employees of an S corp are also members, which means they’re eligible to receive cash payments via dividends from the company’s profits. Dividends can be a great incentive for employees to work there and help the owner attract talented workers.

There are also some disadvantages to establishing and operating an S Corporation.

ConsAlthough most states allow the income generated from an S corporation to be taxed on the owner’s personal tax returns, some states do not. In other words, some states choose to tax an S corporation as if it was a corporation. It’s important to check with your local Secretary of State office to determine how S corporations are taxed in your state.

Read Also: How Many Watts Can One Solar Panel Produce