Things To Know About The Residential Solar Itc

The tax credit is not a refund, it is a credit. The federal government will not send you a check in the amount of the credit but rather the IRS allows you to deduct 26% of the cost of your solar system from what you owe in taxes.

You need tax liability to benefit from this incentive.

The IRS allows a carryover of unused solar tax credits to subsequent years, up to five years. For example, if your 26% credit is worth $6,000, and you only owe $3,000 on your 2019 taxes, you can apply the remaining $3,000 to your 2020 tax liability. CALSSA recommends consumers always consult with a tax professional for tax advice.

Simply purchasing a residential solar system by the end of the year is not enough to claim the full tax credit. The IRS says the system must be placed in service before the end of the year, meaning the system is installed and capable of being used. The process of signing a contract and installing a system can sometimes take several weeks.

If a solar system is placed in service in 2022, you will qualify for a 26% tax credit instead of 22%.

You must purchase the system to claim the ITC. Consumers may not claim the tax credit for leases or Power Purchase Agreements . Paying cash or financing the system through a loan or PACE does allow you to claim the ITC.

California also provides rebates for home battery systems. This incentive is in addition to the tax credit but consumers need to account for the rebate when claiming the tax credit.

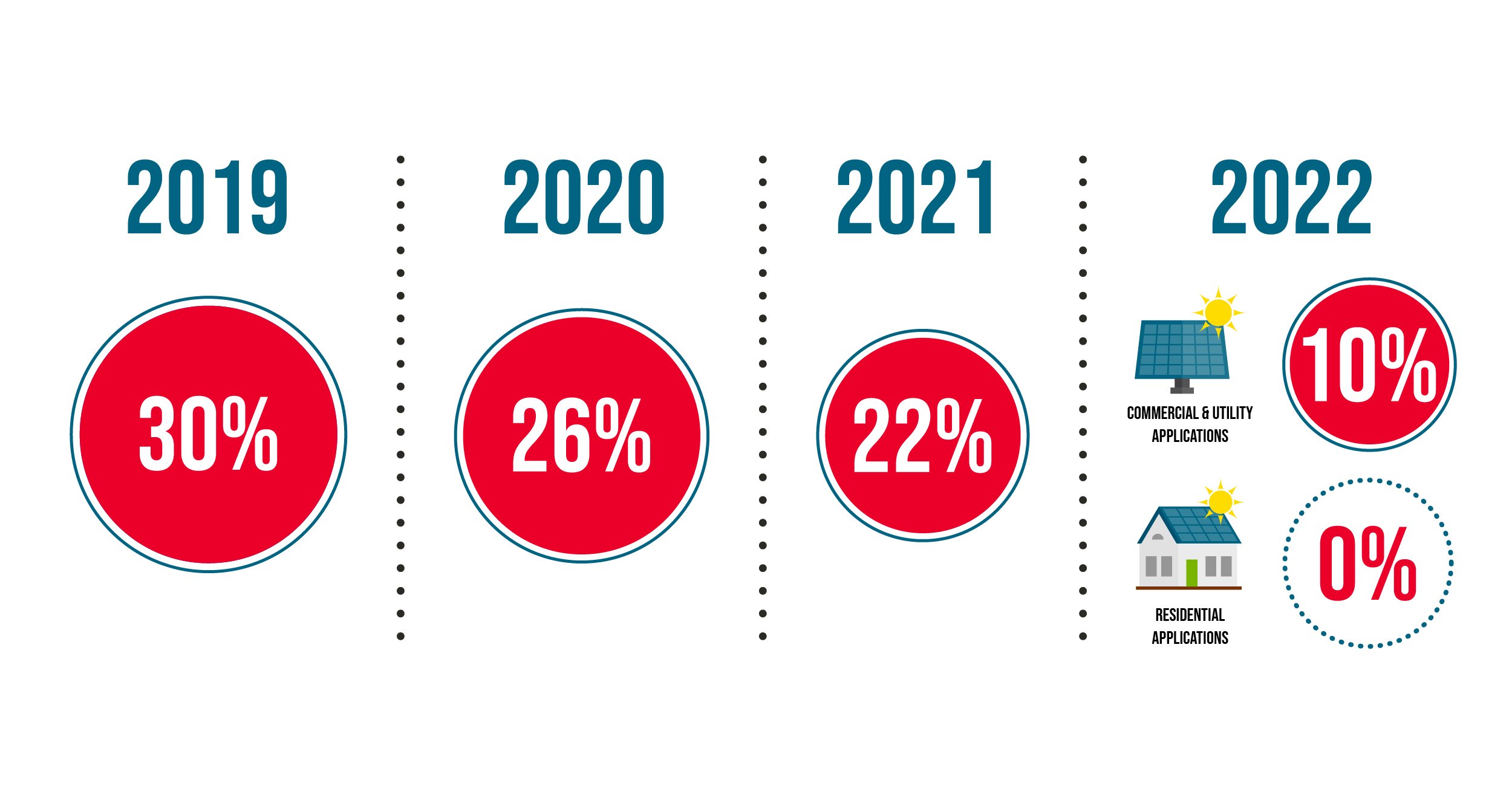

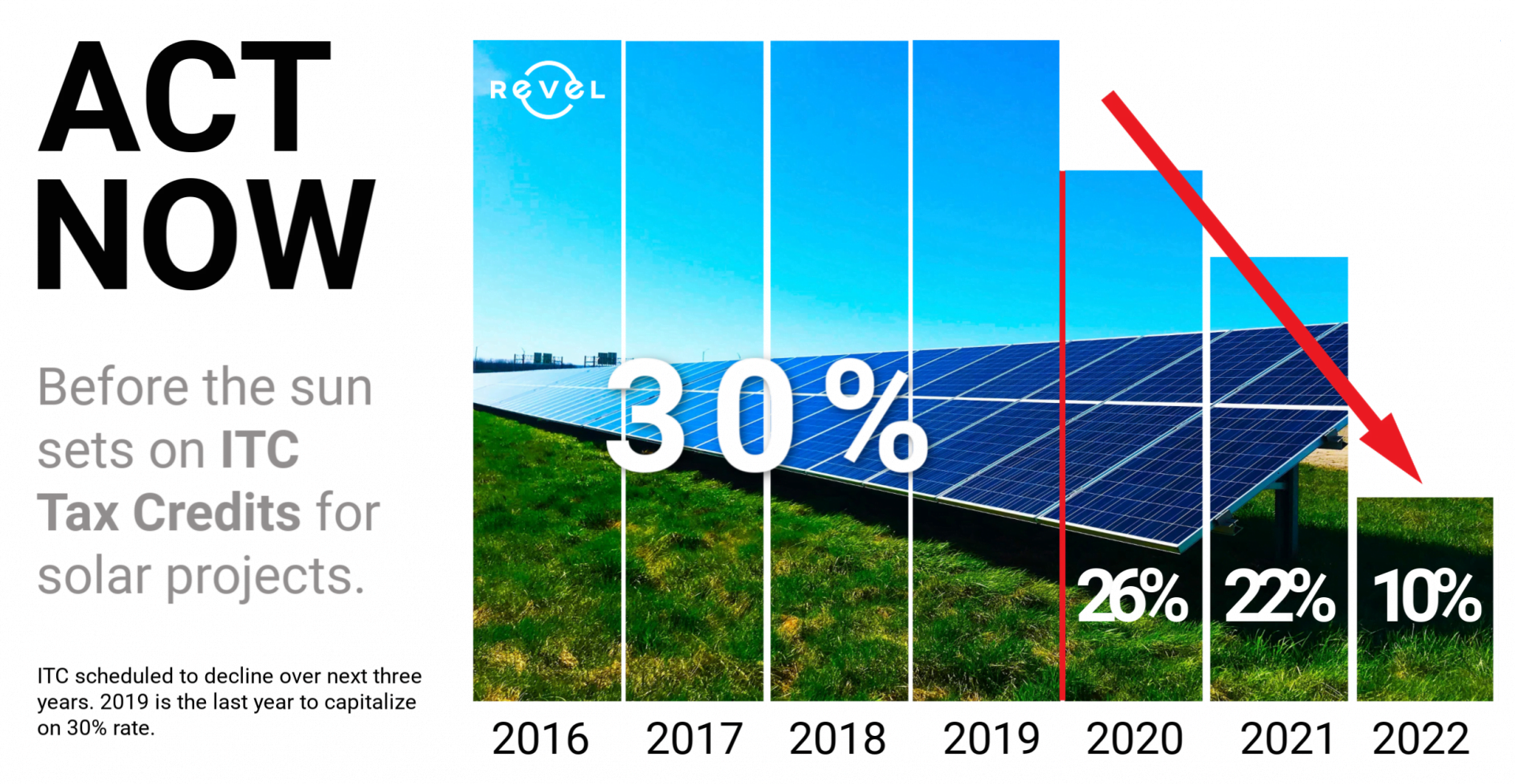

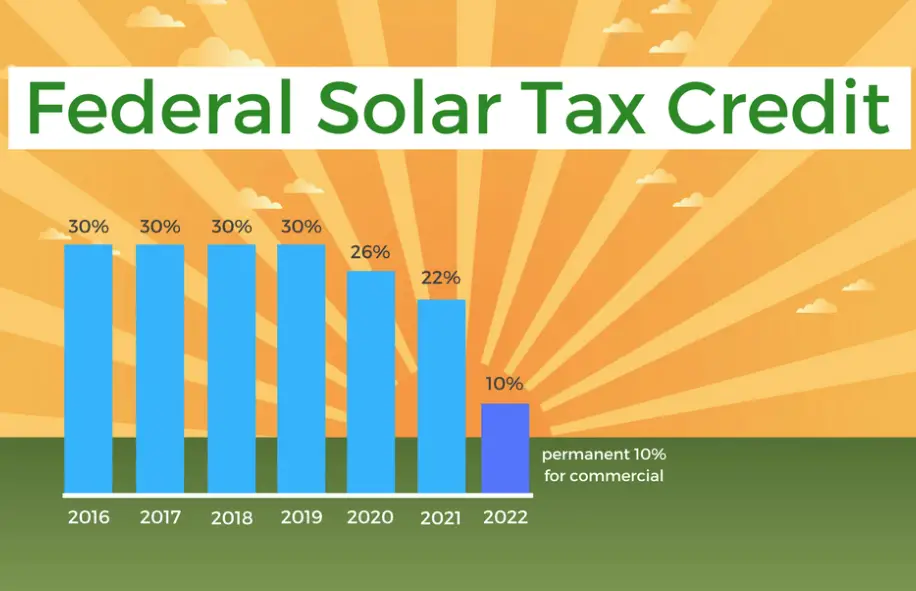

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Sgip Californias Solar Battery Storage Program

By now, you know that California is the leader in solar energy incentives. However, you should also note that the region also leads in battery storage. Its made possible by the Self Generation Incentive Program .

If your battery storage gets service through PG& E, SCE, Southern California Gas, or SDG& E, you are eligible for the program. In addition, battery storage systems that are smaller than 10 kW and installed on residential property are eligible for an incentive of $0.25 per watt-hour of storage installed.

Don’t Miss: What Insurance Companies Cover Solar Panels

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to the following tax year.

- If you failed to claim the credit in a previous year, you can file an amended return to claim the credit.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

TurboTax will search over 350 deductions to get your maximum refund, guaranteed. If youre a homeowner, TurboTax Deluxe gives you step-by-step guidance to help turn your biggest investment into your biggest tax break.

How Does The Solar Tax Credit Work In 2022

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26% tax credit is a dollar-for-dollar reduction of the income tax you owe. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

This is not the case, the federal solar tax credit can get back a refund of the taxes you have already paid out of your weekly or bi-weekly paycheck. Also, if you dont have enough tax liability to claim the credit in that year, you can roll over the rest of your credits to future years.

Don’t Miss: What Is The Life Expectancy Of A Solar Panel

California Solar Rebates : An Overview

If you have a property in California and looking forward to getting solar, then you are in luck. Installing solar panels in California has been made easier with a bevy of incentives for you to choose from. The state has a portfolio that encourages all utilities to source at least 50 % of their power from renewable sources. This goal is the main drive for the incentives being offered all over the state. They are meant to encourage the states residents to integrate the initiative into their homes and hasten the realization of the states portfolio.

Installing a solar system and perhaps adding its battery for energy storage has several benefits that Californian residents enjoy. The incentives are useful in covering the cost of the purchase of the solar system. The net energy metering allows solar system owners to sell some of their extra energy to the national electricity grid system and compensate for their electrical bills. The incentives are being offered by the state, different municipalities, and counties. Here is what you need to know about these solar rebates:

Ready To Reap The Rewards Of Solar Installation In Orange County Its The Best Time To Go Solar

So, how much is the solar tax credit for California in 2021?

If you are a residential owner installing solar panels in California, you will receive a 26% tax credit upon the purchase. When we talk of California tax credit, we refer to the federal solar tax credit applicable to all homes in the US, inclusive of California.

As a homeowner looking to invest in solar panels, you should note that the federal solar tax credit sums up 26% of the system cost until 2022. After that, it will drop to 22% in 2023.

As a homeowner in California, you are eligible for different California solar incentives should you have solar installed in your home.

Is there a California tax credit for solar panels? Its a significant concern that our clients ask when seeking solar installation services. We have been transforming homes to go solar in Orange County, and we have seen the comfort experienced by our clients with their reduction in monthly electric bills.

In the article above, you have been able to note down the eligibility for California solar panel rebates.

How do solar incentives work? At Enlightened Solar, we have all the information. Being a premium solar panel installation company, we care about your energy needs. Investing in solar panels will save you money and time. Contact us today for further consultation.

Recommended Reading: Is A Solar Roof Worth It

How Does The Federal Solar Tax Credit Work And How Much Will I Save

The Federal solar tax can go a long way in lowering your overall photovoltaic system costs. On the other hand, several misconceptions portray a different picture of the program. As a result, the information may mislead you into signing up for the program.

When you understand the common misconceptions, you will maximize the programs benefits as long as it lasts. So what are the misconceptions aboutCalifornia solar panel rebates?

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers don’t want to take over a 25-year lease.

Also Check: When Does Solar Tax Credit End

Determining Eligibility For The Federal Solar Tax Credit

There are several parts to ensuring that your new installation is eligible for the federal solar tax credit. Key requirements include:

- Have sufficient tax liability .

- Your solar or energy storage project must be installed and made operational within the year that you claim the tax credit.

- You own the solar or energy storage project. A financed system is also considered eligible, as is one purchased outright.

- Home batteries are included in the credit, if all the stored energy is generated by solar panels.

- The solar or energy storage system is not being re-used or re-installed.

- For solar installations that require new roofing, SOME of those costs are also covered by the Federal Solar Tax Credit. Youll need to contact a tax professional to determine your eligibility for these circumstances.

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

You May Like: How To Replace Roof With Solar Panels

California Solar Incentive In 2021

How do solar incentives work?

As long as you are within California, there are solar incentives and good savings that you will enjoy by installing solar for your home. They include Property-Assessed Clean Energy , Property Tax exemption for solar panels, and Net Energy Metering . There is also a solar tax incentive that is very significant, known as the Federal Solar Tax Credit.

Let us examine these California tax-based incentives and the benefits they carry for homeowners looking to install residential solar panels.

What Will Happen When The Solar Tax Credit Steps Down

This is speculative, but we foresee a couple possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas to help the state achieve its RPS goals.

- Congress adjusts the step down

- There is a possibility that congress may delay or adjust the tax credit step down. The tax credit was initially passed under a Republican administration and extended under both Republican and Democratic administrations. There is potential bipartisan support for an extension.

- With the most recent extension, the very fact that legislators built in a step down makes us find it less likely to be extended at the current 26% level.

- Residential tax benefits are also going away entirely in 2024.

Recommended Reading: How Much Does A 10kw Solar System Produce

Calculate Your Tax Credit

Finally, youll need to enter the result of line 3 of the worksheet on line 14 of Form 5695. Review line 13 and line 14, and put the smaller of the two values on line 15.

If your tax liability is smaller than your tax credits, subtract line 15 from line 13, and enter it on line 16. Thats the amount you can claim on next years taxes.

Self Generation Incentive Program

Statewide

The California Public Utilities Commission supports existing, new and emerging distributed energy resources through its Self Generation Incentive Program . This program provides California businesses and homes with an up-front rebate for installing an energy storage system. However, this incentive is a tiered-block program, so the incentive value declines over time as more battery storage installations occur throughout the state.

In addition to your utility companys incentive block, your rebate value also depends on the size of the battery you install. For most residential customers, SGIP is currently in Step 6, which translates to $200 per kilowatt-hour of stored energy capacity. So a popular solar battery system like the 13.5 kWh Tesla Powerwall 2 would earn you $2,700.

You May Like: What Can A 25 Watt Solar Panel Run

How Much Money Can Be Saved With This Tax Credit

Claiming the Solar Investment Tax Credit is worth 26% of the system cost. This applies to paying contractors and the cost of the parts.

Anyone spending $10,000 on a solar system would be able to claim back $2,600 in credits.

The catch is that you must own the system. It doesnt apply to solar leasing agreements. The person who owns the system claims the credit, so if you lease from a company, they get to claim the credit, not you.

With solar leasing, you can still save money on your bills, but you wont be able to claim any tax incentives. This is a massive blow to the ROI of installing the system in the first place.

This credit makes such a difference that its highly recommended you finance a solar system if you dont have the money immediately available to finance its installation.

Federal Tax Credit Is Not Calculated From Gross Cost

A lot of homeowners think that the ITC is calculated from the gross cost. That is not the case. As we calculated above, the 30% credit on a $30,000 solar panel system installation would sum up to $9,000. It is only possible if the $30,000 is the net cost. It is against the IRS rules to calculate the gross costs.

In addition, if you received any local or state financial incentives for your residential solar panel installation, it has to be deducted before calculating the 30% credit amount.

Lets dive into this example

Suppose your $30,000 installation qualified for a California solar tax rebate of $2,000 and a $1,000 rebate from your local utility company. It means that your net cost will be $27,000. Hence, the federal solar ITC would then be $8,200 and not $9,000.

Making the ITC calculation from the Gross tax will make you incur a tax bill instead of a deduction.

You May Like: What Are Solar Shades For Windows

Does California Have A Net Metering Incentive

Under Californias net energy metering incentive, investor-owned utilities are required to buy homeowners excess solar electricity at close-to retail rates.

The NEM 2.0 program, passed by the Public Utilities Commission in 2018, guarantees that homeowners going solar will be able to sell the excess solar electricity – typically produced during midday – for a period of 20 years.

This is an extremely valuable incentive selling your electricity to the utility at a good value is the easiest way to pay off your solar panel purchase quickly.

As we mentioned above, NEM 2.0 will end some time in 2022. The reason there isnt a firm date is that the California Public Utilities Commission has to vote on a final version of NEM 3.0, which will take effect 120 days after that vote.

Learn more:

The Importance Of Moving Quickly

If youve considered adding a new solar energy system to your home, you may be tempted to put off your investment to take advantage of even lower prices in the future. Tomorrows solar panels may be cheaper than they are today, however, those savings may be directly offset by the reduction in generous solar incentives like the solar ITC.

Through the end of 2022, it is still possible to knock 26% off the total installation price if you move quickly enough. But if you wait too long, you risk paying full price for a system that the government is willing to subsidize today.

If you are considering going solar, Enphase can help you think through your home energy goals and connect you to a certified installer to help you design a system to your exact specifications.

Don’t Miss: How Much Is The Federal Solar Rebate

Dont Own A Solar System Yet Compare Quotes On Energysage

If you havent started your solar journey yet, the first thing you need to know is that the best way to maximize your return on investment is to compare quotes. On the EnergySage Marketplace, youll receive free, custom quotes from our network of pre-vetted installers. And remember: because the ITC is currently set at 26%, as long as you have enough tax liability, youll receive a tax deduction equal to 26% of the total cost of your solar system.

Enter Your Energy Efficiency Property Costs

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. Well use $25,000 gross cost of a solar energy system as an example.

First, you will need to know the qualified solar electric property costs. This is the total gross cost of your solar energy system after any cash rebates. Add that to line 1. Next, youll insert the total cost of any additional energy improvements, if any, on lines 2 through 5, and add them up on line 6a. In this example, well assume you dont have any additional energy efficiency property costs.

On line 6b, multiply line 6a by 26%. This is the total value of your tax credit .

Assuming you are not also receiving a tax credit for fuel cells installed on your property, and you arent carrying forward any credits from last year, put the value from line 6b on line 13 of form 5695.

Also Check: How Much Does A Solar Street Light Cost