Renewable Energy Tax Credits

Under the Consolidated Appropriations Act of 2021, the renewable energy tax credits for fuel cells, small wind turbines, and geothermal heat pumps now feature a gradual step down in the credit value, the same as those for solar energy systems.

Tax Credit:

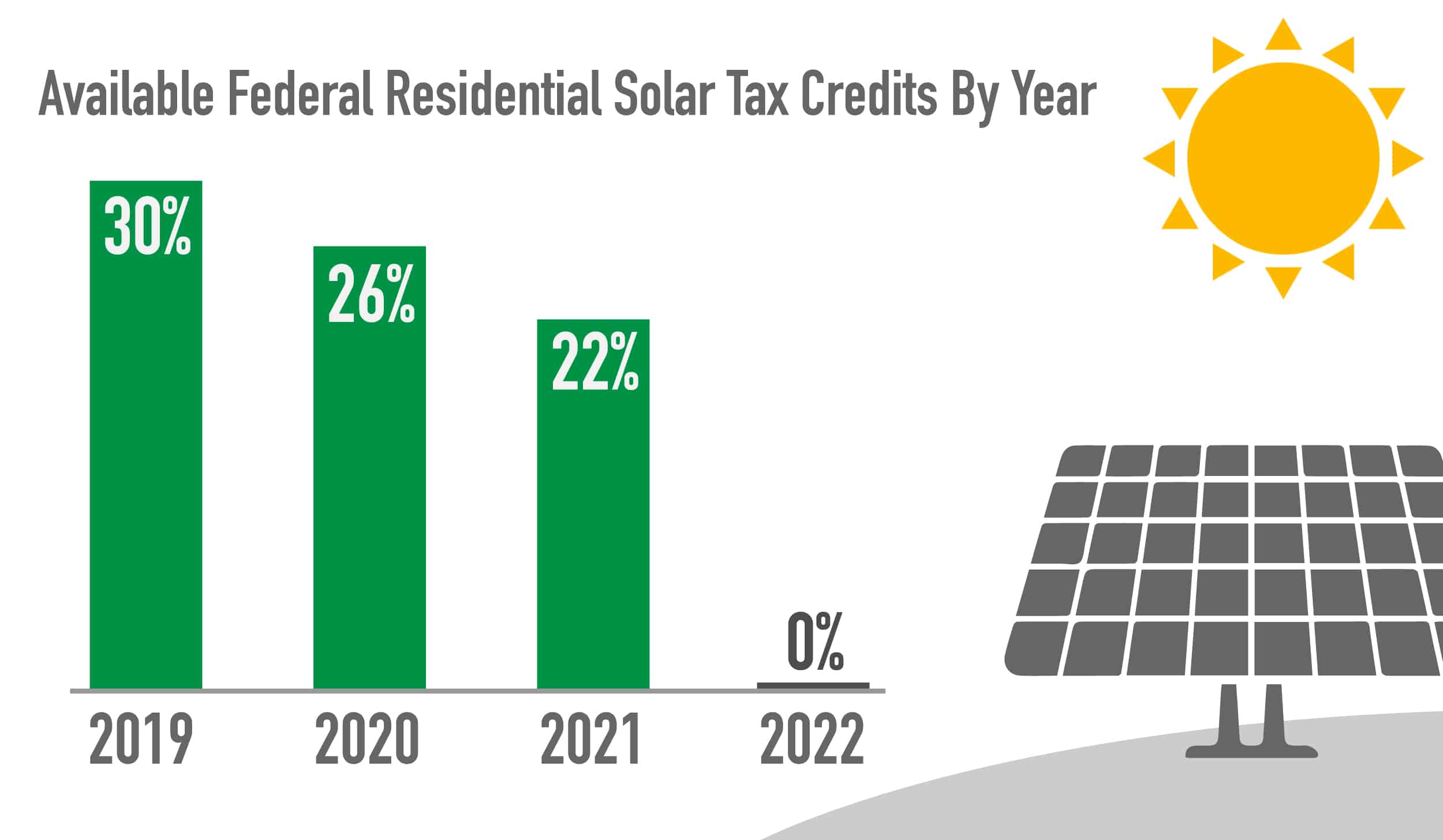

- 30% for systems placed in service by 12/31/2019

- 26% for systems placed in service after 12/31/2019 and before 01/01/2023

- 22% for systems placed in service after 12/31/2022 and before 01/01/2024

Expires: December 31, 2023

Details: Existing homes and new construction qualify. Both principal residences and second homes qualify. Rentals do not qualify.

Geothermal heat pumps are similar to ordinary heat pumps, but use the ground instead of outside air to provide heating, air conditioning and, in most cases, hot water. Because they use the earth’s natural heat, they are among the most efficient and comfortable heating and cooling technologies currently available.

Requirements

Must meet the requirements of the ENERGY STAR program which are in effect at the time of the expenditure. Tax credits includes installation costs.

The home served by the system does not have to be the taxpayer’s principal residence.

| Water-to-Air |

| COP > = 3.5 |

Definitions:

More Information

A wind turbine collets kinetic energy from the wind and converts it to electricity that is compatible with a home’s electrical system.

RequirementsMust generate no more than 100 kilowatts of electricity for residential use.

Solar Investment Tax Credit

The Federal Solar Tax Credit lets you take off up to 26% of the cost of installing a solar energy system from your federal income tax. It applies to both residential and commercial installations, and theres no limit to the value of the system you purchased. So whether your photovoltaic array is worth $15,000 or $30,000, the ITC is available to you.

However, the ITC is stepping down. Solar systems installed from January 1, 2021, to December 31, 2022, are still eligible for the 26% credit. But when 2023 arrives, the credit will go down to 22%, and, barring an extension from Congress, it goes away entirely for residential solar users in 2024.

Does My Business Qualify For The Solar Itc

To qualify for the solar ITC, the commercial solar energy system must generally be located in the U.S. and be:

- Tangible depreciable or amortizable property

- This means land and intangible assets like power purchase agreements are ineligible.

- New

- Keep in mind that under the 80/20 rule, energy property may be considered new even if it contains used components, as long as the value of the used components is not more than 20% of the energy propertys total value.

- Used by a business subject to U.S. federal income tax

- That means that it generally cannot be used by tax-exempt entities, governmental entities, or foreign persons or entities.

Read Also: How Much Will A 400 Watt Solar Panel Run

Can You Claim The Solar Tax Credit If You Lease Your Solar Panel System

If you lease your solar panels, you do not qualify for the Solar Investment Tax Credit directly, but the company that you lease from may use that tax credit to help lower your monthly payments.

Many solar companies offer leasing options where they will pay for the installation and the cost of the equipment, and then they charge you a monthly fee for the use of those solar panels. The solar company acts as a third party and owns the panels during the terms of the lease, and the homeowner gets the benefit of lower monthly energy costs. Because the solar company owns the panels, they will typically receive the solar tax credit, and the homeowner wont qualify for the tax incentives. Solar leasing companies may use the value of those tax incentives to lower the monthly cost that they charge homeowners, but its typically not going to be a direct pass-through savings, as the solar company will want to retain some of that value.

If you lease your solar panel system, you will not typically receive most state and local solar incentives either, though again, the company you lease from may use those incentives to offset their costs and help lower your monthly payment. In some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates , but this depends on where your home is located.

Q Are There Incentives For Making Your Home Energy Efficient By Installing Alternative Energy Equipment

A. Yes, the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property. Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023. The applicable percentages are:

Read Also: Does Solar Energy Work At Night

Montana Solar Incentives Tax Credits Rebates

Heres a quick look at the solar incentives in Montana:

- Federal Solar Tax Credit

Why You Can Trust EcoWatch

Our solar experts have sifted through hundreds of local governments and utility companies websites to find accurate information about current solar incentives in each state. Weve also unbiasedly ranked and reviewed hundreds of solar installers to empower you to make the right choice for your home.

What Is Different About The Solar Itc In 2022

Incentives exist to help jumpstart new industries and encourage widespread adoption, and the solar ITC has accomplished precisely that for the solar sector. According to the Solar Energy Industries Association , the federal solar tax credit helped the industry grow more than 10,000% since 2006 with an estimated 50% annual growth in the past decade alone.

As solar becomes more and more mainstream, some argue that the industry has less need for incentives like the ITC. Thanks to continued cost improvements over time, a home solar system is increasingly within the financial reach of homeowners across the country. These price drops have helped make going solar more affordable, which has allowed those with modest budgets to save on their utility bills and reduce their environmental impact.

In response to dropping solar costs, the ITC was reduced from 30% to 26% for both residential and commercial solar applications at the end of 2019. It was originally scheduled to drop even further at the end of 2020, but last December, the 26% rate was extended for all solar systems through the end of 2022. To qualify for the 26% incentive, your solar system must have been under construction before December 31, 2022.

It is important to note that the ITC will drop again to 22% in 2023 for all solar projects that begin construction during the calendar year. After 2023, the ITC permanently drops to 10% for commercial solar projects. For residential customers, the ITC permanently drops to 0%.

Recommended Reading: How Reliable Is Solar Power

Everything You Need To Know About The Federal Solar Tax Credit

The federal solar tax credit is the personal tax credit available to homeowners who purchase a new solar system. Currently, homeowners receive 26% of the cost of their system in a federal tax credit. For most homeowners that means a $4,000 to $6,000 tax credit for going solar. The actual credit will depend on a few factors like the size of your system.

In practice the solar tax credit would look like this:

Cost of solar system = $20,000

Solar tax credit = $5,200

Price of the solar system after tax credit = $14,800

All US residents can receive the federal solar tax credit. This tax credit deducts 26% of the cost of installing a solar energy system. This credit is available for both residential and commercial systems. The sooner you take advantage of this credit the better because as time goes on the amount of the credit diminishes.

Join The Solar Revolution

The federal solar tax credit has been extended to 2021 to further solar adoption across the U.S. It enables a greater number of homeowners to install a home solar system since they can apply this incentive to reduce their overall cost.

With this legislation extension, homeowners may now claim the tax credit as soon as construction is completed, as long as it is operational by the end of 2023. Previously, the system had to be operational in order to claim the tax credit.

The notable caveat to the extension is that the solar tax credit will be reduced on January 1, 2020.

Plus, other incentives are offered depending on your location. Sunrun solar advisors freely provide knowledge on all available incentives. Well ensure you receive your solar energy system with all possible incentives applied.

Read Also: How Does Vivint Solar Make Money

Why Now Is The Best Time To Install Solar Panels

The Solar Investment Tax Credit was established by the Energy Policy Act of 2005, and was originally set to expire at the end of 2007. Congress has now extended that expiration date multiple times, but the program is set to expire in 2024, and there are currently no signs that it will be extended again. Because of that, homeowners who are thinking about going solar should do so now, so they can take advantage of those tax savings. Starting in 2024, there will be no federal incentive to going solar, so youll be paying more out of pocket for your solar savings.

The solar tax credit has been a major driver of solar industry growth, and for many homeowners, the price difference of a solar power system with and without that tax credit is going to be significant. Thats why theres never been a better time to go solar and take advantage of the maximum amount of the tax credit thats still available while you still can.

What Is The Solar Investment Tax Credit

- The federal solar investment tax credit is a tax credit that can be claimed on federal income taxes for 26% of the cost of a solar photovoltaic system.

- The system must be placed in service during the tax year and generate electricity for a home located in the U.S.

- A solar energy PV system must be placed into service before December 31, 2021, to claim the credit in 2022 or December 31, 2022 to be claimed in 2023.

- There is no maximum amount that can be claimed.

Don’t Miss: Can I Get Solar Panels If I Rent

Using The Federal Tax Credit In Combination With Other Incentives

Aside from the ITC, there are several other solar incentives to consider like rebates, state-sponsored programs, and other tax credits depending on where you live. While some of these financial incentives may impact the ITC, others can be combined to lower the cost of going solar. Heres what you need to know about combining solar incentives with the federal ITC:

- Rebates from your utility company: As a general rule of thumb, subsidies from your utility company will be excluded from income tax returns. So, in this case, any utility rebate for installing solar would be subtracted from your system cost before you can calculate the tax credit.

- Rebates from the state:These types of rebates typically do not reduce your federal tax credit.

- State tax credit:If you get any state tax credit for your solar system, it will not decrease your federal tax credits. However, keep in mind that getting a state tax credit means that your taxable income on federal returns will be higher since you will have less state income tax to deduct.

- Payments from renewable energy certificates: Any time you receive money from selling renewable energy certificates, it will likely be considered taxable income that will increase your gross income. But, it will not reduce your tax credit.

Local Solar Tax Credits And Incentives

Depending on where you live you may be able to receive various tax credits, rebates, and other incentives from your local government and or utility. The rebates can have a drastic impact on the cost of your solar system so make sure you research all the available options. The DSIRE database built by the NC Clean Energy Technology Center is a great resource to find local incentives.

Don’t Miss: Is Home Solar Power Worth It

Everything You Need To Know About Solar Tax Credit

Did you know that if half of the roofs in the world were covered in solar panels, we would have enough energy to power the whole world?

This statement is not surprising if you consider that there’s enough solar energy hitting the earth every 60 minutes to meet all of humanity’s power requirements for a whole year.

It is now generally accepted that the opportunity presented by solar energy is enormous. The advantages in terms of cost and protecting the environment are also widely recognized. Consequently, the use of solar energy has escalated across the US and other parts of the world.

If you are considering installing solar panels, you will be glad to hear that the price of rooftop panels has plummeted 79 percent since 2010. If you’re a US taxpayer, the solar tax credit could see you save another 22 percent on the current prices.

But what is the federal solar tax credit? What expenses are included? How does a solar tax credit work? Do different states have their own programs? How do I know if I qualify for the solar tax credit?

If you are looking for answers to these questions and more, you have come to the right place.

About The Federal Solar Tax Credit

The federal solar tax credit is a tax credit that you can receive when filing your annual tax return. The tax credit equals 26% of the total cost of your home solar energy system. For example, if your solar energy system costs you a total of $20,000 then you can expect to apply $5,200 in credit to your tax return.

There is no limit to the amount you can claim on this credit. Whether your solar system costs $10,000 or $10,000,000, if you meet the eligibility criteria, you can claim your 26% tax credit on this amount.

Recommended Reading: Does Cleaning Solar Panels Help

How Much Can You Save With Solar Incentives In Montana

In this article, well discuss the solar incentives and rebates available to Montana homeowners. When youre ready to speak with a qualified professional, follow the links below. Each of these companies can help you identify and apply for incentives available in Montana.

Jump to Section:

- Offers products from leading manufacturers

- Certified B Corp

- Limited brands of solar equipment available

Services Offered

- Offers products from leading manufacturers

- Great warranty coverage

With solar prices at an all-time low, Montana residents can currently enjoy an average cost of $22,860 to go solar, which is well below the national average. Both the average per-watt price $2.54 and the typical system size needed in Montana to offset electricity usage 9 kilowatts are lower than youll find throughout most of the country. Still, the idea of paying over $22,000 to install solar panels is still not realistic for some homeowners.

Thankfully, there are some solar incentives provided to Montana homeowners by the state and federal governments. These incentives reduce upfront costs and make solar a more accessible renewable energy source by increasing the return on investment. Below, well explain all of the solar incentives available in Montana to help you reduce your costs as much as possible.

Disclaimer: This article is for informational purposes only. It should not be relied on for and is not intended to provide accounting, legal or tax advice.

How Much Is The Solar Tax Credit For 2021 2022

You may be eligible for the federal solar investment tax credit at the federal level . In 2021, the ITC will give a 26 percent tax credit on installation expenses if your taxable income exceeds the credit amount.

This equates to a 26% savings on the cost of your home solar energy system for most households. Thus, if your system costs $20,000, you may claim a solar tax credit of around $5,200 under the ITC.

The ITC is a 26% tax credit on solar systems installed on residential or commercial property. Commercial solar credits under Section 48 may be used for both customer-sited commercial solar systems and large-scale utility-scale solar farms.

Don’t Miss: How Much Do Solar Companies Pay To Lease Land

What Expenses Are Covered

According to the Department of Energy’s Office of Energy Efficiency and Renewable Energy, the cost of the panels or photovoltaic cells is covered, as are labor costs for assembly and installation — including permit and inspection fees, and sales tax on certain expenses.

Energy storage devices that are charged exclusively by the associated solar photovoltaic panels can be claimed, as can balance-of-system equipment, such as wiring, batteries, safety equipment and mounting equipment.

How Does The Solar Tax Credit Work And How Much Will I Save

Right now, the Solar Investment Tax Credit is worth 26% of your total system cost. This includes the value of parts and contractor fees for the installation.

As mentioned before, if it costs $10,000 to buy and install your system, you would be owed a $2,600 credit.

You are only allowed to claim the credit if you own your system. This is why were strongly opposed to solar leasing if you can avoid it. If another company leases you the system, they still own the equipment, so they get to claim the incentives.

Youll still get the benefits of cheap, renewable energy if you lease. But missing out on the tax credit is a huge blow to getting a positive ROI from your system.

It makes more sense to take advantage of solar financing instead. Youre still on the hook for a loan, but you retain rights to the incentives that help make solar such a sound investment.

Don’t Miss: How Much Does Blue Raven Solar Cost