How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To be on the safe side, your solar project should be fully installed and paid for before 2022 to be absolutely certain that you can claim the tax credit in 2022s taxes.

This isnt a concern in early January 2021, but the urgency increases towards the end of 2022.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

Therefore, to be 100% sure that you can claim the 26% ITC, the sooner you move forward with your project, the better.

Towards the end of 2022, as word begins to spread about the incentive stepping down, solar installers will likely get busier and busier, meaning your installation may be scheduled farther out than normal.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

What You Need To Claim The Tax Credit

- The receipts from your solar installation

- IRS Form 1040 for 2020

- IRS Form 5695 for 2020

- Instructions for both those forms

- A pencil

- A calculator

Fill out your Form 1040 as you normally would. Stop when you get down to line 20, and move to Schedule 3, which uses your calculations from Form 5695 on line 5.

Read Also: How Efficient Can Solar Panels Get

Impact Of The Solar Tax Credit

As the United States races to achieve rigorous clean energy benchmarks, the federal policies and incentives to get us there have heightened. On both a distributed and utility-scale level, solar deployment has grown quickly across the country. The federal tax credit has given businesses, homeowners, and tax payers the opportunity to drive down solar costs while increasing long-term energy stability. The ITC has been a driver of huge success, giving us a stronger and cleaner future: in fact, according to the Solar Energy Industries Association , it has helped the U.S. solar industry expand by over 10,000 percent! Learn more about how solar panel costs and efficiency have changed over time.

Also Check: Www.1040paytax.com Review

What Does The Itc Step Down Mean For Homeowners

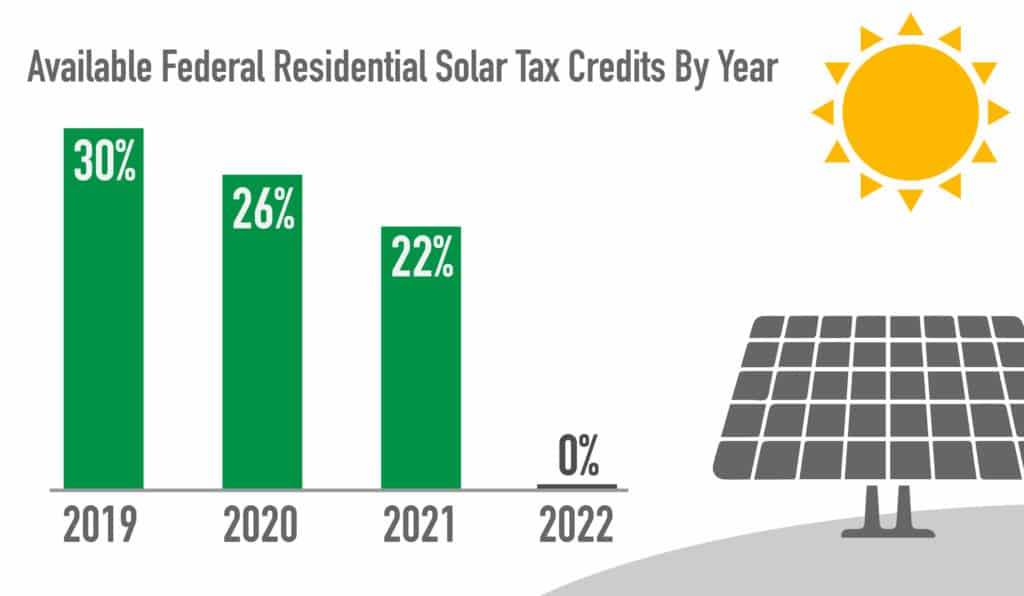

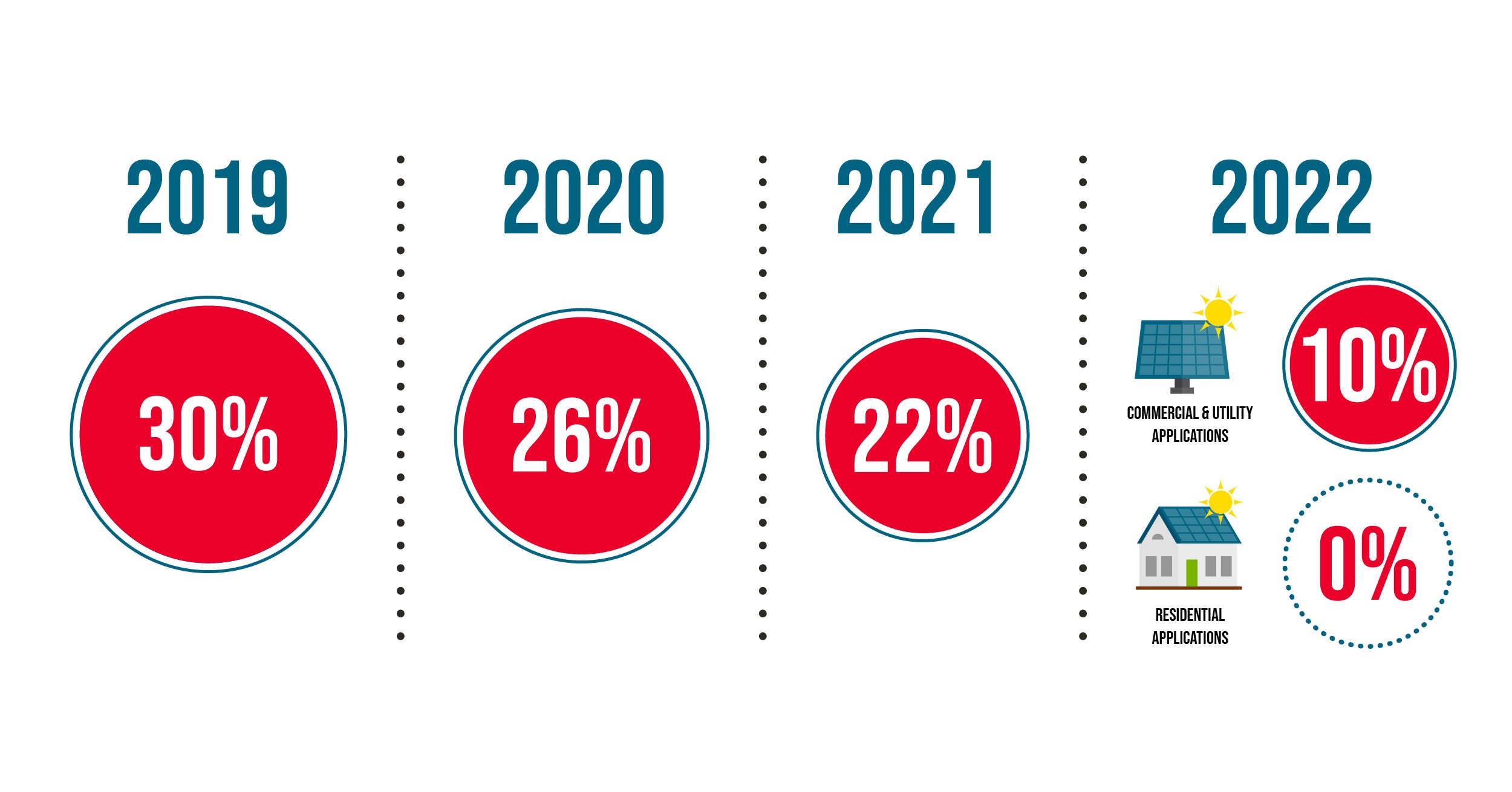

Homeowners that are considering installing rooftop solar panels on their home will see little tax benefit to do so, especially after the ITC steps down again in 2021 to an even lower 22% credit. By 2022, the Federal Solar Tax Credit will only be available for commercial installations at a rate of 10%. That means that homeowners will not see a tax benefit for rooftop installation at all by 2022.

The credit is only for the tax year that the system was installed. Each time the credit steps down, homeowners receive less of a credit on their tax refund. While a 4% decrease this year may not seem like much, that 4% adds up quickly when you consider the cost of purchasing a rooftop solar system for your home. Lets say the system that you decide to install this year costs $25,000. The credit for 2020 will be $6,500 vs. $7,500 that it would have been just last year in 2019. By 2021, you would only receive a $5,500 credit. Because you can also claim any additional work required to install the system, as well as the batteries required to run it, you also lose 4% on those cost savings too.

Also Check: Can I Make Solar Panels At Home

What Does The Federal Solar Tax Credit Extension Mean For The Solar Industry

The federal ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. A series of extensions pushed the expiration date back to the end of 2016, but experts believed that an additional five-year extension would bring the solar industry to its full maturity. Thanks to the spending bill that Congress passed in late December 2015, the tax credit is now available to homeowners in some form through 2021. Here are the specifics:

- 2016 2019: The tax credit remains at 30 percent of the cost of the system. This means you can still get a major discount off the price for your solar panel system.

- 2020-2022: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

- 2023: Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

- 2024 onwards: Owners of new commercial solar energy systems can deduct 10 percent of the cost of the system from their taxes. There is no federal credit for residential solar energy systems.

Was The Solar Itc Extended For 2021

The ITC was scheduled to drop from 26% in 2020 to 22% in 2021.

However, the federal solar tax credit was extended at the end of 2020 as it has been extended many times

In 2020 the Solar ITC was extended as part of the $1.4 trillion federal spending package alongside the $900 billion COVID-19 virus relief package A previous extension of the ITC was included in the Bipartisan Budget Act of 2018.

Now, instead of dropping in 2021, the solar ITC will remain at 26% for two additional years.

The tax credit will drop to 22% in 2023 for commercial solar and eventually drop to zero for residential.

In 2024 the tax credit for commercial solar is expected to remain at 10% indefinitely.

Don’t Miss: How Much Is Solar Panels In Hawaii

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

Don’t Miss: How To Calculate How Much Solar Panels You Need

Utah Solar Tax Credit: Utah Renewable Energy Systems Tax Credit Program

With available tax credits from both state and federal governments, now is the best time to invest in solar energy for your home. Over the next few years, both solar incentives will be decreasing in value until they expire. Energy costs are expected to increase over that same time period. In addition to these factors, Utah has voluntarily mandated that a percentage of energy produced in the state should come from renewable energy sources. The RESTC program is one method Utah is using to meet this mandate.

Who Is Eligible For A Solar Tax Credit

You can claim the federal solar tax credit as long as you have tax liability for the year that the eligible solar equipment was installed. Eligible solar equipment includes solar panels and solar backup batteries. However, you can only claim the credit if you own the equipment. If you lease your solar equipment, then only your lease provider can claim the tax credit.

Recommended Reading: Do Solar Panels Radiate Heat

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

What Is The Federal Solar Tax Credit And How Does It Work

The federal investment tax credit for solar energy is a dollar-for-dollar reduction of the taxes you owe at the end of the year. As long as you had solar equipment installed during that tax year, you can claim the credit by completing IRS form 5695 when you file your tax return. However, if you didnt claim the tax credit for a previous tax year, you can file an amended return. Keep in mind that a tax credit differs from a tax deductionit only lowers the amount of taxes you owe, not the amount of your taxable income.

The federal solar tax credit applies to a percentage of the cost of your solar equipment installation. The percentage for 2022 is 26%, but that rate decreases every year until the tax credit expires. The tax credit percentage was, in fact, meant to go down to 22% in 2021, but Congress passed an extension in December of 2020 to make it last through 2022. That means that filing an amended return for 2020 or 2021 could still earn you the 26% tax credit.

Recommended Reading: How Much Solar Power Will I Generate

How To Claim The Tax Credit For Solar Panels

Note: Were solar experts at Palmetto, but everyones tax situation is unique, so please consult with a tax expert to determine whats best for you. That said, if youre looking for information on how to file for a solar panel tax credit, heres a general overview of how homeowners can claim their Solar Investment Tax Credit:

Expanding Access To Solar

SETO works to create a more equitable clean energy future by addressing the barriers that low- and moderate-income households face in accessing the benefits of solar through innovations in financing, community solar, and workforce development. To this end, the office has set a goal for 2025 that would enable 100% of U.S. energy consumers to choose residential solar or community solar that does not increase their electricity cost. Learn more about equitable access to solar energy.

Read Also: How To Figure Out What Size Solar System I Need

Putting The Numbers In Perspective

With a little math, we can demonstrate the effect of the changes in the solar ITC.

Lets say a PV system comes in at a net price of $30,000. With the full 30 percent ITC, the credit would be a rather impressive $9,000.

Now, imagine that same PV system installed in 2020. The tax credit has dropped to 26 percent, so the tax liability reduction would be $7,800.

If the solar PV system isnt placed into service until 2021, when the credit drops to 22 percent, the ITC will be worth just $6,600.

After the end of 2021, the federal solar ITC for a $30,000 commercial photovoltaic installation will drop to only $3,000. And forget about a credit for a residential PV system that financial incentive will be gone.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

You May Like: Does A Sole Proprietor Need A Registered Agent

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of this year.

- Your system must be installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must either be brand new or have been used for the first time. You only get to claim this credit once, for the âoriginal installationâ of your solar PV equipment.

Summary Of The Residential Energy System Tax Credit

Investing in renewable solar energy for your home is a choice you must consider carefully, but the benefits are clear. Solar power will reduce your energy needs and can lower your power bill. Depending on the interconnection agreement you obtain from your local electrical utility, you can even earn credit for exporting energy to the grid. Current federal and Utah solar tax credits offer an incentive to invest now. Both of these tax credits will decrease over the next few years and end in 2025. From 2018 to 2021, the maximum credit available for residential solar PV is 25% of eligible costs or $1,600, whichever is lower. This amount decreases by $400 each year after until it expires.

You can apply for the Utah solar tax credit yourself or ask your solar installer to gather and complete the necessary steps. You must create an account with the Office of Energy Development and submit the necessary forms. These include an interconnection and net metering agreement or closure letter from the utility company, invoices from your solar PV installation, schematics of the PV system, and photos of the completed solar system. Additionally, there is now a $15 fee due before the OED will issue your TC-40E.

Read Also: Who Makes Solar Panels For Tesla

Is The Solar Itc Refundable

The solar ITC is not a refundable credit it can only be used against your organizations U.S. federal income tax liability.

However, the solar ITC may be carried back one year and forward up to 20 years for companies that dont have sufficient tax liability to offset for the tax year their solar energy system was placed in service.

A deduction is allowed for 50% of any portion of the solar ITC that remains unused after the 20-year carry forward period.