Launching Your Business In Bellevue

Moving from business idea to a real launch is more than a leap of faith. The first time is always the toughest because you are in unfamiliar territory and rookie entrepreneurs will make a lot of mistakes that prove to be very expensive later on. That is why listening and learning from others is so important.

-

Small Business Village

The successful ecosystem of the neighborhood is a collective, interrelated and interdependent community. Support comes from anywhere and everywhere.

- Bothell SCORE

-

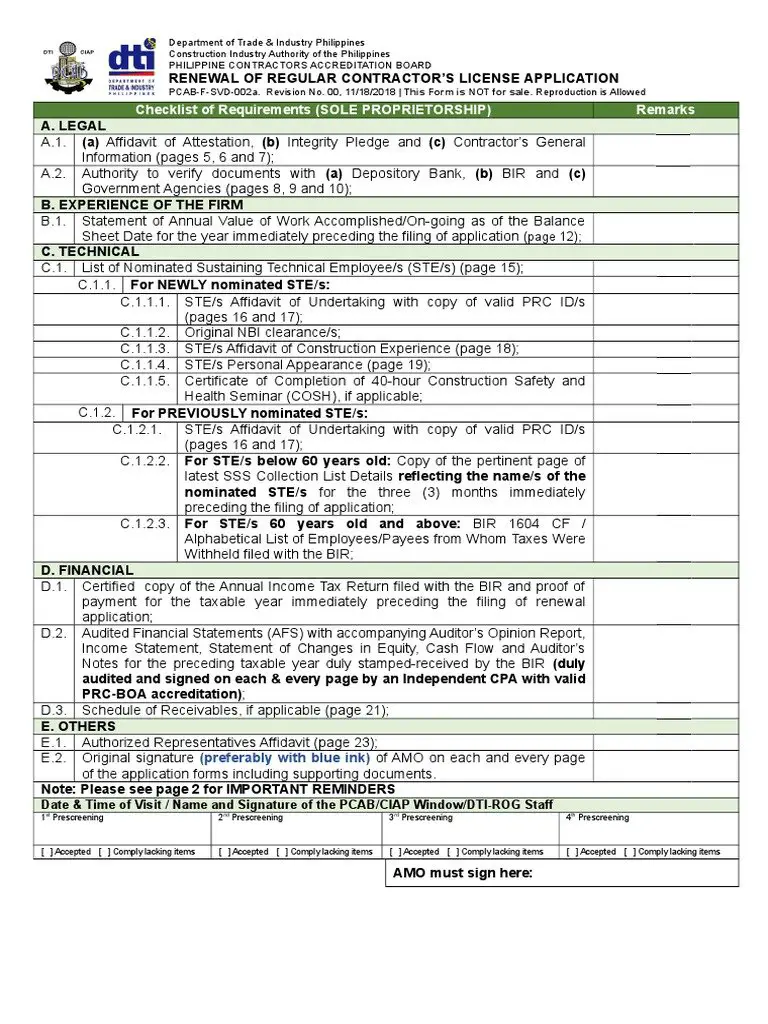

Business License Requirements

- Bothell Business License: Business licenses are authorizations issued by local and state government agencies that allow individuals or companies to conduct business within the government’s geographical jurisdiction.

- Bothell Permits : Practice permits regulate safety, structure and appearance of the business community. They act as proof that your business follows certain laws and ordinances. Requirements vary by jurisdiction, and failure to comply often results in fines or even having your business shut down. Research the permits you need before you start any work, set-up or property purchase. That way, you can make sure compliance is in order and avoid the additional expenses and delays of fixing things later.

Do You Have To Have A Business License For A Sole Proprietorship

Unlike corporations or limited liability companies, sole proprietorships are among the easiest types of businesses to start. You do not have to register with the state like corporations and limited liability companies. As a business owner, however, you must obtain the required permits and licenses to operate legally, and you are personally responsible for any debts, lawsuits, or taxes incurred by the business.

Do Sole Proprietors Need To File Quarterly Taxes

Yes, sole proprietors may need to file quarterly taxes. These include estimated quarterly taxes for income tax, self-employment tax, and alternative minimum tax. However, the IRS doesnt require quarterly tax filings when the last years tax filing covered a 12-month timeframe and when the filer doesnt anticipate owing more than $1000 in taxes for the current year.

You May Like: How To Hook Up Multiple Solar Panels

What Is A Sole Proprietorship And How To Start One

When starting a business, a sole proprietorship is the simplest structure to choose from. A sole proprietorship is a non-registered, unincorporated business run solely by one individual with no distinction between the business and the owner. This has its benefits and drawbacks. For example, as a sole proprietor, you are entitled to all profits, but youre also responsible for all the businesss debts, losses, and liabilities.

A sole proprietorship is a common business structure in the United States. In fact, BizFilingssmall business survey found that 59% of small business owners reportedly operate as a sole proprietorship.

If youre wondering whether you should start your business as a sole proprietorship, heres what you need to know to make the decision.

It Consultant Or Computer/it Specialist

Have you ever run into IT problems? So do countless businesses. As an IT consultant running your own business, you would offer IT troubleshooting services to other companies, resolving issues with both the companys hardware and software solutions. Be open to traveling for this type of sole proprietor business.

Don’t Miss: How To Get Solar Energy

Hard To Raise Money With Limited Growth Potential

Sole proprietors usually face challenges while raising money through sole proprietorship. There is limited growth potential with a sole proprietorship due to the following reasons

- You cant sell stock in the business

- Investors usually do not invest as a sole proprietorship does not have a legal standing

- Banks typically do not lend to a sole proprietorship due to lack of credibility as a sole proprietorship is not a legal business entity

- If a sole proprietorship becomes more profitable, risk increases. In case of liabilities, you may lose personal assets and what you earn from the business.

Can A Sole Proprietor Hire Employees

There is some confusion about this and yes a sole proprietor or self-employed individual can hire employees and there is no limit on the number of employees that can be hired. Just as with any other entity, the owner is responsible to withhold state and federal withholdings pay payroll taxes and purchase workers compensation insurance.

Setting up a new business as a sole proprietorship is a good choice for many businesses. Its important to remember that the business entity can be changed whenever it is appropriate. If the business outgrows the sole proprietorship, the business can change to a corporation or LLC relatively easily. For other businesses, its better to spend a little extra and form a corporation or LLC to have liability protection. Read more about the pros and cons on each of the business entities.

Don’t Miss: Should Solar Panels Be Connected In Series Or Parallel

What Is A Sole Proprietorship In India

A Sole Proprietorship is a business entity formed in the name of a single person called the Proprietor who must be a Citizen and Resident of India. The Proprietor owns the business, manages it and controls its operations. This is a simple business entity that can be formed by any person who wants to start a business without going through various legal formalities.

What Are Examples Of A Sole Proprietorship

Sole proprietors are anyone engaging in independent business activity, meaning they generate profit for themselves rather than receive a salary as an employee for another business. Common examples of sole proprietors are freelancers, independent contractors, part-time gig economy workers, small business owners, etc.

Don’t Miss: Does Texas Have A Solar Rebate

What Is Sole Proprietorship

A Sole proprietorship can be explained as a kind of business or an organization that is owned, controlled and operated by a single individual who is the sole beneficiary of all profits or loss, and responsible for all risks. It is a popular kind of business, especially suitable for small business at least for its initial years of operation. This type of businesses is usually a specialized service such as hair salons, beauty parlours, or small retail shops.

Starting A Sole Proprietorship In India

One of the most common forms of business in India, Sole Proprietorship is the easiest to start. It is a business entity formed in the name of a single person. That person owns, manages, and controls the various operations of the business. In addition to being very easy to start Proprietorships have minimal regulatory compliance requirements.

On the other hand, unlike LLP and Private Limited Company a Sole Proprietorship does not offer the proprietor benefits such as limited liability, separate legal existence, transferability, etc. In this article, we examine how to start a proprietorship and its advantages & disadvantages. We will also detail the criteria on which to decide if one should opt for this business structure.

Don’t Miss: How Much Do Solar Power Batteries Cost

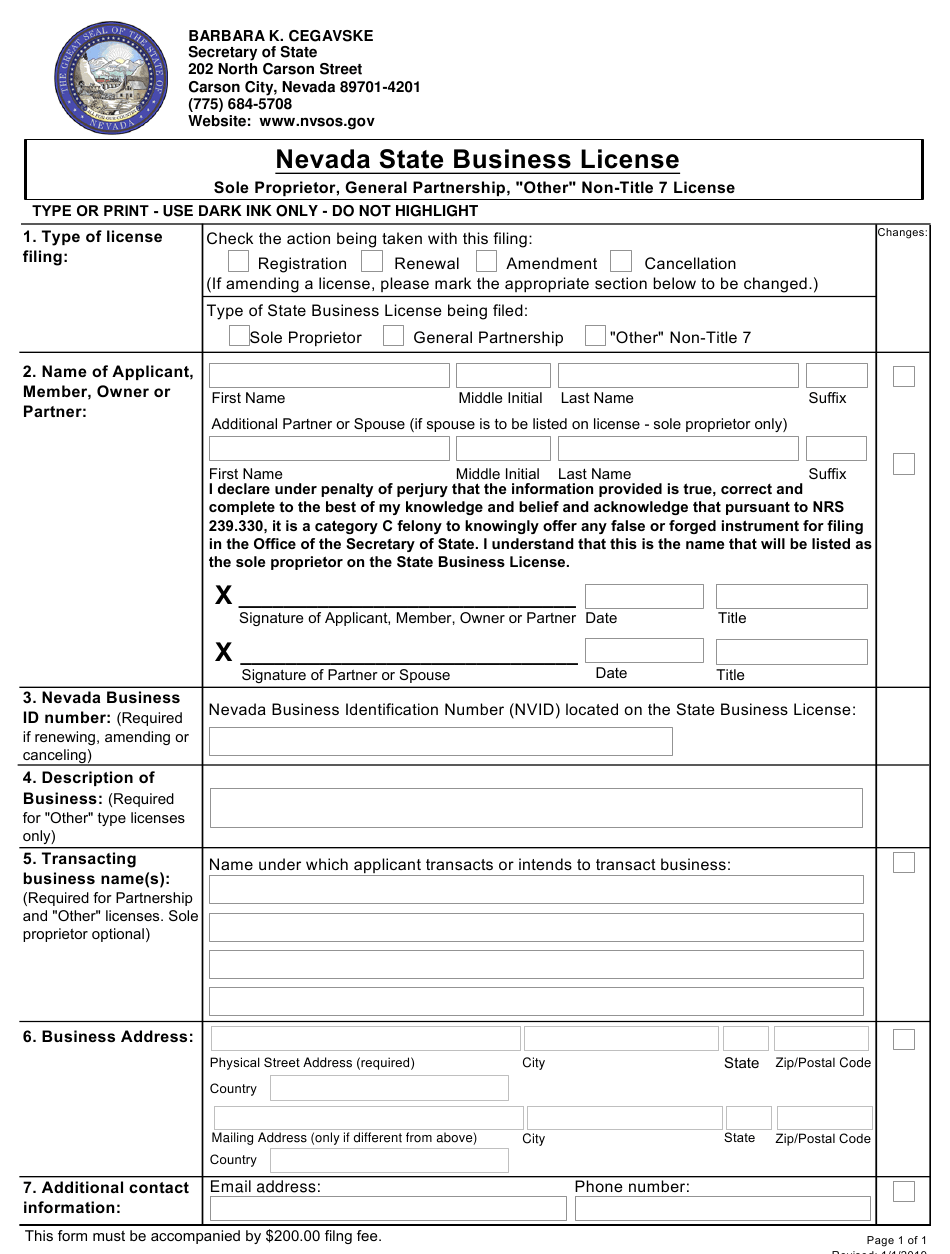

Apply For A Business License

You may have to file for licenses and permits with state, county and municipal agenciesfor example, a sales tax permit from the state, health permits through a department of health, and planning permits through the city.

Look for resources from your state or your local SBA office that gather all the information you need in one place, so you dont have to spend hours researching every relevant agency. Step-by-step guides in your state could walk you through the process and include links to necessary applications on various websites.

In most states and many localities, you can get a general business license online through the proper agencys website. Industry-specific licenses may have a more complicated application process.

You likely wont have to wait long for a business operating license or a sales tax permit to be approved. Other types of licenses and permits may have a longer and more involved review process.

How Does A Sole Proprietorship Get Started

A sole proprietorship is unique because it’s the only business that doesn’t have to register with a state. All other business types – partnerships, limited liability companies, and corporations – must file a registration form with each state in which they do business.

Starting a sole prop business is fairly simple. To start a sole proprietorship, all you need to do is:

- Create a business name and decide on a location for your business

- File for a business license with your city or county, and get permission from your locality if you want to operate your business from home.

- Set up a business checking account so you don’t mix up business and personal spending.

In addition, your sole proprietorship may have to register with federal or state entities :

- If you plan to sell taxable products or services, you must register with your state’s taxing authority.

- If you plan to hire employees, you’ll need an Employer Tax ID Number from the IRS. Your bank may also require this tax number.

Don’t Miss: How Much Tax For Sole Proprietorship

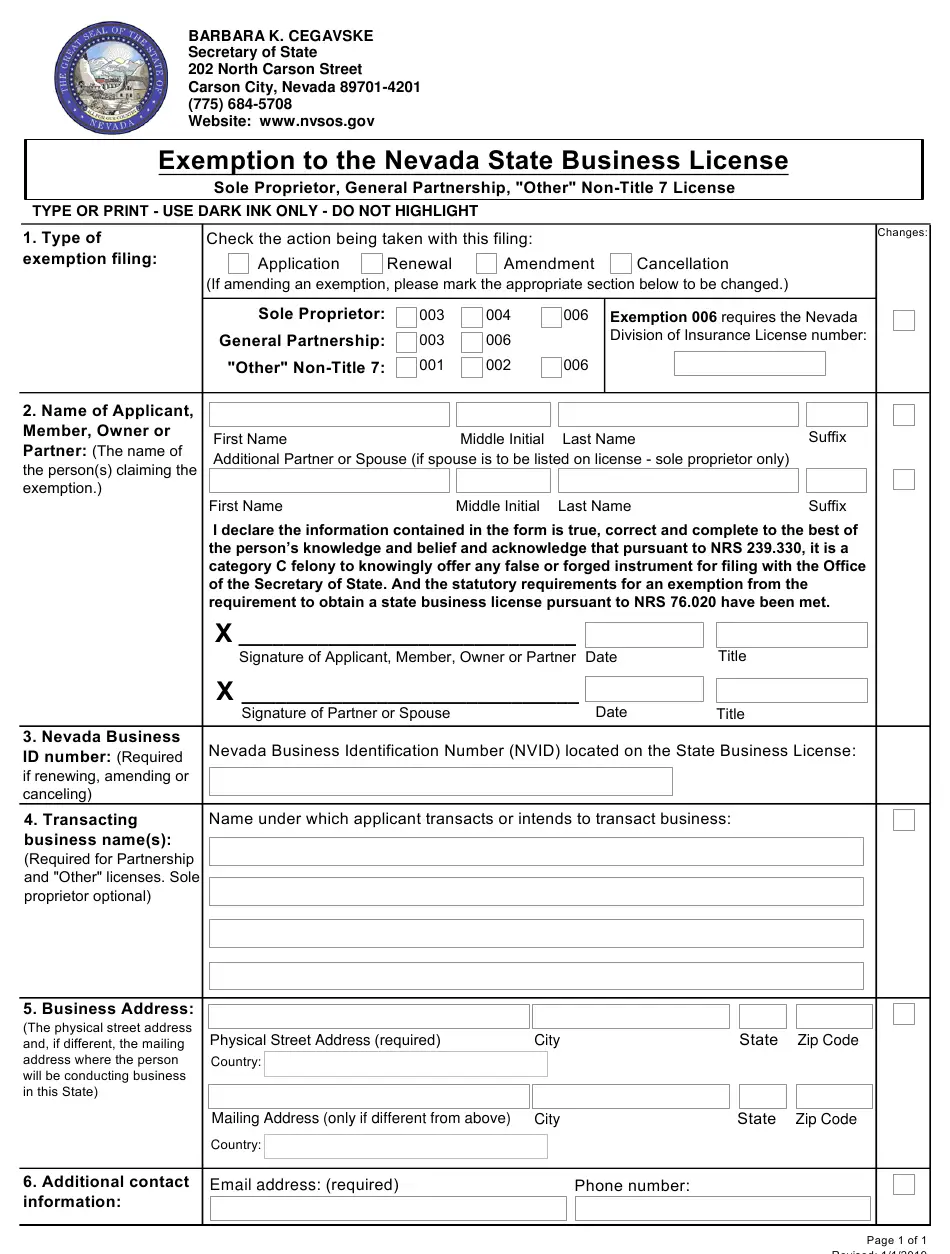

Amending Or Cancelling A Registration

To ensure the Public Record is accurate, you must notify the Central Production and Verification Services Branch when the information in your registration has changed. Changes in address, business activity or partners , must be filed on the Ministry form within 15 days after the change. There is no filing fee. However, changing the name of your business registration is considered a new registration and the relevant fee applies. Changing the type of registration, e.g. a partnership registration to a sole proprietorship, or changing all the partners in a partnership, is also considered a new registration.

If the business ceases to operate, you should cancel your business name registration. There is no filing fee for the cancellation of a business name.

The amended or cancelled registration can be submitted to the Branch by mail or in person at the Public Office in Toronto. Alternatively, the registrant can amend or cancel a business name registration online through the ServiceOntario website at Ontario.ca. The registrant will receive confirmation of the changes by mail in approximately three weeks.

What Taxes Does A Sole Proprietorship Pay

Being self-employed generally requires the filing of an annual return and paying a self-employment tax in addition to a personal income tax. While there are taxes that need to be paid, its important to realize that a sole proprietorship does not pay taxes at the business level. Instead, business income or losses are reported on the owners personal income tax return. The IRS refers to this as pass-through taxation, because the profits of the business pass through the business to the individual.

All expenses incurred in the operations of a business are able to be deducted, same as any of the other business entities. When claiming deductible expenses, be sure to keep records of the receipts in case you need to prove the expense if audited. Read more about business deductions

Also Check: How Many Panels In A 4kw Solar System

Ensure A Sole Proprietorship Is Right For You

First, is starting a sole proprietorship right for you? Or should you launch another type of business?

Choosing the right business structure is key to your ventures success. As the SBA points out, The business structure you choose influences everything from day-to-day operations, to taxes, to how much of your personal assets are at risk.

Sole proprietorships, partnerships, limited liability companies , corporations, and cooperatives are just a few of the ways you can structure your business. While sole proprietorships andLLCs are two of the most common business structures, there are key differences between them.

Determine Your Business Name

When deciding on a business name, there are many things to consider:

- Will it appeal to your potential customers?

- Will it work well in graphic design and marketing?

- Is anyone else using the name? If so, could there be confusion in the marketplace, or could you be infringing on their legal name, trademark, or service mark? Learn the difference between a Legal Entity Name , trade name, a name used in the course of business, and a trademark, an exclusive right to use a name. You can do searches through the U.S. Patent and Trademark Office, the Washington Business Licensing Service, the Secretary of State, and through various Web search engines.

- If your business is a corporation or limited liability entity, the name must indicate the type of entity .

Legal Entity names become record when you file a legal entity such as an LLC or Corporation. You can register a trade name when you complete your Washington Business License Application, at a cost of $5 per name. If you also want to trademark a name, you may want to consult an intellectual property attorney. If your business activities will extend beyond Washington State, file for a trademark with the U.S. Patent and Trademark Office. If your business activities will stay within Washington, file for a trademark with the Secretary of State.

Don’t Miss: How To Open A Solo 401k Account

How To Register Your Business As A Sole Proprietor

A sole proprietor can act as an independent contractor , business owner or franchisee. Keep in mind that since you are self-employed, your paycheques do not have adequate deductions at the time of payment. Instead, you can expect to pay quarterly estimated tax payments and cover the difference or get a refund for bottlenecks or overruns during tax season. Sole proprietors are responsible for all debts. Sole proprietors are personally responsible for all obligations of the company, including responsibility for the employee`s actions in the workplace. Keep in mind that creditors can look for your personal assets to collect your company`s outstanding debts. Success and failure are the sole responsibility of the owner. Do you need state and federal business permits or licenses? Most likely, yes. The best way to know which licenses are relevant to your sole proprietorship is to use the CalGold database. This website is simply designed and guides you based on locations and businesses. In the state of California, whether the business is large or small, the business must apply for a general urban business license. Regulatory and professional licenses for a hairdresser, real estate agent, restaurant, and any type of business find regional, local, state, and federal information in the database. It`s always a good idea to contact your local chamber of commerce and ask them any questions you may have about your business.

Get One Step Closer To Being Your Own Boss

Once you know how to start a sole proprietorship, youll discover its an affordable and relatively easy way to launch your own business. There are few barriers to entry and it allows you to truly be your own boss. However, it does come with some risks, like being vulnerable to unlimited liability.

Determine if a sole proprietorship is the right fit for your business endeavor. When youre ready to move forward, check out these six questions to ask yourself when starting a business.

You May Like: Where Is Solar Energy Used The Most

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

You Can Operate Your Sole Proprietorship Under Your Personal Name

Some entrepreneurs spend hours dreaming up the perfect business name, but if youâre not hanging out a shingle or a sign above a storefront, having a novel name may be of little interest. As a sole proprietorship, you can simply use your personal name as your business’s legal name, and that saves you from having to register a business name at the trademark office or file a Doing Business As with your local administration. It also saves you from the fees associated with each of these processes.

Also Check: What Tax Forms Do I File For A Sole Proprietorship

Whom Sole Proprietorship Is Best For

A sole proprietorship is a good fit for small businesses such as freelancers, consultants, entrepreneurs with the following characteristics:

- The business must be low-profit with low-risk

- The company has smaller customer potential

- Businesses with smaller investments such as blogging, graphic designing, photography, or video streaming.

Does Registration Protect My Business Name

The Business Names Act does not protect the exclusivity of a registered name. You may be able to protect your business name by registering a trademark under the Trade-Marks Act . It may be useful to talk to your lawyer or contact the FedDev Ontario – Small Business Services for more information on trademarks.

The Business Names Act does not prohibit registration of identical names, but if you decide to use a name that is the same as or confusingly similar to that of an existing business, it could result in a lawsuit. The person registering the name also assumes full responsibility for any risk of confusion with an existing corporation, business name or trademark.

You may also wish to do some research to see if incorporating is a better alternative for your business. Identical corporation names cannot be incorporated in Ontario. If you incorporate and carry on business under the corporate name set out in the Articles of Incorporation, there is no requirement to register under the Business Names Act. However, if the corporation is operating with a name that is different from its corporate name, the operating name must be registered under the Business Names Act.

Liability

Central Production and Verification Services Branch staff cannot provide specific advice on name selection. If you are not sure about the use of a name, you should consult a lawyer.

Penalties for not registering

Choosing a business name

Restrictions on business names

You May Like: How Much Money To Install Solar Panels