Which Is Better Llc Or Sole Proprietorship

An LLC is better.

This is because there are no disadvantages to an LLC, however, there are disadvantages to a Sole Proprietorship.

Most importantly, with a Sole Proprietorship your personal assets are not protected if your business is sued.

However, with an LLC, your personal assets are protected if your business is sued.

And there are no tax advantages or disadvantages to either structure. Meaning, you can deduct the same business expenses and the taxes owed will be the same. This is because the IRS treats Single-Member LLCs and Sole Proprietorships the exact same way.

Then why would someone operate as a Sole Proprietorship?

- Some people arent aware of LLCs.

- Some people dont realize how easy it is to form an LLC.

- Some people dont have the money to form an LLC right away.

Some states have expensive LLC fees , and some people dont want to spend the money to form an LLC right away. If you dont have a lot of money, you can start your business as a Sole Proprietorship, and then transition to an LLC when youre ready.

However, LLC fees can be deducted on your taxes. And for most people, the liability protection is worth the cost of forming the LLC.

In summary, a Single-Member LLC and a Sole Proprietorship are taxed the same way. However, LLCs offer additional legal protection that Sole Proprietorships lack.

How Much Tax Do You Pay On Self

As a sole proprietor in Canada, you should plan and set aside 20% to 30% of the income you earned for taxes. You should contact your accountant for accurate dollar figure estimate of your taxes.

Small business taxes typically include:

- Federal taxes

- Canada pension plan payments

- GST/HST payments

The federal income tax rates and brackets for 2020 are:

- Up to $48,535: 15%

Can Being A Corporation Instead Of A Sole Proprietorship Help You Save Money On Taxes

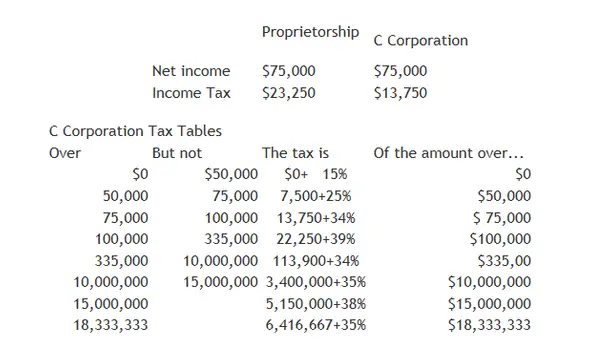

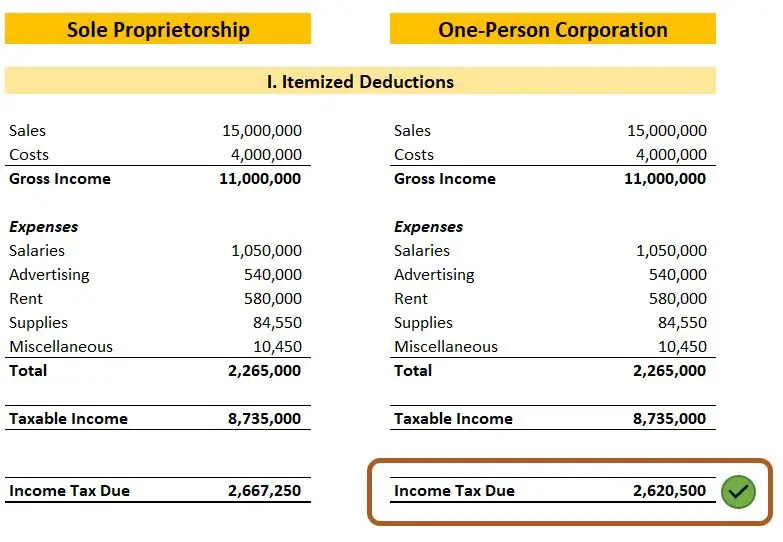

Thats a difficult question to answer because it depends on the individuals tax situation. Corporations file a corporate tax return and pay the corporate tax rate, but corporate owners pay tax on dividends they receive. For sole proprietors, income from all sources is combined to get a net taxable income. The federal tax rates vary depending on the persons tax filing status.

Other factors, like whether the business has a loss or profit, and available tax credits and dividends in each business type also come into play when figuring a business owners personal tax liability. This question is best answered by having a licensed tax professional review your sole proprietorship income on a regular basis.

Recommended Reading: Can I Install Solar Panels On My Townhouse

What Tax Forms Do I File For A Single

Typically, business income from a Single-Member LLC is reported on a Schedule C. Schedule C is part of the owners personal tax return . The owners return may also need to include these forms:

Note: Your tax return may require additional Schedules and Forms. It depends on what type of business you have and how you make money.

We recommend hiring an accountant for help with your taxes.

Different Required Taxes For Sole Proprietorships

Sole proprietors are required to pay federal income tax, state income tax , self-employment tax, and sales tax .

- Within the federal income tax area, sole proprietors will need to file both a Form 1040 and a Schedule C . The two numbers on both your Form 1040 and Schedule C forms are used to calculate your tax bracket. That being said, its important to note that taxes in the United States are based on a progressive system. This means that different portions of your income are taxed at different rates. For example, say you made $45,000 as a sole proprietor in 2020. That would put you in the 22% tax bracket. However, you would only pay 22% on $4,126 as the previous bracket of 12% covers amounts from $9,876 to $40,125.

- State taxes largely follow the same process as federal taxes. However, not all states assess income taxes. As of 2021, nine states dont have an income tax: Alaska, Tennessee, Wyoming, Florida, New Hampshire, South Dakota, Texas, Washington, and Nevada.

- Self-employment taxes cover the costs of entitlements that are usually taken out by your employer. For example, in 2020, you should expect to pay 15.3% as a self-employment tax with 12.4% going toward Social Security and 2.9% going toward Medicare.

-

Sales taxes are required if youre actively selling products or services as a part of your business. These rates will vary depending on where you live and you can get more information for your taxes from the states department of revenue.

Also Check: Where Are Most Solar Panels Manufactured

How Much Does A Small Business Pay In Taxes

Most small businesses are owned by individuals and are not corporations. Sole proprietorship, partnerships and a Limited Liability Company do not pay business taxes and pay taxes at the personal tax rate of the owner.

Since non-corporate small businesses are taxed through their owners personal tax returns, how much they pay in taxes can get mixed up with the tax owed by the individual for all forms of income, not just the income of the business.

Small businesses of all types pay an estimated average tax rate of 19.8 percent. This rate is the average of the tax for business or an individual taxpayer. The effective tax rate is calculated by dividing the total tax paid by the taxable income. According to an SBA report, the tax rates for sole proprietorships is 13.3 percent rate, small partnerships is 23.6 percent, and small S corporations is 26.9 percent.

Small business owner you must pay self-employment taxes which is a flat rate of 15.3%, which is 12.4% for Social Security and 2.9% for Medicare. This is in addition to any income tax that you pay. You can calculate this with your tax software program or your tax preparer.

This may sound like a lot but small businesses also have a lot of expenses that they can deduct from their taxes too.

This article will also discuss:

How To Manage Small Business Taxes

Now that you know the different small business tax rates and what your business can expect, youre probably wondering how you can prepare so that you wont be caught off guard when it comes time to pay your taxes. Given that no two businesses will end up paying the same amount of tax, every businesss approach will be slightly different.

However, the best thing any business owner can do is put money aside ahead of time. You may want to allocate as much as 40% of your income to cover state and federal taxes each quarter, in accordance with your small business tax rate. This is especially important when you just start your business since you wont yet have a complete understanding of your businesss tax liabilities.

A best practice is to set aside money to pay taxes in a bank account separate from your businesss day-to-day finances. This way, you wont accidentally spend money that was earmarked for the IRS. You can even set up automatic transfers from your business bank account into a separate account, so that you know youre always putting away money to cover your tax bill.

If you miscalculate and end up underpaying what you owe, dont worry. Most business owners can avoid the underpayment penalty if they pay as much in taxes each quarter as they did the previous year. You can read more about this rule on the IRS website.

Also Check: How To Clean Solo Stove Yukon

State Sales Excise And Franchise Taxes

Sole proprietors are required to pay state sales taxes on taxable products and services sold by the business. In addition, the sole proprietor may have to pay excise taxes in the same manner as other business types.

Check with your state department of revenue for more information on sales and excise taxes. Sole proprietorships are not typically liable for franchise taxes, because these are levied by states on corporations and other types of state-registered businesses.

Tax Rates For A Sole Proprietorship

If you have or want to start a small business without partners or are an independent contractor , you have a sole proprietorship. If you are an independent contractor and receive a form 1099 at year’s end or generate earnings from nonemployer relationships, you should file as a self-employed sole proprietorship to take advantage of deductible expenses to lower your tax liability. The IRS considers a sole proprietorship a nontaxable entity. All earnings belong to the owner and are added to his personal income, subject to personal tax rates.

Also Check: What Is The Difference Between Corporation Llc And Sole Proprietorship

Can A Husband And Wife Have A Single

Yes, but only in some states.

If you and your spouse live in a community property state, you have the option of how you want your LLC to be taxed:

Community property states are: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

If you have a husband and wife LLC in a non-community property state, it cant be a Single-Member LLC. It must be a Multi-Member LLC and it will be treated like a Partnership for tax purposes.

Tax Tips For Sole Proprietors

OVERVIEW

As a sole proprietor, you are in charge of your own business. You’ll face additional taxes and reporting requirements, but you may also be eligible for certain business tax deductions.

As a sole proprietor, you are in charge of your own business. As far as the tax code is concerned, you and your business are a single entity. While this entails certain freedoms, it also creates added responsibilities. You’ll face additional taxes and reporting requirements, but you may also be eligible for certain business tax deductions.

You May Like: Is It Better To Lease Or Buy Solar

Determining Your Small Business Tax Rate

At the end of the day, understanding and meeting your tax requirements are some of the most complicated parts of running a business. There are a number of reasons why business taxes are so complexâthere are a variety of taxes to consider, your small business tax rate will differ based on your entity type, and there are deductions and credits to incorporate as well.

Therefore, the best thing you can do for your business is to work with a qualified tax professional, like a CPA, enrolled agent, or tax attorney. Their expertise can help you understand the types of taxes your business is responsible for and make sure you are paying the correct small business tax rate.

Article Sources:

Health Insurance And Other Costs

In addition to insurance premiums, you can deduct other out-of-pocket medical costs, such as office co-pays and the cost of prescriptions. These costs are included as itemized deductions on Schedule A.

Sole proprietors can also deduct health insurance premiums for themselves, their spouse, and dependents on Schedule 1 of Form 1040. However, if you are eligible to participate in a plan through your spouseâs employer, then you canât deduct those premiums.

Read Also: Where To Buy Portable Solar Panels

Definition Of A Business For Income Tax Purposes

The definition of a business under Canadian tax law is a profession, calling, trade, manufacture, undertaking of any kind whatever or an adventure or concern in the nature of trade. It must be entered into with a reasonable expectation of turning a profit, and there must be evidence to that extent. The profit you generate from any activity is considered business income and must be declared. A business must also have a definite start date. You can deduct expenses against the profit as of this date. CRA reviews each business on its own merits when defining the businesss start date.

Does An Llc Need Its Own Bank Account

Technically speaking, an LLC doesnt need to have its own bank account. However, opening one helps you avoid legal risks down the road. You dont want to have the same account for your personal and business expenses, as that can drop the corporate veil and expose your personal assets.

But what if someone has already started selling on Amazon as a sole proprietor and wants to change to LLC? Is it possible to do that?

Read Also: How Much Does Solar Cost In Arizona

Is An Llc Better Than A Sole Proprietorship

A sole proprietorship is a less complex type of business than an LLC, and its simplicity is its greatest advantage. An LLC which you can form as a single owner, called a single-member LLC comes with other advantages, including a separation of your business and personal assets and liabilities, and the ability to file taxes as an S Corp, which could mean tax savings at the state and federal level. But it comes with filing requirements and fees that might be an unnecessary burden depending on how much money the business is generating. Read more about the differences between an LLC and sole proprietorship.

If My Llc Is A Sole Proprietorship Are My Personal Assets Still Protected

Remember, your LLC isnt a Sole Proprietorship. Its just taxed like a Sole Proprietorship.

The reason an LLC is taxed like a Sole Proprietorship is because there is no LLC tax classification with the IRS. Meaning, the IRS doesnt tax an LLC like an LLC.

Instead, they tax LLCs under already existing classifications . And for Single-Member LLCs, the classification that the IRS automatically uses is Sole Proprietorship taxation.

Said another way, your LLC is still an LLC . Its just that the IRS is treating your LLC like a Sole Proprietorship for federal tax purposes.

Also Check: Can Solar Panels Cause Cancer

What Is A Sole Proprietorship

A sole proprietorship is the most common business structure and the easiest to establish. In short, a sole proprietor draws no distinction between yourself and your business for tax purposes. As a result, the IRS treats you as both. This type of business structure is unincorporated and you can receive all income from your business activities. Similarly, youre solely responsible for any debts and tax obligations the business accumulates.

The advantages of a sole proprietorship include easy setup and complete control over business decisions. Depending on the state you live and do business in, you may form a sole proprietorship without a special license. It also runs more simply if youre the only employee and dont manage payroll for others.

Tax Deductions For Self

You can deduct half of your self-employment tax on your income taxes. So, for example, if your Schedule SE says you owe $2,000 in self-employment tax for the year, you’ll need to pay that money when it’s due during the year, but at tax time $1,000 would be deductible on your 1040.

Self-employment can score you a bunch of sweet tax deductions, too. One is the qualified business income deduction, which lets you take an income tax deduction for as much as 20% of your self-employment net income. Plus, there are other deductions available for your home office, health insurance and more. Heres a primer.

About the author:Tina Orem is NerdWallet’s authority on taxes and small business. Her work has appeared in a variety of local and national outlets.Read more

You May Like: How Much Do Solar Companies Make

If Youre Late Paying Any Of Your Self

In general, if you make a late payment to the CRA, you will incur interest and fines. If its a simple mistake, in most cases, itll take a little work to fix but youll be able to work it out. But if youve intentionally underpaid, paid late or not paid at all, things get a little more ugly.

If youre late or underpay an installment payment, interest is compounded daily. Additional penalties can be up to $1,000 or a percentage of the difference in the interest between the amounts you paid and should have paid.

For GST/HST there are several scenarios for penalties and fines depending on the mistake you make. For instance, if you fail to file after youve received a demand to do so, its an immediate $250 fine. Interest also accrues on late or underpayments.

Fact : Almost All Businesses Are Small

The vast majority of U.S. businesses are small, whether they are pass-through businesses or C-corporations. Figure 2 shows the share of businesses with $10 million in receipts by type of business. Receipts generally mean sales, but can include income from legal services, rent received, or portfolio income of a financial firm. In 2014, almost 99 percent of all businesses were small by this standard .4 Almost every sole proprietorship was a small business but 95 percent of C-Corporations were small as well.

Whether a business is a pass-through partnership or an S-corporation, or whether it is a C-corporation is not a good indicator for the size, complexity, or even number of shareholders of a business.

Read Also: How Solid State Relay Works

Other Sole Proprietorship Taxes That May Apply

As your business grows, you may have to pay other forms of taxes in addition to your personal income taxes:

- Employee taxes: If you hire employees, youll have to withhold a certain amount of money from your employees paychecks and pay Social Security and Medicare taxes.

- Unemployment taxes: If you have employees, you have to pay unemployment taxes so that workers have compensation when they lose their jobs.

- Sales tax: If youre selling products or services, you may have to collect and pay sales taxes. If your state requires you to collect sales taxes and you dont meet that obligation, you may have to repay the sales tax that should have been collected. If youre not sure what your states tax laws are, check with your state chamber of commerce.

- Property tax: If you own property or land used for your business, you may be subject to property taxes.