Why 2022 Is The Year To Go Solar If You Can

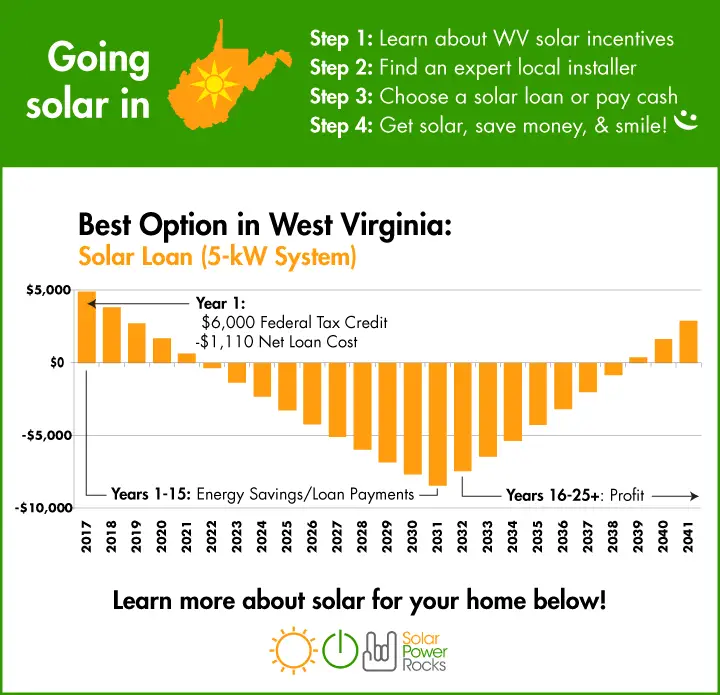

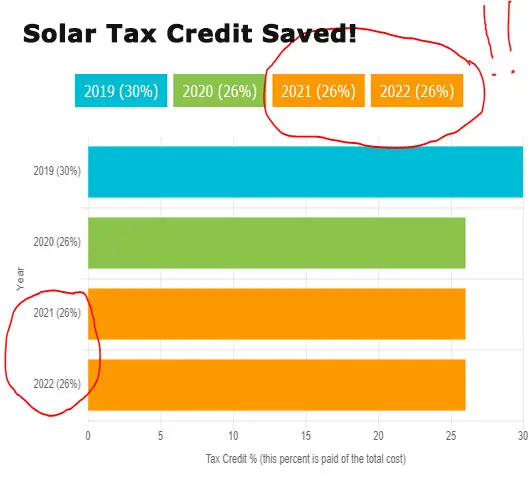

Nothing lasts forever, and the federal solar tax credit is no exception. If you want to invest in solar energy for your home, 2022 is the last year to enjoy maximum benefits under the ITC.

Starting in 2023, the federal tax credit will drop to 22%. After that, unless Congress extends it again, there will be no residential tax credit on solar panels.

Federal Tax Credit For Solar Panels 2022

Hawaii Renewable Energy Technologies Income Tax Credit

The Hawaii Department of Taxation oversees the Hawaii Renewable Energy Technologies Income Tax Credit.

Database of STATE Renewable Energy and Energy Efficiency Incentives Available in Hawaii

The Database of State Incentives for Renewables & Efficiency , maintained by the North Carolina Clean Energy Technology Center and originally funded by the United States Department of Energy, is a free and open resource providing a searchable database of incentives and policies available for clean energy in each state.

Hawaii Enterprise Zones

Currently, wind energy producers may be eligible for this incentive that provides a 100% general excise tax exemption as well as reductions in state income taxes in exchange for demonstrated job growth. This incentive is available statewide in designated geographic areas.

Hawaii Foreign Trade Zone

Hawaiis Foreign Trade Zone Program supports manufacturing and small business activity in Hawaii by encouraging companies to compete in export markets and providing growth to new companies that import and export merchandise, including renewable energy and energy efficiency equipment.

Renewable Fuels Production Tax Credit

The Importance Of Moving Quickly

If youve considered adding a new solar energy system to your home, you may be tempted to put off your investment to take advantage of even lower prices in the future. Tomorrows solar panels may be cheaper than they are today, however, those savings may be directly offset by the reduction in generous solar incentives like the solar ITC.

Through the end of 2022, it is still possible to knock 26% off the total installation price if you move quickly enough. But if you wait too long, you risk paying full price for a system that the government is willing to subsidize today.

If you are considering going solar, Enphase can help you think through your home energy goals and connect you to a certified installer to help you design a system to your exact specifications.

Don’t Miss: How Do I Create A Sole Proprietorship

Dont Own A Solar System Yet Compare Quotes On Energysage

If you havent started your solar journey yet, the first thing you need to know is that the best way to maximize your return on investment is to compare quotes. On the EnergySage Marketplace, youll receive free, custom quotes from our network of pre-vetted installers. And remember: because the ITC is currently set at 26%, as long as you have enough tax liability, youll receive a tax deduction equal to 26% of the total cost of your solar system.

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Don’t Miss: How Solid State Relay Works

Tax Credits For Drivers Who Buy Electric Cars

The bill includes a credit to help consumers purchase an electric vehicle but it has some major caveats.

Any individual who makes less than $150,000 or $300,000 for married couples can take advantage of a $7,500 credit to buy a new EV or up to $4,000 for a used version. But the bill specifies that the EV batteries must be sourced in certain amounts from North America and the United States trading partners. These requirements are being phased in over time, but even right off the bat, the Alliance for Automotive Innovation estimates that of the 72 currently available EVs, only 20 to 25 of them would be eligible. Over the next few years as the sourcing requirements ramp up, the Alliance says that none of the models would be eligible.

These specifications might push the industry to change its practices and phase down its reliance on Chinese materials and labor faster, but for the moment it does seem to leave many consumers out of luck.

Read Also: How Much Does It Cost To Register A Sole Proprietorship

How Does The Federal Solar Investment Tax Credit Work

The solar ITC in 2022 offers system owners a tax credit worth 26% of the total solar installation cost, including all parts and labor. So, if you purchased a solar system that cost $10,000, you would qualify for a $2,600 credit that you could apply to your next IRS bill. In effect, your solar installation would end up costing only $7,400 . System owners would simply include IRS form 5695 in their next annual tax filing.

However, the ITC has undergone significant changes in the past few years, with even bigger ones on the horizon. And if you are thinking about going solar, it is important you understand the impact of these developments because the amount of the tax credit is expected to decrease over time.

Also Check: Solar Panel Installation Kansas City

Don’t Miss: Advantage And Disadvantage Of Solar Energy

The Best Time To Claim The Solar Tax Credit Is Now

You have about 10 years to take advantage of the full 30% tax credit. But just because you can wait 10 years, doesnt mean you should. Its almost always a good idea to make an investment sooner rather than later. installing solar as soon as possible lets you start saving money earlier, so you can stop paying high electricity bills and start putting your money towards the things that really matter to you.

Not to mention, going solar will never be a better investment than it is right now. Other solar incentives throughout the country could expire well before the federal tax credit. Take net metering, the incentive that pays you the full price of electricity for the solar energy you send to the grid, for example. Utilities across the country are moving away from net metering and paying solar customers less money for solar electricity.

Youll want to install solar before things like net metering and utility rebates start to disappear to guarantee that you get the best solar savings possible. Use our solar panel savings calculator to see what kind of incentives are available in your area, so you can start saving on your electricity bills. Dont let the sun set on maximum savings!

Calculate how much solar will cost after the tax credit

What Expenses Are Eligible For The Itc

While the PTC is calculated based on the electricity produced by a system, the ITC is calculated based on the cost of building the system, so understanding what expenses are eligible to include is important in determining how much of a tax credit the system is eligible for.

To calculate the ITC, you multiply the applicable tax credit percentage by the tax basis, or the amount spent on eligible property. Eligible property includes the following:

- Solar PV panels, inverters, racking, balance-of-system equipment, and sales and use taxes on the equipment

- CSP equipment necessary to generate electricity, heat or cool a structure, or to provide solar process heat

- Installation costs and certain prorated indirect costs

- Step-up transformers, circuit breakers, and surge arrestors

- Energy storage devices that have a capacity rating of 5 kilowatt hours or greater

- For projects 5 MW or less, the tax basis can include the interconnection property costs spent by the project owner to enable distribution and transmission of the electricity produced or stored by the systemthis can include costs that are incurred beyond the point at which the energy property interconnects to the distribution or transmission systems.

Structures and Building-Integrated PV

Recommended Reading: What Size Inverter Do I Need For My Solar System

How Does The Federal Solar Tax Credit Work

As a homeowner, you can claim a federal solar tax credit for the amount of money that you pay towards installing solar, and reduce the amount you owe when you file your yearly federal tax return. The Residential Clean Energy Credit can be filed one time for the tax year in which you install your system using Tax Form 5695.

The credit received is then calculated dollar-by-dollar as a reduction of your federal tax liability, so if you receive $1,000 in credits, youll owe $1,000 less in taxes. Once you calculate how many credits youve received, you will want to add your renewable energy credit information to a typical Form 1040 while filing your taxes.

Note that a tax credit is different from a tax refund. In order to claim a tax credit, you must owe taxes to the government, so that the tax credit can cancel out some or all of the amount that you owe.

If you dont owe any taxes then you wouldnt receive any money for the tax credit, because you didnt owe any money to begin with. If youve already had those tax dollars deducted from your paycheck, then you can get that money back in the form of a refund, but youre only getting back money that youve already paid.

Lastly, the solar panel federal tax credit can be used against either the federal income tax or the alternative minimum tax, so regardless of how you calculate the taxes you owe, you can be eligible to claim the value of the federal income tax credit for solar.

Solar Tax Credits By State

Arizona

Arizona has great incentives to make switching to solar energy more affordable.

- In Arizona, purchased household solar systems are eligible for the states 25% solar tax credit.

- Property taxes on the increased home value due to the rooftop solar panel system are exempt.

- A home solar system sales tax exemption of 5.6%.

California

The present federal solar tax credit is available to all people even though California does not have a state-wide solar tax credit. Federal tax returns may be used to claim the solar tax credit, which is worth 30% of the cost of the installed system.

Colorado

Colorado experiences 245 sunny days on average per year. One of the reasons Coloradans are switching to solar power is to use all of this sunshine to power their houses in a safer, more environmentally friendly, and more cost-effective manner. Colorado also provides fantastic solar incentives to help you get started with solar power at a lower cost.

- A property tax exemption in Colorado that deducts the increased value of a solar panel installation from the homes assessed value.

- 2.9% state sales tax exemption for household solar systems.

- Monetary rewards for the purchase of brand-new rooftop solar panels.

- Per kWh that the system produces, compensation is given.

Connecticut

Florida

Florida additionally provides incentives that may enable you to transition to solar power more affordable.

Hawaii

Hawaii Tax Incentives and Solar Rebates

Iowa

Kentucky

Louisiana

New Jersey

New York

Oregon

Texas

You May Like: Solar Power Pros And Cons

How Is The Federal Solar Tax Credit Calculated

The equation for figuring out how much your solar tax credit is worth is simple.

Gross cost of project x 0.30 = tax credit value

So if your project costs $30,000, your tax credit will be worth $9,000 .

The gross system cost may include improvements needed to facilitate the solar installation, such as electrical box upgrades. However, its best to speak to your tax advisor about your unique circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. It also means that you have to pay and file taxes in the same tax year order to receive the credit.

Now that we know how to calculate your solar tax credit, lets go over how to claim it.

Solar Tax Credit History And Background

The Federal Solar Tax credit was established as a part of the Energy Policy Act of 2005 in an effort to expand the US renewable energy market.

The Energy Policy Act of 2005 created an ITC , perhaps more commonly known as the federal solar tax credit. This Federal tax credit is equal to a percentage of the total qualified costs of installing a solar energy system. The Energy Policy Act tax incentive was extended numerous times. Then in 2015, the Omnibus Appropriates Act included a multi-year extension with a step-down tax credit.

This step-down extension means that the tax credit will drop over time. It dropped to 26%, starting in 2020, and will continue to fall till 2022. You can claim the solar tax credit when you file your Federal taxes. Even if you dont have enough Federal tax liability to claim the full amount in a single year, you have up to three years to claim the tax liabilitys total amount.

Recommended Reading: Can You Use Pine Sol In Laundry

Here’s How Solar Panels Can Earn You A Big Tax Credit

The federal solar tax credit can slash up to 30% from the cost of a home solar-energy system.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Since 2006, the Federal Solar Investment Tax Credit has given owners of a home or commercial solar-energy system a one-time deduction on their federal return.

That credit can defray a lot of the cost of a rooftop solar-energy setup: A $20,000 solar photovoltaic system that was installed in 2018, for example, is eligible for a 30% deduction. That essentially brings the price down to $14,000.

There are also additional state and local tax incentives that could save you even more money. And with solar panels running between $15,000 and $25,000, every bit helps.

If you’re thinking about getting solar panels, now is the time. Congress extended the Solar ITC in 2020, but the percentage deduction available is steadily declining — in fact, the credit could soon expire altogether.

How Much Money Can Be Saved With This Tax Credit

Claiming the Solar Investment Tax Credit is worth 30% of the system cost. This applies to paying contractors and the cost of the parts.

Anyone spending $10,000 on a solar system would be able to claim back $3,000 in credits.

The catch is that you must own the system. It doesnt apply to solar leasing agreements. The person who owns the system claims the credit, so if you lease from a company, they get to claim the credit, not you.

With solar leasing, you can still save money on your bills, but you wont be able to claim any tax incentives. This is a massive blow to the ROI of installing the system in the first place.

This credit makes such a difference that its highly recommended you finance a solar system if you dont have the money immediately available to finance its installation.

Don’t Miss: How Much Does A Solar System Cost For A House

What About State And Local Incentives

Some states have also introduced tax credits, rebates, and other incentives to encourage the growth of solar energy. Unfortunately, Colorado does not have a state tax credit for solar panel systems.

However, this does not mean that our state is lacking in support for solar. Public utilities throughout Colorado offer incentives for customers to switch to solar, including:

Residential solar adopters are also exempt from sales tax on solar panels and other equipment involved in the installation of your energy system. In addition, âRenewable energy personal property that is located on a residential classified property, owned by the residential property owner, and produces energy that is used by the residential property is exempt from Colorado property taxation.â

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system installed in 2022 cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

* 0.30 = $5,100

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit. Note: A private letter ruling may not be relied on as precedent by other taxpayers.

Rebate from My State Government

$18,000 * 0.30 = $5,400

State Tax Credit

Also Check: 4×4 Post Caps Solar Lights

The Federal Solar Investment Credit In 2020

The 2020 Solar Tax Credit is a 26% Federal Tax Credit for solar PV systems installed before December 31, 2020. It will decrease to 22% for systems installed in 2021. And the tax credit expires starting in 2022 for residential solar unless Congress renews it. There is no maximum amount that can be claimed.

Atlantic Investment Tax Credit

2.54 The Atlantic investment tax credit in subsection 127 is a credit equal to 10% of the capital cost of prescribed energy generation and conservation properties that are used primarily for the purpose of the following activities:

- manufacturing or processing goods for sale or lease

- farming or fishing

- storing grain or

- harvesting peat

and the activities are carried on in the Atlantic provinces, the Gaspé Peninsula and their associated offshore regions.

2.55 The Atlantic investment tax credit applies to the following qualified properties which are defined in subsection 127:

- prescribed energy generation and conservation property which includes all the properties described in Class 43.1and 43.2 acquired by the taxpayer after March 28, 2012 and

- prescribed energy generation and conservation properties that are leased in the ordinary course of carrying on business in Canada by a corporation:

- whose principal business is leasing property, lending money, purchasing conditional sales contracts and account receivables

- who manufactured and leased the property and the lessors principal business is manufacturing the property it sells or leases or

- whose principal business is selling or servicing properties described in Classes 43.1or 43.2.

2.56 Where a prescribed energy generation and conservation property is leased, the lessee must use the leased qualified property in the activities described in ¶2.54.

You May Like: What Does A Solar Installer Do

You May Like: Do Solar Shades Provide Privacy