Solar Power Tax Credits In California

Living in the southern part of California, maybe you have thought about solar power, or know of someone thats talked about getting solar panels installed. Solar power has many benefits and advantages ranging from environmental to economical. Not to mention, California offers Solar Power Tax Credits, so why havent you gone solar yet?

To begin, solar power is readily available because it uses the sun which is free, and for the most part, limitless. By installing a solar home energy system, homeowners will experience significant savings on energy.

Local Solar Incentives In California

Finally, California is home to quite a few local solar incentives, which are provided by individual utility companies, cities, counties or other municipalities. Below, well provide a comprehensive list of all of the local perks available in California and how they can help make solar more affordable for you.

- San Diego County Green Building Program: If you live in San Diego County and youre coupling a home build or renovation with solar or other energy efficiency upgrades, you can get a reduction in the permit fees. This offers a 7.5% reduction, plus expedited processing times.

- City of San Francisco GreenFinanceSF: Residents of San Francisco can opt to finance PV systems using this program. It allows your payments to be processed via your taxes for convenience, and it helps to reduce interest rates for greater savings over time.

- Rancho Mirage Energy Authority Solar Rebate: Customers of RMEA can claim up to $500 in rebates from the utility provider when installing or expanding upon an existing solar PV system.

- Sacramento Municipal Utility District Solar Rebates: SMUD provides additional rebates and incentives to customers who install batteries along with their panels. Rebates can add up to around $2,500.

Local incentives are always subject to change. As such, we recommend checking with your utility provider and your municipality to see if there are any additional perks available to you for converting to solar.

What You Should Know About The Equity Resiliency Program In California

The Equity Resiliency Program is offered as part of the SASH program. Rather than providing rebates for solar panels, this program provides rebates for energy storage solutions.

If you qualify for the SASH program and you also want to install solar energy batteries in your home, then the ERP is an outstanding option. It will help reduce the cost of your batteries by up to $1,000 per kWh of battery capacity installed. For a Tesla Powerwall, thats around $13,500, which could cover the entire cost.

Recommended Reading: How Does Power Home Solar Work

Key Takeaways: The Best California Solar Incentives

California is likely the best place in the world to invest in residential, commercial, or industrial solar energy systems. With lots of sun to power your systems and a government that offers tons of tax incentives to install solar panels, what more could you ask for? There is really no reason not to buy a solar energy system, especially with variable energy prices around the world and climbing utility bills at home. If you are interested in purchasing, there are many great companies that will help get you set up.

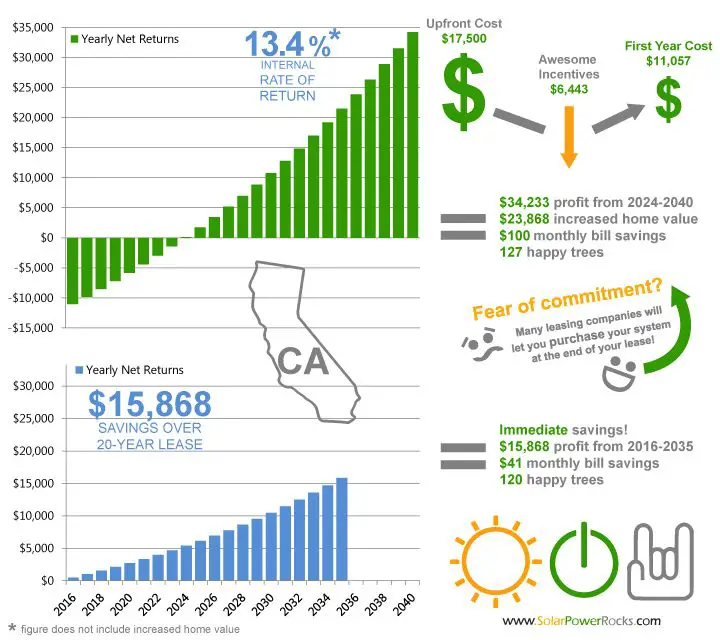

Does Solar Increase Home Value

Yes, solar can significantly increase the value of a home. According to the Lawrence Berkeley National Laboratory, solar panels installed on a single-family home can increase its sale price by more than $15,000.

Multiple studies have also taken into account the property tax implications of installing solar panels and have found that installing solar can add an additional three to four percent to a homes value.

There are also intangible benefits to using solar energy, such as reduced utility bills, potential credits and natural lighting. All of these benefits add to a higher overall property value. Finally, solar panels are becoming more and more popular in the United States, and this will only continue to increase the value of homes with solar energy over time.

Recommended Reading: Diy Solar With Will Prowse

Solar Incentives And Rebates In California

There are many incentives in place to help reduce the cost of your solar panels. Options available to California homeowners include:

- The 26% federal solar tax credit available to all homeowners who install solar systems on their primary or secondary homes in 2021.

- Californias net metering program, which allows customers to credit their net excess energy generation back to their next bill at the current retail rate.

- Local government and utility programs that may be available in your area.

How Many Times Can You Claim Solar Tax Credit

7. Can you claim solar tax credit twice? You cannot technically claim the solar tax credit twice if you own a home however, you can carry over any unused amount of the credit to the next tax year for up to five years. Note: if you own more than one home with solar, you may be eligible.

Don’t Miss: How To Buy Solar Panels For Your Home

Solar Tax Credit Eligibility

You can qualify for the ITC as long as your solar system is new or being used for the first time between January 1, 2006 and December 31, 2023. Unless Congress renews the ITC, it expires in 2024.

Other requirements include:

- You must own the system outright

- The system must be located in the United States

- The system must be located at your primary or secondary U.S. residence or for an off-site community solar project

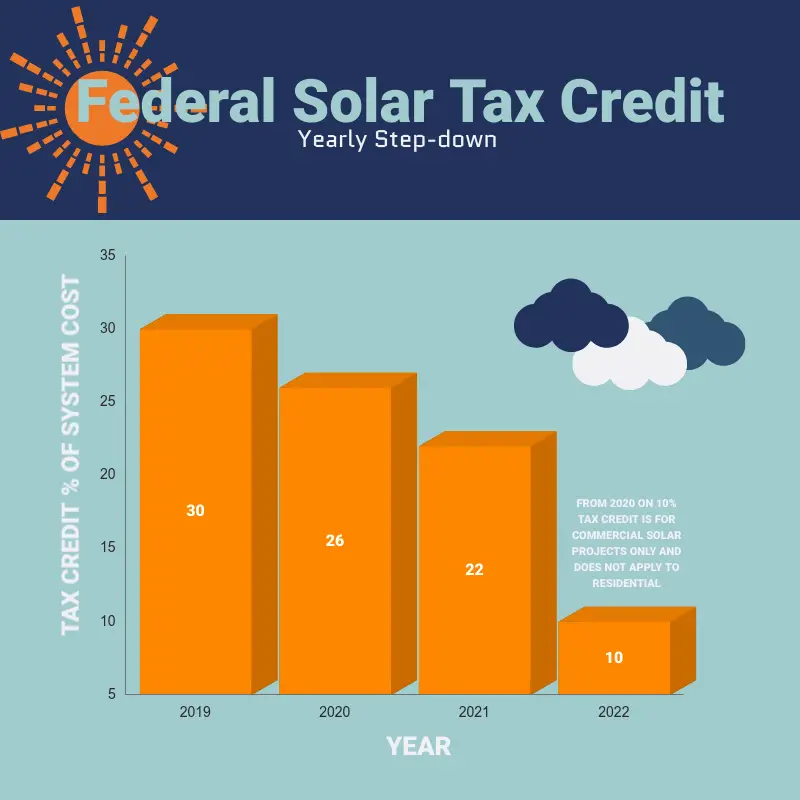

Dont Wait Too Long The Solar Tax Credit Is Expiring Soon

2020 is a very important year pertaining to residential energy incentives in California. The Investment Tax Credit grants an amount of 26% of the purchase cost of your solar system to homeowners before 2020. Getting a solar energy system installed in 2020 grants the maximum 26% California solar tax credit before stepping down to 22% in 2021.

The federal government will be offering:

- The tax credit amount is 26% for solar PV systems put into service between 01/01/2020 and 12/31/2020.

- Systems put into service between 01/01/2021 and 12/31/2021 will be eligible for a 22% solar tax credit.

- Systems put into service between 01/01/2022 and 12/31/2022 will be eligible for a 10% solar tax credit.

- After 01/01/2023, the solar tax credit will no longer be available for residential solar installations.

- Unlike the Residential Renewable Energy Tax Credit, the Business Energy Investment Tax Credit will still get a tax credit of 10% for solar energy systems placed into service beyond the end of 2021.

The date that your solar panel system is approved to operate determines the year you can claim your tax credit.

The California tax credit for solar does not have a maximum limit. You can still claim the full 26% California solar tax credit without having to worry about a limit. Whether your solar panel system installation included costs you $10,000 or $1,000,000.

Don’t Miss: Costco Solar Pathway Lights 8 Pack

How Much Money Can Be Saved With This Tax Credit

Claiming the Solar Investment Tax Credit is worth 26% of the system cost. This applies to paying contractors and the cost of the parts.

Anyone spending $10,000 on a solar system would be able to claim back $2,600 in credits.

The catch is that you must own the system. It doesnt apply to solar leasing agreements. The person who owns the system claims the credit, so if you lease from a company, they get to claim the credit, not you.

With solar leasing, you can still save money on your bills, but you wont be able to claim any tax incentives. This is a massive blow to the ROI of installing the system in the first place.

This credit makes such a difference that its highly recommended you finance a solar system if you dont have the money immediately available to finance its installation.

Read Also: How Much Solar Power Per Square Foot

Multifamily Affordable Solar Housing

The states MASH program provides incentive rates of $1.10 to $1.80/watt for qualified multifamily affordable housing.

The program is administered by PG& E, SCE, and the Center for Sustainable Energy in SDG& E territory. To qualify for this program, you need

- General obligation bonds

- Local, state, or federal grant or loans

- Tax-exempt mortgage revenue bonds

The MASH program consists of two tracks of qualification. That is track 1C and Track 1D. If you are eligible for Track 1C, you receive a $1.10 per watt rebate of solar installed.

Read Also: How To Heat Pool With Solar Panels

How Do I Calculate My Solar Rebate

Calculating your solar rebate is dependent upon many factors. The most important factor is the state in which you live. Each state has different laws and regulations that determine the amount of rebate or incentive they can provide after you purchase and install solar energy systems.

The federal government also offers various tax credits and rebates. Additionally, utilities, municipalities and state governments often offer incentives such as rebate programs and net-metering.

In general, you can take the total cost of installing the solar energy system and subtract any rebates you may receive from the federal, state, and local governments. Your total cost will then be reduced by the amount of the rebate offered.

You can also check with your local utility company to see if they offer any additional incentives such as net-metering or demand-response programs.

You can also go to DSIRE, the Database of State Incentives for Renewables & Efficiency, for more information about incentives and programs offered. DSIRE is a comprehensive source of information on state, local, utility, and federal incentives that promote renewable energy and energy efficiency.

Ultimately, the best way to determine how much rebate you can receive is to contact an expert in solar energy systems and ask them to provide you with an estimate. They can help you understand the local laws and regulations and provide guidance on the various solar energy rebates and incentives you may qualify for.

Rebates Incentives And Tax Credits

Homeowners and Businesses which install solar energy systems may be eligible for a variety of rebates, incentives, and tax credits.

Rebates & Incentives

Rebates for PG& E and for SCE customers have been exhausted and the program is closed.

These programs are administered through Southern California Edison in conjunction the State of California .

- The Energy Upgrade California also includes a link on the main page to find a qualified contractor. Residents are not required to use the contractors listed here but it is important that the contractor you utilize is a State Licensed Contractor. You can check to see if a contractor has a valid license with the Contractors State License Board .

- New California Solar Thermal This newly announced program offers cash rebates of up to $1,875 for solar water heating systems on single family homes. For more information visit the Go Solar California CSI Thermal Site .

Tax Credits

A Federal Tax Credit of up to 30% of the cost is currently available for solar systems for a principal residence . For more information visit the Go Solar California website and consult a qualified tax professional.

Donât Miss: How Big Is A 1000 Watt Solar Panel

Don’t Miss: Best Solar Panels For Van Conversion

What Are The Benefits Of Going Solar In California

California is a pioneer in solar energy production and a leader in residential solar in the U.S. Its weather is ideal to maximize year-round benefits from this clean energy source.

There has been a significant drop in the price of equipment and installation over the last five years, and it is expected that Californias electricity generation will come 100% from clean and renewable energy sources by 2045.

Things To Know About The Residential Solar Itc

The tax credit is not a refund, it is a credit. The federal government will not send you a check in the amount of the credit but rather the IRS allows you to deduct 26% of the cost of your solar system from what you owe in taxes.

You need tax liability to benefit from this incentive.

The IRS allows a carryover of unused solar tax credits to subsequent years, up to five years. For example, if your 26% credit is worth $6,000, and you only owe $3,000 on your 2019 taxes, you can apply the remaining $3,000 to your 2020 tax liability. CALSSA recommends consumers always consult with a tax professional for tax advice.

Simply purchasing a residential solar system by the end of the year is not enough to claim the full tax credit. The IRS says the system must be placed in service before the end of the year, meaning the system is installed and capable of being used. The process of signing a contract and installing a system can sometimes take several weeks.

If a solar system is placed in service in 2022, you will qualify for a 26% tax credit instead of 22%.

You must purchase the system to claim the ITC. Consumers may not claim the tax credit for leases or Power Purchase Agreements . Paying cash or financing the system through a loan or PACE does allow you to claim the ITC.

California also provides rebates for home battery systems. This incentive is in addition to the tax credit but consumers need to account for the rebate when claiming the tax credit.

Recommended Reading: Battery Backup For Solar Panels

Financing Options With Energy Saving Pros

From roof-mounted systems and ground arrays to small PV modules, we offer competitive pricing on solar energy systems of any size. We also offer zero-down financing options and payment plans for every budget. Getting started in solar energy production might not cost as much as you thinktalk to one of our expert energy consultants today.

Federal Solar Tax Credit

To maximize your solar savings, you should also consider the federal solar investment tax credit . The federal solar tax credit lets you claim 30% of your total solar installation costs on your federal taxes. Its not a tax refund. Instead, it reduces the amount of money you owe in taxes as a credit.

The federal solar tax credit helps with most installation costs for a solar PV system. Best of all, there is no maximum amount that you can claim. The 30% rate will remain until 2032. It will decrease to 26% in 2033 and 22% in 2034. The credit is set to end by 2035.

Recommended Reading: Worksheets On The Solar System

Not Everyone Is Eligible For The Federal Solar Tax Credit

As a homeowner looking to install solar panels in your home, you are about to experience a stress-free life. Solar panels will save you a lot of energy in the long run. Most homeowners invested in solar panels have testified to the numerous benefits, especially on lower electric bills.

However, not every homeowner can claim the federal solar ITC. It is because not every person is eligible for the California tax incentive.

To benefit from the ITC, you have to owe federal income taxes. If you dont, then you will not be eligible. As the policy stands, the ITC gets rolled over to the future tax years. So with a tax liability in the coming year, you will have the ability to claim the 30% credit.

A great advantage to note is that it is possible to carry forward ITC to the future tax years. Therefore, if you have a tax liability next year, you will be eligible to claim a 30% credit. It would be advisable to talk to your tax accountant about maximizing solar tax credit in California.

Enlightened Solar has contributed to the growth of solar installations in Orange County over the years. We have a vast knowledge ofCalifornia solar tax credits and can advise you as you install your residential solar panels. Check out our wide range of services in regards to solar installation in Orange County.

Contact us to request a quote and start the process of getting you into thesolar tax credit California program. You need to enjoy all the benefits that come with going solar.

Are You Eligible For The Federal Solar Tax Credit

Anyone who buys and installs a PV system and pays federal taxes is eligible for this solar incentive.

The property in question doesnt even have to be your primary residence. Vacation homes, stationary RVs, and rental properties all qualify if you install solar PV panels on them.

Moreover, there are no maximum limits on the amount of credit you can receive:

- A $20,000 solar installation produces a $5,200 credit.

- A $50,000 solar PV system yields a $13,000 credit.

- A $100,000 solar system translates to a $26,000 credit.

And if the credit exceeds your tax liability for that year, it can be carried forward to the following tax season.

There is one caveat, however.

In order to qualify for this solar incentive, you must be the PV system owner. In other words, you have to finance your installation using cash or a low-interest solar loan.

If you finance your PV system using solar leases or a power purchase agreement , the tax credit goes to the third-party lessor of the installation not you.

The same is true with most types of solar incentives, which is why many homeowners prefer to buy their PV systems instead of renting them.

Read Also: How Much To Add Solar Panels To House

Recommended Reading: Blue Sky Solar And Roofing

How Many Years Can I Claim Solar Tax Credit

The federal solar tax credit, also known as the Investment Tax Credit , allows you to deduct 26% of the cost of installing a solar energy system from your federal taxes. The credit applies to both residential and commercial solar installations and has no cap on its value.

Furthermore, it has no expiration date so you can claim it as long as your system is operational.

Additionally, note that the 26% solar tax credit applies to new systems only and any systems purchased and installed prior to 2020 are eligible to claim a 24% credit. Also, keep in mind that some states, cities, and counties may also offer their own solar tax credits and incentives for both residential and commercial systems.

You may want to check with your local municipality for more details.