The Latest Extension Gives Homeowners And Business More Time To Take Advantage Of Large Savings On A Solar Photovoltaic System

Big news! The Inflation Reduction Act has increased the federal tax credit for solar to 30% and extended it for another decade. Thats a big deal for anyone who wants to install solar on their home or business.

Disclaimer:

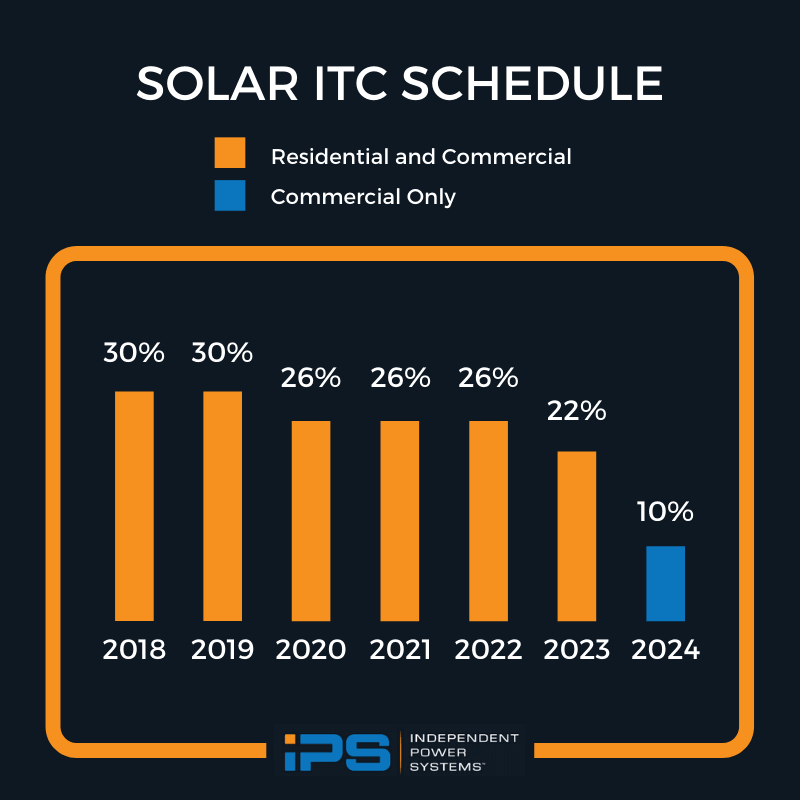

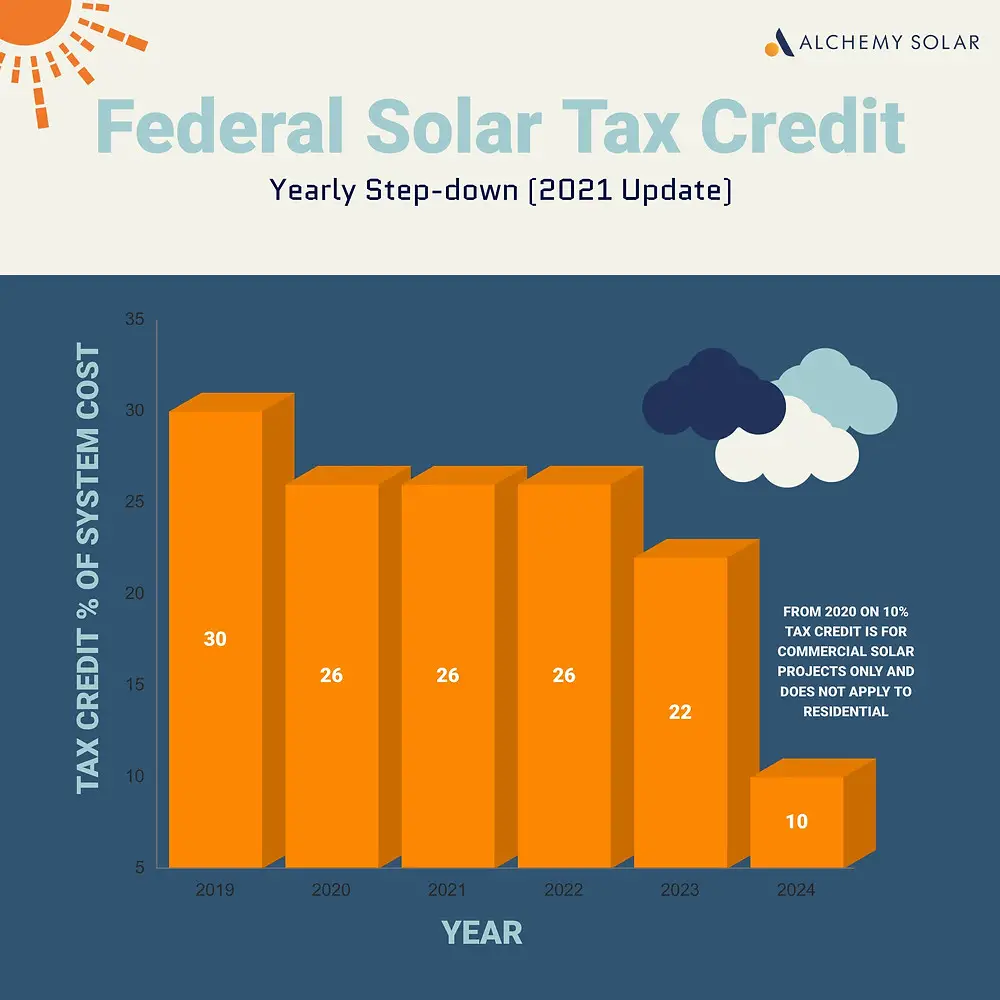

This tax credit, often called the Solar Investment Tax Credit, gives homeowners and businesses a break on their federal taxes worth 30% of the gross price of a solar photovoltaic system. Before the IRA passed, the tax credit was 26% and set to drop to 22% in 2023. Now, its been extended for another 10 years and wont be phased out until 2035.

Heres the new schedule for the tax credit and when each tier of the credit will expire:

| Date installation completed |

|---|

| 0% |

How Does The Federal Solar Investment Tax Credit Work

The solar ITC in 2022 offers system owners a tax credit worth 26% of the total solar installation cost, including all parts and labor. So, if you purchased a solar system that cost $10,000, you would qualify for a $2,600 credit that you could apply to your next IRS bill. In effect, your solar installation would end up costing only $7,400 . System owners would simply include IRS form 5695 in their next annual tax filing.

However, the ITC has undergone significant changes in the past few years, with even bigger ones on the horizon. And if you are thinking about going solar, it is important you understand the impact of these developments because the amount of the tax credit is expected to decrease over time.

The State Of Residential Solar Panels

Despite delays associated with the pandemic, residential solar projects increased 11% in 2020. In the third quarter of 2021, one out of every 600 households in the US installed a solar system, totaling more than 1 Gigawatt and 130,000 solar systems, according to Wood Mackenzie.

Growing interest in solar panels is due to a variety of factors, including incentives such as the Federal solar Investment Tax Credit and prices for residential solar panels decreasing by an average of 64% over the past decade. Much of that change is due to falling hardware costs, especially solar panel components, which dropped 85% between 2010 and 2020.

Although there have been notable reductions in solar costs since 2010, the most significant declines took place earlier in the decade.

“The cost of solar projects has declined considerably in recent years, but the cost reductions have now started to taper off and move closer to a floor, currently defined by the price of input factors such as labor, polysilicon, silver, copper, aluminum and steel,” according to a report by Rystad Energy in September 2021. “These input factors have seen a clear rise in prices in 2020 and 2021.”

While solar component prices are going up, the solar Investment Tax Credit is only available at 26% through 2022.

Let’s look at these competing factors a bit more closely.

Also Check: Is An Llc A Sole Proprietorship Or A Partnership

How Do I Claim The Tax Credit

You need to submit IRS Form 5695 together with your tax return to claim the tax credit. The credit will be calculated on the form, and the outcome will be entered on your individual tax Form 1040.

You cannot receive money back from the IRS if your tax return for the previous year showed that you had a larger credit than the income tax that was owed. The credit can normally be carried over to the following tax year. Its critical to realize that this is a tax credit, not a reimbursement or a deduction.

Tax credits serve to offset the remaining amount of tax owed to the government as a result, they are not available to you if you have no tax liability. Dont worry if you overlooked claiming the credit in a previous year. You may submit a corrected return.

Can You Qualify For The Solar Tax Credit 2022

You can read an overview of how to qualify for the tax credit as a commercial business, on the Solar Industries Association website. They explain that the IRS has released guidance on the requirements for taxpayers running commercial enterprises to qualify for the solar tax credit.

Simplified guidelines for homeowners are available on the energy.gov website too.

To summarize, homeowners may be eligible for this tax credit if they fulfill all of the following conditions:

- Between January 1, 2006, and December 31, 2023, your photovoltaic system was put in place

- In the United States, your primary or secondary residence is where you install a solar PV system

- You are the owner of the solar PV system

- The solar PV installation is either brand new or has never been used before, so its an original installation

The following charges are covered by this plan:

- The photovoltaic solar panels or PV cells

- Costs of labor for onsite preparation, installation, or original construction, including permit fees, inspection expenditures, and developer expenses

- Purchase of required electrical equipment, including wiring, inverters, and mounting equipment

- Battery banks that are charged only by the connected solar PV panels

The solar tax credit is available for a limited time and there are currently no plans to extend it again for residential purposes past 2023. Now is the time to apply!

You May Like: What Does Individual Sole Proprietor Mean

How Does The Tax Credit Work

You can claim the federal solar tax credit as long as you are a U.S. homeowner and own your solar panel system. You can claim the credit once it will roll over to the next year if the taxes you owe are less than the credit you earn. Keep in mind that the credit is a deduction, not a refund.

For example, if you install a solar panel system for $19,000, youll owe $5,700 less on your federal tax return. If your tax liability is less than $5,700, the remainder of the credit will roll over and be applied to your federal income taxes the following year.

State Incentives And Tax Credits

Unlike utility incentives, state government incentives usually dont need to be deducted before the federal tax credit is calculated.

So, if you installed a $20,000 system and got a $1,000 state government rebate, the solar tax credit would be based on the initial price of $20,000. In this example, that means the tax credit would be worth 30% of $20,000, for a federal tax credit worth $6,000. That would mean you would get a total of $7,000 in incentives.

The same goes for state tax incentives. But, getting a state tax credit will end up increasing your taxable income on your federal tax returns, as you will have fewer state income taxes to deduct. Currently, ten states offer state tax credits, including Arizona, Massachusetts, and New Mexico.

Also Check: How Much Is A Whole House Solar System

Has The Solar Itc Been A Good Thing For Solar

It absolutely has. While we canât know for sure what would have happened to the solar industry if the ITC wasnât in place, we do know that the solar industry has grown by a staggering total of 10,000%, or more than 50% every year since the ITC was enacted in 2006.

While solar costs will likely continue to drop even after the ITC expires, theres little doubt that losing the credit will slow the growth of solar. You can read more from the Solar Energy Industries Association, an industry advocacy group.

Whats Covered By The Tax Credit

Homeowners who leverage the 30 percent ITC can plan to see the following covered:

- Cost of solar panels

- Labor costs for installation, including permitting fees, inspection costs, and developer fees

- Any and all additional solar equipment, like inverters, wiring, and mounting hardware

- Home batteries charged by your solar equipment

- Sales taxes on eligible expenses

Don’t Miss: Solar Light Caps For 4×4 Posts

Solar Investment Tax Credit Extension 2022 Update

The Solar Investment Tax Credit has had a tumultuous history over the last few years. With planned step-downs, extensions, and even further proposed changes showing up in different proposals and responses to the COVID-19 pandemic, its been challenging to keep up with the current state of the ITC.

This article will outline everything thats happened in terms of the federal ITC extension, from where we started to where we are now and will be in the next few years, along with how you can capitalize on its current state.

How To Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . Your solar provider should supply the proper documentation and instructions upon your demand. We have listed the essential steps in claiming the credit here:

We recommend that taxpayers consult a tax expert and your solar provider to ensure you are correctly claiming the ITC.

You can use the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits are available in your zip code.

Recommended Reading: Solar Panel Cost In India

Section 1603 Treasury Program

The Section 1603 Treasury program is a technology-neutral finance mechanism that allows solar and other renewable energy project developers to receive a direct federal grant in lieu of the Section 48 ITC they were otherwise entitled to receive. The program was part of the American Recovery and Reinvestment Act of 2009 and allows taxpayers and small businesses to maximize the return and value of tax incentives by providing access to capital and streamlining financing costs. The payment is made after the energy property is placed in service. The program applies to solar and wind, as well as biomass, combined heat and power, fuel cells, geothermal, incremental hydropower, landfill gas, marine hydrokinetic, microturbine and municipal solid waste.

How Will The Solar Tax Credit Save You Money

The credit lowers your federal taxes. So if you spend $24,000 on a system, you can subtract 30 percent of that, or $7,200, from your federal taxes. If, say, you would owe $7,000 in taxes before the credit, a $7,200 credit would drop what you owe to zero. You cant get a tax refund for the $200 remainder, however. But you can carry forward that remainder into a later tax year.

Youll save, too, in lower electricity bills. How much youll save depends on a number of factors, including how much electricity your household uses, the size of your solar system and the amount of sunlight it gets, and local electricity rates. Real estate experts say a purchased solar systemas opposed to a leased onecan raise the value of your home when you sell.

You May Like: Solar Panels For Charging Battery 12v

How Does The Solar Tax Credit Work With State Local And Utility Incentives

The federal tax credit isn’t the only incentive available to homeowners who switch to solar. You could be eligible for other incentives offered by your state government, or even your utility company. The type of incentive could potentially impact how much your federal solar tax credit will be worth.

How Do I Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . But, first, check with your solar provider to receive the proper documentation and instructions on exactly how to claim the ITC as part of your installation. We have listed some of the most critical steps in the process below:

We recommend that you consult a tax expert, as well as your solar provider, to ensure you are correctly claiming the federal solar tax. As a reminder, the tax credit only offsets the taxes you owe on your return. If the taxes you owe are less than the credit you earn, the credit will roll over year after year.

You may also file any sales and property tax exemptions that may be available in your state in addition to the ITC. Enter your zip code on the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits you can receive.

You May Like: 27 Ft Round Solar Pool Cover

The Department May Award The Tax Credit Once The Following Documents Are Provided:

Understanding Solar Tax Credit In 2022

The Solar Tax Credit 2022 is a valuable incentive that can help reduce the cost of solar energy systems.

According to the Solar Energy Industries Association, solar has seen 42% annual solar growth as a result of the Solar Investment Tax Credit .

To qualify for the solar tax credit, certain requirements must be met. In this blog post, we will provide an overview of the solar tax credit and what you need to know to take advantage of this incentive.

Here at Tax Savers Online, were experts on business, finance, and taxes so were ready to give you all the details on Section 25D of the Internal Revenue Code.

Contents

Also Check: What Solar Panels Does Tesla Use

What Does Commence Construction Mean

A solar project is considered to have commenced construction if:

- At least 5% of final qualifying project costs are incurred. Expenses must be integral to generating electricity, and equipment and services must be delivered or

- Physical work of significant nature is commenced on the project site or on project equipment at the factory. Physical work must be integral to the project. Preliminary activities on site do not count as integral.

Both tests require that the project makes continuous progress towards completion once construction has begun, which the IRS considers satisfied automatically if the project is placed in service no later than four calendar years after the calendar year in which construction began . Projects can still potentially satisfy the continuity safe harbor beyond four years, depending on their individual facts and circumstances, however, because this is not guaranteed, owners may bear additional risk.

How Do I Make Sure Im Eligible To Claim The Solar Tax Credit

To qualify for the 30% Residential Clean Energy Credit, youre solar system needs to be installed and deemed operation by a city inspector in any of the tax years 2022-2032. The 30% credit applies retroactively to systems installed in 2022 when the credit was still at 26%.

Even though physically installing a solar system usually does not take more than a single day, many homeowners do not realize that a solar project may take weeks to complete after contract signing. This is due to factors such as permitting, financing approval, utility approval, and so on. Read more about the solar installation process here.

While you dont have to worry about the tax credit stepping down for another 10 years, there are plenty of reasons to install solar sooner rather than later. First, the sooner you install, the sooner you will see a return on investment. Second, net metering policies are subject to change over time, so its best lock net metering while its available.

Recommended Reading: Renogy 12 Volt Flexible Monocrystalline Solar Panel

Why The Federal Solar Itc Matters

The reconciliation bill includes a staggering $360 billion in spending for renewable energy and measures to tackle climate change. Part of that goes towards funding the Federal Solar ITC, which has had a huge impact on the solar industry in the U.S.

This kind of funding helps create hundreds of thousands of green jobs. It also helps establish training programs to help traditional energy sector and manufacturing workers transition into more sustainable professions in renewable energy.

Find a Solar Energy partner near you.

The new law will also help boost solar projects in low- and moderate-income communities, acknowledging and addressing the inequities in green energy infrastructure. This is thanks to bonus tax credits of 10-20% for disadvantaged communities installing solar.

In practice, this could see tax credits of up to 50% for solar installations in some communities of color, rural regions with economic hardship, and other communities shouldering the burden of environmental pollution. That means some homeowners or community solar projects could cut the cost of going solar in half.

The bill also offers an extra 10% tax credit for solar installed on formerly polluted brownfield sites or in areas where the oil, gas, or coal industries previously offered significant employment .