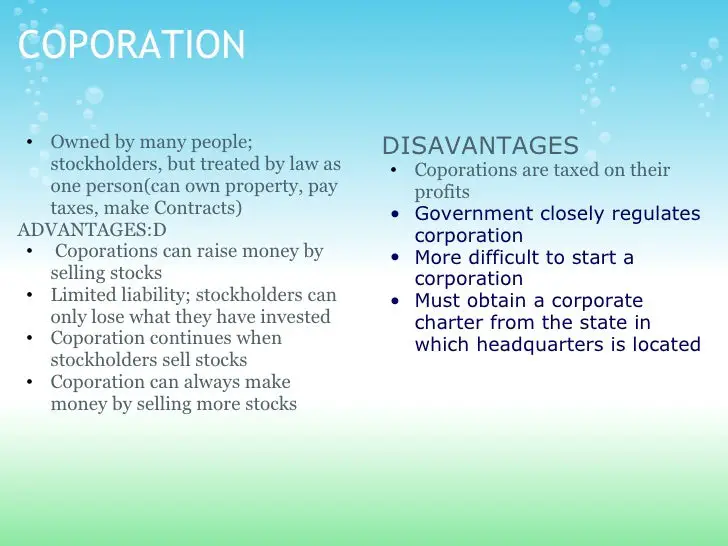

Pros And Cons Of Corporations

A corporation is a business entity that is legally separate from its owners. It has the right to enter into contracts, take legal action against others, give and receive loans, own assets, hire workers and pay taxes.

One of the most significant things about a corporation is its limited liability. That is, shareholders have the right to participate in the profits through stocks and paid dividends, but are not held personally accountable for the company’s debts or legal issues that may arise.

Remember that famous trial where the woman successfully sued McDonalds for serving their coffee at too high a temperature? Good thing McDonalds was incorporated!

| The Pros | The Cons |

|---|---|

|

Owners are separate from legal liability so theyre not entirely responsible when faced with legal issues or debt. |

The process is time consuming and expensive, lots of paperwork. |

|

Ability to sell stock, which raises the likelihood of acquiring financial capital. |

Tons of regulations, which make for very little flexibility. |

|

Well established structure with clearly defined roles, accountabilities and agendas. |

Possibility of double taxation . |

|

Employees have the option to buy stock at a fixed-in price, and receive stock benefits. |

Llc Vs Sole Proprietorship: Which Should You Choose

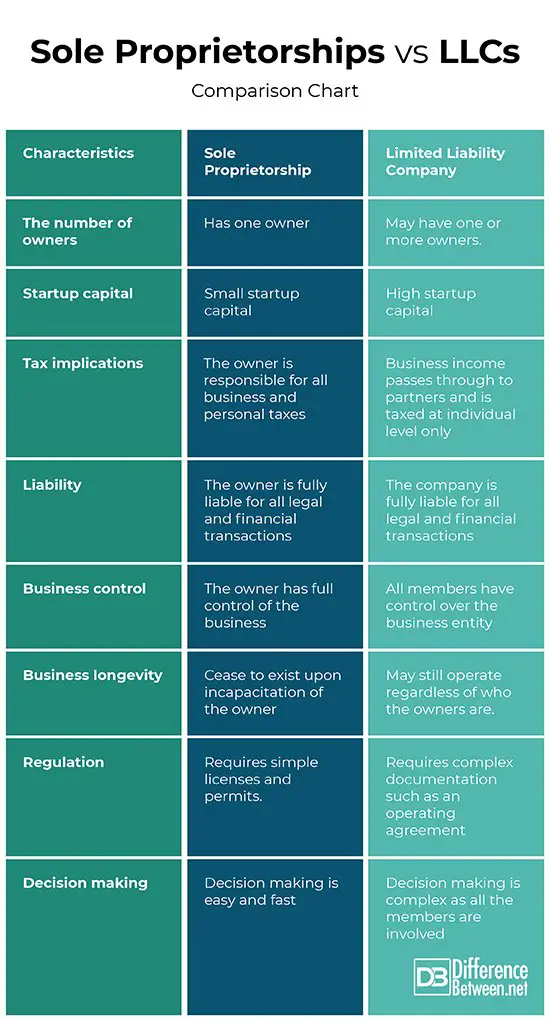

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

Which Entity Type Should You Choose

Going back to the fictitious companies introduced at the beginning, which entity type should they choose?

FreeBooks

As a classic technology startup hoping to receive VC or PE funding, they have little option but to be a C corporation. The other types of entities wouldnt allow for the complex share class and ownership structures these types of companies require.

The only other possible consideration would be to form first as an LLC then cut over to C status when the corporate investors become a reality. This structure would be simpler early on and potentially allow the early investors to deduct losses on their personal tax returns.

Brilliant Ideas

With losses this year, and $250,000 of profits next year, Bill and Ashley appear to be perfect candidates for forming an LLC and electing to be taxed as a proprietorship or partnership this year, then electing S corporation status next year. That way they can use this years business losses to offset wages or other income. Next year they will draw wages from the S corporation and the remaining profits will not be subject to FICA.

Joes Mowing

JBD Group

You May Like: Can You Write Off Solar Panels On Taxes

Who Pays More Taxes An Llc Or S Corp

It depends on how the business is established for tax purposes and how much profit is going to be generated. Both an LLC and S corp can be taxed at the personal income tax level. LLCs are often taxed using personal rates, but some LLC owners choose to be taxed as a separate entity with its own federal ID number. S corporation owners must be paid a salary in which they pay Social Security and Medicare taxes. However, dividend income or some of the remaining profits can be passed through to the owner, but not as an employee, meaning they won’t pay Social Security and Medicare taxes on those funds.

How Do I Form An Llc

You create an LLC by filing paperwork with your state and paying a filing fee. Visit the website for your states secretary of state or other agency in charge of business filings for information, forms, and instructions specific to your state. You can also form an LLC with the assistance of an accountant, lawyer or online business formation company.

Also Check: When Do Babies Eat Solid Food

When Should You Open An Llc

There are a few reasons to open up an LLC instead of operating as a sole proprietorship:

- You want to expand the company to more than one owner in the future, which is easy with an LLC

- You want to protect your personal assets from potential financial and legal liability

- You want to take advantage of any applicable local, state or federal tax benefits that come with forming an LLC

In summary, setting up an LLC could position you for growth and protect you from liability. People also consider opening up an LLC when they reach a certain income threshold in their business and the additional fees and paperwork make sense from a tax perspective. This varies by state and the type of business, so its a good idea to speak to your accountant and compare the taxes youll be paying with each business structure.

Sole Proprietorships Partnerships And Llcs Are Commonly Used Entities

Choosing the business structure that best meets your needs is a critical decision: you must consider both non-tax and tax ramifications. This article looks at three of the most popular choices: sole proprietorships, partnerships and limited liability companies.

Selecting the legal structure for your company is one of the most important and far-reaching decisions that you will make as you start your business.

To make the best decision, you must carefully consider your initial choice of business entity from multiple angles, including ownership/control of the business, asset protection, and tax minimization.

You must also regularly re-evaluate your decision to make sure that it is still the best suited for your business and personal needs.

For example, you may begin running your business as a sole proprietorship. However, as the business grows, you may wish to bring in co-owners or to have a different capital structure. Or, you may want to restructure your business in order to shield your assets from business liability.

The most common business entities are:

- sole proprietorships, including husband and wife joint ventures

- S corporation

Each different entity choice brings its own set of advantages and disadvantages. No one entity is the perfect choice under all circumstances. Selecting the best entity for your business involves considering both tax issues and non-tax issues. The following are some factors that must be considered.

You May Like: Is Solar Panel Tax Deductible

What Types Of Business Entities Can You Choose

There are four main business forms:

- sole proprietorship

- limited liability company , and

- corporation.

If you own your business alone, you need not be concerned about partnerships this business form requires two or more owners.

There is no âone size fits allâ when it comes to choice of entity. Moreover, your initial choice about how to organize your business is not set in stone. You can always switch to another legal form later. Itâs common, for example, for small business owners to start out as sole proprietors, then incorporate or form LLCs later when they become better established and make substantial income.

Selecting A Business Structure

The decision regarding business structure is a decision that a person should make, in consultation with an attorney and accountant, and taking into consideration issues regarding tax, liability, management, continuity, transferability of ownership interests, and formality of operation.

Generally, businesses are created and operated in one of the following forms:

The information on this page should not be considered a substitute for the advice and services of an attorney and tax specialist in deciding on the business structure.

Also Check: How To Use A Solar Battery Charger

About Sole Proprietorships Llcs Corporations And Partnerships

The ideal entity depends on a number of factors, which includes the industry, location, ownership structure, and exit strategy.

Entity 1: Sole proprietorship. Sole proprietorships are perhaps the most common and are the easiest to form. It is allowed only for businesses with one owner. Note that there is no legal distinction between the owner and the business, for asset protection and tax purposes, in a sole proprietorship.

A sole proprietorship’s main benefits:

- preferable tax treatment and

- ease of formation.

As mentioned, however, that an owners personal assets are not protected so that the owner can be personally compelled to use personal finances for the businesss obligations, including lawsuits against the business.

Entity 2:Partnership. Partnerships are entities owned by two or more persons run for a profit. Like sole proprietorships, partnerships are easy to form and have minimal upfront costs. Each individual partner can contribute either money, labor or skills for ownership in the business.

A partnership’s main benefits:

- preferable tax treatment and

- ease of formation.

There is, however, personal liability for business obligations. Also, it is common for partners to disagree on material issues, leading to tedious and long-running legal battles. To minimize this risk, it is recommended to create a partnership agreement.

Some features of an LLC:

Comparison and Advantages

Llc Vs Sole Proprietorship: How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Choosing a business entity structure for your company is one of the most importantbut potentially most confusingdecisions youll make as a small business owner. Unless youre a lawyer or tax expert, the differences between each type of business entity can be hard to understand in real-life terms. However, your choice of business entity does have real-world impact, such as how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

New business owners are often confused about the difference between a limited liability company and sole proprietorship. In this guide, well look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

Don’t Miss: How To Make Efficient Solar Panels

Key Features Of An Llc

- An LLC may have one or more owners, and may have different classes of owners.

- An LLC may be owned by any combination of individuals or business entities.

- An LLC may not be formed under state civil law to conduct a business that requires a professional license to operate, for example, a lawyer may not form an LLC. However, there may be certain exceptions to this rule.

- An LLC may be taxable as a sole proprietorship, partnership, C corporation, or S corporation.

- An LLC that is taxable as a partnership can achieve both conduit tax treatment and limited liability protection under civil law.

- An LLC taxable as a partnership does not have the ownership restrictions that apply to entities taxable as S corporations.

- If the LLC has a single member, it will be disregarded as separate from its owner, and will be treated as a sole proprietorship or a division of its owner, unless it elects to be taxable as a corporation.

- In general, all the owners are shielded from individual liability for debts and obligations of the LLC.

- Forming and maintaining an LLC may be simpler and faster than forming and maintaining a civil law corporation.

- An LLC is typically managed by all its members, unless the members agree to have a manager handle the LLCâs business affairs.

- An LLCâs life is perpetual in nature. However, the members may agree to a date or event of termination.

Sole Proprietorship Vs Partnership Corporation & Llc

Lets take a look at how different business ownership types compare. We will look at the sole proprietorship vs. LLC, LLC vs. corporation, sole proprietorship vs corporation vs. partnership and pros and cons of each. In addition to tax issues, two main items to look at are asset protection and lawsuit protection. Asset protection comes into play when someone sues the owner in a personal lawsuit. How does that type of ownership protect business assets from personal lawsuits? Lawsuit protection is needed when someone sues the business. What happens to the individual owners when an angry customer or supplier sues the business? The quick answer, as you will see, is that the LLC typically provides the best protection from both forms of liability.

Asset protection entails a well-laid plan that is individually crafted for you and your current and future financial needs. There is no one-size-fits-all remedy when it comes to protecting your hard-earned assets. As such, there is no shortage of options today for individuals who wish to protect their assets from predatory claims. The asset protection field continues to expand and diversify, most likely due to the increasingly litigious climate in America. Seasoned asset protection specialists can now offer their clients a range of options to safeguard practically any type of asset.

Recommended Reading: What To Know About Solar

Tax Benefits Of An Llc Vs Sole Proprietorship

Both structures have pass-through taxation, which is when business owners pay business taxes on a Schedule C attached to their personal tax returns. With pass-through taxation, the income is taxed at the same rate as the owners personal income tax.

For a sole proprietorship, the above is the only option. Meanwhile, an LLC can elect to instead use corporate tax status. As a result, you can avoid paying a self-employment tax on your income as an owner of the LLC, thus avoiding double taxation. The current self-employment tax rate is 15.3 percent.Internal Revenue Service. Self-Employment Tax (Social Security and Medicare Taxes. Accessed March 17, 2022. Furthermore, a corporation can also be eligible for more credits and deductions. This can save you money. Note, however, that in some states and local jurisdictions, an LLC may have to pay an additional LLC tax.

Both LLCs and sole proprietorships are responsible for things like payroll taxes if they have employees, as well as state and local sales taxes.

Start A Sole Proprietorship Or Partnership

To conduct business as a sole proprietorship or partnership, you need to reserve a business name and register the business.

If you’re going to do business under your name, you do not need to request a business name or register the business with the province.

OPTIONAL: If you’re not sure which business structure you should choose,consider the different business structure options available. You may also want to:

- Explore resources from the Small Business Branch or Small Business BC

- Get advice from a chartered accountant or lawyer before setting up your business

Request and reserve a business name online

Businesses must have their name approved and confirm that it doesn’t conflict with a name already being used by a corporation. Only incorporated companies, cooperatives or societies can guarantee exclusive use of their name. Find out how to choose the right name.

If you’re unable to submit a request online, complete the Name Request form and mail it or drop it off at a Service BC locationwith payment. Make cheque or money order payable to the Minister of Finance.

It takes about 7 to 14 days to process a name request.Once it’s complete, you’ll receive a confirmation email and a name request number you can use to register your business. Be sure to complete the registration before the name request expires . If not, you’ll need to submit another name request. Request priority service if you need to have a name approved in 1 to 2 business days.

Read Also: What Does A Solar Installer Do

Registering With The State

Depending on your industry, you might require licenses to operate, regardless of your business structure . However, there are different requirements for registering your business if youre running an LLC or a sole proprietorship.

Sole proprietorship: Beyond attaining the appropriate licenses and registering a business name , no other registration is required to operate as a sole proprietor. Your proprietorship is established automatically as you start work, and it is your responsibility to ensure that you have the correct licenses to continue operations.

LLC: An LLC needs to be registered with the state, and this happens when you fileArticles of Organization. This document outlines the responsibilities of each member of the LLC, including their rights, powers, and obligations. As well as this, the articles should stipulate what the LLC will do for its members. The fees and rules around this registration will vary between states in New York, for example, LLCs are required to publish a notification of their formation in two newspapers designated by the county clerk within 120 days of filing the articles.

If youre running your LLC in more than one state, you must form the company in your domestic state, and then file for foreign qualification in other states of operation. To do this, you should file for a Certificate of Authority with the foreign state and you may be asked to provide a Certificate of Good Standing from your home state.