History Of The Solar Itc

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Texass Solar Potential Is At Reach

Aside from these excellent state incentive programs, our home solar and energy storage plans in Texas start at $0 down. If you’re interested in creating and storing your own solar energy in Texas, our team is here to answer all your solar questions. Rest easy knowing that were one of the best solar installers in Texas. Discover if Sunrun is right for you and your familys energy needs. Use our Product Selector or request a free quote today to get one-on-one service from our expert Solar Advisors.

How Does The Federal Solar Investment Tax Credit Work

The solar ITC in 2022 offers system owners a tax credit worth 26% of the total solar installation cost, including all parts and labor. So, if you purchased a solar system that cost $10,000, you would qualify for a $2,600 credit that you could apply to your next IRS bill. In effect, your solar installation would end up costing only $7,400 . System owners would simply include IRS form 5695 in their next annual tax filing.

However, the ITC has undergone significant changes in the past few years, with even bigger ones on the horizon. And if you are thinking about going solar, it is important you understand the impact of these developments because the amount of the tax credit is expected to decrease over time.

Don’t Miss: What Size Charge Controller For 300w Solar Panel

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

New Solar Itc Is An Extra 4% Value For All Solar Investments

Alan Lee, CEO of Revel Energy comments, This is a big win for solar and its users. The high cost was continuing to rise, this added 4% tax credit or cash rebate levels the initial investment in favor of the users. He continues, Increased incentives lowers the payback period for our customers making it much more feasible for them to capitalize on the carbon reducing technology.

With rising energy costs across the country, more affordable solar and energy storage is expected to bolster the industry for the near and long term future.

An important new feature to the ITC is the inclusion of systems that use standalone energy storage or solar plus storage, as large batteries can help buildings reduce their electricity costs even further.

The new provision for direct cash payment opens a lot of new potential. This feature is accessible to a non-profit or a state, local, or tribal government, and eligible for these projects installed in 2022.

Additional triggers like US-sourced panels, certain labor requirements and other factors can boost the incentive applied to the total project cost. This means that a solar plus storage system, built under perfect circumstances, could earn a whopping 50% of its value paid back directly to the system owner reducing their solar investment costs by half.

Read Also: Instinct Solar Tactical Edition Watch

The History Of The Solar Itc

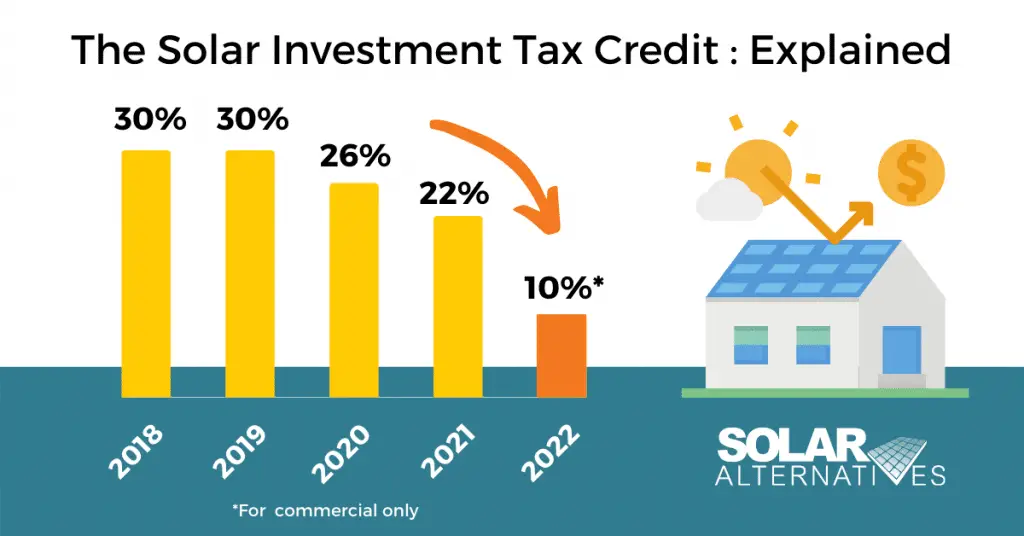

In 2005, the Energy Policy Act created a 30% federal tax credit for purchasers of solar energy systems. Called the Investment Tax Credit, this policy was supposed to sunset at the end of 2006 but was revived by the Tax Relief and Health Care Act, which extended it for another year.

In 2008, the Emergency Economic Stabilization Act further extended the ITC for another 8 years at 30% and then reduced it to a permanent 0% for residential solar installs and 10% for commercial projects after 2016.

This, obviously, didnt end up happening, and the ITC was extended yet again, through to 2020, with a planned gradual step-down process through to 2022. This planned step-down was as follows:

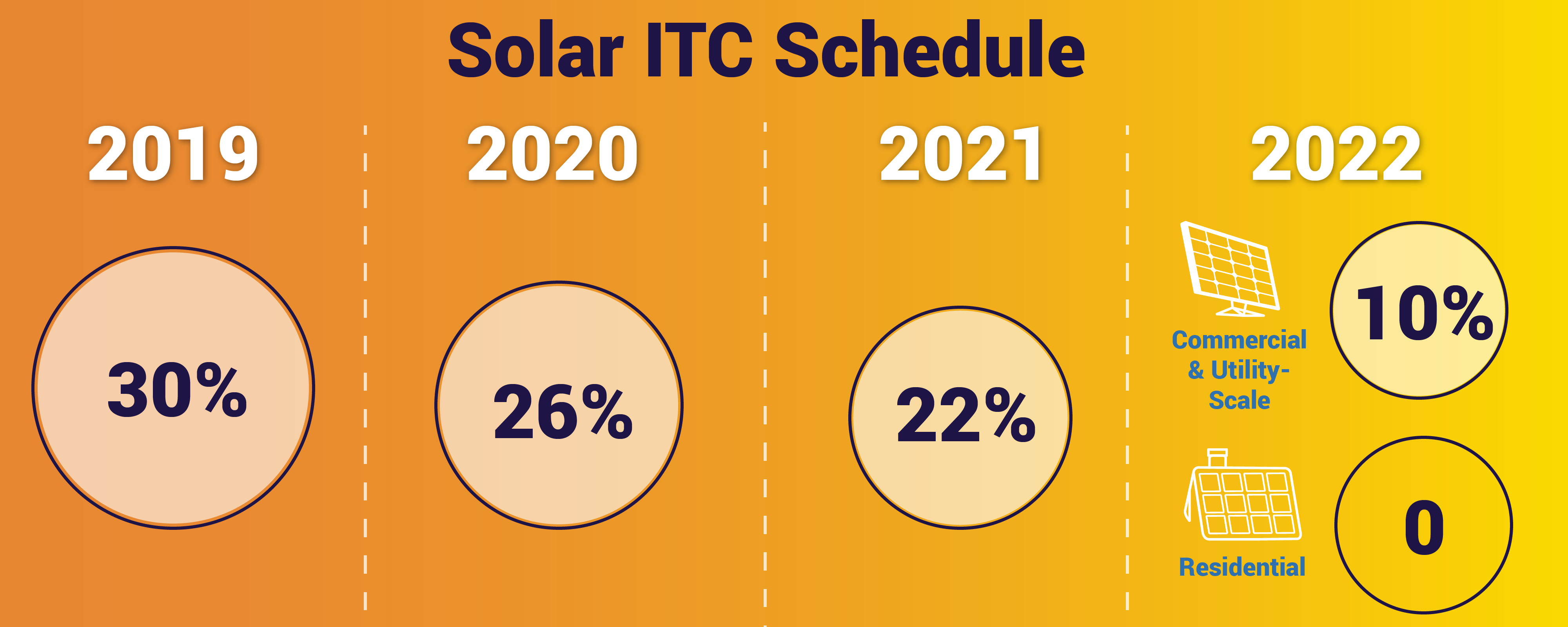

- 30% in 2019

- 26% in 2020

- 22% in 2021

After January 1st, 2022, the tax credit for residential installs would fall to 0%, while commercial projects would sit at a permanent 10% credit. This, however, didnt end up happening after all

In November 2021, the U.S. House passed President Bidens Build Back Better Act in a 220-213 vote but Senator Joe Manchin eventually pulled his support of the bill stating that he couldnt move forward with it in its current form, ultimately leaving BBB dead in the water.

For the following two years, solar customers in the United States were able to benefit from a 26% tax credit on residential and commercial solar installs but needed to be prepared for it to hit 0% in 2024.

What Does The Federal Solar Tax Credit Cover

According to the EERE, the federal solar tax credit covers the following items:

- Panels: The credit covers solar PV panels or PV solar cells.

- Additional equipment: The credit covers other solar system components, including the balance-of-system equipment and wiring, inverters and other mounting equipment.

- Batteries: The ITC covers any storage devices, such as solar batteries, charged exclusively by your solar PV panels. This claim works even if the storage is activated in a subsequent tax year to when the solar energy system is installed. Storage devices are still subject to the installation date requirement.

- Labor: Labor costs for on-site preparation, assembly or original solar installation. Coverage also includes the permitting fees, inspection costs and developer fees.

- Sales tax: The credit also covers any sales taxes applied to these eligible expenses.

Recommended Reading: How To Transfer Sole Proprietorship To Llc

Things To Know About The Residential Solar Itc

The tax credit is not a refund, it is a credit. The federal government will not send you a check in the amount of the credit but rather the IRS allows you to deduct 26% of the cost of your solar system from what you owe in taxes.

You need tax liability to benefit from this incentive.

The IRS allows a carryover of unused solar tax credits to subsequent years, up to five years. For example, if your 26% credit is worth $6,000, and you only owe $3,000 on your 2019 taxes, you can apply the remaining $3,000 to your 2020 tax liability. CALSSA recommends consumers always consult with a tax professional for tax advice.

Simply purchasing a residential solar system by the end of the year is not enough to claim the full tax credit. The IRS says the system must be placed in service before the end of the year, meaning the system is installed and capable of being used. The process of signing a contract and installing a system can sometimes take several weeks.

If a solar system is placed in service in 2022, you will qualify for a 26% tax credit instead of 22%.

You must purchase the system to claim the ITC. Consumers may not claim the tax credit for leases or Power Purchase Agreements . Paying cash or financing the system through a loan or PACE does allow you to claim the ITC.

California also provides rebates for home battery systems. This incentive is in addition to the tax credit but consumers need to account for the rebate when claiming the tax credit.

Itc 202: How Does Federal Solar Tax Credit Work

If you are thinking about opting for solar energy, you could get some financial help

The investment tax credit , which is also known as the federal solar tax credit, gives people in the United States the chance to subtract 26 percent of the cost of installing sonar energy on their homes off of their federal tax bill.

There is no cap on the value when it comes to claiming the federal solar tax credit, with the average EnergySage Marketplace customer making a saving of almost 9,000 dollars on opting for solar energy thanks to the ITC.

Read Also: How To Make A Solar Panel With Cd

Solar Investment Tax Credit Extension 2022 Update

The Solar Investment Tax Credit has had a tumultuous history over the last few years. With planned step-downs, extensions, and even further proposed changes showing up in different proposals and responses to the COVID-19 pandemic, its been challenging to keep up with the current state of the ITC.

This article will outline everything thats happened in terms of the federal ITC extension, from where we started to where we are now and will be in the next few years, along with how you can capitalize on its current state.

How Is The Federal Solar Tax Credit Calculated

The gross system cost can include any improvements needed to facilitate the solar installation. This includes any electrical work needed for the installation such as a panel box upgrade, and also includes roof work under the solar array. Please speak to your tax advisor for specific advice for your given circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of tax that you owe. Many clients mistakenly believe that getting a tax return would make them ineligible for the ITC, but this is not the case. As long as youve been paying taxes in some form throughout the year, if you get a tax return and claim your ITC in the same year, your ITC is simply added to the amount of your tax return .

Read Also: How Tall Are Solar Panels

What Is The Solar Investment Tax Credit

- The federal solar investment tax credit is a tax credit that can be claimed on federal income taxes for 30% of the cost of a solar photovoltaic system.

- The system must be placed in service during the tax year it is claimed and generate electricity for a home located in the U.S.

- Although the increased 30% tax credit was approved in August of 2022, that rate is retroactive to systems placed into service any time that calendar year.

- The 30% tax credit applies to the total cost of a residential solar energy system, including labor and equipment.

- The tax credit applies to solar batteries. As of January 1, 2023, that will include standalone backup batteries.

- There is no maximum amount that can be claimed.

- If you dont use all the tax credit the first year, the remaining amount can be rolled over to the following year.

Solar Tax Credit Eligibility

You can qualify for the ITC as long as your solar system is new or being used for the first time between January 1, 2006 and December 31, 2023. Unless Congress renews the ITC, it expires in 2024.

Other requirements include:

- You must own the system outright

- The system must be located in the United States

- The system must be located at your primary or secondary U.S. residence or for an off-site community solar project

Recommended Reading: What Size Solar System For My House

The Federal Solar Tax Credit

There are fewer options for Southern California home owners to save money if they want to increase their home renewable energy profile. However, knowing how the federal solar tax credit works can go a long ways towards offsetting installation costs.

Also known as the Investment Tax Credit , the federal solar tax credit is one of the ways California homeowners can reduce the overall cost of a new residential solar system. As of 2022, there are crucial deadline updates, so its important you dont delay on your renewable energy plans if you want to take advantage of these incentives.

Get a quote on your tax credit-compliant solar system

Why The Federal Solar Itc Matters

The reconciliation bill includes a staggering $360 billion in spending for renewable energy and measures to tackle climate change. Part of that goes towards funding the Federal Solar ITC, which has had a huge impact on the solar industry in the U.S.

This kind of funding helps create hundreds of thousands of green jobs. It also helps establish training programs to help traditional energy sector and manufacturing workers transition into more sustainable professions in renewable energy.

Find a Solar Energy partner near you.

The new law will also help boost solar projects in low- and moderate-income communities, acknowledging and addressing the inequities in green energy infrastructure. This is thanks to bonus tax credits of 10-20% for disadvantaged communities installing solar.

In practice, this could see tax credits of up to 50% for solar installations in some communities of color, rural regions with economic hardship, and other communities shouldering the burden of environmental pollution. That means some homeowners or community solar projects could cut the cost of going solar in half.

The bill also offers an extra 10% tax credit for solar installed on formerly polluted brownfield sites or in areas where the oil, gas, or coal industries previously offered significant employment .

You May Like: Will A 5kw Solar System Run A House

What Is The Federal Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes placed in service, but the IRS has equated it with completed installation.

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be claimed.

Learn The Details Of Texas Solar Incentives

Buy and install new rooftop panels in Texas in 2021, with or without a home battery, and qualify for the 26% federal tax credit. The residential ITC drops to 22% in 2023 and ends in 2024.6

Approximate average-sized 5-kilowatt system cost in TX: $13,109

Approximate system cost in TX after the 26% ITC in 2021: $9,70113

TXU Energy Home Solar Buyback Plan

Weve joined forces with TXU Energy to boost the value of the solar kilowatt-hours you produce in the Lone Star State.14 TXU Energy, a Vistra Energy company, is Texass leading retail electric provider and powers more homes and businesses than any other provider.15

With TXU Energys Home Solar Buyback plan, you can get paid for the excess energy your Texas solar installation creates. Earn automatic clean energy bill credits to offset up to 100% of your energy charges on your electricity bill each month.7, 16 In other states, this type of arrangement is known as net metering. If you need more electricity, youll pay a simple, flat rate for 100% wind or solar power from the grid.

Local Utility Company Solar Rebates

If youre an American Electric Power Texas,9 Austin Energy,10 CPS Energy,11 or Oncor residential customer,12 you may be eligible to get a cash incentive of $2,500 to $8,500 for the kW of solar power installed in your home. This varies by electric provider, solar PV system size, location, and applicant income.

Don’t Miss: How Much For Sole Proprietorship

Whats Covered Under The Solar Investment Tax Credit

The ITC applies to the total cost of the energy-efficient equipment, the cost of labor, and any additional equipment that supports the system. The following equipment meets the eligibility requirements:

- Solar photovoltaic panels or PV cells

- Labor costs for the preparation and installation of your solar PV system, including permits, developer, and inspection fees

- Solar storage devices that are charged by the PV system

- Additional equipment that supports the solar system, including mounting equipment, inverters, and wiring

- Sales taxes on qualified expenses

Only 25 states offer sales tax exemptions for purchasing a solar panel system, so this may not apply to you. Check your states solar policies to verify.

How Does This Tax Credit Work

Say your solar system was quoted at $20,000. Where I live in Louisiana, this would be about an 8-kilowatt system, which is medium in size. A 26% credit would save you $5,200 on your federal returns. The tax credit rolls over year after year, should the taxes you owe amount to less than the credit you earn.

The federal solar tax credit can be claimed by any U.S. homeowner, so long as the solar system installed is for a residential location based in the United States.

The system must be placed in service during the tax year. So, if you install and begin using a residential solar system during the year 2022, youll claim the credit on your 2022 tax filing. If you start a solar panel installation in December of 2022 but dont turn the system on until January of 2023, youll claim the credit on your 2023 filing.

Read Also: How To Hook Up Solar Power