Sole Proprietorship Vs Llc 101

A sole proprietorship is for businesses that have a single owner. In a sole proprietorship, thereâs no separation between the business and its owner. In contrast, an LLC can have one or multiple owners. And you create a separate legal entity for your business when you register your LLC.

Why is that important? Having a separate entity means that if youâre sued for damages, the business gets sued, not you as the owner. An LLC gives youâand your assetsâa lot more protection.

Now that we answered your burning question, letâs take a closer look at each structure. Weâll discuss some other differences between the two youâll want to consider once you know a bit more about them.

Llc Vs Sole Proprietorship: Paperwork And Compliance

The final difference between an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. As we mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs have to file an annual report in many states. An LLC with multiple members has even more responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business entity, dissolving an LLC takes additional paperwork.

What Is An S

If you opt for a Corporation, there are two types: a C Corporation and an S Corporation.

Some small business owners will form an S Corporation to sidestep this double tax burden. This means that the business does not file its own taxes. Instead, profits pass through the individual taxes of the shareholders.

Suppose any of the shareholders are employees of the company. In that case, the business must pay a fair wage to those employees, aside from their profit shares and payroll taxes on the aforementioned wages.

Additionally, it is crucial to remember that not all C Corporations will qualify for S Corporation status. For example, an S Corporation cannot have more than 100 shareholders, and they must all reside in the United States.

#DidYouKnow A legal formation is also called business structure and legal structure.

Also Check: Should I Install Solar Panels On My Roof

How To Set Up One And Requirements

#DidYouKnow Some states require that you register a DBA while others dont.

Filing fees average between $10 to $50.

Running Your Business As A Sole Proprietorship Vs Llc

There are a few distinctions in operating a business as a sole proprietorship vs. an LLC. As a sole proprietor, theres no separation between you and your business. Youre not obligated to separate your personal and business bank accounts and credit cards. However, opening up a different checking account for your business will make it easier to identify business expenses when it comes time to file your taxes.

With an LLC, its important to keep your business finances completely separate from your personal ones. Youll need a business bank account, and youll sign documents and contracts on behalf of the business, not as yourself personally. Keeping things separate preserves your liability protection because it shows that the LLC truly has its own separate identity.

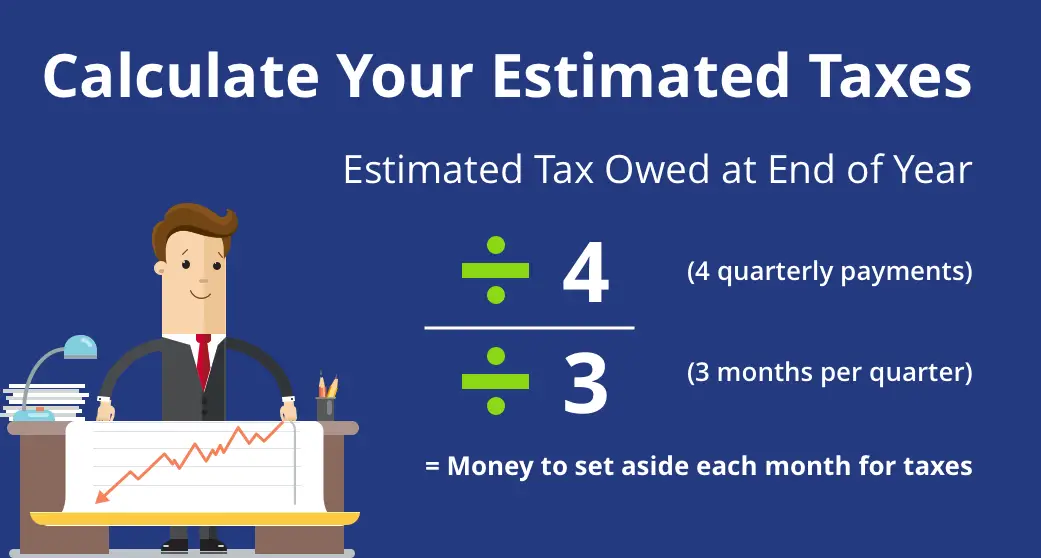

Taxwise, an LLC offers more options than a sole proprietorship. All sole proprietors are self-employed. Youll list your business income and expenses on Schedule C of your personal tax return and youll pay personal income tax on your profits. Youll also be responsible for paying your own Social Security and Medicare taxes, otherwise known as self-employment taxes.

You May Like: How To Start A Sole Proprietorship In Kentucky

How To Form An S Corporation

Registering With The State

Depending on your industry, you might require licenses to operate, regardless of your business structure . However, there are different requirements for registering your business if youre running an LLC or a sole proprietorship.

Sole proprietorship: Beyond attaining the appropriate licenses and registering a business name , no other registration is required to operate as a sole proprietor. Your proprietorship is established automatically as you start work, and it is your responsibility to ensure that you have the correct licenses to continue operations.

LLC: An LLC needs to be registered with the state, and this happens when you fileArticles of Organization. This document outlines the responsibilities of each member of the LLC, including their rights, powers, and obligations. As well as this, the articles should stipulate what the LLC will do for its members. The fees and rules around this registration will vary between states in New York, for example, LLCs are required to publish a notification of their formation in two newspapers designated by the county clerk within 120 days of filing the articles.

If youre running your LLC in more than one state, you must form the company in your domestic state, and then file for foreign qualification in other states of operation. To do this, you should file for a Certificate of Authority with the foreign state and you may be asked to provide a Certificate of Good Standing from your home state.

Read Also: What Makes Solar Panels So Expensive

Disadvantages Of An Llc

While LLCs provide very welcome protections and flexibility for small businesses, there are some drawbacks to consider.

- Complexity: LLCs are more complicated to set up and run than sole proprietorships. To form an LLC, the business will need to conduct a name availability search to see if there are competing businesses with the same name and to ensure that the name meets any state regulations for the specific business type. The business will also need to file formation documents with the state and appoint a registered agent to receive legal notices and other official documents. In many states, the business will have ongoing filing requirements such as annual reports. Greater tax options further add to the complexity.

- Costs: To establish an LLC, you can expect to pay state fees ranging from $50 to $300, along with additional fees for ongoing filings. Youll also need to invest time in completing the filings or pay a service to handle the paperwork for you. All of this adds up to greater administrative costs to set up and maintain the business entity.

Llc Vs Sole Proprietorship: Pros And Cons

Choosing the right business structure for your new venture is a crucial decision. Many business owners lean toward two of the most popular optionsLLCs and sole proprietorships.

Each one has its fair share of benefits and drawbacks.

The right one for you and your business will depend on several factors. Youll need to consider things like the tax implications, startup costs, regulations, liability protection, and more.

If youre torn between the two, youve come to the right place. This guide will provide you with an in-depth explanation of LLCs and sole proprietorships. Youll learn more about each ones advantages, potential downsides, and the differences between the two.

You May Like: How To Install A Solar Inverter

Move Forward With Your New Business

Incorporating your business makes it official in the eyes of the government. Youll protect your personal assets, build credit and history for your company, and even enjoy lower taxes in some cases. But the best benefits of business incorporation are perhaps intangible. Incorporation transforms your idea into a real, official businessthe rest is up to you.

Can A Sole Proprietor Be An Llc

No. While you can operate your business in a very similar manner from one to the other, you cant be both at the same time. Once a sole proprietors business forms an LLC, its legally separated from the owner, a truly different entity.

How about the other way around, is an LLC a sole proprietorship?Yes, but only for tax purposes and only if the LLC hasnt elected to be taxed as an S Corp or C Corp. When it comes to liability protection, an LLC is not a sole proprietorship.

Still not sure who would win in the battle of LLC vs sole proprietorship? The final choice is something only you can make. In the end, those who choose an LLC are those who need liability protection or who want to have several owners or partners. Those who pick a sole proprietorship have basic business needs or limited budgets.

Whatever you choose, the most important step is to weigh the pros and cons of a sole proprietorship vs LLCand choose the one that meets the unique needs of your business.

Recommended Reading: How Much Does A Typical Solar System Cost

Disadvantages Of An Llc:

- There are additional fees and paperwork associated with setting up an LLC, including state licensing, annual filing fees, etc.

- It might be more difficult to raise capital compared to a corporation.

- If a member leaves the company, the LLC must be dissolved and the remaining members must deal with the obligations required to terminate the business. The remaining members will then need to file for a brand new LLC.

- Members of an LLC are responsible for paying Social Security and Medicare taxes based on the business’s total pretax profits .

How Does The Management Structure Differ

In an LLC, the business can be owned by one or more members. Its members usually manage an LLC, but they can also appoint a manager to handle the day-to-day operation.

The membership of an LLC and the way it will be run are laid out in a legal document known as an operating agreement.

In a sole proprietorship, you are truly the boss and call all the shots. There are no partners or members to deal with.

You May Like: How To Feed Solid Food To Baby

Llc Vs Incorporation: Which Should I Choose

The decision to form either a limited liability company or a corporation depends on the type of business an individual is creating, the possible tax consequences of forming the entity, and other considerations. Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability.

In general, the creation and management of an LLC are much easier and more flexible than that of a corporation. Still, there are advantages and disadvantages to both types of business structures.

How Bench Can Help

Regardless of your business structure, accurate and complete bookkeeping is the backbone of a stress-free tax season. With Bench, your bookkeeping is completed and reviewed every month, giving you access to up-to-date and accurate information on your businessâs financial health. Come tax season, a CPA or tax professional uses your Bench-generated financial reports to get you filed. Donât have a tax solution? Bench can file for you as part of your subscription package. Learn more.

Read Also: How To Design Solar Panel

Which Is Better An Llc Or S Corp

An LLC is better for a single-owner and likely better for a partnership. An LLC is more appropriate for business owners whose primary concern is business management flexibility. This owner wants to avoid all, but a minimum of corporate paperwork does not project a need for extensive outside investment and does not plan on taking her company public and selling the stock.

In general, the smaller, simpler, and more personally managed the business is, the more appropriate the LLC structure would be for the owner. If your business is larger and more complex, an S corporation structure would likely be more appropriate.

Differences Between Llcs And Sole Proprietorships

Now its time to compare the differences between LLCs and sole proprietorships. There are more differences between these business structures than similarities. Rather than just listing bullet points, well take a closer look at various categories you should evaluate. This will make it much easier for you to decide which one is right for your business.

Also Check: How To Use Solar Power In An Apartment

Is An Llc Better Than A Sole Proprietorship

The question of whether an LLC is better than a sole proprietorship is a complicated one. The truth is, the answer greatly depends on your circumstances. Some businesses may be better off as an LLC while others will be better off as a sole proprietorship. You have to look closely at your circumstances and how you plan to operate your business to determine if you would gain advantages from incorporating. The following break down of the pros and cons of each option should help you gain some perspective so you can make an informed decision.

What are the differences between an LLC and a sole proprietorship?

Probably the most important difference between an LLC and a sole proprietorship is the legal liability you face in each category. In an LLC, if you are sued the other party can only go after the assets of the LLC not your personal assets . In contrast, if someone sues your sole proprietorship they can go after your personal assets.

There are more things to consider, though, between these two options. Lets look at some of the pros and cons of each.

LLC pros and cons

Pros of an LLC

Cons of an LLC

Pros of a sole proprietorship

Cons of a sole proprietorship

Which should you choose?

Sole Proprietorship Vs Llc: Legal Protection

The biggest advantage to choosing an LLC over a sole proprietorship is liability protection.

Since sole proprietorships arenât separate entities from the business owner, what the business is liable for, so is the business owner. For example, if you got a loan to buy new equipment for your lawn care business, defaulting on the loan could mean the lender will come after your personal assets as collateral.

An LLC is a separate legal entity from the business owners. The owners are granted liability protection, so their personal assets are protected.

Also Check: Is There A Tax Credit For Solar Panels

Advantages And Disadvantages Of Llcs And Smllcs

There are a number of advantages with LLCs and SMLLCs:

- Pass-through taxation for SMLLCs where profits are passed along to its members who are then responsible for reporting the income on their personal tax returns.

- SMLLCs do not pay federal business tax, and there is no business tax in most states.

- LLCs are more informal when compared to a corporation that has to designate a board of directors and shareholders who are legally responsible.

There is also a potential downside with LLCs due to its less formal status. It can be harder to obtain credit, raise capital, and determine the value of the LLC business when compared to a corporation. A bank is likely to look at how the business is structured and the method for distributing profits and contributions to the owners. With a corporation, the risk is spread out among shareholders which could lead the bank to determine a corporation is less risky versus a single owner LLC.

Dont Make Things Unnecessarily Complicated

You mightve been around the Google block searching for this and that about saving money. You may have stumbled across some tips telling you to incorporate your business in a different state, like Delaware. Sadly, that tip doesnt really apply to you.

Those tax benefits refer to publicly traded or multi-state corporations. If youre forming an LLC, theres no reason to form it in another state. Incorporate your business in the state you live and operate in to keep things simple.

Read Also: How To Become A Solar Farm

Llc Vs S Corporation: An Overview

Choosing the right business structure is crucial to the success of your business.

An LLC is a limited liability company, which is a type of legal entity that can be used when forming a business. An LLC offers a more formal business structure than a sole proprietorship or partnership. It also offers protection to the owner from personal liability for any of the debts that a business incurs. In other words, the personal assets of the owner can not be used for legal claims against the business. LLCs are common because they provide the liability that’s similar to a corporation, but they are easier to establish.

While LLCs and S corporations two terms are often discussed side-by-side, they actually refer to different aspects of a business. An LLC is a type of business entity, while an S corporation is a tax classification. It lets the Internal Revenue Service know that your business should be taxed as a partnership. To become an S-corporation, your business first must register as a C corporation or an LLC. A business must meet specific guidelines by the Internal Revenue Service in order to qualify as an S corporation.

An S corporation provides limited liability protection but also offers corporations with 100 shareholders or fewer to be taxed as a partnership. An S corporation is also known as an S subchapter. In some instances, a business may be both an LLC and an S-corporation.