When Do You Need A Business License In Michigan

When beginning a new business in the state of Michigan, you will likely need at least one, if not two to three business licenses from the local, state and/or federal levels before opening your doors. The majority of local municipalities, cities or unincorporated areas of counties do not require a general business operating license but do require professional licensing for certain occupations and industries.

The city of Detroit provides a lengthy list of all those businesses required to obtain a specialty license including amusement parks, dry cleaners, gas stations, hotels, pet shops, restaurants and sports stadiums, to name a few. To determine if your business needs a professional license in Detroit, or any other city in Detroit, visit the website of your city clerk or county recorder.

Similarly, the state of Michigan does not require business licenses for all businesses but does require certain types of businesses and professions to obtain licensing. The list of required licenses includes a number of health-related professions such as acupuncturists, optometrists, pharmacists and social workers as well as a few other industries such as construction, cosmetology and alcoholic beverage sales.

Finally, your business may be required to obtain federal licensing to operate legally. Though federal licenses are rarer, they are required for businesses operating in certain highly regulated industries.

Second Decision: Llc Vs Inc

Now that you know your business will need to be more than a sole proprietorship, youll need to decide whether to form an LLC or an Inc. .

LLC vs. Inc.: What they have in common

Both LLCs and corporations provide personal asset and legal protection for their owners or shareholders and are also both formed by filing paperwork with the state.

LLC vs. Inc.: How they differ

Ownership LLCs are owned by members, who own a percentage of the business. Its difficult to transfer the percentage of ownership from one member to another. Membership details and rules, including how membership interest is transferred, are usually organized in the LLCs operating agreement.

C corps have the most flexible ownership structures, in that they can sell stock in their company to anyone by going public. As a result, this gives the C corp many more funding and financing options than any other type of business. Venture capitalists typically prefer to deal with C corps. There are no restrictions on the number of owners that they can have, and they can be owned by individuals from any country. This makes them prime candidates for quick exit strategies, and rapid growth models.

Taxation LLCs have somewhat flexible tax structures. Single-member LLCs are taxed like a sole proprietorship. Multi-member LLCs, on the other hand, are taxed like a partnership, which means all profits and losses pass through to the owners.

The Takeaway

Choosing Ca And Or Com

If your business operates in Canada, the .ca is the web country code for Canada and lets consumers know you are a Canadian company. The .ca also provides business owners with higher access to Canadas marketplace than other businesses with different country code web presence through Google and other browsers. Many entrepreneurs include the .com as well to have a universal country code. The .com is the most common choice for American companies. If you intend to provide business services to individuals or businesses outside of Canada, we recommend that you opt-in for the .com as well. By selecting both the .ca and .com, your brand has better protection against another business using the same business model with just a different country code.

You May Like: Is Pine Sol Safe To Use Around Pets

How To Start A Sole Proprietorship In South Carolina

When you consider starting a business, you may imagine endless paperwork and lawyers in order to handle all of the logistics. While the decision should never be taken lightly, starting out as a sole proprietorship can eliminate a lot of these steps and allow you to operate in South Carolina almost immediately.

Sole proprietorships are the most commonly chosen business structure because theyre fast and easy to start. However, before selecting a business structure, you should consider the tax and liability implications for your personal scenario.

Well explain how to start a sole proprietorship in South Carolina and help you determine if its the right choice for you.

Why You Should Turn Your Sole Proprietorship Into An Llc

Youve probably heard it again and again for as long as youve had your small business: You should form an LLC. Its common advicebut is it really the right move for your business?

Most small businesses start as sole proprietorshipsits the most common form of business in the United States. Many of these businesses do eventually take the extra step of registering with the state and becoming an incorporated business like an LLC, but is it worth it? What is there to gain ?

To know if transitioning to an LLC is right for you, its important to understand exactly what it means to be a sole proprietorand how LLCs are different in the eyes of the law, the IRS, and the bank.

Also Check: How Do I Connect Solar Panels To My House Electricity

The Requirements For Setting Up A Sole Proprietorship In Singapore

As long as you are a legal person who is at least 18 years old and is either a Singapore Citizen, Singapore Permanent Resident or EntrePass holder, you are in the correct position to embark on a new sole proprietorship.

Foreigners who wish to set up a sole proprietorship are required to appoint at least one local authorized representative whose job is to supervise the sole proprietorship. This key individual must be a legal person who is an ordinary resident i.e. a Singapore Citizen or a Permanent Resident. You should also take into account the minimum age requirement of this position, which is 18.

For all that, you are allowed to appoint yourself as the manager and be the one-man show.

One more key requirement is the amount contributed to the Medisave account given that youâre self-employed and are either Singapore Citizen or PR, so make sure you top it up with CPF Board before registering a sole proprietorship.

The following are all the documents required to register your sole proprietorship:

- Proposed business name

- The local business address for the proposed business

- Copy of owners Singapore ID

- Local residential address of sole proprietor

What Is The Meaning Of Sole Proprietorship

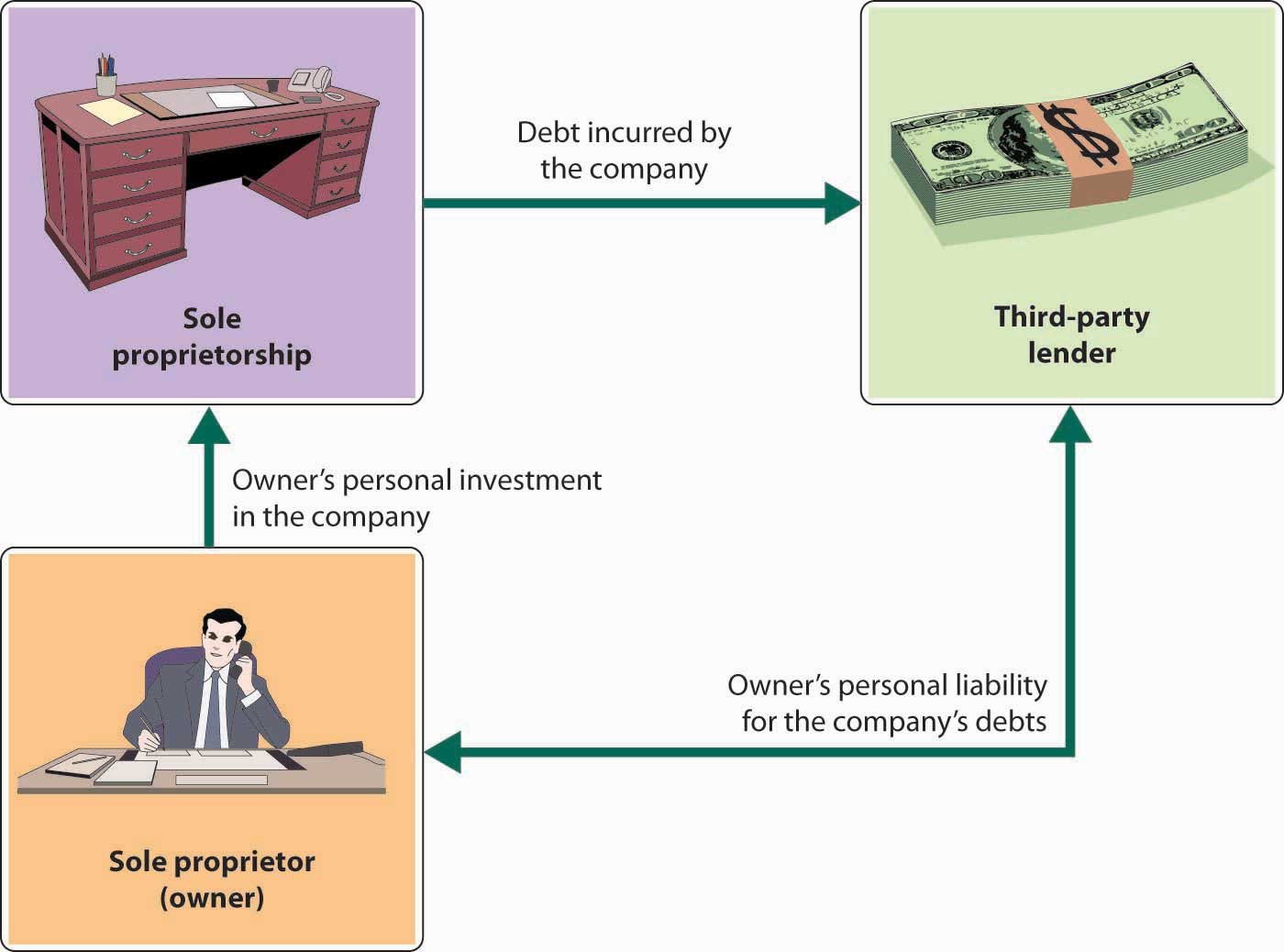

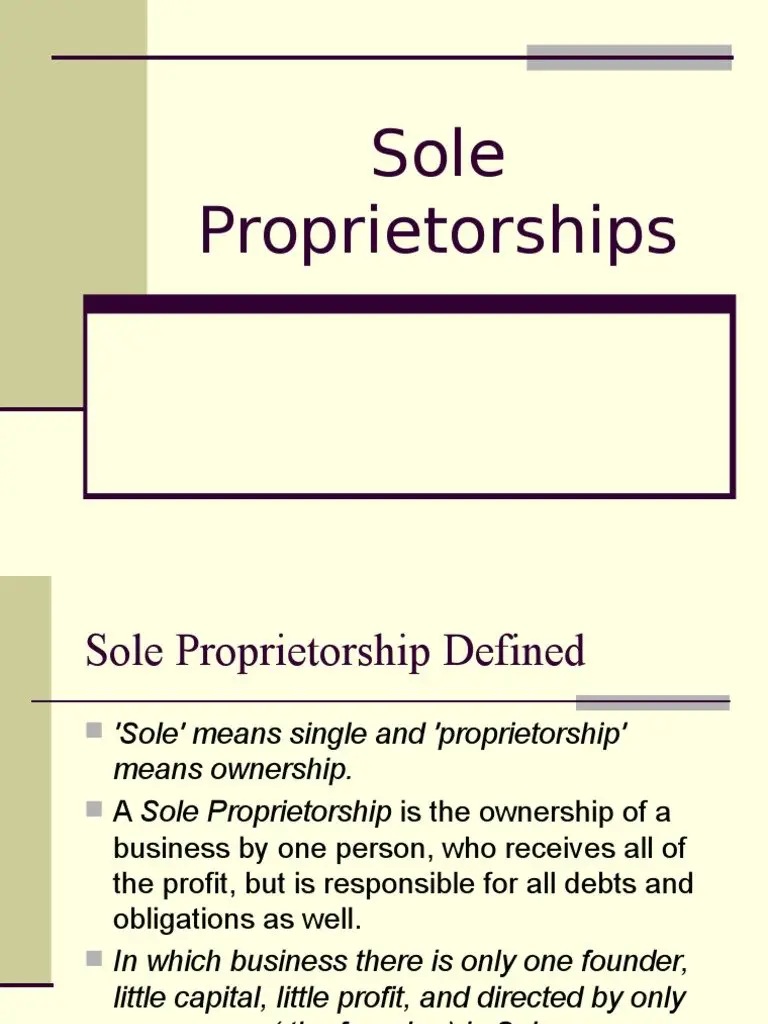

A sole proprietorship firm means a type of business entity that is owned, controlled and managed by a single person. The owner of the Business is called Sole Proprietor of the Firm. As the business is run by a natural person, there is no legal difference between the promoter and the business. The promoter himself receives all the profits. Sole Proprietorship firm does not require any formal registration.

The key feature of sole proprietorship firm is that it is very easy to start as there are less legal formalities and lesser formation costs involved.

Read Also: How To Wire In Solar Panel To Home

Also Check: How Long Do Residential Solar Panels Last

Sort Business Names By:

Here is a list of proprietorship business name ideas for your new startup:

- Unbiased Proprietorship

Here are some funny and unique proprietorship company name ideas:

Here are some cool and catchy proprietorship company names for your inspiration:

- Warm Proprietorship

- Rational Proprietorship

What About Partnerships

In this context, a partnership is a business union in which two or more individuals manage and maintain their business. Unlike a corporation or LLC, a partnership requires no incorporation paperwork with the Federal government. Therefore, the three types of partnerships general, limited or limited liability are somewhat informal structures.

In a General Partnership, all owners are equally responsible for the debts of the business, each assuming unlimited liability.

| The Pros | |

|---|---|

|

Flow-through income taxation for all partners |

Each owner is equally responsible for debt and loss |

|

Less expensive and less paperwork than incorporating or filing to become an LLC |

|

|

Partners can pool resources and share the financial obligation rather than facing it alone |

Liable for debts and actions of your partner |

|

No rigid, obligatory corporate structure |

Limited capacity to raise money and attract investors |

In a Limited Partnership, owners can take on the role of a limited partner who reports to a GP and therefore have less responsibility in the event of company debt or accountability. The GPs have managing power, but also take on all of the liability for partnership duties.

| The Pros | |

|---|---|

|

Flow-through income taxation for all partners |

More filing formalities than a general partnership |

|

Less expensive than incorporating or filing to become an LLC |

LPs can lose all of their limited liability if they take on any management roles |

|

Safer and thus more attractive to some investors |

Read Also: What Is Solar Energy Panels

Filing With Your County

In some states, FBN registration is accomplished through the Secretary of State or other state agency however, in most states, you’ll register your FBN at the county level.

Your first step should be to contact your county clerk’s office either online or by phone to find out its requirements and fees. An increasing number of counties are providing information online and some have online applications. However most counties still require a paper form to be filled out and mailed in. Find out from your county clerk what its process is.

At A Glance: Sole Proprietorship Vs Llc

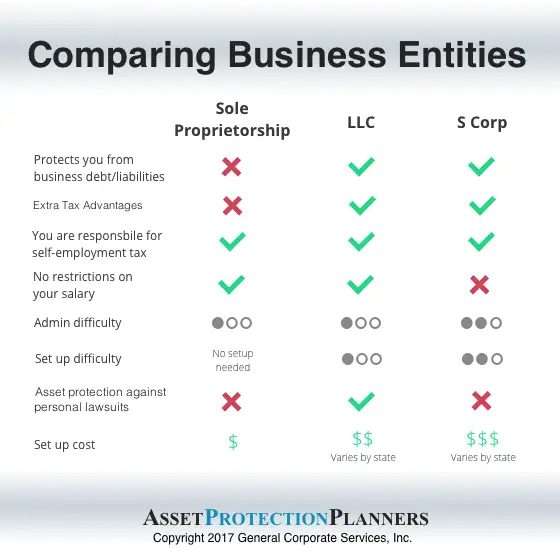

Sole proprietorships and limited liability companies are two of the most common business structures for individuals and small businesses. A sole proprietorship is the simplest and requires minimal paperwork. An LLC requires upfront paperwork and costs but could provide your business long-term benefits that make the investment worth it. Legal protection and potential tax advantages are two big factors to consider when choosing between a sole proprietorship and an LLC.

Read Also: Does Tesla Make Solar Panels For Homes

Less Access To Funding

A sole proprietorship may not be given the same access to business accounts and lines of credit as an LLC or a corporation. Government grants and funds awarded to small businesses are usually not available for sole proprietorships. You may also experience problems raising capital in the beginning since a sole proprietorship doesnt carry the same credibility as an LLC or corporation.

Easy Transition To A Corporation

Starting a business as a sole proprietor does not mean you will have to operate that way through the life of your business. At any time, you can convert a business to an LLC, corporation, or general partnership with the right paperwork and process. This allows you to feel out your business and settle on a model before you move to a corporate structure.

Many large companies started this way. eBay, for example, started as a sole proprietorship called Auction Web. By the time the owner, Pierre Omidyar, incorporated the business he changed the name to eBay.

Recommended Reading: How Much Solar Power For Tiny House

Switching From A Sole Proprietor To Llc

As your business expands, it might make sense to switch to an LLC. You of course want to be able to protect your assets not to mention, the fact that an LLC does give you a better format for growing your organization. Below are six steps that will help you move from a sole proprietorship to an LLC.

1. Have a unique business name

Unlike with a sole proprietorship, you will need a legal business name that is not already in use by another LLC or corporation in your state. So even if you have been using a name up until this point as a sole proprietor, if it is taken, you will have to select another. There are a couple of ways to check your name. You can call the relevant state office you can also usually access an online database of registered business names to see if yours is currently in use. Often, companies will hire a lawyer for this task as well.

Keep in mind too, the name that you use will have to include the words Limited Liability Company or you can opt for an abbreviated LLC or Ltd. The name itself is most often automatically registered upon you filing the requisite paperwork with your state.

2. Fill out and file the articles of organization

You will also have to list a registered agent who is eligible to receive paperwork on behalf of the LLC. If you are the sole owner, you can be that registered agent. If it is a multiple-member LLC, one of you will need to be designated as the agent.

3. Come up with your operating agreement

4. Publish notice of your LLC

Sole Proprietorship In Florida

Sole means one. And Proprietor means owner. Put them together and you have a Sole Proprietor, or Sole Proprietorship. A Sole Proprietor is the person. A Sole Proprietorship is the business entity.

A Sole Proprietorship in Florida is an informal structure with one business owner. Often, it is the easiest and simplest form of business structure to create. However, that doesnt always mean they are the best choice for small business owners.

While Sole Proprietorships have some advantages, there are also disadvantages you should be aware of. New business owners often consider other business structures before choosing to be a Florida Sole Proprietor.

Weve explained these below, as well as provide step-by-step instructions if you decide to start a Sole Proprietorship in Florida.

Pro tip: Sole Proprietorships dont protect your personal assets, so you have personal liability for claims. On the other hand, if you form an LLC, your personal assets are protected in the event of a lawsuit. Check out Sole Proprietorship vs LLC for more information.

Read Also: How To Assemble Solar Panel

The Sole Proprietorship Vs Other Business Entities

If you stay as a sole proprietor, you cannot protect your personal liability we consider this to be the fatal flaw of the sole proprietorship as a business structure. There are a few other options to protect yourself, however.

For one thing, you could consider forming a multi-member limited liability company . This entity type is more expensive to form and has more formality than a partnership, but it provides personal liability protection.

For the vast majority of our readers, we strongly suggest forming an LLC rather than sticking with the informalities of the sole proprietorship. Not only does the LLC provide personal asset protection, but it also lends an air of credibility to your business that a sole proprietorship cant match.

This is due in part to the fact that an LLC has a unique business name that is registered with the state, whereas a sole proprietorship is simply referred to using the personal name of its owner for instance, if your name is Susan Smith, your sole proprietorship would simply be known as Susan Smith, not by a formal business name.

Do you still want to stay as a sole proprietorship instead? If so, you should look into obtaining a general liability insurance policy for your business. A general liability policy helps you cover expenses caused by mistakes made in the course of operating your business.

Obtaining An Employer Id

An employer ID number can be acquired from the IRS after the business name, type and location are decided. Almost all businesses need an EIN, even if they dont have employees on the payroll. The process of acquiring an EIN online can be referred to in detail here or by phone and get the number immediately.

Another thing to be aware of is that the IRS would never charge for this. Therefore, an employer must be aware of fake application websites too.

Also Check: Where Can You Buy Small Solar Panels

Types Of Business Structure:

- Sole Proprietorship is an unincorporated business that is owned by one person. The owner of a sole proprietorship has sole responsibility for making decisions, receives all of the profits, claims all losses, and does not have separate legal status from the business.

- Partnership is an association between two or more people who join together to carry on a trade or business. Each partner contributes money, labour, property, or skills to the partnership.

- Corporation is an incorporated entity with its own rights and responsibilities as a distinct person under the law. A corporation is owned by the shareholders and managed by directors chosen by the shareholders. The owners of a corporation are not personally responsible for the debts of the corporation. The corporation is responsible for its debts.

Read Also: How Much Energy Does A 10kw Solar System Produce

How Much Does It Cost To Start A Business In Michigan

The cost to start a business in Michigan is going to vary significantly depending on what the business does and where its located. Below is a list of the estimated costs for some of the more common licenses and registrations a business will need:

Business Entity Formation $0 $60 Business License $0 $250

Don’t Miss: How Much Does It Cost To Install A Solar System

How Long Is Too Long For A Proprietorship Business Name

The length of a company’s business name may depend on the type of proprietorship company being run. Short names are just easier for people to remember and say. Think about it from from your own perspective – would you want to say and remember longer words? So what we recommend is sticking with 4-9 characters.

Msz Consultancy Is Here To Help

Not sure where to go from here? If the whole process still seems a bit confusing to you, dont worry. MSZ Consultancy can come alongside to help you get started! Were located right here in Dubai, and we know all the ins and outs for ensuring that the whole process will go smoothly for you.

Reach out today to book your free consultation! You can give us a call at , or you can also get the conversation started by shooting us an email at . Dont wait any longer to make your UAE business dreams come true let us help you to make it happen!

Also Check: How Large Is A Solar Panel