Using The Federal Solar Tax Credit With Other Incentives

Along with the ITC, there are several New York State solar incentives available. In addition to the federal solar tax credit, NYC solar customers can file for the following state and city solar credits and rebates:

- NYC Property Tax Abatement

- New York State Solar Income Tax Credit

- New York State Solar Rebate

- NYS Historic Homeownership Rehabilitation Tax Credit

When combined with the ITC, these incentives can cover 60 to 70 percent of the cost of your solar system.

What Is The Federal Solar Investment Tax Credit

The ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. Congress passed the law in part because the United States is transitioning to a renewable energy economy. The ITC has been extended multiple times since its inception and will continue to be extended indefinitely into the future.

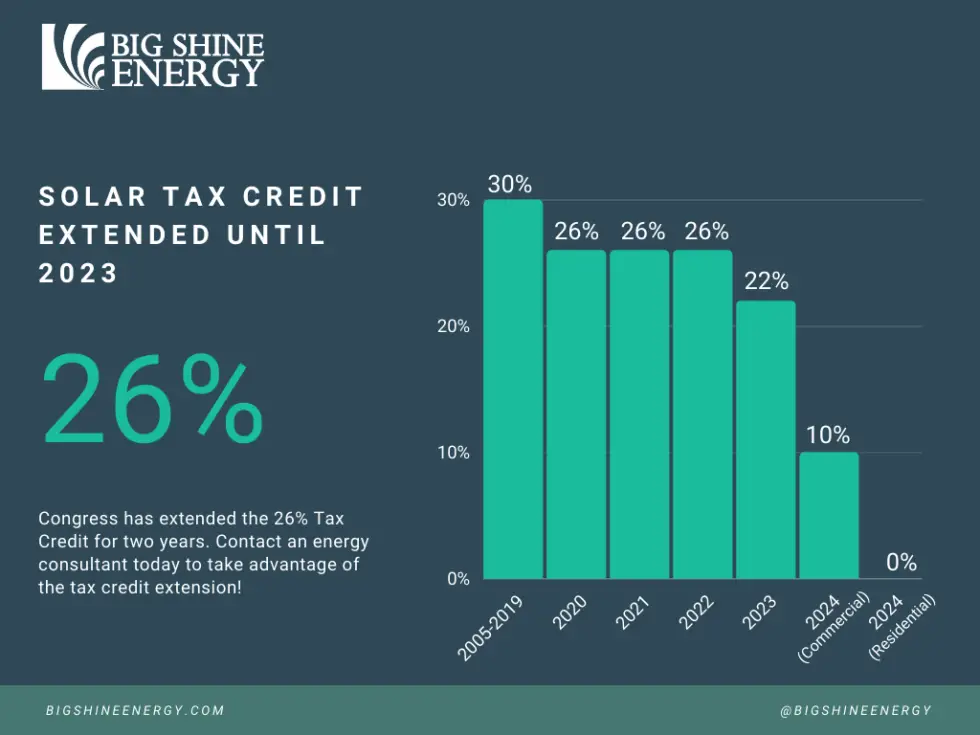

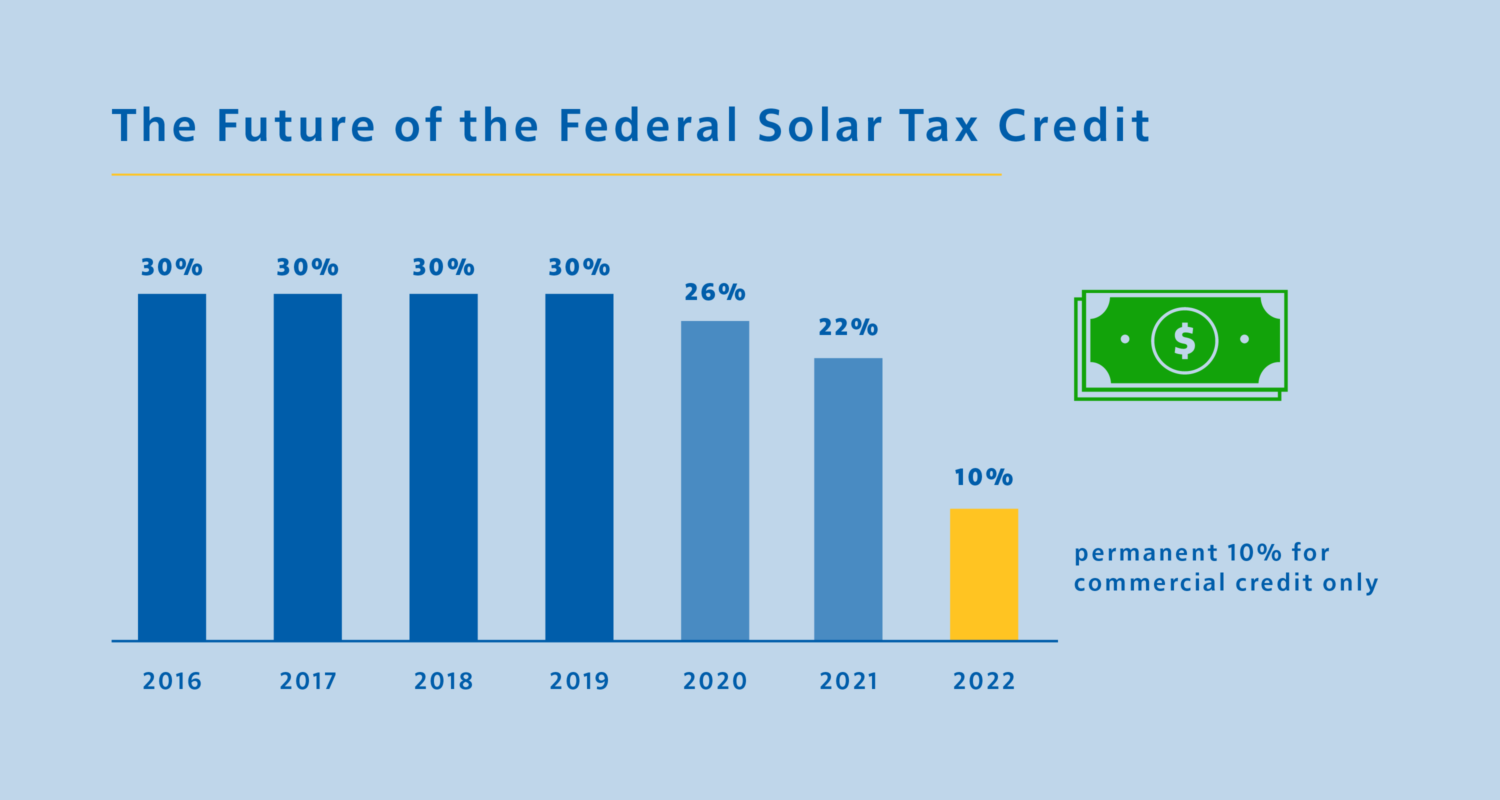

Now, the solar investment tax credit is available to homeowners in some form through 2022. However, the credits will change in a few years:2016 2019: The tax credit remains at 30 percent of the cost of the system.

2020-2022: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

2023: Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

2024: Owners of new commercial solar energy systems can deduct 10 percent of the cost of the system from their taxes.

At that point, there are no tax benefits, rebates or other incentives for residential solar energy systems in the United States.

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

Logo

You May Like: How Much Is One Solid Gold Bar Worth

Do Other Solar Incentives And Rebates Affect The Itc

Solar customers can take advantage of other solar rebates, tax credits, and renewable energy certificates in addition to the ITC. While most incentives wont affect the ITC, others will reduce the total installation costs of your system. This reduction will affect the amount you would report to the IRS on your tax return. Utility rebates, for example, usually dont count toward your income tax. Instead, the rebate amount would be deducted from the total cost of your solar system installation.

On the other hand, incentives such as renewable energy certificates and state rebates would not affect the ITC. These incentives affect other aspects of your income tax, though. State government rebates are added to your taxable income but dont affect the federal income tax credit.

State tax credits are tax incentives that reduce the amount of owed tax on the state level. However, as your owed state tax amount decreases, the amount of your owed federal income tax increases due to having less state tax to deduct.

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS From 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount over 5 years.

Check this video that walks you through the process for claiming the tax credit.

In conclusion, the federal tax credit is 30% of your gross system cost and is a great opportunity to go green, create clean energy, and save money on home improvement. Now is the time to go solar!

Read Also: Is Solar Power Worth The Investment

What Pb Roofing Can Do For Your Commercial Building

As a property or building manager, you must know who performs what during a solar system installation. At PB Roofing, we can perform a ThreatCheck inspection for your commercial building and provide preventative maintenance after the solar panels are installed. We also work alongside solar consulting firms and installation companies, so you dont have to worry about finding a reputable installer. We can also help you navigate the ITC and answer any questions you may have.

How Do I Apply For The Federal Solar Tax Credit

Homeowners should complete IRS Form 5695 when they file their federal tax returns. First, you complete Part 1 of the form to determine your renewable energy tax credit. Make sure to keep all of your receipts for your solar system project and enter the information accurately. Next, you enter the amount of your tax deduction on your 1040 form. The Internal Revenue Service provides detailed instructions on completing the tax form.

Remember that the ITC is a tax credit, not a tax refund. The difference is that a tax refund is paid out to the taxpayer, but a tax credit reduces the amount of taxes owed. So, if your tax liability for the year is less than the ITC, the Internal Revenue Service will not refund you for the tax deduction. Instead, the deduction would roll over to the next tax year to be applied to your next years tax liability .

We are not a professional tax service provider or preparer. All information provided is for educational purposes only. Please consult a tax professional for tax advice about your federal income tax preparation. You can also contact the Internal Revenue Service directly for any additional information.

Also Check: Who Is The Biggest Solar Company

Can You Claim The Solar Tax Credit If You Lease Your Solar Panel System

If you lease your solar panels, you do not qualify for the Solar Investment Tax Credit directly, but the company that you lease from may use that tax credit to help lower your monthly payments.

Many solar companies offer leasing options where they will pay for the installation and the cost of the equipment, and then they charge you a monthly fee for the use of those solar panels. The solar company acts as a third party and owns the panels during the terms of the lease, and the homeowner gets the benefit of lower monthly energy costs. Because the solar company owns the panels, they will typically receive the solar tax credit, and the homeowner wont qualify for the tax incentives. Solar leasing companies may use the value of those tax incentives to lower the monthly cost that they charge homeowners, but its typically not going to be a direct pass-through savings, as the solar company will want to retain some of that value.

If you lease your solar panel system, you will not typically receive most state and local solar incentives either, though again, the company you lease from may use those incentives to offset their costs and help lower your monthly payment. In some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates , but this depends on where your home is located.

Looking Forward: 2021 Is An Excellent Time To Install A Solar Power System

The incoming Biden Administration has announced an ambitious 100-day energy agenda known as The Solar Vision. Under this plan, the Biden Administration wants to extend the solar tax credit so that it includes standalone battery storage systems.

People who live in California can also take advantage of the California Self-Generation Incentive Program, or SGIP. This initiative supports distributed generation and offers rebates for energy storage and generation projects throughout the PG& E, SDG& E, SCE, and SoCalGas territories. SGIP targets low-income, medically vulnerable, and disadvantaged customers in these areas.

Recently, the SGIP program was extended to include customers who live in high fire-threat districts or those who have been subject to at least two Public Safety Power Shutoffs. The extension of the program helps eliminate financial barriers and increase access to battery backup systems for qualifying customers.

Despite recent extensions, the ITC started decreasing in 2020, and it will continue to fall over the coming years.

With that in mind, property owners who want to maximize their ITC deductions should install their solar systems before the end of the year. Dont forget the ITC relies on the date your system is placed into service , not the date you install it.

Also Check: How Much Do Tesla Solar Shingles Cost

History Of The Solar Itc

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

How Does The Tax Credit Work

You can claim the federal solar tax credit as long as you are a U.S. homeowner and own the solar panel system installed in a residence in the United States. The tax credit rolls over for up to five years if the taxes you owe are less than the credit you earn. However, you do not receive any part of the tax credit in your tax refund.

For example, if you have a solar system installed for $19,000, the 26% tax credit saves you $4,940 on your federal tax return the same year the system is activated. This way, you technically pay $14,060 for your solar power system. If your tax liability is less than $4,940, the remainder of the credit will roll over and be applied to your federal income taxes the following year.

Also Check: How Much Do Solar Cells Cost

Cashing In On Other Solar Incentives

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other solar incentives may impact your federal tax credit. Heres what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit. However, the compensation you receive through net metering shouldnt affect your federal tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credit you get for your residential solar system will not decrease your federal tax credit amount. However, getting a state tax credit means the taxable income you report on your federal returns will be higher, as youll have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income but will not reduce your tax credit.

How To Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . Your solar provider should supply the proper documentation and instructions upon your demand. We have listed the essential steps in claiming the credit here:

We recommend consulting a tax expert and your solar provider to ensure you are correctly claiming the ITC.

You can use the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits are available in your zip code.

You May Like: How Much Does A Solar Electrician Make

Impact Of The Solar Tax Credit

As the United States races to achieve rigorous clean energy benchmarks, the federal policies and incentives to get us there have heightened. On both a distributed and utility-scale level, solar deployment has grown quickly across the country. The federal tax credit has given businesses, homeowners, and tax payers the opportunity to drive down solar costs while increasing long-term energy stability. The ITC has been a driver of huge success, giving us a stronger and cleaner future: in fact, according to the Solar Energy Industries Association , it has helped the U.S. solar industry expand by over 10,000 percent! Learn more about how solar panel costs and efficiency have changed over time.

The Federal Solar Tax Credit: What You Need To Know

Could investing in solar energy pay off sooner than you think? The short answer is, yes. Many residential home solar power systems are eligible for a federal investment tax credit, or ITC.

At the time of this writing, you can get up to 26% of your installation costs back by claiming the tax credit when you file with the IRS. The ITC benefits both residential and commercial customers, and there is no cap on its value.

Wondering how the solar tax credit works in 2021? Well cover everything you need to know in this post.

Lets dive in.

You May Like: How Many Solar Panels Per Square Foot

How Does The Solar Tax Credit Work The Ultimate Guide

If youre debating adding solar panels to your business or home, youve probably heard about the federal solar tax credit.

The federal government is offering a federal solar tax credit to subsidize the purchase and installation costs of solar panel systems for commercial businesses and residential homeowners throughout the United States.

Although the solar tax credit was set to expire come 2020, federal legislation recently extended it through the coronavirus relief package as a financial incentive to push green energy meaning that it continues to be a relevant and helpful option for anyone looking to go solar.

Heres what you need to know about the solar tax credit.

Can You Qualify For The Solar Tax Credit 2022

You can read an overview of how to qualify for the tax credit as a commercial business, on the Solar Industries Association website. They explain that the IRS has released guidance on the requirements for taxpayers running commercial enterprises to qualify for the solar tax credit.

Simplified guidelines for homeowners are available on the energy.gov website too.

To summarize, homeowners may be eligible for this tax credit if they fulfill all of the following conditions:

- Between January 1, 2006, and December 31, 2023, your photovoltaic system was put in place

- In the United States, your primary or secondary residence is where you install a solar PV system

- You are the owner of the solar PV system

- The solar PV installation is either brand new or has never been used before, so its an original installation

The following charges are covered by this plan:

- The photovoltaic solar panels or PV cells

- Costs of labor for onsite preparation, installation, or original construction, including permit fees, inspection expenditures, and developer expenses

- Purchase of required electrical equipment, including wiring, inverters, and mounting equipment

- Battery banks that are charged only by the connected solar PV panels

The solar tax credit is available for a limited time and there are currently no plans to extend it again for residential purposes past 2023. Now is the time to apply!

Also Check: Can You Write Off Solar Panels On Your Taxes

Federal Tax Credit For Residential Solar Energy

OVERVIEW

The federal solar tax credit for solar energy upgrades to your home may not be around for much longer. Here’s how to claim this credit.

In an effort to encourage Americans to use solar power, the U.S. government offers tax credits for solar-powered systems. Let’s take a closer look at some of the benefits of the solar tax credit and how you can claim it.

Installation Location And Timeline

The solar system that you claim should be installed on either your primary or secondary home in the U.S. A home is defined by the IRS as where you lived during the tax year this can be a house, houseboat, mobile home, co-op, condo, or other form of housing.

In order to claim the 26% tax credit, your solar energy system must begin construction by December 31, 2022.

The timeline for a solar panel installation in NYC can take anywhere from two to five months. That means that if you want to take advantage of the 26% tax credit, youll need to move forward with your project as soon as possible. Contact us to get started!

Recommended Reading: What Is A Solar Skylight