Do Sole Proprietors Need Articles Of Incorporation

There are no documents to file to begin a sole proprietorship or a partnership. However, businesses are required to file articles of incorporation, also known as a certificate of formation, to legally form a corporation in any state. This requirement is not imposed on sole proprietorships or partnerships.

Do I Really Need To Incorporate In Pennsylvania

At some point in his or her career, nearly every sole proprietor and most every small business partner will ask, and perhaps agonize over the question, Do I really need to incorporate? Some businesses proceed to incorporate with little more reason than the desire to bolster a trade name with the suffix Inc. or LLC. Others who may desperately require additional liability protection or organization proceed without it, unaware of the need to incorporate. What follows is a discussion of some of the factors which small businesses should consider in deciding whether or not to incorporate.

Benefits Of A Corporation

– Shareholders are not personally liable for debts or obligations of the corporation

– More government funding options to help build and grow your business

– Can write off certain business expenses and may also benefit from additional tax advantages

– A corporation exists in perpetuity and ownership is transferable

Also Check: How To Read Electric Bill With Solar

Why You Do Really Need That Business Checking Account

While you may be able to get away with using your personal checking account for business expenses, it’s almost never advisable. It’s worth repeating that opening a business checking account should be one of the first things you do as a business owner. Here are some of the biggest benefits that come with handling your company’s finances through a business checking account.

Simplifies your taxes — Would you rather spend a few minutes opening a business checking account now, or hours sorting through your jumbled up finances come tax season? Having your business and personal finances completely separate is crucial to getting your taxes done quickly and accurately. Plus, you could lose out on important money-saving deductions by not having a business checking account. Not only will it be harder to identify expenses you could have deducted, but it will also make it more likely that you get audited by the IRS.

Protects your liability — If you’ve registered as an LLC or corporation in order to limit your personal liability, your personal assets are generally protected if anyone tries to come after your business. However, mixing up your personal and business finances makes it more likely that a court could go after your personal finances as well because it doesn’t look like you are, in fact, running a separate entity.

The Process Of Incorporating Your Sole Proprietorship

Changing your sole proprietorship business into a corporation or an LLC could become complicated, depending on your business history. It is extremely important to document each step of this process. You can do your own research and if you feel confident, you may start the process on your own, but it might bring you peace of mind to consult a small business attorney to help you with terminating your sole proprietorship and creating a corporation

-

Choose the Name of Your Company: Once youve chosen your preferred business model, you have to decide if you should keep the name of your business or select another. When you pick a business name, check with the local register of businesses to make sure the name has not already been trademarked. We suggest you register a corresponding domain name for your new companys website, even if setting up your online presence is not your first priority.

-

Transfer Your Financial Information: Youll need to close your old bank account and open a new one for the corporation, as well as obtain a new federal tax identification number from the IRS. You may also need to apply for a state tax identification number depending on which state you incorporate your company in. We recommend you file a final tax return under the old DBA and request that the IRS close out the account and tax ID for the sole proprietorship. Do this after obtaining a new EIN for the new corporation to appropriately complete your business taxes and income tax returns.

You May Like: How Much Is It To Lease Solar Panels

How To Get Started With The Business Licensing Process

First, you should identify in which industry you plan to operate your business. Highly-regulated industries like agriculture and wildlife will require an extensive federal licensing process with the relevant agencies.

Next, you should identify the jurisdictions in which you plan to operate, including the local and state government regulating bodies.

You may also consider retaining the services of an attorney or industry expert to help guide you through the sole proprietorship licensing process.

Finally, you can learn more about acquiring the necessary licenses for your business in this helpful guide.

Why Should I Use Articles Of Incorporation

Using Articles of Incorporation means that youve made a conscious decision to create a legal business. This can help you separate yourself from your business. Separating yourself from your business can help protect your personal assets from business creditors or others who may decide to sue your business.

Filing Articles of Incorporation could mean that your business has the ability to raise capital through selling stock. Of course, before you elect to do this, make sure that you do your research and use the stock option that is best for you and your business. There may be additional paperwork required for you to issue stock.

Additionally, using Articles of Incorporation can create more confidence in your target market about your business. It can also make your business more attractive to lenders if youre looking to grow in your industry. Also, as a business, you may, depending on the type of corporation you form, receive more favorable tax treatment than continuing on as a sole proprietor.

Corporations can perpetually exist. This means that, at least in theory, you could set up your business to last forever. When you fill out your Articles of Incorporation, you choose a timeframe for which the business will exist. You can use the term perpetually to keep the business in existence unless and until you complete and file the right documents to dissolve the company. You can also transfer ownership of the business.

Recommended Reading: How Much Does It Cost For 1 Solar Panel

Sole Proprietorship Vs Corporation

Sole Proprietorship and Corporation are two of the most popular business models in Canada. A lot of startup founders are often confused about which one is the best for their new business. Sole proprietorship is a more common option for freelancers or small businesses that don’t have any employees. It doesn’t require you to register your business with the government and it offers a lot of flexibility. Corporation, on the other hand, is more complicated, requires you to register with the government, and its best to incorporate with a lawyers guidance to ensure the legal entity is set up to best serve your business goals. It offers stability since it’s less likely that you’ll be sued for any mistakes made by your employees. Founders who are serious about growing their businesses will typically choose to incorporate their businesses sooner than later to benefit from the legal corporation benefits.

What Are The Advantages Of A Sole Proprietorship

The sole proprietorship offers several advantages over other types of business entities such as it is easy and inexpensive to set up as there is no need to register the business entity. In addition, the sole proprietorship is less complex than the corporation as there are few fewer formalities such as holding annual meetings, having a board of directors, issuing shares and more.

The biggest downside to the sole proprietorship is that it doesnt protect the business owners assets. If the business is sued or the business cant cover its debts, the business owner is personally liable.

Related: How does an LLC protect your personal assets?

Also Check: What Is Silver Sol Good For

Determine Your Business Location

Your business may have a clear location, such as a retail store, a restaurant or a practitioners office, or it may be mobile or Web-based. Regardless, to license your business you will need to identify a physical location. Consider the following when determining where to locate your business:

- Will the location appeal to your customers?

- Have you accounted for all site-related start-up and operational costs in your business plan?

- Is the location zoned appropriately?

- If it will involve a lease, what will the terms be?

- What special permits, if any, will be required at that location?

- If home-based, what restrictions will your city or town, county or homeowner association place on your business?

Consequences Of Not Using One

If you dont file Articles of Incorporation , youre considered a sole proprietor or a doing business as. Youre treated differently because youre not separate from your business. You are the business. You could lose your personal assets if your business is sued. You could also face negative tax treatment as sole proprietor.

You May Like: How Much Does A Solar Panel Lease Cost

If Selecting A Corporation Or Llc Structure Get Registered

If the business structure youve chosen is a corporation, limited liability company, or limited partnership, you will need to create the entity or have your attorney do it for you.

- You may have heard that registering your business entity in a state other than Washington is the way to go. Do your homework before acting on that advice! If youre operating your business in Washington, youll need to be registered in Washington. If you do the initial registration in another state, youll need to register in Washington as a foreign entity. You wont save anything in state registration, licensing, and tax costs for your Washington operation, but youll have the added costs of the other state.

- Determine who will be your registered agent, the Washington-based person who will receive your official service of process and business entity notifications. It can be you, your attorney, or an outside party.

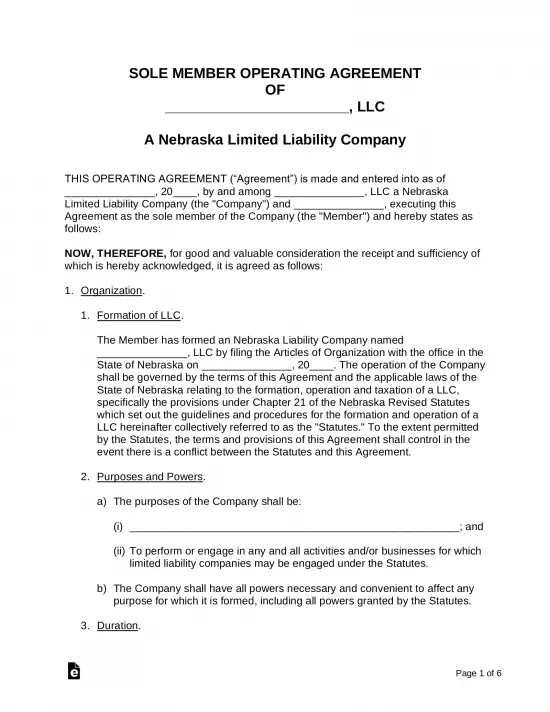

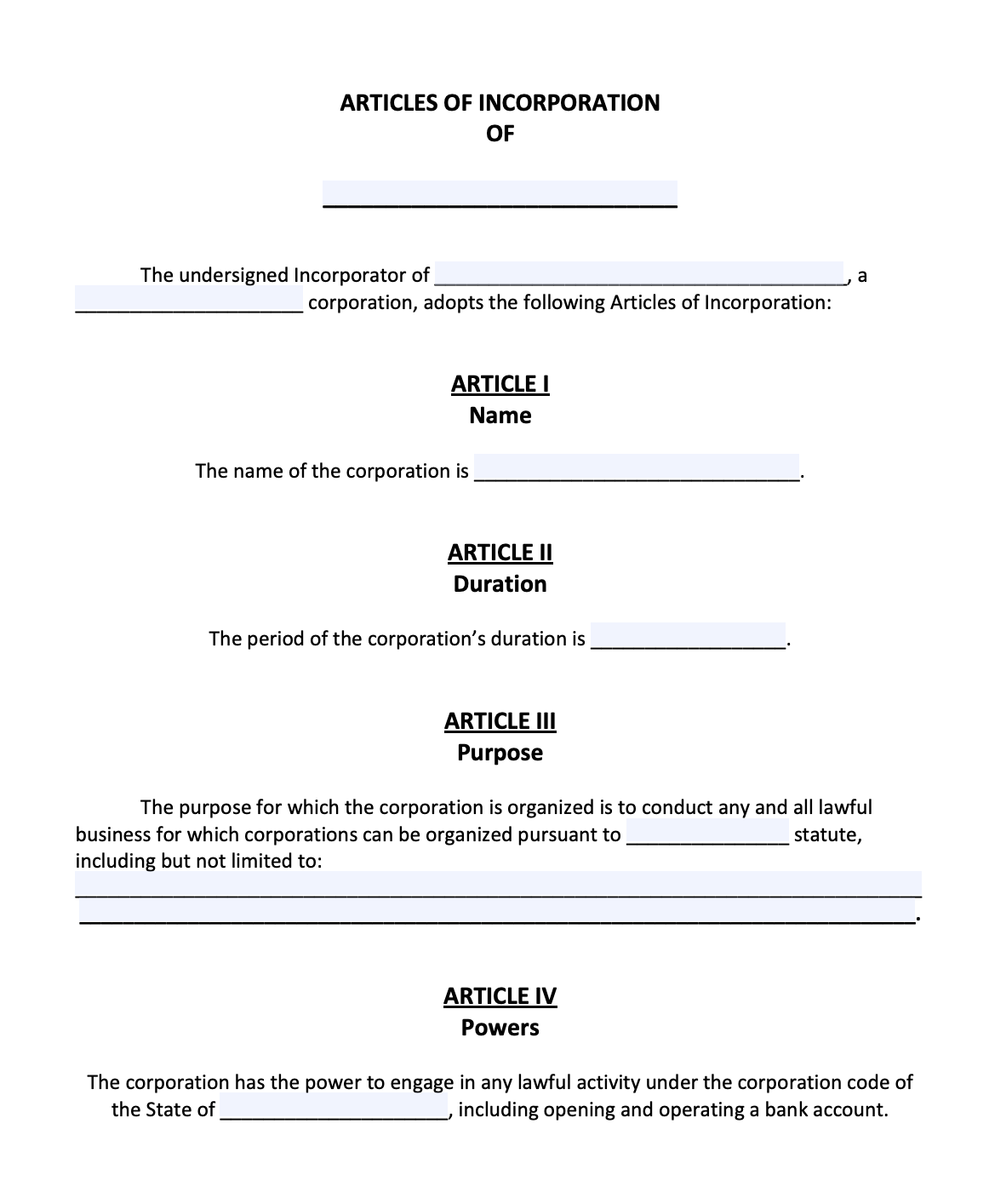

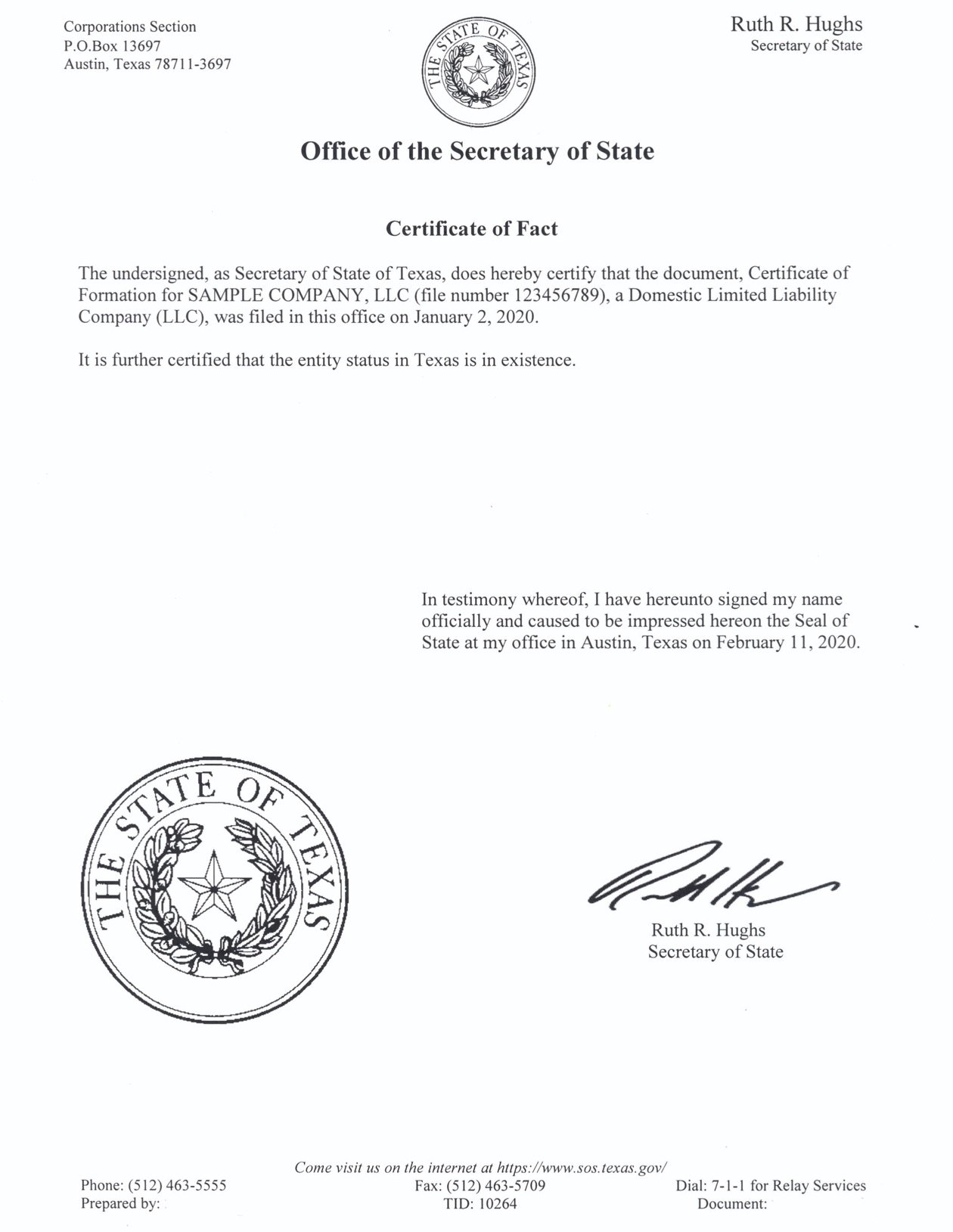

- Create Articles of Incorporation or Certificate of Formation , and file them with the Secretary of States office. Filing with the Secretary of State can be done at .

- Create the governance document for your entity: Bylaws Operating Agreement or Partnership Agreement .

Get Legal Help Setting Up Your Sole Proprietorship

Although it’s relatively easy to set up a sole proprietorship without the assistance of an attorney, you may still have some questions about liability, taxes, and other possible risks. You should speak with a business organizations attorney in your area to help answer your additional questions and guide you through the process of setting your business up.

Thank you for subscribing!

You May Like: How To Dissolve A Sole Proprietorship In Texas

How Do You Pay Taxes As A Sole Proprietor

If you’re self employed as a sole-proprietorship or partnership, you must file your personal income tax return and pay the same amount of tax as any employed wage earner. Your business income, after deductions, is considered your annual wage, you report it as professional or business income on a T2125 form.

Have You Prepared Your Business Plan

You wont want to start your business before you have completed your business plan! You may want to click the Planning box for business planning guidelines. For planning assistance and more in-depth information regarding any of the steps on this page, you may wish to check out the following resources:

Recommended Reading: Do I Need To Register My Sole Proprietorship

Does An Llc Have Articles Of Incorporation: Everything You Need To Know

Does an LLC have articles of incorporation that establish the business as a legal entity? Yes, an LLC must file an organizing document with a state agency.3 min read

Does an LLC have articles of incorporation that establish the business as a legal entity? Yes, an LLC must file an organizing document with a state agency. However, in the case of an LLC, the document is called the Articles of Organization, not the Articles of Incorporation. While they may share many similar features, they are not the same document, for the simple fact that an LLC is, technically and legally speaking, formed while a corporation is incorporated.

Articles of Incorporation are used by businesses that are registering with a state as a corporation, and LLCs, like corporations, are entities that provide, among other things, the benefit of protecting the personal assets of the owners of the business. LLCs also have to file an organizing document with a state to legally meet the requirements established by that state to conduct business.

How To Establish A Gtc Account:

If you have filed a return in Georgia, you can establish a GTC logon to access your individual income tax account. To establish your GTC account:

Read Also: How Much Is The Cost To Install Solar Panels

How To Incorporate A Sole Proprietorship

A sole proprietorship is the simplest form of small business: once you begin conducting business on your own, you’re a sole proprietorship. There is little in the way of paperwork or bureaucracy to contend with, and you don’t have to report to anyone. But if you decide to expand your company, or want the legal and financial protection not offered by the sole proprietorship model, you need to incorporate your small business. Incorporating may also make it easier to attract potential investors, should you choose to do so.

1.

Choose a name for your business. Verify through the local registrar of businesses that the name is not already in use if it is, select another name. To be safe, perform an online search on your company name, or have your lawyer do the search, to ensure your name does not violate an existing company’s registered trademark. Select a domain name to register your company’s website, even if you do not plan to set up a website right away.

2.

Create a statement of purpose, articles of incorporation and bylaws for your small business. Guidance on preparing these documents is available at reputable online small business sites, such as the U.S. Small Business Administration’s Small Business Development Center, or through your business attorney. The articles of incorporation and bylaws provide the legal guidelines by which you will operate your incorporated business.

References

Pros And Cons Of Incorporation

When you incorporate your business, youre creating a separate legal entity. And one of the biggest advantages is the liability protection that comes with this.

When you incorporate, youre not held personally responsible for any debts or lawsuits incurred by the business. If any legal claims are brought up against the business, then youre not personally responsible for them.

When you incorporate your business, you may be taken more seriously as a business owner. Incorporating can also make it easier to apply for business financing in the future.

However, theres a lot of work that comes with incorporating your business. You have to file your articles of incorporation, hold shareholders meetings and track corporate minutes. If youre a new business owner, you may not be ready to commit to all of that.

Read Also: Does Having Solar Panels Save Money

Are Articles Of Incorporation Confidential

The information in an articles of incorporation application becomes part of the corporations public record. As such, the information provided is not considered confidential for corporations.

Deborah Sweeney is the CEO of MyCorporation.com which provides online legal filing services for entrepreneurs and businesses, startup bundles that include corporation and LLC formation, registered agent services, DBAs, and trademark and copyright filing services. You can find MyCorporation on Twitter at .

Understanding Articles Of Incorporation

Many businesses in the United States are formed as corporations, but to be recognized as such, you’ll need to take steps to officially establish your company. One of the key steps is filing an Articles of Incorporation.

Articles of Incorporation acts as a company charter and provides the state with the necessary information to formally establish the company. The document also acts as an outline for how the company is governed. You must file your Articles of Incorporation with the secretary of state’s office in the state in which you’re going to conduct business.

It’s worth noting that certain states offer more favorable tax and regulatory environments than others, which attract more businesses. For instance, Nevada and Delaware attract a large portion of public corporations because they offer unbeatable tax advantages. These states also don’t require shareholders, officers, or directors to be local residents, making it easy to form a company without residing in that particular location.

Although Articles of Incorporation requirements vary by state, it’s important to include:

- The company’s name

- The registered agent’s name and address

- The type of corporate structure

- Contact information for the initial board of directors

- The type and number of authorized shares

- How long the corporation is expected to exist if it isn’t meant to last forever

- The incorporator’s name, address, and signature

Don’t Miss: How Much Would It Cost To Get Solar Panels

Pros And Cons Of Sole Proprietorship

Operating as a sole proprietor is the easiest and more inexpensive way to start a business. For instance, if you provide freelance services, then you may start out as a sole proprietor. You have complete control over your business, and all of the profits are yours to keep.

As a sole proprietor, you and the business are viewed as a single entity. Your business is considered a pass-through business, which means any income and tax liability passes through to you as the owner. For that reason, your business income wont be taxed separately, which will make things much simpler come tax season.

However, there is no liability protection for sole proprietors. So as a business owner, youre personally responsible for any debt the business takes on. And if one of your clients sues you, your personal assets could be at risk.

When you incorporate your business, you may be taken more seriously as a business owner. Incorporating can also make it easier to apply for business financing in the future.