Can You Claim The Solar Tax Credit On An Investment Property That You Own And Rent Out

Yes, you can claim the tax credit on an investment property that you own and rent.

However, it cant technically be claimed under the residential solar tax credit. There are actually two federal solar tax credits: one for homeowners and one for business owners, and in this case, your property would qualify under the business tax credit.

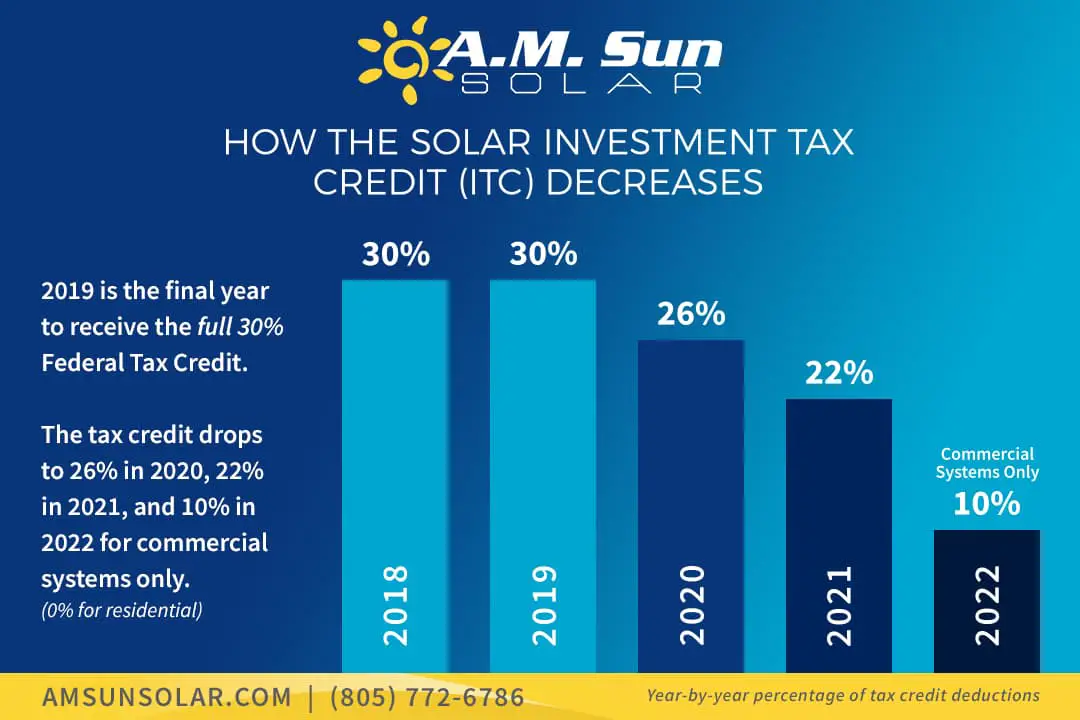

They have slight differences in their step-down schedules and are under different tax code sections, but currently, they are both worth 26% of the cost.

History Of The Solar Itc

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of 2021.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must have been used for the first time. You only get to claim this credit once, for the original installation of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you wont be able to claim a second credit.

Recommended Reading: Does Solar Work In Winter

Can I Claim The Federal Solar Tax Credit For Fiscal Year 2021

Any solar-energy system installed after Jan. 1, 2006, is eligible for the one-time credit.

If your system was installed and generating electricity in your home last year then, yes, you can claim it. But if you buy and install one this year, you’ll have to wait until next tax season to deduct the credit.

Bring your home up to speed with the latest on smart tech, security, utilities, environmental issues and more.

Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home, rental or otherwise, to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 26% credit would be $2,600, and you could claim 25% of that, or $650.

- $10,000 system cost x 0.26 = $2,600 credit amount

- $2,600 credit amount x 0.25 = $650 credit amount

Recommended Reading: How Many Homes Use Solar Power

What Does The Solar Tax Credit Cover

Taxpayers who installed and began using a solar PV system in 2021 can claim a federal tax credit that covers 26% of the following costs:

- All additional solarequipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

Can You Write Off Solar Panels On Your Taxes

The second tax incentive is called Backing Business Investment. The Economic Response document states:

If a business investment of up to $150,000 is made this financial year it can use the instant asset write-off incentive, but any investment regardless of its expense can deduct 50% of its price with normal depreciation applying to the rest, just so long as:

- The business has an annual turnover of less than $500 million.

- It occurs before the end of next financial year the 30th of June 2021.

You May Like: How To Start A Sole Proprietorship Llc

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

Irs Form 5695 Guidance:

The IRS guidance states that tax reductions apply to qualified solar electric property costs. Which are defined as:

Qualified solar electric property costs are costs for property that uses solar energy to generate electricity for use in your home located in the United States.

No costs relating to a solar panel or other property installed as a roof will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed.

Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit.

This is in contrast to structural components such as a roofs decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit. The home doesnt have to be your main home.

You May Like: Can Solid Wood Flooring Be Installed On Concrete

What Is The Federal Investment Tax Credit

Think of the ITC like a coupon for 26% off your home solar installation, backed and funded by the federal government. In the year that you install solar, the ITC can greatly reduce or even eliminate the taxes that you would have otherwise owed to the federal government.

The ITC was originally created by the Energy Policy Act of 2005, and was set to expire just two years later at the end of 2007. Thanks to the ITC, the growth of the solar industry helped create hundreds of thousands of jobs, injected billions of dollars into the US economy, and was a significant step towards cutting down on greenhouse gases, so it was very popular.

According to the Solar Energy Industries Association , The ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006. As a result, Congress has extended the expiration date multiple times to continue supporting that growth, including the latest extension that was part of the COVID relief bill and sets the expiration date at the end of 2023.

How Do I Claim The Solar Panel Tax Credit

To claim the solar investment tax credit in 2021, you will need to complete form 5695 when you lodge your tax return. On part 1 of the form, you will calculate how much you are eligible for, and then you enter that amount on your form 1040.

We have a step-by-step guide on how to claim the solar tax credit by one of our solar experts here at SolarReviews.com. If you need help claiming the tax credit use this article to help you through the process.

Read Also: How To Tie In Solar Panels To House

Eligibility For Solar Rebates

To qualify for solar rebates, you must purchase and install a solar energy system. There are no solar tax credit requirements for this incentive. Its also important to note that solar rebate amounts vary by state, so be sure to check with your local solar company for the specific amount available in your area.

No Refund Check Comes With The Solar Tax Credit Program

According to theSolar Energy Industries Association, Solar Investment Tax Credit is one of the most significant Federal policies supporting solar energy development in the USA. Since its inception, there has been a massive growth of solar adoption in the US by over 10,000%. It has seen the creation of more jobs and also increases in the US economy through billion-dollar investments. However, as a homeowner looking to install solar panels, no cashback comes from solar tax credit California. If, for example, your rooftop solar system installation costs $30,000. If you claim the 30% ITC, you are eligible to save $9,000.

Do you get this as a cash refund?

No, you will not get this claim in cash.

What happens?

Instead of the cash at hand, the money goes to your tax liability. This money helps you a great deal in reducing your yearly tax.

You May Like: How To Start A Solo Law Practice

Getting Your States Tax Credit

Many states also offer tax credits for solar some will continue even after the federal credit expires. Arizona and Massachusetts, for instance, currently give state income tax credits worth up to $1,000 toward solar installations. New York offers a state tax credit of up to $5,000. Marylands is $1,000 per system, plus 30 percent of the cost to install a giant battery to store the energy thats produced.

For details on your states programs, go to your states tax authority website, or to dsireusa.org, a catalog of all state energy incentives run by the North Carolina Clean Energy Technology Center.

Solar Tax Credit Tips

Here are a few tips to help you take advantage of the solar tax credit.

If youre considering installing solar panels on your home or business, make sure to do your research first. There are a lot of factors to consider, and its important to find the right solar energy system for your needs.

Learn more about state-level PBIs and SRECs. We go into more detail about them in this guide.

The solar tax credit is a great incentive, but its important to remember that its not the only thing you should consider when making the switch to solar. There are other benefits to solar energy, including lower energy bills and increased property value.

Make sure you take advantage of all the tax deductions and credits available to you.

The solar tax credit will be available through December 2022, so theres still plenty of time to take advantage of this incentive. If youre thinking about making the switch to solar energy, now is the time!

Don’t Miss: How Much Do Save With Solar Panels

Can You Claim The Solar Tax Credit If You Lease Your Solar Panel System

If you lease your solar panels, you do not qualify for the Solar Investment Tax Credit directly, but the company that you lease from may use that tax credit to help lower your monthly payments.

Many solar companies offer leasing options where they will pay for the installation and the cost of the equipment, and then they charge you a monthly fee for the use of those solar panels. The solar company acts as a third party and owns the panels during the terms of the lease, and the homeowner gets the benefit of lower monthly energy costs. Because the solar company owns the panels, they will typically receive the solar tax credit, and the homeowner wont qualify for the tax incentives. Solar leasing companies may use the value of those tax incentives to lower the monthly cost that they charge homeowners, but its typically not going to be a direct pass-through savings, as the solar company will want to retain some of that value.

If you lease your solar panel system, you will not typically receive most state and local solar incentives either, though again, the company you lease from may use those incentives to offset their costs and help lower your monthly payment. In some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates , but this depends on where your home is located.

New York City Real Property Tax Abatement Program

If you live in New York City, ask your participating contractor about the NYC Real Property Abatement Program, which New York City offers in lieu of the New York State Real Property Tax Exemption. Confirm your contractors process for submitting and handling the appropriate forms, as some contractors may do it on your behalf.

Don’t Miss: How Much To Get Solar Panels On Your Roof

Solar Service Plans And The Tax Credit12

The sun rises every day. Capture its energy for your home.

Many homeowners want to go solar, yet, they want to avoid the upfront cost of purchasing a system outright with cash. With a solar service plan, sometimes known as a solar lease or Power Purchase Agreement, you can be part of todays solar revolution.

Sunrun can readily help you with a solar service plan. With this option, however, homeowners do not directly receive the federal tax credit. Instead, Sunrun passes along the financial benefits in the form of smaller monthly bills. You still get the benefits of the tax credit, without having to pay for a system upfront.

Financing a home solar system through a solar service plan requires $0 down and no capital investment since it is funded through third-party party ownership . With a solar service plan, the tax credit is leveraged by solar companies to reduce homeowners monthly electric costs.

Since the TPO owns the solar system, the TPOnot the homeowneris eligible for all rebates, tax credits or other incentives. Yet, homeowners still benefit from incentives through lower electricity rates.

Sunrun and other solar installers pass on the savings to homeowners by decreasing their monthly electricity rates, based on the total value of incentives that the company receives.

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

Also Check: Should I Get A Solar Roof

We Hope You Enjoyed Our Solar Tax Credit 2022 Guide

Solar tax credits are still available to taxpayers in 2022. However, they will reduce from 26% of the total cost of installing solar panels to 22% by 2023. Then, in 2024 they will no longer be available to residential taxpayers.

Are you considering going solar-powered this year? If so, you must do so before the end of December 2022. This will ensure that you receive solar tax credit 2022 for the full 26%.

Dig a little deeper into your state solar tax credit offerings. You may find that solar rebates or other solar incentives are available to you, which will further reduce the cost of your solar energy system!

We hope you enjoyed reading this solar tax credit 2022 guide. Read more helpful guides from Tax Savers Online!

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Recommended Reading: How To Heal Solar Plexus Chakra

What Is Not Eligible

Equally as important is for consumers to understand that there are costs incurred on a residential dwelling or a commercial building that may be ineligible costs for the solar rebate program or the investment tax credits. For example, if a homeowner includes new insulation to the dwelling or adds LED lighting to the interior and exterior to efficiently use the electricity generated by the solar system, these items are not eligible for the Federal investment tax credit.

Prior to 2018, these costs may have been eligible for another incentive under §25C for a one-time tax credit of up to $500.00 for Residential Energy Efficiency, however there has been no guidance as of this writing from the U.S. Congress on whether the Residential Energy Efficiency tax credit will be extended beyond its expiration date of 12/31/2017.