There Are Two Types Of Feed

The feed-in tariffs you may receive depends on the date SA Power Networks gave permission to connect the system to the main electricity grid.

Any payments your system earns will get credited to your electricity account by your electricity retailer.

Solar Tax Credit Tips

Here are a few tips to help you take advantage of the solar tax credit.

If youre considering installing solar panels on your home or business, make sure to do your research first. There are a lot of factors to consider, and its important to find the right solar energy system for your needs.

Learn more about state-level PBIs and SRECs. We go into more detail about them in this guide.

The solar tax credit is a great incentive, but its important to remember that its not the only thing you should consider when making the switch to solar. There are other benefits to solar energy, including lower energy bills and increased property value.

Make sure you take advantage of all the tax deductions and credits available to you.

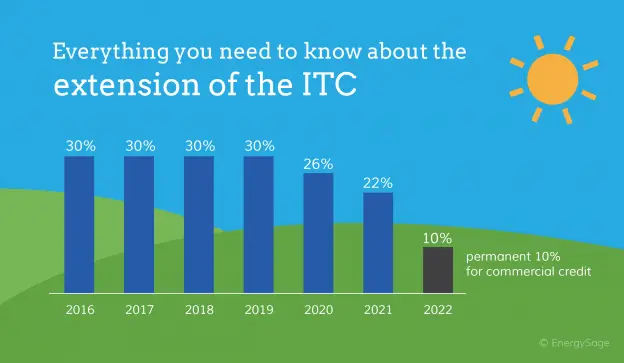

The solar tax credit will be available through December 2022, so theres still plenty of time to take advantage of this incentive. If youre thinking about making the switch to solar energy, now is the time!

Solar Renewable Energy Certificates

Solar renewable energy certificates are a performance-based solar incentive that enables you to profit from solar power generation. An SREC is earned for every megawatt-hour or 1,000 kilowatt-hours of electricity your solar panel system creates as a homeowner.

Have you heard people talk about generating power with solar panels and then selling it back to the grid? They probably meant they were making SRECs.

The amount of money youre eligible for by selling SRECs depends on your state, as each varies in its solar policies. In some states, residents may receive a rebate instead of SRECs.

SRECs are used to prove that a solar system is producing renewable energy.

To learn more about solar tax credit in 2022 and SRECs, speak to a solar energy specialist in your state. They will be able to help you understand how the solar tax credit works and whether or not youre eligible.

Solsystems in Washington DC and SRECTrade are both businesses that buy and sell SRECs. Some states have local government initiatives to enable selling SRECs.

For example, New Jersey has an SREC registration program. Its managed by New Jersey Clean Energy for residential rebates. They also support commercial, industrial, and local government clean energy tax incentives.

You May Like: How Small Can Solar Panels Be

Will Solar Energy Become Too Expensive

Certainly, solar power will not be unaffordable. Judging from how the price of solar power has been dropping in the last 10 years, it is unlikely that the price will remain about the same.

Taking a quick look at how the trend has been, the price of a 5Kw solar system in 2008 was $40,000, and in 2016 it was valued at $6,500. This is a huge decline in price.

Moreover, even as technology continues to improve, solar power still continues to be affordable for many people. Again, with the Australian government still encouraging people to use solar power, it is, without a doubt, that prices will not shoot to unaffordable levels. It will still be affordable to install solar power systems for most people.

How Much Rebate Do I Get For Solar Power

Under the STC program, a megawatt-hour in energy production is eligible for a renewable energy certificate . The STCs are only issued for the solar panels and the solar power systems that are meet the recommended standards.

The amount of rebate you get for solar set up depends on three factors such as the state or location, the fluctuation value of the STCs and the deeming period, it goes up every year.

You can use an STC calculator to know how much STC you qualify for. Here is how to calculate the number of STCs you are eligible for: The size of the solar system x the postal code rating x the Deeming Period. If the deeming period is short, you will get lesser STCs. For Example, in 2018, the deeming period was 13 years, in 2019 it is 12 years.

Don’t Miss: Is Non Small Cell Lung Cancer A Solid Tumor

Do I Qualify For The Solar Panel Tax Credit

As long as you own your solar energy system, you are eligible for the solar tax credit. Even if you dont have enough tax liability to claim the entire credit in one year, you can roll over the remaining credits into future years for as long as the tax credit is in effect. However, remember that if you sign a lease or PPA with a solar installer, you are not the owner of the system, and thus you cannot receive the tax credit.

Stcs Are The Federal Government Rebate Meaning Every State Can Claim This

Essentially, when I say solar panel rebate Im talking about the federal solar rebate in the form of STCs. These are available nationwide for all homeowners and are really easy to claim and get. This is the panel rebate that will be phased out by 2030.

This is the main solar panel rebate and probably the most important one. You can save a considerable amount on your solar system using this helpful incentive.

Id say that Small Scale Technology Certificates are the most popular financial incentive given by the government. STCs are certificates given to homeowners when they install a small renewable energy system at their home.

Its easy to look at STCs like shares in your solar system which you can sell for money. Essentially they are environmental credits given by the government as rewards or incentives for buying solar.

Also Check: What Do I Need For Solar Panels

How To Claim Solar Tax Credit

Those who are eligible and who wish to claim the credit should file IRS Form 5695 with their tax return. Part I of the form calculates the credit. The final amount is listed on the 1040 form. Individuals who failed to claim the credit when they were supposed to can file an amended return later.

Residential solar energy investors claim this tax credit under Section 25D, while commercial solar investors claim it under Section 48. Individuals claim the residential tax credit on their personal income taxes, while businesses that claim the credit do so on their business taxes.

Adding Battery Storage Or Other Renewable Generators

If you receive the 44c per kWh distributor feed-in tariff, you will stop receiving it if you install an energy storage device or another grid-connected renewable generator. This is because it is not possible to distinguish between the electricity fed into the grid from the solar PV system and a storage device or generator.

Anyone who installs battery storage or a renewable generator may be able to receive a retailer feed-in tariff. Electricity retailers have a variety of energy offers for customers with battery storage or renewable generation visit the Australian Governments Energy Made Easy website to compare offers available in South Australia.

Read Also: How Much Are Solar Panels In California

Victoria & South Australia Has The Best State

Overall, Id say that Victoria and South Australia have the best state owned solar panel and battery rebates. This is because they actually give you a direct rebate / discount off the cost of your solar panels or battery system.

The other states just seem to provide an interest free loan which is still good, but not quite as fancy as getting a huge chunk of your system paid for. It would be interesting to see if any extra rebates get added in the future by these states.

As we now move into a booming demand for EV vehicles, it would be good to see a rebate available on home EV charging systems. Homeowners can then take advantage of getting a solar EV charger installed at their home and maximise their savings.

So, for anyone living in these two states Take advantage of these rebates whilst they are still available. Honestly, they drop so quickly and its best to get them while theyre hot.

The Solar Rebate Ending Is Online Nonsense

If you have the internet and so arent reading this by peeking through your neighbours curtains, you may have noticed ads appearing on Facebook4 and other sites saying you have rush and get solar panels now because the solar rebate is ending or trying to imply thats the case without directly saying so. Either way they are attempting the old hard sales tactic of convincing people they have to act now or miss out.

My favorite is this Facebook ad that tries very hard to create the impression you have to hurry while technically not lying at all:

This could be your last chance to take advantage of the solar rebate before Summer starts!

I suppose that with only a couple of days to go until the end of November, this technically would be your last chance to to take advantage of the solar rebate before summer. There will be no change in the solar rebate between November and December, but since thats when summer officially starts they are not technically lying. Ill leave it up to you to decide if they are technically being misleading.

Don’t Miss: How To Run My House On Solar Power

How Much Is The Solar Rebate In 2022

Solar rebates in 2022 will still see those installing solar power systems in their properties receiving generous incentives.

So, anyone who missed the opportunity to install a solar panel system in their home has the chance to become part of the solar rebate scheme in 2022.

For instance, if a person residing in Adelaide installs a 6.6kW solar system, the incentive offered by the State of SA is around $3,157, according to the current STC values on the open market. This means that the early part of 2022 is a good time for one to install solar power systems.

Full rebate information for other states can be found below:

| Zone 4 |

The Value Of The Queensland Solar Rebate Will Go Down

Something to consider is that the solar rebate in Queensland is always changing in price. Just a few years ago the price of these STC rebates was dropping fast. At one point years ago, it went to as little as $17 per STC.

Thats nowhere near as good as $30-40 what you can get right now. So, in saying this its important to consider that the qld solar rebate cannot be relied on. Its best to get solar now before the price of the rebate drops again.

Its important to ensure that you have done your research before rushing into getting your solar rebate though. Remember, you can only claim the rebate once so dont waste it on crap solar installation You can see the difference between good and bad panel installation here.

Recommended Reading: How To Start Sole Proprietorship In Florida

What Expenses Are Included

The following expenses are included:

- Solar PV panels or PV cells used to power an attic fan

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that are charged exclusively by the associated solar PV panels, even if the storage is placed in service in a subsequent tax year to when the solar energy system is installed

- Sales taxes on eligible expenses

The Solar Rebate That Is Not Officially A Rebate

To make things confusing, the current rebate for anyone buying a solar system of up to 100kW is called the STC program. Which stands for Small-scale Technology Certificate. The government says that this should not be called a solar rebate.

From the Clean Energy Regulator website:

Under the Small-scale Renewable Energy Scheme the reduction in the cost of your solar panel is not a rebate. You will not qualify for any Government-based financial recompense at the completion of any process relating to STCs.

I think what our government friends are trying to get across is that the thousands of dollars you get off your solar system price does not actually come from the government.

It is a government program, but it compels other people to buy your certificates. So it is a government run scheme, using other peoples money to provide the subsidy.

Now, you could argue that all government subsidy and incentive schemes use other peoples money!

But Im not gonna pick a fight with the Clean Energy Regulator so from now on I will try to refer to the rebate as the solar financial incentive then!

The solar rebate financial incentive subsidises the upfront cost of installing a solar power system and is not means-tested in any way. The only criteria for claiming it are:

1) Your PV system is less than 100kW in size.

2) You get it installed and designed by a Clean Energy Council accredited professional.

You May Like: How To Make Sole Proprietorship Into Llc

How Do I Claim The Solar Tax Credit

You claim the solar tax credit when you file your yearly federal tax return. Remember to let your accountant know youve gone solar in the past year, or if you file your own taxes, use EnergySages step-by-step guide on how to claim the solar ITC.

More resources on the extension of the federal ITC

- The Wall Street Journal explores the legislation and what it means for todays homeowners.

- Greentech Media conducted an in-depth analysis of the solar tax credit extensions impact on the broader solar industry.

- Read the language of the official bill .

Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

Don’t Miss: What To Look For In A Solar Company

Who Provides The Solar Panel Rebate

Well, were all thinking the same thing. Ok then, where is this money coming from? The solar panel rebate is provided by the government as an incentive for homeowners to move to solar energy.

This is provided by the federal government of Australia and is offered nationwide to all homeowners in every state. Now, there are also other rebates available at state level. These are in place by the state governments.

Each panel rebate is slightly different from state to state and is provided by the Small-scale Renewable Energy Scheme in Australia. The Clean Energy Regulator provides two schemes:

Large scale renewable energy targets which encourages investment in renewable power stations. These are pretty much commercial solar rebates. Small scale renewable energy scheme which supports small scale installations like solar panels and solar hot water systems. These are the most common, residential solar panel rebates.

These rebates are offered in the form of a certificate by the REC which requires you to be a member to claim these incentives.

This is an important factor to consider, which is why your solar installer will help. Ill go into more details about the easiest way to claim rebates below.

Solar Hot Water Incentive

Eligible Victorian households get a 50% incentive of up to $1000 on solar hot water systems. Installing a hot water system can help you save between $140-$400 annually.

Who is eligible for a Solar Hot Water incentive?

Property owners from Victoria must pass the following criteria to get a Solar Hot Water incentive:

- You own and occupy the property

- You have a combined income of not more than $180,000 annually

- Your property should have a value of under $3 million

- The hot water system being replaced should be more than three years old from the buying date

- Solar Homes Program have not previously offered you a battery incentive or solar PV incentive

- Your property shouldnt be new

- Your heat pump or solar is on the approved list of the Solar Homes Program

How to apply for a Solar Hot Water incentive?

If you have confirmed your eligibility, it is time to start the solar hot water installation process. Ensure that you dont install a solar hot water system before Solar Victoria confirms eligibility. Unless you have an emergency, you wont receive the incentive if installation happens before eligibility approval.

1. Get a Quote

First, you need to obtain a solar hot water installation quote. Inform your solar retailer that you plan on getting a Solar Hot Water incentive.

A quote will help you apply for an eligibility number. The eligibility number helps your installer confirm that they can start the installation.

2. Apply for eligibility

3. Install the system

Apply for eligibility

Don’t Miss: How Many Solar Panels For 1500 Kwh

When Does The Solar Rebate End

The government solar rebate ends in most states on 31st December 2030. In 2011, the Australian government introduced the solar rebate initiative to encourage the citizens to use solar energy and save on electricity costs.

Initially, people thought that this initiative was to end a few years later, however, the government thought of phasing the rebate gradually. This phase was set to take 15 years and ends on the 31st December 2030 and serves the greater parts of the country.

The small-scale certificate systems started on 1st January 2017. Once these solar rebates by the government end, people will no longer receive rebates for the installations of solar systems in their properties.

How Does the Solar Rebate Work?

Before you concern yourself about when the solar rebate ends, you also need to be conversant with how the rebate works. Several factors determine the working nature of the solar rebate.

The first and the most common one is the property location. Regions with more sun exposure hours mean that the solar system will be generating more power than those that receive a lower amount. That is, a person residing in Western Australia will receive more rebates.

The size of the solar system installed is another determinant of the amount of rebate that one receives. If your panel is large, then expect to receive a higher solar rebate. Note that solar rebates are centralized through STCs issuance.

Solar Rebate by State

Solar Rebate New South Wales

| System Size |

| $886.5 |