What Are The Tax Implications Of Each Business Structure

To file taxes, you report your operating results, including profit or loss, by submitting Profit or Loss From Business with your personal 1040 tax return. An LLC is very flexible and can also be taxed as a sole proprietorship, a partnership, or a corporation.

A sole proprietor also benefits from pass-through taxation, so you’ll report your business’s income or loss in the same way. The difference is that you don’t have the option to file as a corporation.

You’re also not required to pay taxes on the full amount of your sole proprietorship’s income. Instead, you’ll only pay taxes on the profit of your business.

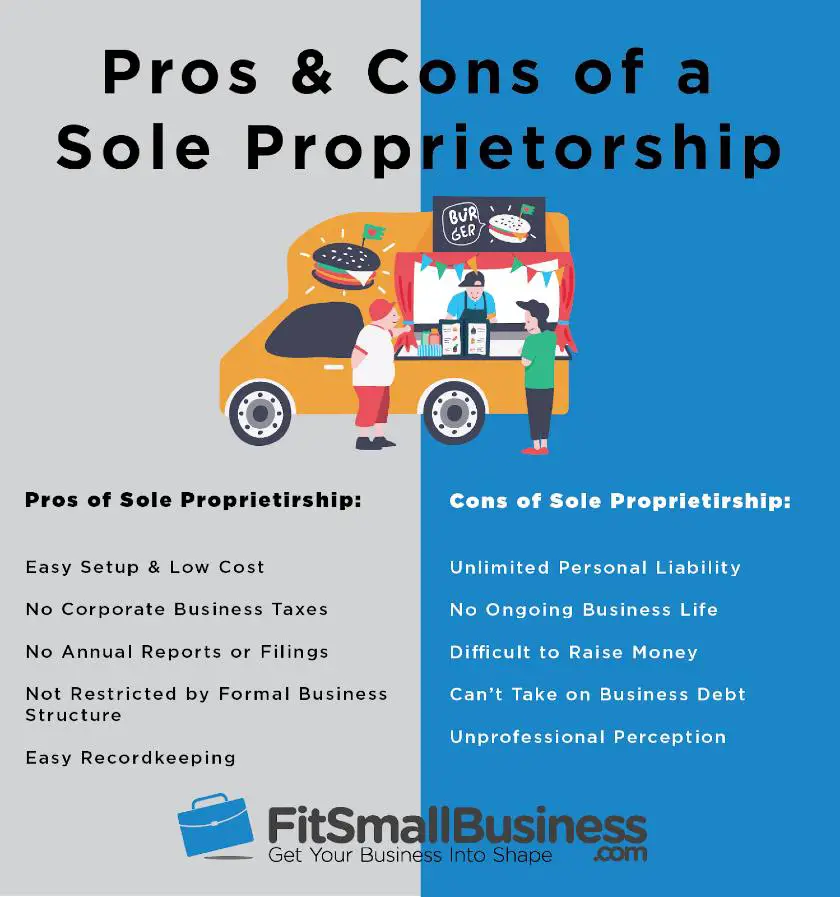

Benefits Of Sole Proprietorships

A sole prop is a common choice for new businesses and entrepreneurs because it offers the following advantages compared to LLCs:

- Simplicity. Its relatively easy and inexpensive to establish. If youre the only owner and employee performing your business activities, then youve already formed your own sole prop. Establishing other business structures, like an LLC, requires paperwork and processing.

- Income tax filing considerations. The owner and business are considered the same entity and generally will only have to file one federal income tax return and one state income tax return so income is only taxed once. Single-member LLCs could offer this same advantage If a second owner joins the businesses, the sole proprietorship will then be required to file partnership tax returns.

- Fewer guidelines. Sole props have fewer regulatory requirements than other business structures. LLCs require a formal registration process including a separate and unique business name and registering an agent to correspond on behalf of the company. Many states charge filing fees for LLCs.

You May Like: Can You Make Money On Solar Panels

Where Should You Form An Llc

If you determine you want an LLC, you also have to decide what state will be the home base for your business. For most people, this is a fairly easy decision as they want the company to register where they are doing business. Other people prefer to file in a different state, like Delaware, even if they are not based there. Delaware is the state of choice for many investors. While the process is a little more expensive as you need someone to act as your local registered agent, it can be an important choice if you plan to raise capital for your business. It’s also important to point out if you form your LLC in one state and plan to do business in another state, you will need to register in other ones where you do business, which will increase your startup costs.

Read Also: What Size Solar Panel To Charge 50ah Battery

Pros And Cons Of Limited Liability Corporations

With the limited liability characteristics of a corporation and the convenience of a flow-through income taxation , this option is suitable for multiple ownership circumstances.

| The Pros | The Cons |

|---|---|

|

You have the flexibility of being taxed as a sole proprietor, partnership, S corporation or C corporation. |

As an LLC member, you cannot pay yourself wages. |

|

Less paperwork and lower filing costs |

High renewal fees or publication requirements can be pricey, depending on your state. |

|

You can form an LLC with as little as one person, but you can also have an unlimited number of members. |

Many states have a franchise or capital values tax on LLCs, ranging from a flat fee to an amount based on the companys revenue |

|

Flow-through income taxation, keeping things simple |

Investors may be more likely to put their money into a corporation, making it harder to raise financial capital |

|

Members are protected from some liability if the company runs into legal issues or debts. |

Unless you are running the LLC alone, the ownership of the business is spread across its members |

|

Members can receive revenues that are larger than their individual ownership percentage. |

Which Is Better: Llc Or Sole Proprietorship

Each business structure has its own benefits, so you cannot say that one is better than the other. An LLC is good for those looking for low-risk businesses, as it offers personal liability protection. Aside from the legal protection, you also get more credibility.

However, a sole proprietorship involves less paperwork hassle. You won’t have to file for as many licenses, nor do you need to pay as many annual fees. However, you do get less credibility, as it’s the most basic type of business structure.

You May Like: How Much Do Solar Installers Get Paid

Whats The Difference Between A Sole Proprietor And An Llc

A sole proprietor is defined by the IRS as a person who owns an unincorporated business. Any person who does business but isnt registered as a corporation, partnership, or limited liability company is a sole proprietor by default.

A sole proprietor is personally liable for any debt accrued by the business, including lawsuits and other business obligations. If a sole proprietor owes money from a lawsuit judgment or any other debt and the business assets are not enough to cover it, creditors could go after personal assets.

A person who owns a business alone can also file for LLC status. If an LLC owes money that it cant pay, the owners personal assets are protected and creditors wont be able to reach them.

Which Business Organization Takes The Lead

If you want complete autonomy over your organization, then a sole proprietorship or a single-member LLC is the best choice. The two company types let you single-handedly manage business operations, set up policies, and determine resource flow. However, you also shoulder losses alone. The only benefit a single-member LLC has over a proprietorship is it gives the owner limited liability.

A multi-member LLC gives you control of a portion of the business. You do not have absolute power, but your voice is crucial. Furthermore, your profits might depend on your capital contribution, if the operating agreement stipulates as much.

Although you wont be paying business income tax, youll still have to pay the self-employment tax, too. The significant benefits of a multi-member LLC are that you get limited liability and only pay for a portion of company losses.

Recommended Reading: How Do Solar Panels Work On A Home

Llc Vs Sole Proprietorship: How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Choosing a business entity structure for your company is one of the most importantbut potentially most confusingdecisions youll make as a small business owner. Unless youre a lawyer or tax expert, the differences between each type of business entity can be hard to understand in real-life terms. However, your choice of business entity does have real-world impact, such as how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

New business owners are often confused about the difference between a limited liability company and sole proprietorship. In this guide, well look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

Can You Mix Business Funds And Personal Finances

Sole proprietors don’t have to worry about mixing business and personal accounts from a legal standpoint. In the eyes of the law, they’re regarded as one and the same. However, the practice is still discouraged by most experts.

In an LLC, you must be careful to keep banking records and funds separate from your own personal records and funds. Violating this rule can result in the loss of your limited liability protection.

Also Check: How Many Batteries For A 400 Watt Solar System

Whats The Difference Between An Llc And A Sole Proprietorship

A limited liability company is a legal entity formed at the state level. An LLC exists separately from its ownersknown as members. However, members are not personally responsible for business debts and liabilities. Instead, the LLC is responsible.

A sole proprietorship is an unincorporated business owned and run by one person. This option is the simplest, no muss, no fuss structure out there. You are entitled to all the profits of the business.

However, unlike an LLC, you are also responsible for all of the liability.

Recommended Reading: How Big Is A 1000 Watt Solar Panel

Formation And Compliance Requirements

Sole proprietorships are the simplest business structure to set up because theres little paperwork involved.

Theres a nominal fee ranging from $10 to $50

Don’t Miss: Will A 5kw Solar System Run A House

Get Business Licenses And Permits

You need to register new business licenses and permits for your LLC. Check with your state to find out which licenses and permits apply to your business. Licenses you might need include a business license, sellers permit, and zoning permit.

You must apply for a new Employer Identification Number with the IRS. This is true even if you already have an EIN for your sole proprietorship.

Do you need a simple way to record business transactions? Patriots online accounting software is easy to use and made for the non-accountant. We offer free, U.S.-based support. Try it for free today.

Apply For A New Bank Account

When you form an LLC, you create a new legal entity. The business has many of the same rights as a person, including being able to own property and open a bank account.

Opening a bank account under the name of the LLC helps you separate business and personal funds. A helps you protect personal assets, keep records, and report taxes.

Read Also: Is Iceland Good For Solo Travel

Advantages Of An Llc:

- Owners aren’t personally liable for debts or lawsuits

- Easier to obtain equity, small business loans, or venture capital.

- You have the flexibility of choosing how you file your taxes including as an S-corporation or C-corporation which could save you money depending on the amount of revenue your business generates.

- If you have multiple owners of a business, this is an easier option than filing as a corporation.

Ease Of Raising Money

Sole proprietorships have more difficulty raising money than an LLC. For starters, a sole proprietorship may be viewed as having less credibility, since the business owner did not take the time or pay the expense to incorporate or form an LLC. Lack of credibility makes it harder for a sole proprietorship to get loans, and could force the business owner to rely on business assets and personal credit history to raise funds for the business.

LLCs may offer ownership interest in the business in exchange for money which will help finance the company’s expansion. When a sole proprietor offers ownership in the business to another business or person, the company will no longer be treated as a sole proprietorship.

Read Also: When Should Babies Start Solid Food

Registering The Business Name

Sole Proprietorship In a sole proprietorship, the business owner IS the business. If the business will operate under a name other than the owners legal name, the owner must file a Doing Business As . For example, if John Wilcox operates his business as John Wilcox Plumbing and Heating, he will not need to do a fictitious name filing. If, however, he wants to call his business, West End Plumbing and Heating, he will need to submit the fictitious name to the state for approval. Some states also require advertisements or notices be run in a local or legal newspaper to disclose to the public who is operating the business under the DBA.

Limited Liability Company When registering an LLC, the business name is automatically registered when formation documents are filed. In some states, its possible to reserve a name in advance of formally registering the business. Name reservations expire after a certain amount of time if not renewed or if business registration isnt completed. Most states require an LLC to include the designation of LLC,Limited Liability Co.,Limited Liability Co. or some other identifier after its name.

What Is A Sole Proprietorship And What Does It Do

Heres a short video explaining how it works.

Essentially, you work for yourself and represent your business. The sole proprietor and the sole proprietorship are not separate legal entities. And so, the business owner is responsible for all aspects of the company.

For example, most self-employed individuals report their freelance income as sole proprietors on personal tax returns. And so do members of the limited liability companies .

According to the latest government stats, 86% of businesses without employees operate as sole proprietorships. This stat, however, also includes single-member LLCs who also report business taxes under this category.

Recommended Reading: Can You Put Solar On A Mobile Home

Llc Vs Sole Proprietorship Tax Differences

Choosing to be a sole proprietor vs LLC doesnt directly have anything to do with taxes. Even if you form an LLC, youll continue to pay taxes as a sole proprietorship, where the profits pass through to the owners personal income. This is the default tax treatment for single-member LLCs.

If your LLC has multiple owners, youll each pay taxes based on a percentage of ownership. The separation of an LLC from the owner for liability purposes isnt what determines your tax situation.

In tax terms, the biggest difference between a sole proprietor and LLC is that an LLC has whats called tax flexibility. That means you can request to be taxed as an S Corp or C Corp.

There are differences between S Corps and C Corps, especially when it comes to taxes. You can consult with a tax advisor on whats best for your situation or read our guide to S Corps vs C Corps.

The most important difference is that C Corps pay corporate income taxes in addition to requiring their owners to pay personal income tax on their salary and corporate distributions this is called double-taxation. S Corp owners only pay personal income tax on their wages and the company profits that are passed through to their personal tax return.

The bottom line is theres not a big difference between LLC vs sole proprietorship taxes, unless you elect to have your LLC taxed as a C Corp or S Corp.

Highlights Of The Two Business Structures

Heres an at-a-glance run-down of some highlights to compare a sole proprietorship vs. LLC business structure:

- Sole proprietorships are generally less expensive to establish and easier to maintain administratively.

- In a sole proprietorship, owners are taxed at the applicable individual income tax rates on profits that the business makes.

- LLCs shield their owners legally, providing a level of personal liability protection against debts of the business.

- LLCs must complete formation documents, register with the state, and pay a filing fee.

- LLCs must follow their states laws that govern the LLC entity type. They may need to pay annual fees, file annual reports, and hold annual meetings.

- LLCs must keep their company records and funds separated from those of their owners.

- LLCs have tax flexibilitythey may choose to be taxed as a sole proprietorship , C Corporation, or S Corporation.

As you can see, there are potential pros and cons to each business structure. Which will be the best option for you will depend on your specific circumstances and objectives.

Read Also: How Much Does It Cost To Produce Solar Panels

Can I Pay Myself A Salary As A Sole Proprietor

In theory, yes. But it wont make a difference in how youre taxed. As a sole proprietor, all of your businesss income is considered your personal income. So even if you had a separate business bank account that you drew a salary from, all of the money your business madenot just the salary youre choosing to withdrawwould be taxed as your personal income.

When To Use An Llc

LLCs offer taxation benefits, increased credibility, and most importantly, personal liability protection.

LLCs are recommended for businesses with the following characteristics:

- Larger customer base

- Potential for immediate and sustainable profit

- Increased risk of liability or loss

- Would benefit from unique tax options

Advantages of LLCs

- Personal Liability Protection. LLCs provide personal liability protection. This means your personal assets are protected in the event your business is sued or if it defaults on a debt.

- Tax Benefits. LLCs and have options to customize their tax structure. This allows businesses to use the best tax strategy for their circumstances.

- Growth Potential. LLCs can grow in profit and risk because they provide personal liability protection and tax benefits.

- Credibility and Consumer Trust. LLCs generally earn more trust from both banks and consumers than do informal business structures like sole proprietorships. This can impact a business’s ability to take out loans and can affect marketability.

Ready to Form Your LLC?

Our free guide walks you through the process of LLC formation in all fifty states. In just five easy steps, you can be on your way to owning your own business.

You can also use an LLC formation service to register your LLC for you.

Also Check: How To Connect Solar Power To House