Do I Qualify For The Solar Tax Credit

If you installed solar panels or will install them by December 31, 2022, and you own your solar energy system and property, you will likely qualify whether you have a residential or commercial system. If you lease your system, you wont be eligible for the tax credit.

To qualify for the 2022 tax deduction rate, you must begin your solar project by Dec. 31. What does that mean? The IRS defines the beginning of construction for energy tax deductions in two ways. The first way to qualify is if significant physical work is underway by the deadline. In solars case, that might look like the beginning of panel installation or preparing a roof to bear new panels.

The other way to prove construction has commenced is if the taxpayer completes the Five Percent Safe Harbor, meaning they have put 5% down toward their solar panels. If using physical work or a 5% down payment, you will need to continue making steady progress on construction. Either way, this rule makes it incredibly easy to take advantage of the 26% deduction before the end of the year.

To get the incentive, you will need to keep the receipts for the system and claim the credit on your taxes, just as you might claim any deduction. If you cannot claim the whole credit in one tax year because you do not have enough liability, you can rollover the credits into future years, as long as the solar tax credit remains in effect.

Availability Of Solar Rebates

Solar rebates are available in most US states. However, they are not available in every state. You can check with your local solar company to see if solar rebates are available in your area.

If solar rebates are not currently offered in your state, dont worry! There are other solar incentives that may be available.

Additionally, solar rebates are changing rapidly. You can check with your solar company for the most up-to-date information about solar rebate programs in your area or visit EnergySages Rebate Database to see what solar rebate opportunities exist near you!

How Does The Itc Work For Businesses

Importantly, the ITC is a tax not a tax deduction. However, MACRS and bonus depreciationtwo other great incentives that help businesses go solarreduce your taxable earnings. Heres what that means in practice, with an example $100,000 solar panel system for a business with $100,000 in taxable income to keep the math simple:

If you have earnings of $100,000 on a 37 percent tax rate, then youll pay $37,000 in taxes. Both MACRS and bonus depreciation reduce your taxable earnings, meaning for a $100,000 solar project, bonus depreciation will reduce your taxable earnings by $87,000. So instead of paying taxes on $100,000, youll pay taxes on $13,000, meaning youd owe $4,810 in taxes instead of $37,000 pre-solar. In that way, bonus depreciation provides a benefit while helping you save on what you owe in taxes.

The ITC, on the other hand, is a direct credit on your taxes: instead of reducing the your taxable earnings, the ITC just is a credit towards what you owe. So with the same example above, and at the current 26 percent rate, the ITC would reduce how much you owe in taxes by $26,000, dropping what you owe from $37,000 to $11,000.

And the cool thing about it is that, as a business, you can take advantage of both the ITC and bonus depreciation, leading to pretty significant savings from solar.

Also Check: Where Can I Buy Sol Beer

What Does The 2021 Tax Credit Cover

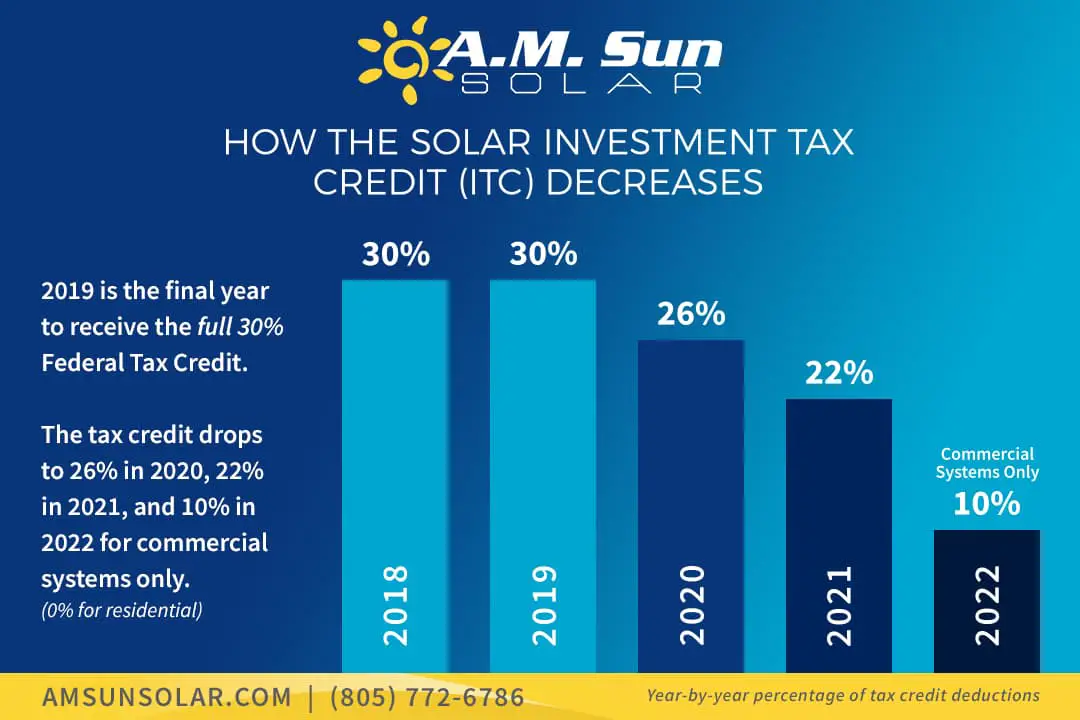

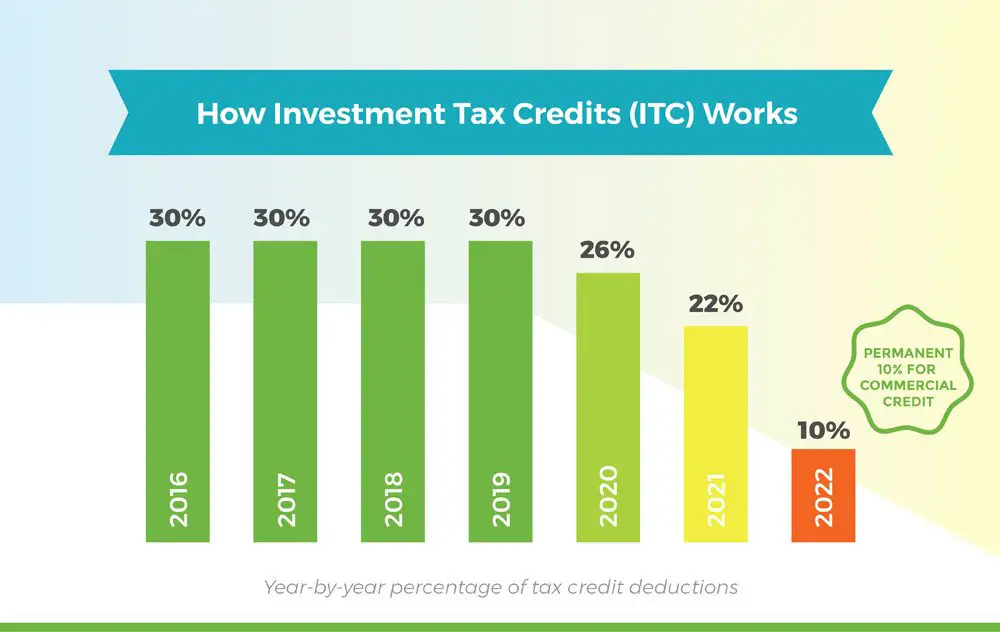

The 2021 solar tax credit provides a 26% credit for systems installed in 2020 through 2022, and 22% for systems installed in 2023. Systems installed prior to Dec. 31, 2019, were eligible for a 30% credit.

When filing your next tax return, homeowners will be able to include the following expenses:

- Solar PV panels or PV cells used to power an attic fan

- Labor costs for preparation, assembly, and/or installation

- Permitting fees, inspection costs, and developer fees

- Equipment such as wiring, inverters, and mounting hardware

- Energy storage devices that are charged exclusively by the associated panels

- Sales taxes on eligible expenses

While some local or state solar tax credits might place limits on the amount that can be claimed, three is no such maximum for the 2021 solar tax credit.

Atlantic Investment Tax Credit

2.54 The Atlantic investment tax credit in subsection 127 is a credit equal to 10% of the capital cost of prescribed energy generation and conservation properties that are used primarily for the purpose of the following activities:

- manufacturing or processing goods for sale or lease

- farming or fishing

- storing grain or

- harvesting peat

and the activities are carried on in the Atlantic provinces, the Gaspé Peninsula and their associated offshore regions.

2.55 The Atlantic investment tax credit applies to the following qualified properties which are defined in subsection 127:

- prescribed energy generation and conservation property which includes all the properties described in Class 43.1and 43.2 acquired by the taxpayer after March 28, 2012 and

- prescribed energy generation and conservation properties that are leased in the ordinary course of carrying on business in Canada by a corporation:

- whose principal business is leasing property, lending money, purchasing conditional sales contracts and account receivables

- who manufactured and leased the property and the lessors principal business is manufacturing the property it sells or leases or

- whose principal business is selling or servicing properties described in Classes 43.1or 43.2.

2.56 Where a prescribed energy generation and conservation property is leased, the lessee must use the leased qualified property in the activities described in ¶2.54.

You May Like: What Does A Solar Installer Do

What Does The Solar Tax Credit Cover

Taxpayers who installed and began using a solar PV system in 2021 can claim a federal tax credit that covers 26% of the following costs:

- All additional solarequipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

Impact Of The New Itc Extensions

The ITC has resulted in an extremely effective subsidy in catalyzing both rooftop and utility scale solar energy adoption across the U.S. The multi-year extension from late 2015 has caused the cost of solar to drop, while installation rates and technological efficiencies have improved. The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st-century energy systems and technology.

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the US by 2015, and they predict we will have nearly 100 GW total by the end of 2020. From 2015 to 2017 there was a 25% increase in the number of solar industry jobs and that number is forecasted to increase throughout the next decade. The federal solar rebate program is proof that long-term federal tax incentives can drive economic growth, technological innovation to reduce costs, and create a new generation of jobs and skillsets. We offer commercial solar in 26 states, Washington D.C., and Puerto Rico, to find out more about the ITC close to you, contact us today.

Also Check: Will Solar Panels Work During Power Outage

Things To Know About The Residential Solar Itc

The tax credit is not a refund, it is a credit. The federal government will not send you a check in the amount of the credit but rather the IRS allows you to deduct 26% of the cost of your solar system from what you owe in taxes.

You need tax liability to benefit from this incentive.

The IRS allows a carryover of unused solar tax credits to subsequent years, up to five years. For example, if your 26% credit is worth $6,000, and you only owe $3,000 on your 2019 taxes, you can apply the remaining $3,000 to your 2020 tax liability. CALSSA recommends consumers always consult with a tax professional for tax advice.

Simply purchasing a residential solar system by the end of the year is not enough to claim the full tax credit. The IRS says the system must be placed in service before the end of the year, meaning the system is installed and capable of being used. The process of signing a contract and installing a system can sometimes take several weeks.

If a solar system is placed in service in 2022, you will qualify for a 26% tax credit instead of 22%.

You must purchase the system to claim the ITC. Consumers may not claim the tax credit for leases or Power Purchase Agreements . Paying cash or financing the system through a loan or PACE does allow you to claim the ITC.

California also provides rebates for home battery systems. This incentive is in addition to the tax credit but consumers need to account for the rebate when claiming the tax credit.

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

Recommended Reading: How Home Solar Panels Work

Energy Storage And The Federal Solar Tax Credit

The primary requirement is that you own your home solar system. When homeowners add a home battery, it must be charged at your home by an on-site renewable energy system like solar . This is necessary for the home battery to be considered renewable, and for its cost to be eligible for the tax credit.

So, for your battery cost to be included in the tax credit, you must show that its only charged by renewable energy. To earn the tax credit for your battery cost, Sunruns solar guides can easily help you document how your home battery is charged solar.

When And For How Long Can I Claim The Solar Tax Credit

If youre eligible for the ITC, but you dont owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. The 26 percent ITC is not refundable. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried back one year and forward 20 years. Therefore, if you had a tax liability last year, but dont have any this year, you can still claim the credit. Likewise, if you had no tax liability last year or this year, you can use the credit any time you have liability over the next 20 years.

You May Like: How To Hook Up Solar Panels To Your Home

Federal Solar Investment Tax Credit

The Solar ITC allows you to reduce the tax you owe to the Federal government by a maximum of 26% of the cost of your solar energy device. This credit also applies to batteries used to store solar energy on your property.

The Federal ITC can reduce your payments on your personal income tax. However, it does not directly reduce your taxesit simply drops your tax liability for all applicable years.

Generally, the Solar ITC applies to the year you install your solar power system. However, property owners can use this credit over multiple years in some cases. Speak to a solar professional to learn more.

Am I Eligible To Claim The Federal Solar Tax Credit In 2021

- You might be eligible for this tax credit this year if you meet all of the following criteria: 3

- Your solar PV system was placed in service after 12/31/2019 and before 01/01/2023.

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.

Don’t Miss: How To Get Sole Custody In Va

Is There A Tax Credit For Solar Panels

Is There A Tax Credit For Solar Panels? As a homeowner, youre always looking for ways to savemoney on your taxes. So you may be wondering if there are tax credits for solar panels? The answer is yes, there is! Keep reading to learn more about the tax credits for solar panels and how you can take advantage of them.

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

Read Also: How Much Does A Solar Sales Rep Make

Solar Renewable Energy Certificates

Solar renewable energy certificates are a performance-based solar incentive that enables you to profit from solar power generation. An SREC is earned for every megawatt-hour or 1,000 kilowatt-hours of electricity your solar panel system creates as a homeowner.

Have you heard people talk about generating power with solar panels and then selling it back to the grid? They probably meant they were making SRECs.

The amount of money youre eligible for by selling SRECs depends on your state, as each varies in its solar policies. In some states, residents may receive a rebate instead of SRECs.

SRECs are used to prove that a solar system is producing renewable energy.

To learn more about solar tax credit in 2022 and SRECs, speak to a solar energy specialist in your state. They will be able to help you understand how the solar tax credit works and whether or not youre eligible.

Solsystems in Washington DC and SRECTrade are both businesses that buy and sell SRECs. Some states have local government initiatives to enable selling SRECs.

For example, New Jersey has an SREC registration program. Its managed by New Jersey Clean Energy for residential rebates. They also support commercial, industrial, and local government clean energy tax incentives.

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

Also Check: How To Waterproof A Flat Concrete Roof

Recommended Reading: Who Manufactures The Best Solar Panels

How Can I Estimate The Portion Of My Solar Roof That Could Receive The Tax Credit

Your Solar Roof Purchase Agreement provides an estimated allocation of components that may be eligible for a tax credit. This estimated allocation is not intended as tax advice you should discuss this allocation with a tax professional to determine the appropriate tax credit amount in your circumstance.

*The Consolidated Appropriations Act of 2021 signed December 27, 2020, provided a two-year extension of the Investment Tax Credit for solar. The dates above reflect the extension.

What Are The Criteria To Claim The Solar Energy Credit

You can claim the credit once toward the original installation of the equipment. You must own the solar photovoltaic system and it must be located at your primary or secondary residence. If you are leasing solar panels, you don’t get the tax incentives.

There is no maximum amount that can be claimed, though. In addition, if you financed the system through the manufacturer and are contractually obligated to pay for it in full, you can claim the credit based on the full cost of the system.

You don’t even have to be connected to the electric grid to claim the federal solar tax credit, though there are definite financial incentives to being connected.

If Congress doesn’t renew it, the Federal Solar Investment Tax Credit will vanish in 2024.

Recommended Reading: Is Solo On Disney Plus

What Is The Federal Investment Tax Credit

Think of the ITC like a coupon for 26% off your home solar installation, backed and funded by the federal government. In the year that you install solar, the ITC can greatly reduce or even eliminate the taxes that you would have otherwise owed to the federal government.

The ITC was originally created by the Energy Policy Act of 2005, and was set to expire just two years later at the end of 2007. Thanks to the ITC, the growth of the solar industry helped create hundreds of thousands of jobs, injected billions of dollars into the US economy, and was a significant step towards cutting down on greenhouse gases, so it was very popular.

According to the Solar Energy Industries Association , The ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006. As a result, Congress has extended the expiration date multiple times to continue supporting that growth, including the latest extension that was part of the COVID relief bill and sets the expiration date at the end of 2023.