What If Im Getting A Tax Refund

Theres also the scenario that you had your taxes withheld from your paycheck, which means you already paid your taxes. In some cases, too much might have been taken out of your paycheck, and now the federal government owes you a refund.

If this is the case, the federal solar tax credit will be added to your tax refund check. But, only the amount up to what you owed. If you owed $8,000 in taxes, but $10,000 was withheld from your paychecks, youd be getting a $2,000 tax refund from the government.

If in that same year, you installed solar and got a $9,000 tax credit, you would get an additional $8,000 on your refund check – for a total tax refund of $10,000. The remaining $1,000 from the tax credit would carry over to the next year.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. You’ll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou can’t use the credit to get money back from the IRS. Instead, you can carry the credit over to the following tax year.

- If you failed to claim the credit in a previous year, you can file an amended return to claim the credit.

Currently, the residential solar tax credit is set to expire at the end of 2023. If you’re thinking about adding solar energy to your home, now might be the right time to act.

TurboTax will search over 350 deductions to get your maximum refund, guaranteed. If youre a homeowner, TurboTax Deluxe gives you step-by-step guidance to help turn your biggest investment into your biggest tax break.

Also Check: Can You Lease Solar Panels

Explore Solar Options For Your Business Today With Energysage

At EnergySage, we dont just help homeowners go solarwe help businesses explore their solar options too! When you register for a free account with EnergySage, well provide you with an initial estimate of how much solar you need for your business, how much it might cost, and how much you can save with solar. If it looks like the right investment for you, then well gather custom quotes from multiple solar companies in your area and help you decide which is right for your business.

How Does This Tax Credit Work

Say your solar system was quoted at $20,000. Where I live in Louisiana, this would be about an 8-kilowatt system, which is medium in size. A 30% credit would save you $6,000 on your federal returns. The tax credit rolls over year after year, should the taxes you owe amount to less than the credit you earn.

The federal solar tax credit can be claimed by any U.S. homeowner, so long as the solar system installed is for a residential location based in the United States.

The system must be placed in service during the tax year. So, if you install and begin using a residential solar system during the year 2022, youll claim the credit on your 2022 tax filing.

If you start a solar panel installation in December of 2022 but dont turn the system on until January of 2023, youll claim the credit on your 2023 filing.

Recommended Reading: Cost To Install Solar Panels California

Are Solar Batteries Eligible For The Federal Solar Tax Credit

Yes, solar batteries are eligible for the federal solar tax credit. In this document, The National Renewable Energy Laboratory outlines the parts of solar systems that are included. It states: âBattery systems that are charged by the renewable energy system 100% of the time on an annual basis can claim the full value of the ITC.â

Do States Offer Their Own Solar Energy Tax Incentives

Many states offer their own upfront rebates and tax credits that can be used in addition to the federal ITC.

New York’s Solar Energy System Equipment Credit, for example, is equal to 25% of your qualified solar energy system equipment expenditures, up to $5,000.

Ecowatch named New York one of the top 10 states for solar power tax incentives, along with Colorado, Connecticut, Iowa, Maryland, Massachusetts, New Hampshire, New Mexico, New Jersey and Rhode Island.

Even though solar panels increase property values, at least 36 states have property-tax exemptions for solar energy. If you live in one of those states, your real estate taxes won’t go up if you add a solar-energy system.

And in many states, solar equipment is exempt from sales tax.

You May Like: Can I Have A Business Name As A Sole Proprietor

How Does The Federal Solar Tax Credit Work

As a homeowner, you can claim a federal solar tax credit for the amount of money that you pay towards installing solar, and reduce the amount you owe when you file your yearly federal tax return. The Residential Clean Energy Credit can be filed one time for the tax year in which you install your system using Tax Form 5695.

The credit received is then calculated dollar-by-dollar as a reduction of your federal tax liability, so if you receive $1,000 in credits, youll owe $1,000 less in taxes. Once you calculate how many credits youve received, you will want to add your renewable energy credit information to a typical Form 1040 while filing your taxes.

Note that a tax credit is different from a tax refund. In order to claim a tax credit, you must owe taxes to the government, so that the tax credit can cancel out some or all of the amount that you owe.

If you dont owe any taxes then you wouldnt receive any money for the tax credit, because you didnt owe any money to begin with. If youve already had those tax dollars deducted from your paycheck, then you can get that money back in the form of a refund, but youre only getting back money that youve already paid.

Lastly, the solar panel federal tax credit can be used against either the federal income tax or the alternative minimum tax, so regardless of how you calculate the taxes you owe, you can be eligible to claim the value of the federal income tax credit for solar.

How To Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . Your solar provider should supply the proper documentation and instructions upon your demand. We have listed the essential steps in claiming the credit here:

We recommend that taxpayers consult a tax expert and your solar provider to ensure you are correctly claiming the ITC.

You can use the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits are available in your zip code.

You May Like: 200 Watt Solar Panel Kit

Why The Federal Solar Itc Matters

The reconciliation bill includes a staggering $360 billion in spending for renewable energy and measures to tackle climate change. Part of that goes towards funding the Federal Solar ITC, which has had a huge impact on the solar industry in the U.S.

This kind of funding helps create hundreds of thousands of green jobs. It also helps establish training programs to help traditional energy sector and manufacturing workers transition into more sustainable professions in renewable energy.

Find a Solar Energy partner near you.

The new law will also help boost solar projects in low- and moderate-income communities, acknowledging and addressing the inequities in green energy infrastructure. This is thanks to bonus tax credits of 10-20% for disadvantaged communities installing solar.

In practice, this could see tax credits of up to 50% for solar installations in some communities of color, rural regions with economic hardship, and other communities shouldering the burden of environmental pollution. That means some homeowners or community solar projects could cut the cost of going solar in half.

The bill also offers an extra 10% tax credit for solar installed on formerly polluted brownfield sites or in areas where the oil, gas, or coal industries previously offered significant employment .

What Does The Solar Tax Credit Cover

Taxpayers who installed and began using a solar PV system in 2022 can claim a federal tax credit that covers 30% of the following costs:

- Cost of solar panels

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

You May Like: 24 Round Solar Pool Cover

How To Fill Out Form 5695

Today, were helping Example Exampleson, who hails from my home state of Minnesota, dontcha know. He spent $15,500 to install a 6.2 kW solar panel system on his home, and entered that number in line 1 below:

So whats a qualified solar electric property cost? Heres what the instructions for Form 5695 say:

“Include any labor costs properly allocable to the onsite preparation, assembly, or original installation of the residential energy efficient property and for piping or wiring to interconnect such property to the home.

Qualified solar electric property costs are costs for property that uses solar energy to generate electricity for use in your home located in the United States. No costs relating to a solar panel or other property installed as a roof will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed. Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof’s decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit. The home does not have to be your main home.”

Can I Claim The Federal Solar Tax Credit Twice

Technically, you cannot claim the solar tax credit twice. The unused amount of the credit will continue to roll over to the next tax year if you owe less taxes than the credit. If you own more than one home with solar, you might be eligible to claim the credit more than once. We recommend consulting a tax expert to determine whether you can take advantage of this.

Read Also: How Much Are Tesla Solar Roof Panels

Can I Claim The Federal Solar Tax Credit For Fiscal Year 2021

Any solar-energy system installed after Jan. 1, 2006, is eligible for the one-time credit.

If your system was installed and generating electricity in your home last year then, yes, you can claim it. But if you buy and install one this year, you’ll have to wait until next tax season to deduct the credit.

Solar Tax Credit Eligibility Checklist For 2022

If youre not sure the ITC applies to you and your home, here is a checklist of criteria to keep in mind:

- Your solar photovoltaic system was installed between January 1, 2006 and December 31, 2034.

- Your solar PV system was installed on your primary or secondary residence in the United States.

- For an off-site community solar project, the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS allows a taxpayer to claim a section 25D tax credit for purchasing a portion of a community solar project.

- You own the solar PV system, meaning you purchased it outright or financed it with a loan. You did not sign a lease or PPA.

- Your solar PV system is new or being used for the first timethe credit can only be claimed on the original installation of the solar equipment. For instance, if you bought a house that came with a solar system already installed, you would not be eligible for the credit.

Recommended Reading: Solar Panel For Pool Pump

Are There Other Solar Energy Incentives

In addition to the federal ITC, there are other incentives available to people going solar, including the following:

- Utility company incentives: Local utility companies often offer incentives to get homeowners to purchase home solar power systems. Some companies subsidize the cost of installation or offer rebates, depending on the amount of energy a system produces.

- State solar rebates: State governments can also offer cash rebates for installing solar panels. These rebates often help reduce the cost of installation by 10% to 20%.

- State solar tax credits: Some states also offer tax credits to encourage residents to purchase solar panel systems. If this is true in your state, you may be able to claim both your states tax credit and the federal ITC.

Other incentives may include subsidized loans, tax exemptions and solar renewable energy certificates . Before purchasing a system, talk to your local solar panel supplier about your options they likely know about the incentives available in your area.

How Do I Claim The Solar Panel Tax Credit To Claim My Rebate

So lets get to the good stuff. What do you need to do to actually get your hands on this money and reduce the total cost?

Our first bit of advice is to keep all your receipts from the start of your solar installation project. Like any tax incentive, the Federal Solar Tax Credit requires a paper trail. The more you spend on your project, the larger your credit so make sure to keep track of everything!

Here are some of the expenses that you are allowed to claim:

- Solar equipment

Read Also: Is Solar Power Worth It In Michigan

Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

How To Calculate The Federal Solar Tax Credit

The total amount of the tax credit is calculated easily. You can calculate the tax credit amount by taking thirty percent of the solar energy systems total cost.

If you install your system in 2021, a solar energy system that costs $20,000 would have a tax credit that would be $20,000 x 22%= $4,400.

If you install solar in 2022, the solar tax credit will decrease to 0%. So for the same system that costs $20,000 your tax credit in 2022 would be $20,000 x 0% = $0.

Read Also: What The Average Cost To Install Solar Panels

How Long Will The Federal Solar Tax Credit Stay In Effect

As the saying goes, all good things must come to an end. And the solar tax credit is no exception.

However, the federal government recently extended the federal solar tax credit as part of a federal spending package passed in December 2020.

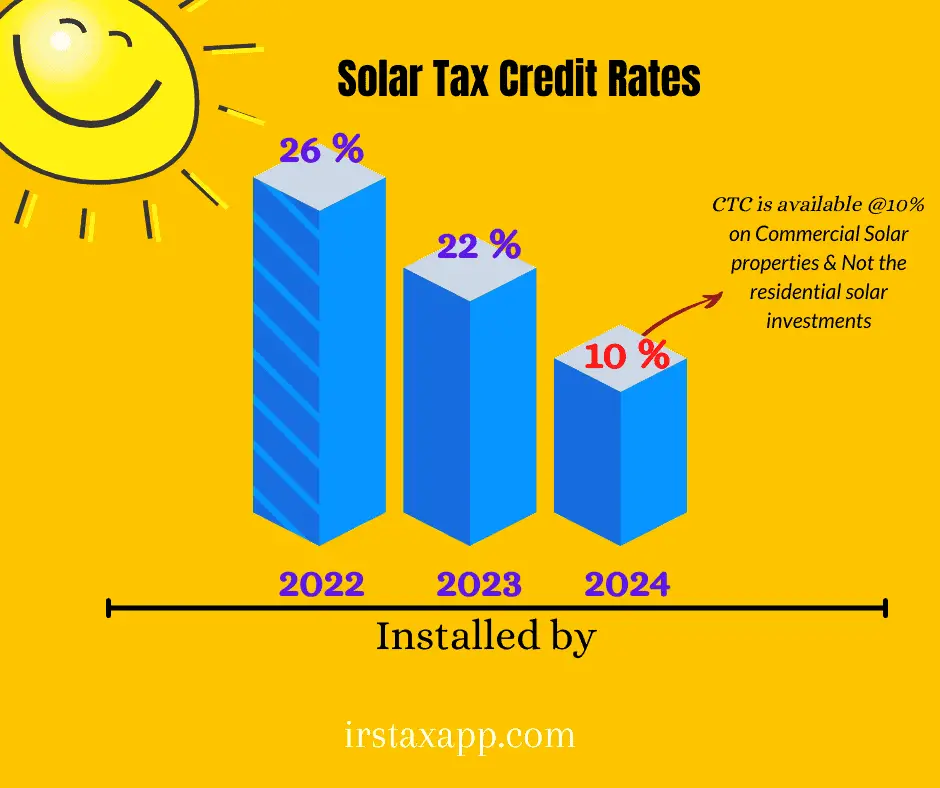

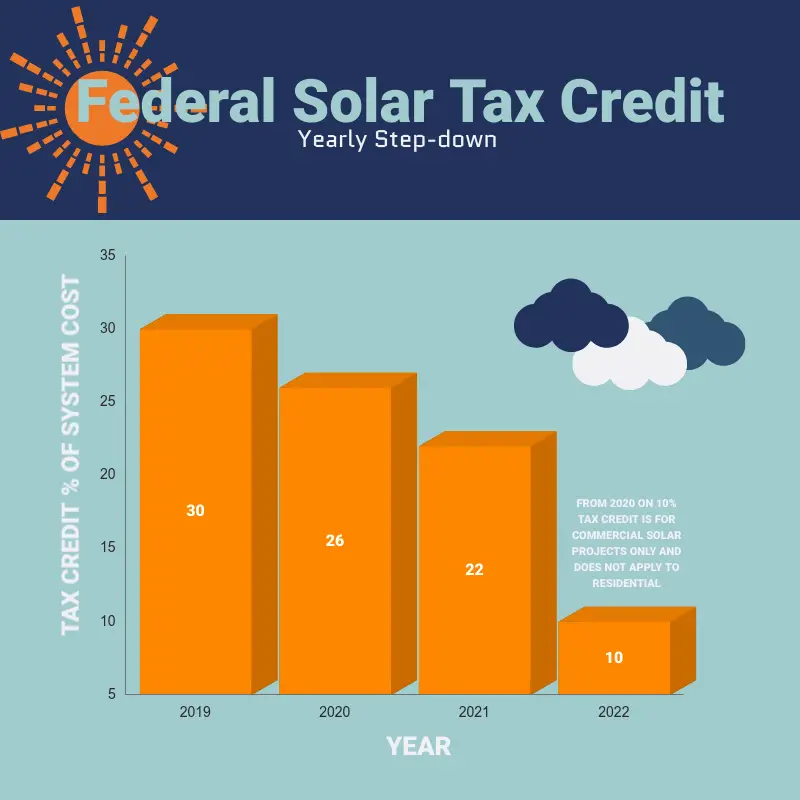

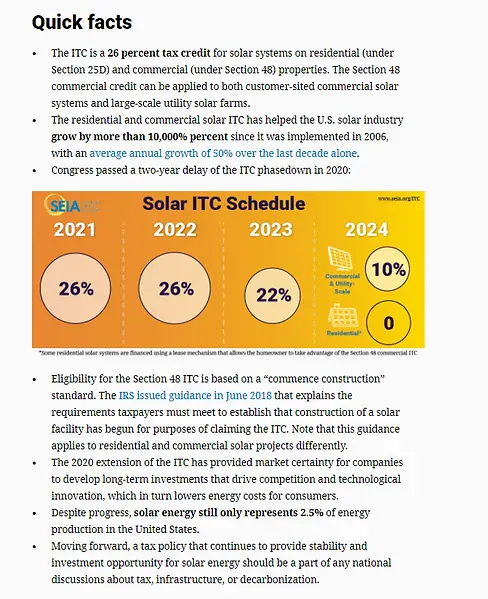

Under this new bill, residential, commercial, industrial and utility-scale solar projects that begin in 2021 and 2022 will be eligible for 26% tax credit. This number will drop down to 22% for solar projects in 2023, and it disappears completely for residential installs beginning in 2024.

Heres a quick overview showing the value of the federal tax credit over the next couple of years:

- 2020 2022: 26%

You can claim the credit in the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

The tax credit plays a major part in the return on investment you see from going solar, as well as minimizing the upfront cost of the system however, youll have to wait until after filing to see the overall cost go down. Grid-tie systems pay for themselves either way, but claiming the credit allows you to realize more immediate savings. We cant recommend enough that you capitalize on the full 26% credit, because the value only shrinks after 2022.

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

You May Like: How To Get Sole Custody In Texas