How To Set Up A Solo 401k Plan In 2020

The Solo 401 retirement plan, also called the self-employed 401 or individual 401, is similar to a traditional 401, except that it was designed to benefit business owners with no full-time employees .

The Solo 401k plan isnt a new type of plan, and not all plans are the same. In this article, well explain how to easily set up a Solo 401k plan to make traditional, as well as non-traditional investments.

Choose The Right Provider

With your provider, its important to ask questions. Two common questions people ask are how to make contributions with the Solo 401, and how to use the Solo 401 loan.

However, tailor your questions to your specific needs. At IRA Financial Group, you can call at 401 specialist for a free consultation. With the 401 specialist, you can answer any questions you may have regarding the Solo 401 retirement plan.

You have a few options when choosing a provider to set up a Solo 401k plan. Here are the three options you have to easily set up a Solo 401.

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Don’t Miss: Do You Need An Ein For Sole Proprietorship

How To Open A Solo 401

Opening a Solo 401 is pretty simple. Many online brokerages provide Solo 401s in their menu of account offerings. All you’ll need in order to sign up are your Employer Identification Number , a plan adoption agreement, and an application.

Once you’re approved, you can go ahead and set up your contributions.

You’ll have access to many of the available investment options that brokerage provides, like mutual funds, index funds, and ETF’s.

After your Solo 401 commences, you may need to file some additional paperwork. The IRS requires you to complete Form 5500-SF if your 401 plan exceeds $250,000 by the end of the year.

Vanguard Solo 401k Plan Document

Starting a Solo 401K at Vanguard is easy. If you are already a Vanguard client, you can set the account up online by logging into your account and choosing Individual 401K. If you dont have an account with Vanguard right now, you must call 1-800-992-1788 and a representative will walk you through the process.

Before you can apply for a Solo 401K, youll need an Employee Identification Number. You get this number directly from the IRS and it only takes a matter of minutes as they provide it to you instantly. Head to the IRS website and complete the required information to get your EIN.

Beyond the EIN, youll need to sign a few Vanguard documents, which they will send to you. Youll need to sign them and send back the originals, but make sure you keep a copy for yourself.

As a part of the process, youll also need to choose a plan administrator. Many business owners choose to handle it themselves, but if you dont want the responsibility, you can assign it to your spouse or your accountant .

Recommended Reading: How Home Solar Panels Work

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Things To Consider When Opening A Solo 401k

If you’re considering opening a solo 401k, there are a few things to consider when it comes to plan features.

There are five key areas that you need to decide before you open your solo 401k:

Everyone who opens a solo 401k will have different requirements. However, I would recommend you open a solo 401k plan with the most options and flexibility. While you can always amend your plan documents, it can be a hassle and can cost you money . As such, it makes sense to create a solo 401k plan with the most options up front.

Recommended Reading: Can You Put Solar Panels On Metal Roof

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Traditional Or Roth Ira

Best for: Those just starting out. If youre leaving a job to start a business, you can also roll your old 401 into an IRA.

IRA contribution limit: $6,000 in 2021 and 2022 .

Tax advantage: Tax deduction on contributions to a traditional IRA no immediate deduction for Roth IRA, but withdrawals in retirement are tax-free.

Employee element: None. These are individual plans. If you have employees, they can set up and contribute to their own IRAs.

How to get started: You can open an IRA at an online brokerage in a few minutes. See NerdWallet’s picks for the best IRA providers for more details.

You May Like: What Is The Best Solar Company To Work For

How To Set Up A Solo 401 In 5 Steps

Tom has 15 years of experience helping small businesses evaluate financing options. He shares this expertise in Fit Small Businesss financing content.

A Solo 401 is an employer-sponsored retirement plan that allows self-employed individuals to contribute up to $58,000 per year before taxes, including $19,500 of employee contributions. Setting up a Solo 401 requires five steps that range from understanding how a Solo 401 works to funding the account.

Should you need a Solo 401 provider, allows entrepreneurs to maximize their retirement savings at an affordable price for both setup and administration of their plan. Clients get access to a low-expense, diverse, high-quality fund lineup and an easy-to-use online portal.

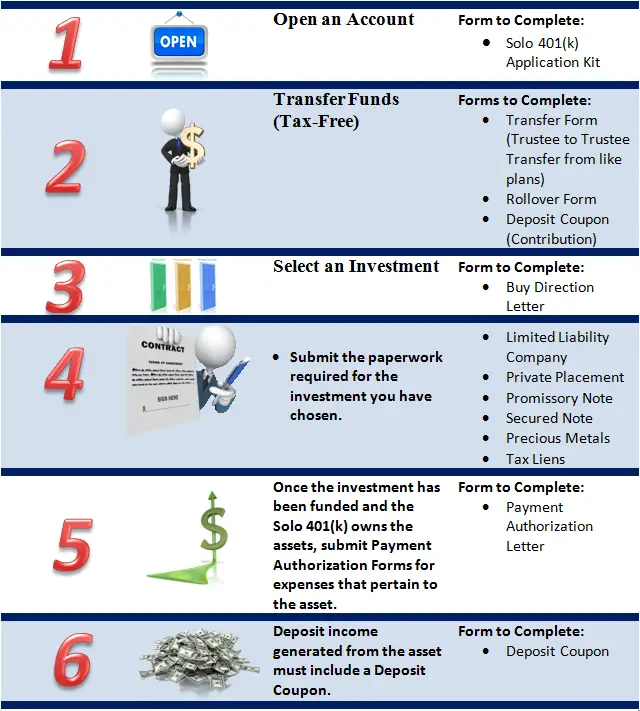

To set up your own Solo 401, here are the steps to follow:

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. You’d think it would be simple, with very common forms to fill out. However, it’s completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if you’re adding a spouse to your plan.

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

Required Documents For Spouse

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When you’re done with all these documents, you’ll have two solo 401k plans, and 4 accounts .

Recommended Reading: How To Pigeon Proof Solar Panels

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE providers).

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

How A Health Savings Account Works

HSAs are funded with pretax dollars, and the money within them grows tax-deferred as with an IRA or a 401. While the funds are meant to be withdrawn for out-of-pocket medical costs, they dont have to be, so you can let them accumulate year after year. Once you reach age 65, you can withdraw them for any reason. If its a medical one , its still tax-free. If its a non-medical expense, you are taxed at your current rate.

To open an HSA, you have to be covered by a high-deductible health insurance plan . For 2021 and 2022, the Internal Revenue Service defines a high deductible as $1,400 per individual and $2,800 per family.

Also, the annual out-of-pocket expenses, including deductibles, co-payments, but not premiums, must not exceed $7,000 for self-only coverage or $14,000 for family coverage for 2021, but for 2022, not exceed $7,050 for self-only coverage or $14,100 for family coverage.

The annual contribution limit for 2021 is $3,600 for individuals and $7,200 for families the 2022 contribution limit is $3,650 for individuals and $7,300 for families. People age 55 and older are allowed a $1,000 catch-up contribution.

Read Also: How To Determine Solar Panel Size

Solo 401 Pros And Cons

At some point in everybodys life, you contemplate the dilemma of what retirement plan best suits your needs. Today, there are over 50 million individual retirement accounts. However, that doesnt necessarily mean the IRA is the right retirement strategy.

Determining whether you can enhance your retirement savings with a Solo 401 or self-directed 401 plan) completely depends on whether you are self-employed and have a business.

There are a number of significant advantage to establishing a Solo 401 over an IRA.

Best For Account Features: E*trade

E*TRADE

E*TRADE gives you more flexibility with its solo 401 offering. E*TRADE supports both traditional individual 401 plans and Roth 401 plans. You are also able to take out a loan on your 401 balance at E*TRADE, all of which makes E*TRADE best in our review for account features.

-

Choose between traditional or Roth 401 contributions

-

Support for 401 loans

-

No recurring account fees, and commission-free stock and ETF trades

-

Now run by Morgan Stanley, meaning changes are likely

-

High fee for broker-assisted trades and some mutual fund trades

E*TRADE has a long history of supporting online investors, with its first online trade placed in 1983. It is now a subsidiary of Morgan Stanley after an acquisition that closed in October 2020. At E*TRADE, you can choose between traditional and Roth individual 401 plans, which allows you to choose between pre-tax and post-tax contributions. You can also take a 401 loan from an individual 401 account at E*TRADE.

There are no listed fees to open or keep a solo 401 account at E*TRADE. Stock and ETF trades are commission free. The brokerage also supports over 7,000 mutual funds on its no-load, no-transaction-fee list. E*TRADE supports options, futures, and fixed-income bonds and CDs, as well.

Read our full E*TRADE review.

Don’t Miss: How To Start A Solar Panel Installation Company

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Getting Your Solo 401 Started

Once you have established the type of plan you want, you will need to create a trust that will hold the funds until you need them or you reach retirement age. You can select an investment firm, online brokerage, or insurance company to administer the plan for you.

You also need to establish a record-keeping system, so that your investments are accounted for properly.

Read Also: How To Be A Solo Practitioner Lawyer

How To Open A Traditional And Roth Solo 401k

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

How Do They Work

When you set up a Solo 401K, you are both the employee and the employer. In other words, you make both contributions, but one comes from your earnings and the other from your profit-sharing.

Employees can contribute as much as $19,500 per year toward your retirement account. If you make less than $19,500, you may contribute 100% of your earnings and again, if youre over 50-years old, you may contribute the extra $6,500.

You also contribute as the employer. This money comes from your companys profit sharing. Youll need the following equation to determine how much you may contribute as the employer:

- 25% x you earned income ½ of your self-employment tax

- The maximum contribution is $57,000 as an employer.

Read Also: What Is A Sole Proprietor Mean

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.