How To Set Up As A Sole Proprietor In Canada

Canada is not only the second-largest country in the world, but it is also a great place to start a business. According to the World Bank’s Doing Business 2018 ranking, Canada is the third-best country in the world in which to start a business. Indeed, for instance, Canada has one of the lowest corporate tax rates in the world . Furthermore, the economic growth is stable and the country has a skilled workforce.

Self-employment is a status that more and more people are choosing when they come to live in Canada. This article will help you through the steps to become a self-employed professional in Canada.

The general procedure for setting up a business such as the sole proprietorship is the same no matter where you live in Canada. However, there are different details in each province and territory, so keep an eye on that.

Disclaimer: This article doesn’t substitute legal advice. Information in this article was collected from Canadian government websites and other online resources.

Liability And You As A Business Owner

When registered, the Ontario Sole Proprietorship combines the individual who operates the business to the risks and liabilities of the business operation. The liability concerns some individuals running a business with higher risks, such as construction or landscaping companies. The higher the liability risk is to the businesss operation, the higher risk to the individual. Ultimately, the individual owner has personal responsibility for the business risk, damage and default. You may wish to speak to an insurance professional regarding gaining business insurance as part of your due diligence with registering your Master Business Licence.

Apollo Has You Covered

We can help you understand the benefits of Business Insurance, and get the kind of protection you need in minutes.

111 Water Street, Unit 210, Vancouver, British Columbia, V6B 1A7

APOLLO Insurance Agency Ltd. is a licensed retail brokerage, offering our clients with a comprehensive set of insurance solutions to meet their individual needs. APOLLO Insurance Agency Ltd. maintains necessary corporate licensing in provinces across Canada. Availability of products and service depends on licensing and product availability. The information that appears on this page is provided for information purposes only. Advertised products and prices are not guaranteed and vary based on insurance provider and/or insurance companys discretion and product availability.

Transparency and Disclosure:

APOLLO Insurance Agencys role is to provide you with exceptional service and the best insurance products that suit your needs. As a licensed retail brokerage, our compensation is based on a commission basis already built into your insurance premium and varies based on the product purchased through our platform. For a description of how APOLLO Insurance Agency is compensated and how this is calculated, please refer to our Compensation Disclosure document.

You May Like: How Long Does It Take To Install Solar

What Exactly Is A Name Search

The idea behind a name search is to ensure that you do not register a business name that is already in use or, in many cases, trademarked.Although there are legal steps you can take, registering your business name does not guarantee protection regarding exclusivity. In this case, a trademark is required.

When you do conduct your name search, it is also beneficial to obtain a Nuans report. This will provide you with a list of all corporate names and trademarks across Canada that are similar to your intended name. It is valid for a total of 90 days, so it gives you plenty of time to decide and register your company title.

Can I Run A Business Without Registering

Its possible to run a business in Canada without registering it in any way. However, it requires that you operate a sole proprietorship under your own name and earn under $30,000 per year.

Only sole proprietors running their business under their own name can avoid a business name registration. Thus, sole proprietors carrying on business under a name other than the owners, as well as partnerships and corporations must register their business in some manner.

Additionally, sole proprietors who earn over $30,000 in annual revenue must register with the CRA as a GST/HST registrant to collect and remit sales tax.There may be numerous fines and other consequences if you dont register your business when youre supposed to.

For example, under the Ontario Business Names Act, a sole proprietor or partnership may see fines of up to $2,000 for using an unregistered name. This fine shoots up to $25,000 for corporations.

Registering your business in Ontario could include registering a business name, incorporation, or opening a GST/HST account. Make sure to understand whether registration is mandatory for your business. Otherwise, you may face fines or other consequences.

Don’t Miss: How Much Does Solar Heating Cost For A Pool

How Much Can A Small Business Make Before Paying Taxes In Canada

Managing the collection and submission of the tax payment If the annual income of your company is more than $30,000, you are required to register to collect and return the GST/HST on sales of items and services that are subject to the tax. If the annual income of your company is less than $30,000, you also have the option of registering voluntarily to collect and remit the tax.

Getting A Master Business License

Making sure your business name isnt already in use is an important first step. But after youve done the search, the next step would be registering the name by obtaining a Master Business License, also known as trade name.

As illustrated above, going back to the five-step process for business registration example, registering your trade name could also coincide with registering any marks or intellectual property you intend to use in the course of business.

Don’t Miss: Can My Roof Support Solar Panels

File Articles Of Incorporation

Articles of Incorporation must be completed and filed to incorporate your business in Ontario.

You can file it electronically through a service provider affiliated with the Ministry of Government and Consumer Services.

You can also file it over-the-counter at participating Service Ontario offices or send it by mail to the Central Production and Verification Services Branch, 393 University Avenue, Suite 200, Toronto, Ontario M5G 2M2.

Online filling of the Articles of Incorporation costs$300, plus the fee charged by the service provider.

Mail or in-person filing has a $360fee.

The Articles of Incorporation Form 1 requires the following information:

- Business name

- Office address

- Number of directors

- The name and address for each of the first directors

- Restrictions on the business the corporation may carry out

- Classes and maximum number of shares

- Rights, privileges, restrictions and conditions attached to each class of shares

- Restrictions on issue, transfer or ownership of shares

- Name and address of each of the incorporators

- Signatures

Eight Business Name Registration Introduction

You will then be directed to the Business Name Registration Introduction page. There you will be given a summary of how the process works. Registrations cost $60, and upon payment completion, you will receive a Master Business License, a profile summary of your registration, and a receipt. Your MBL will arrive in the mail within ten business days. New business name applications can be submitted 24 hours a day, 7 days a week which is great. And if you provide an email address during registration, you will receive your MBL via email within two business days. In addition, if you register during regular business hours, you will receive a printable Master Business License immediately via email. Read the introduction and click next.

Don’t Miss: What Is Difference Between Sole Proprietorship And Llc

Reporting Income As A Sole Proprietor

From a tax point of view, the money earned as a sole proprietor is considered as personal income. The sole proprietor pays taxes by reporting income or loss on a T1 income tax and benefit return. Because your personal income and business income are one, along with your personal T1 income tax and benefit return, you must file Form T2125 Statement of Business and Professional Activities.

In addition to federal income taxes, youâre also subject to provincial income taxes.

Furthermore, you also need to file a return if you are claiming an income tax refund, a refundable tax credit, a GST/HST credit. You should also file a return if you are entitled to receive provincial tax credits.

How Do I Get A Small Business Number In Ontario

Utilizing the Business Registration Online tool offered by the CRA is the simplest way to register for a business number in the province of Ontario. If you would rather, you may also fill out an RC1 form and either mail it or fax it to the tax services office that is located closest to you. Dial 1-800-959-5525 to speak with an agent about registering for a BN over the phone.

Also Check: Do Solar Panels Work In Blackouts

Registration Required By Law

Even if you are not concerned about someone using your business name, under the Ontario Business Names Act, you are required by law to register it. If you do not register the name of your sole proprietorship, you may be fined up to $2,000.

Further, the law requires that you register your business name unless you are using your own name. For example, if your name is John Smith you can call your business John Smith, and you do not need to register your name. However, if you decide to call the business Johns Ice Cream, then you must register the name. This helps to ensure that a particular name is not used by more than one business. The goodwill or familiarity that goes with a particular business name is very important and valuable.

It is advisable that you ensure that the business name you want is not already being used. Although the Act does not prohibit the registration of identical business names, if you use a name that another business is already using, you may be sued and end up being ordered to change your business name and pay the other person compensation.

Further, the Act does not provide protection for the exclusivity of a business name registration. Exclusive use of names can be protected by registering a trademark. For more information about trademarks, refer to the Intellectual Property section of this website.

Do I Have To Apply For Hst

Once your business earns $30,000.00 or more in a year between January 1st and December 31st, you must apply for HST. If the company does not reach the $30,000.00 within this timeframe, the HST is optional. You may find that suppliers who contract to you may want you to have HST even when you are below the threshold of $30,000.00.

If you wish for additional information on registering HST, you can go to the CRA website directly for further details at

Recommended Reading: How To Put Up A Solar Electric Fence

For More Information On Ontario Business Registration

Need more information? Ontario business incorporation is handled through the Companies and Personal Property Security Branch of the Ministry of Government Services. You can contact the Ministry in Toronto at 212-2665 or toll-free at 1-800-361-3223. The mailing address is:

Companies and Personal Property Security BranchMinistry of Government and Consumer Services393 University Ave., Suite 200Toronto ON M5G 2M2

Registering your business in Ontario is an important first step in getting it off the ground. Be sure you’ve covered all these steps before you start operating.

What Is A Sole Proprietorship

Check out the benefits and risks of a sole proprietorship to decide if it’s right for your business.

Your choice of how to set up your small business should be one of the first things you do as it affects finances, budgets, registration and your day-to-day operations. Sole proprietorships are one of the most popular small business structures in Canada, representing 70% of gross domestic product in the unincorporated sector in Canada1.

Simply put, a sole proprietorship is an unincorporated business that is owned by a single individual. Itâs easy and generally less costly to set up. However, there are a few risks that you should keep in mind.

You May Like: Can You Really Get Solar For Free

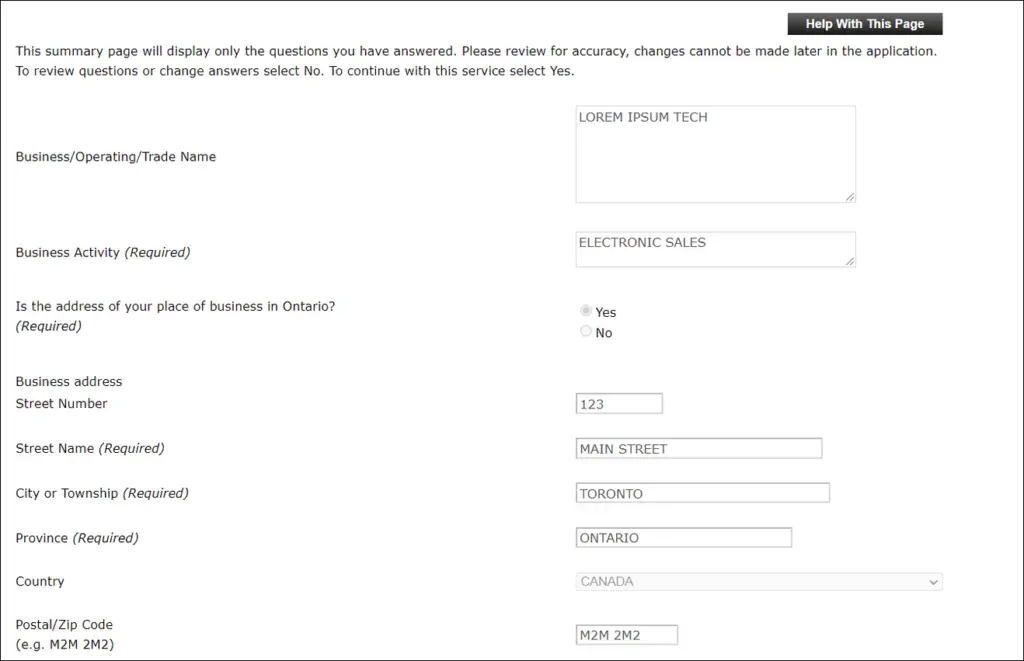

What Information Is Required To Register A Sole Proprietorship

- Name of business or legal name of the individual

- Business activity

- The legal name of the individual registrant

- Business address

- Individual owner address

If you are ready to complete the registration with us, here is the link to do so:

Once the registration has been completed, you will receive a single-page document for Your Sole Proprietorship, which will list the details as provided above and the additional BIN number associated with your specific registration, the date of registration and expiry. The Province of Ontario does not remind you of your registration expiry date, so it is essential to maintain this information for renewal purposes. If you register with us, we will also keep the date for renewal and send you an email notice reminding you to renew.

Business Number And Canada Revenue Agency

The Canada Revenue Agency generally uses a Business number to communicate with Canadian businesses.

What is exactly the BN?

The BN is a nine-digit number the CRA assigns to your business as a tax ID. It’s unique to your business and you will use it to deal with federal, provincial, or local governments.

When do you need a Business Number?

The CRA assigns a BN to your company in case you register for any of the four following major program accounts needed to operate a business:

- Goods and services tax/harmonized sales tax in case your business collects GST/HST

- Payroll deductions in case your business pays employees

- Corporate income tax in case your business is incorporated

- Import/export privileges in case your business imports goods or sells goods or services abroad.

Registering for one of these CRA programs will allow you to get a Business Number. The CRA program account will be added to your Business Number if you already have one.

If you don’t fall under the four categories above, you don’t need a Business Number. Also, if you are a sole proprietor qualified as a Small Supplier , you could operate without a Business Number.

You May Like: Can An Air Conditioner Run Off Solar Power

Choosing Ca And Or Com

If your business operates in Canada, the .ca is the web country code for Canada and lets consumers know you are a Canadian company. The .ca also provides business owners with higher access to Canadas marketplace than other businesses with different country code web presence through Google and other browsers. Many entrepreneurs include the .com as well to have a universal country code. The .com is the most common choice for American companies. If you intend to provide business services to individuals or businesses outside of Canada, we recommend that you opt-in for the .com as well. By selecting both the .ca and .com, your brand has better protection against another business using the same business model with just a different country code.

Types Of Business Structure:

- Sole Proprietorship is an unincorporated business that is owned by one person. The owner of a sole proprietorship has sole responsibility for making decisions, receives all of the profits, claims all losses, and does not have separate legal status from the business.

- Partnership is an association between two or more people who join together to carry on a trade or business. Each partner contributes money, labour, property, or skills to the partnership.

- Corporation is an incorporated entity with its own rights and responsibilities as a distinct person under the law. A corporation is owned by the shareholders and managed by directors chosen by the shareholders. The owners of a corporation are not personally responsible for the debts of the corporation. The corporation is responsible for its debts.

To learn more about business structures, view Step 8 here.

Read Also: How Much Energy Does A 10kw Solar System Produce

How Much Does Registration Cost

Depending on the name search you conduct, this step will cost you between $8 and $26, followed by a $60 fee to register your business name .

If, at any point, you are unsure whether your business name is already in use, or would simply like to ensure due diligence, a public record search is recommended.

How To Incorporate In Ontario Using Ownr

Ownr provides provincial and federal incorporation in Ontario, Alberta and British Columbia.

To get started, create an account and search for available business names. You can check up to 30 unique business names.

Fill out your business details, pay the registration fee and submit your application.

Ownr sends you the name search report within 1 business day.

Review and confirm your corporation name. The incorporation documents are delivered through email within 1 business day, with directions on the next steps.

Ownralso prepares your corporation documents including:

- First Directors Resolution

What does it cost?

Provincial incorporation in Ontario using Ownr costs $599 plus tax. This includes the $300 government fee.

You can claim up to $300 cash back when you open an RBC Business Bank Account within 60 days of incorporating with Ownr.

You also get a 15% discount here.

In addition, when you register a business with Ownr, you get access to perks including discounts on accounting software, phone plans, and office supplies.

Don’t Miss: How To Size Your Solar System

Obtaining An Employer Id

An employer ID number can be acquired from the IRS after the business name, type and location are decided. Almost all businesses need an EIN, even if they dont have employees on the payroll. The process of acquiring an EIN online can be referred to in detail here or by phone and get the number immediately.

Another thing to be aware of is that the IRS would never charge for this. Therefore, an employer must be aware of fake application websites too.