How To Claim Solar Tax Credit

Those who are eligible and who wish to claim the credit should file IRS Form 5695 with their tax return. Part I of the form calculates the credit. The final amount is listed on the 1040 form. Individuals who failed to claim the credit when they were supposed to can file an amended return later.

Residential solar energy investors claim this tax credit under Section 25D, while commercial solar investors claim it under Section 48. Individuals claim the residential tax credit on their personal income taxes, while businesses that claim the credit do so on their business taxes.

How Can I Claim The Federal Solar Tax Credit In 2021

If youre ready to take advantage of the ITC in 2021, but not sure where to start, youre not alone.

The first step is to ensure you meet all of the eligibility requirements listed above, including that you must own your system. Once youve ensured all the eligibility statements apply to you and your system, its smart to talk to a CPA or other tax professional about the implications of claiming the tax credit.

Once youve talked to a tax professional, the next step is to fill out IRS form 5695, and add the energy credit information to the form 1040 you complete at the end of the year.

After completing IRS Form 569516, attach it to your federal tax return. Information and instructions on filling out the form are available here.

The Time For Home Solar In Illinois Is Now

On top of the many attractive solar tax credits, incentives, and rebates, our home solar plans in Illinois allow you to start creating your own solar power for as little as $0 down. What’s more, Ameren Illinois, Commonwealth Edison Company , and MidAmerican Energy Company offer net energy metering programs that could let you earn credits on your bill for the excess solar energy you produce.11,12,13 Net metering in Illinois may help you save money on your future electricity bills.

Sunrun is one of the best solar installers in Illinois that you can team up with. To check if our solar and storage services are available in your area, use our Product Selector or request a free quote to get one-on-one service from our expert Solar Advisors.

Also Check: Does Pine Sol Have Ammonia

Impact Of The New Itc Extensions

The ITC has resulted in an extremely effective subsidy in catalyzing both rooftop and utility scale solar energy adoption across the U.S. The multi-year extension from late 2015 has caused the cost of solar to drop, while installation rates and technological efficiencies have improved. The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st-century energy systems and technology.

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the US by 2015, and they predict we will have nearly 100 GW total by the end of 2020. From 2015 to 2017 there was a 25% increase in the number of solar industry jobs and that number is forecasted to increase throughout the next decade. The federal solar rebate program is proof that long-term federal tax incentives can drive economic growth, technological innovation to reduce costs, and create a new generation of jobs and skillsets. We offer commercial solar in 26 states, Washington D.C., and Puerto Rico, to find out more about the ITC close to you, contact us today.

The Federal Solar Tax Credit: What You Need To Know

Could investing in solar energy pay off sooner than you think? The short answer is, yes. Many residential home solar power systems are eligible for a federal investment tax credit, or ITC.

At the time of this writing, you can get up to 26% of your installation costs back by claiming the tax credit when you file with the IRS. The ITC benefits both residential and commercial customers, and there is no cap on its value.

Wondering how the solar tax credit works in 2021? Well cover everything you need to know in this post.

Lets dive in.

Recommended Reading: How Much Does The Average Solar Panel System Cost

Getting Your States Tax Credit

Many states also offer tax credits for solar some will continue even after the federal credit expires. Arizona and Massachusetts, for instance, currently give state income tax credits worth up to $1,000 toward solar installations. New York offers a state tax credit of up to $5,000. Marylands is $1,000 per system, plus 30 percent of the cost to install a giant battery to store the energy thats produced.

For details on your states programs, go to your states tax authority website, or to dsireusa.org, a catalog of all state energy incentives run by the North Carolina Clean Energy Technology Center.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

You May Like: How Much Can Solar Panels Produce

Understanding The Solar Investment Tax Credit

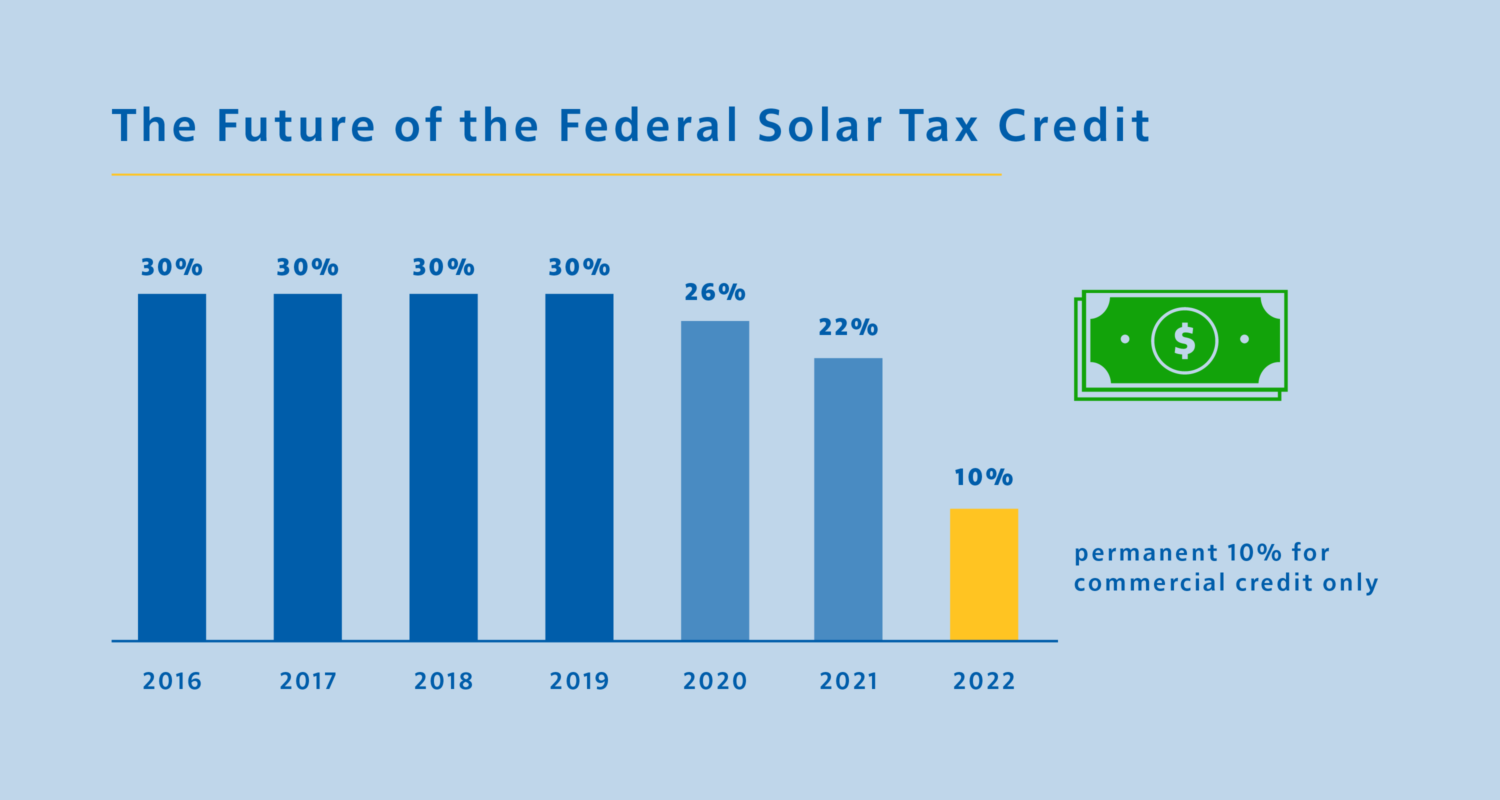

The Solar Investment Tax Credit, or ITC, was created in 2005 and originally offered a hefty 30% tax credit benefit. In the almost two decade history of the solar tax credit, the credit ratio has been lowered by just 4%. Currently, you can get a federal tax credit of up to 26% when you install a solar energy system on your property.

The good news is that the price of installing residential solar panels has steadily declined since the launch of the tax credit, with some reports estimating a reduction in costs by up to 90% in the past decade. So, the value of the solar tax credit in 2021 is arguably an even greater value than in past years. But federal tax credits for solar wont be around forever.

It should be pointed out that the ITC has many names, so, when doing your research, if you see mentions of the federal solar tax credit, solar tax credit, solar ITC, or the investment tax credit, these terms are all referring to the same thing.

Keep reading to find out how the solar tax credit can help you save on your 2021 taxes, what you need to qualify, and how to apply.

What Will Happen When The Solar Tax Credit Steps Down

This is speculative, but we foresee a couple possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas to help the state achieve its RPS goals.

- Congress adjusts the step down

- There is a possibility that congress may delay or adjust the tax credit step down. The tax credit was initially passed under a Republican administration and extended under both Republican and Democratic administrations. There is potential bipartisan support for an extension.

- With the most recent extension, the very fact that legislators built in a step down makes us find it less likely to be extended at the current 26% level.

- Residential tax benefits are also going away entirely in 2024.

You May Like: How To Start A Sole Proprietorship In Alabama

The Solar Energy Credit: Where To Draw The Line

How much of the cost of a roof replacement can be included in calculating the credit?

To encourage investment in solar energy , the Internal Revenue Code offers a credit to taxpayers who install solar energy equipment. Specifically, the taxpayer may take a 30% credit for the costs of the solar panels and related equipment and material installed to generate electricity for use by a residential or commercial building.

Sec. 25D provides a credit of 30% if the property was placed in service in a residence before Jan. 1, 2020, a 26% credit if the property was placed in service after Dec. 31, 2019, and before Jan. 1, 2021, and a 22% credit if the property was placed in service after Dec. 31, 2020, and before Jan. 1, 2022. Sec. 48 provides a 30% credit for solar energy equipment in commercial property if construction begins before Jan. 1, 2022.

This credit raises the question as to how much of the equipment and materials are properly includible for purposes of calculating the credit. Can a taxpayer include the entire cost of a new roof being installed in conjunction with the solar panels? Does it matter whether the roof is undamaged or in need of repair?

Sec. 25D Residential energy credit

Lastly, Notice 2013-70 provides two useful questions and answers:

A-21: The taxpayer may request that the homebuilder make a reasonable allocation or the taxpayer may use any other reasonable method to determine the cost of the property that is eligible for §25D.

. . .

How Much Money Can Be Saved With This Tax Credit

Claiming the Solar Investment Tax Credit is worth 30% of the system cost. This applies to paying contractors and the cost of the parts.

Anyone spending $10,000 on a solar system would be able to claim back $3,000 in credits.

The catch is that you must own the system. It doesnt apply to solar leasing agreements. The person who owns the system claims the credit, so if you lease from a company, they get to claim the credit, not you.

With solar leasing, you can still save money on your bills, but you wont be able to claim any tax incentives. This is a massive blow to the ROI of installing the system in the first place.

This credit makes such a difference that its highly recommended you finance a solar system if you dont have the money immediately available to finance its installation.

You May Like: Are Solar Panels Harmful To Your Health

A Beginners Guide To Federal Tax Credits For Solar And Energy Storage Rebates

Are you thinking about a clean energy investment in rooftop solar? Read how residential solar installations or home battery additions, can allow you to deduct up to 26% of the cost from your federal income taxes, dollar-for-dollar! Thereâs no better time than now to invest in renewable energy for your home.

sonnen, inc.

Are you thinking about a clean energy investment in rooftop solar? Or are you considering a rechargeable home battery to get more out of the solar power you generate? For 2021 residential solar installations or home battery additions, you can deduct up to 26% of the cost from your federal income taxes, dollar-for-dollar! Thereâs no better time than now to invest in renewable energy for your home. Next year, the residential credit drops down to 22% before disappearing entirely in 2022. Hereâs some background:

HISTORY OF THE INVESTMENT TAX CREDIT

FUTURE OF THE ITC

WHAT THIS MEANS FOR YOU

Thereâs still time to reduce your 2021 tax liability up to 26% of the cost of new solar and energy storage installations, including any sonnen intelligent battery recharged with solar energy. Batteries like the sonnen eco and ecoLinx allow you to store solar power you generate by day for use when the sun goes down. With a home battery, youâll maximize your clean energy investment, become less dependent on the grid, and always have a backup power reserve for outages.

LOCAL REBATES FOR HOMEOWNERS

How Much Is The Federal Tax Credit For Solar Panels

The federal tax credit for solar panels is currently at 26%, its highest available rate. That means serious savings on your tax returns when it comes time to file. For another two years, the 26% federal solar tax credit presents a huge opportunity for savings. The current rate is thanks to the newly signed legislation which removed the originally established timeline for the tax credit.

Now, instead of expiring at the end of 2020, the 26% solar tax credit will renew in 2021 and remain in place through 2022. After 2022, the tax credit will then drop to 22% in 2023.

This is an encouraging sign of things to come as more legislation is planned in the coming years that will further incentivize more homeowners to install clean, renewable energy.

Don’t Miss: How To Heal Solar Plexus Chakra

How Much Can You Save With The Solar Tax Credit In 2021

For example, if your solar installation costs were $20,000, you can take 26% of those total costs and subtract them from what you owe in federal taxes on your tax return. Thats a savings of $5,200 from taxes you would normally be required to pay!

If the ITC had not been extended, the tax credit savings would have added up to $4,400 at the previously scheduled 22% rate thats $800 less. So, the tax credit extension just gave homeowners looking to reduce their carbon footprint and take their energy into their own hands hundreds of dollars in tax savings!

Bonus ITC Savings: If the amount you are allowed to reduce from your taxes is greater than what you owe, you can rollover the remainder into the next tax year, so that all of the tax savings can be utilized for their intended purpose.

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

You May Like: Is There A Government Scheme For Free Solar Panels

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet all of the following criteria:

- Your solar PV system was installed between January 1, 2006, and December 31, 2023.

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.

Solar System Covered Expenses

You can claim expenses relating to your solar PV panels or the PV cells. An installation and balance of the systems equipment, including wires and inverters, are covered.

Other covered expenses:

- Contractor labor costs

- Energy storage devices charged by the panels

You can claim any contractor labor costs, including any onsite preparation or permitting fees. The solar panels themselves must exclusively charge the energy storage devices. This includes any battery backup banks or any off-grid systems.

Recommended Reading: Does Cleaning Solar Panels Help

How To Get The Federal Tax Credit For Solar Batteries

If you follow news about the energy industry, you have surely noticed the growing popularity of solar power. When used in utility-scale projects, solar panels can now produce cheaper electricity than coal power plants. Unfortunately, solar panels are unproductive at night, and their output is drastically reduced with cloudy weather. Fossil fuels dont have this limitation, since power plants can burn them at any time.

Battery systems are an excellent complement for solar panels: they can store surplus electricity production, and supply that energy when there is no generation. Considering this opportunity, the federal tax credit for solar panels was amended to include batteries in 2018, and the tax credit extension from December 2020 also covers them. However, stand-alone batteries are not eligible, and they must get their charge from solar panels.

The Irs Is Still Offering Incentives For Switching To Solar Heres How Much You Could Save On Your Taxes And Electricity Bill

Solar-panel companies are aggressively marketing their products this season.

In my own neighborhood in a New York City suburb, door-to-door salespeople have been making the rounds. Reps from two different solar companies have stopped by, and thats in addition to multiple mailings Ive received.

Their pitch: Hurry if I want a big federal tax credit for a new solar-panel system, because itll be gone at year-end.

“Residential solar installers are notorious for using deadlines like this to create a sense of urgency with customers, and that’s definitely been the case this year,” says Michelle Davis, a solar-industry analyst with the market research company Wood Mackenzie.

If youve heard the same hard sell, dont believe it. The federal credit is still available next year, both for existing homes and new construction. Its just slightly smaller: 26 percent of purchase and installation costs vs. 30 percent for 2019. For 2021, the credit will be worth 22 percent.

After that, it really does expire for individuals.

The Residential Renewable Energy Tax Credit, as the IRS calls it, can be an attractive way to save on the significant cost of installing solar panels or roofing. An average-sized residential solar systemabout 400 square feet of solar panelscosts $18,000, according to the Solar Energy Industries Association, an industry group. The tax break reduces the cost by $4,680, to $13,320.

Don’t Miss: Does California Require Solar Panels On New Homes