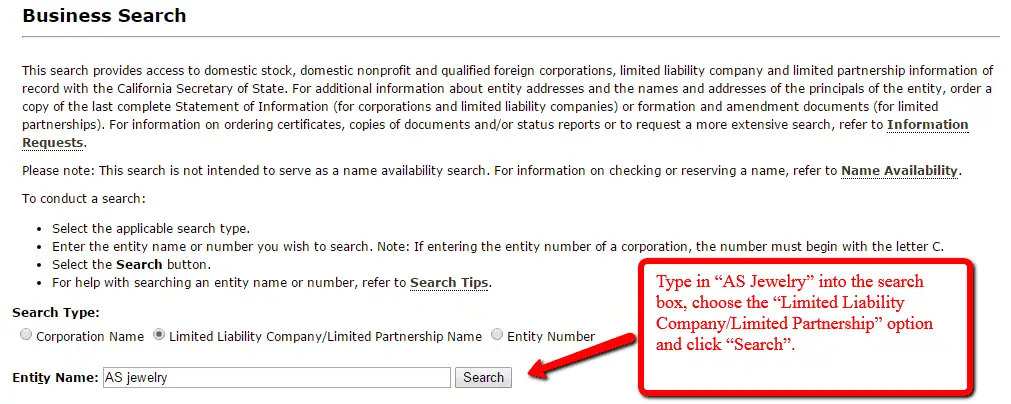

How Do I Look Up A Sole Proprietorship In California

If you are looking for a specific sole proprietorship in California, you can sometimes search by the entity number , the identification number provided by the California Secretary of State. Sole proprietors dont always need to obtain an EIN and often use their private social security numbers instead.

Pick A Business Location And Check Zoning Regulations

You’ll need to pick a location for your business and check local zoning regulations. Consider the needs of your customers, and if you have the kind of business that could benefit from foot or highway traffic. Before you commit to a location, take time to calculate the costs of running your business in the desired spot, including rent and utilities. Refer back to your business plan to evaluate whether you can afford your desired location during your company’s early months.

It is important to verify that the spot iszonedfor your type of business. You might find zoning regulations for your town or city by reviewing your local ordinances and contacting your town’s zoning or planning department. Read our article formore tips on picking a location.

One alternative to opening your business at a new location is running your company out of your home. If you decide to run a home-based business, again check your local zoning laws. You should also review your lease and homeowners association rules , either of which might ban some or all home businesses.

Landing New Clients And Investors Could Be A Challenge

While it may seem trivial, potential clients and investors sometimes see a sole proprietorship as less professional than a limited liability company or corporation. In some cases, these outside parties may not take your business seriously or may be wary about doing business with you.

Sole proprietorships are unincorporated companies, which means you havent formed a separate legal business entity. Clients or investors may be cautious of working with an individual rather than a separate legal business entity.

For example, a larger client may only choose to do business with incorporated businesses instead of sole proprietorships based on a perceived sense of stability.

Some banks even require business owners to incorporate before they lend money. This could stall your growth efforts if you ever need outside funding to take your business to the next level.

Read Also: Should Solar Panels Be Cleaned

How Do I Start A Sole Proprietorship

Starting a sole proprietorship is simple, although the specific steps you take may vary depending on where you live. In most states, you need to follow these three steps to become a legal entity:

Steps to start a sole proprietorship

What Taxes Are Associated With A Sole Proprietorship

While sole proprietors report income on their personal taxes instead of as a separate business entity, taxes can still be a big headache. Again, at the state and local levels, what you will be required to pay may vary. Generally, though, you will be responsible for:

- Federal income tax

- State income tax

- Self-employment tax

- Sales tax

Sole proprietors will also pay quarterly estimated taxes rather than just paying once a year. The estimated taxes include your income and self-employment tax. Estimated tax payments are owed if you expect to owe at least ,000 in taxes at the federal level and are due in January, April, June, and September.

Sole proprietors should also closely track their business deductions. These will help offset your income and result in lowering your tax obligation. A few common deductions include home office space, some retirement plans, health savings accounts , marketing, loan interest, bank fees, legal fees, and the internet.

There are ways to make the tax headache easier and let you focus more on the business. Employing a tax professional can help you with the guidance, preparation, and filing of your taxes.

Recommended Reading: How Many Solar Panels Do I Need For My Cabin

Do I Have To Pay Franchise Tax In California

In general, every California corporation that is incorporated, qualified for business, or doing business in California is required to pay a franchise tax of $800. The first taxable year of a corporation incorporated in California or qualified to conduct business in California is exempt from paying the minimum franchise tax.

Obtain General Liability Insurance For Your Business

Because the owner and the business are not separate entities in a sole proprietorship structure, the owners are personally liable for all the debts and obligations that the business may incur. To protect yourself from many problems in the future, it is a must that you obtain a business liability insurance policy.

Don’t Miss: Which Way To Face Solar Panels

Payment Of Taxes On Business Income

A sole proprietor pays taxes by reporting income on a T1 income tax and benefit return.

If you are a sole proprietor, you or your authorized representative have to file a T1 return if you:

- have to pay tax for the year

- disposed of a capital property or had a taxable capital gain in the year

- have to make Canada Pension Plan/Quebec Pension Plan payments on self-employed earnings or pensionable earnings for the year

- want to access employment insurance special benefits for self-employed persons

- received a demand from us to file a return

You also need to file a return if you are claiming an income tax refund, a refundable tax credit, a GST/HST credit, or the Canada Child Benefit. You should also file a return if you are entitled to receive provincial tax credits.

The list above does not include every situation where you may have to file. If you are not sure whether you have to file, call 1-800-959-5525.

Llc Vs Sole Proprietorship: Which Should You Choose

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

Also Check: Where Are Sunrun Solar Panels Made

What Is The Minimum Capital Required To Start A Sole Proprietorship

This business does not require a minimum capital investment, and the proprietor has complete control over the business. Profits or income generated by your business are yours to keep. Sole proprietorships also prevent double taxation, as the firm is not taxed twice. Paying taxes and filing returns in your own name is the only way to file.

Resources That Help Sole Proprietors

These resources provide additional guides for how to set up a sole proprietor in California, among other entities. These offices can administer, issue permits and licenses, and registrations for your business needs. The agencies below can help inform your sole proprietorship on outstanding requirements by different levels of government, county, state or federal.

Governors Office of Business and Economic Development .

California Business Portal.

Its always a good idea to contact your local chamber of commerce and ask them questions you might have concerning your business.

At Stone & Sallus, our attorneys are also available to help answer questions on your sole proprietorship. Visit our other business resources and contact us for all your legal questions.

Also Check: How Much Is A 4kw Solar System

Is A Sole Proprietorship Right For You

A sole proprietorship may be the best option for an entrepreneur who offers products or services that might carry minimal legal risks associated with the business activity. If you do not plan on hiring employees, nor want to deal with formal corporate compliance with the state, a sole proprietorship may be a better route. When considering any business structure, including a sole proprietorship, LLC or corporation, entrepreneurs should discuss these matters with an attorney or tax professional for the best possible guidance. This will allow you to determine the optimal legal structure for your business as it relates to liability and taxes.

Third Decision: Should I Make An S Corp Election

Once youve chosen to form an LLC or a corp, you can then choose to make an S corp election.

S corp defining factors

Taxation The main reason to choose an S corp election is for taxation purposes, as they can save the owners on taxes. The possible tax savings may vary for an LLC versus a corporation and each is explained below. One note of caution, if not implemented correctly, the IRS may invalidate your S corp election resulting in back taxes and possible penalties.

Ownership restrictions S corps trade their tax benefits for strict ownership restrictions. They are limited to only 100 owners , and these individuals must all be legal U.S. citizens. Trusts and other subsidiary companies are not eligible to become part of the ownership structure. This can be a serious limitation, depending on the nature of the business and how it plans on generating its funding or financing.Filing In addition to the typical incorporation documents, S corps must file a special form with the IRS, Form 2553. This can be a relatively complicated and time-sensitive process it is encouraged that you contact a business filing professional for assistance when taking care of this step.

Why Youd Make an S Corp Election for an LLC

Why Youd Make an S Corp Election for an Inc.

An S corp isnt appropriate, however, if an inc has a lot of shareholders or wants to go public given the ownership restrictions discussed above.

The Takeaway

You May Like: How To Get Sole Custody In Va

Starting A Business Entity Types

Once you decide to establish a business, a primary consideration is the type of business entity to form. Tax and liability issues, director and ownership concerns, as well as state and federal obligations pertaining to the type of entity should be considered when making your determination. Personal and personnel needs and the needs of your particular type of business should also be considered.

The following is a brief overview of various business structures. The information is intended to provide a basic understanding of the different business structures and is not intended to provide legal advice.

Before you establish a business in the State of California, you should consult with a private attorney or tax advisor for advice about what type of business entity will meet your business needs, and what your legal obligations will be.

Ready To Officially Form Your Business

Making an informed decision regarding the ideal structure for your business ensures youre launching on the right foot. With Swyft Filings, you can file your business online and apply for your S corp election in just a short few minutes, or you can speak with one of our friendly account managers to walk you through the process.

Get Started Today

Also Check: Can You Clean Solar Panels With A Pressure Washer

Does Sole Proprietorship Need Business License

Unlike corporations or limited liability companies, sole proprietorships are among the easiest types of businesses to start. You do not have to register with the state like corporations and limited liability companies. As a business owner, however, you must obtain the required permits and licenses to operate legally, and you are personally responsible for any debts, lawsuits, or taxes incurred by the business.

New Business Guide 101

Starting a business can be a daunting task. We are here to help! Learn how to get your business started using these 10 steps.

Preparation and planning are critical to the success of your business. Begin thinking of how you will turn your dream into a reality and create an effective business plan that includes financing, marketing, implementation and beyond.

Your entity type influences how much you pay in taxes, your personal liability, your ability to raise money and your day-to-day operations. Carefully choose the entity type that will give you the right balance of legal protections and benefits.

Here are some common entity types to choose from: Corporation, Limited Liability Company , Partnership and Sole Proprietorship.

Visit www.sos.ca.gov to learn the details about each entity type.

Choose a business name that captivates what your business offers and targets your prospective clients. Note that corporations, LLCs, and limited and limited liability partnerships must comply with statutory name requirements.

The location of your business is vital to your success. Contact our Planning Department at 703-4460 to inquire whether your proposed business use is allowable on a particular parcel before you commit to any long-term lease or property purchase.

Also Check: How Much Will A 400 Watt Solar Panel Run

Apply For California Licenses And Permits

Tax Registration. If you will be selling goods in California, you must register with the Board of Equalization to obtain a seller’s permit. You can register online at the BOE website. If your business will have employees, you must register with the California Employment Development Department for employer withholding taxes. You can register online using the EDD’s Employer Services Online.

EIN. If your business has employees or is taxed separately from you, you must obtain a federal Employer Identification Number from the IRS. Even if you are not required to obtain an EIN, there are often business reasons for doing so. Banks often require an EIN to open an account in the business’s name and other companies you do business with may require an EIN to process payments. You can get an EIN by completing an online application on the IRS website. There is no filing fee.

General Business License. Every California business must obtain a general business license from the city where the business is located. In the case of unincorporated sections of the state, the license is issued by the county where the business is located.

Professional and occupational licenses. These cover people who work in various fields. The state’s CalGold website provides information on professional and occupational licensing.

Disadvantages Of A Sole Proprietorship

However, with a Sole Proprietorship, you also have the following drawbacks:

- Theres no liability protection against commercial debts, lawsuits and other obligations. This means you can be sued personally for commercial activities, putting your personal assets at risk.

- Outside of friends and family, its nearly impossible to secure equity financing for a Sole Proprietorship, as many investors choose not to invest in a Sole Proprietorship. This could limit the amount of funds available to grow, develop, and sustain your business.

- Its difficult to establish business credit to obtain debt financing for a Sole Proprietorship, as many financial institutions will categorize your request as a personal loan rather than a business loan, which brings all sorts of caps in terms of approval amount potential.

- You will have a lower amount of market credibility by not operating under a trade name. Now this could be easily resolved by creating a Doing Business As Name with your states department of revenue or the secretary of state, but this will require fees for establishment and ongoing fees to continue to use the DBA name.

Set Your Business Up for Success & Scalability

Make sure youre taking all the right steps to establish your business and build your business credit. Our course will guide you step by step so you can create a solid foundation and grow your business.

You May Like: How Much Do Solar Backup Batteries Cost

What Is An Llc

The LLC business structure, which stands for Limited Liability Company, is widely known as a pass-through entity because the profits of an LLC company flow directly to the managers/members. This type of business structure is quickly becoming the most common form of incorporation. LLCs have a relatively flexible structure that provides many of the benefits of a partnership or sole proprietorship, with some of the protections provided by C corps and S corps . They do not require many of the formal processes required by other types of corporations.

However, LLCs are unable to offer stock to the public and are still required to keep a fair amount of internal paperwork. LLCs do still require an owner to follow filing regulations. Companies that abuse the flexibility offered by filing as an LLC can lose their personal liability protection, in a process called piercing the corporate veil. If this happens, business owners can retroactively be held liable to pay corporate debts with personal funds.

LLC Pros

How Is A Sole Proprietorship Different From An Llc Or Freelancing

Anyone who does work on a freelance basis can technically be considered a sole proprietor of their business. They will pay taxes individually and usually operate under their own name, assuming liability associated with their work. However, there are a number of ways the two can differ.

A sole proprietor is able to hire employees and is responsible for employment taxes, while a freelancer usually cannot do this without filing paperwork and effectively becoming a sole proprietor. Freelancers also do not have to adhere to the same local regulations that a business might and cannot purchase the same types of insurance. A freelancer is considered somebody who has a relationship with external clients, while a sole proprietorship operates as a small business.

In contrast, an LLC is another possible business structure for small businesses. An LLC, or limited liability company, must file articles of organization and register with their state. This also protects the owner from personal liability, and the business is treated separately for tax purposes. Because of this separation, LLCs are often given larger lines of credit or more likely to attract future investments in times of growth.

Don’t Miss: How Does A Residential Solar System Work