How Much Can A Small Business Make Before Paying Taxes

Small businesses must keep records of their business activities and pay taxes on the money they make. You may be the only employee of your small business and operating as a self-employed independent contractor but federal income taxes apply to your income. The simplest business to set up is to become a sole proprietorship where you are the owner and the liabilities of the business are yours. Calculating profit and loss determines income and you can deduct expenses from income to determine your tax liability.

If you have made than $400 in self-employment income, you must pay self-employment tax on this income. If your business has employees, you must withhold federal and maybe state income taxes along with Social Security and Medicare taxes and unemployment insurance taxes.

RELATED ARTICLES

Deductions To Keep In Mind As A Sole Proprietorship

Tax deductions can go a long way in reducing your overall tax burden, and sole proprietorships are no different. According to the IRS, some credits and deductions available to all types of businesses include items like the Manufacturers Energy Efficient Appliance Credit and the Plug-in Electric Drive Vehicle Credit, among other things.

Other tax deductions that exist for sole proprietorships include health insurance deductions for yourself, your spouse and any dependents in your home. Even if you dont itemize deductions on your tax return, this deduction can still happen as an above-the-line item, according to Intuit. Keep in mind, however, that this deduction is limited by your taxable income.

Business operating expenses found to be ordinary and necessary by the IRS can also be deducted on your tax return. Things like equipment, capital improvements and other reasonable expenses can be considered for potential deduction. Furthermore, if you work out of your home, some home-office costs, including rent and utilities, can be deducted if you have a part of your house dedicated solely to your business.

If your sole proprietorship makes more than $415,000 or $207,500 , then your business is not eligible for the TCJA pass-through tax deduction.

Key takeaway: Save money on your taxes by taking advantage of tax deductions that reduce your tax burden.

What Qualifies You As A Sole Proprietor

A sole proprietor is an individual operating a single-person business and owns all the assets and liabilities. Theres no separate legal entity. You and your business are one in the eyes of the law and taxes..

A sole proprietorship can only have one owner. Hence the world sole! If you bring in another person to co-own the business, it becomes a partnership by default.

Sole proprietors are commonly called self-employed, though youre not technically an employee of the business, because the business isnt an entity separate from you . We tend to use the term self-employed in this case, though, because it points out a key factor of being a sole proprietor: Youre not an employee of someone elses company.

If you sell services as a sole proprietor, you most likely work as an independent contractor with clients. That designation is important on the employers side, because a company has very different legal and tax obligations toward employees versus independent contractors. For your purposes i.e. taxes and legal liabilities the business structure is sole proprietorship

Not all sole proprietors are independent contractors, though. If you sell goods, you dont generally have any contractual relationship with your customers, but youre still in business as a sole proprietor.

You May Like: How To Calculate Kw For Solar Panels

Paying Your Income Taxes As A Self

As a sole proprietor, your personal income and business income are one in the same and the government sees it this way too.

This means that you file Form T2125 Statement of Business and Professional Activities along with your personal T1. Remember: In addition to federal income taxes, youre also subject to provincial income taxes.

Also if you have your business registered under a different name other than your own, youll need a bank account in the companys name to manage your taxes.

While your filing deadline is June 15 , if you are required to make quarterly installment payments, your first payment is due by April 30.

The factors that determine if you have to pay taxes in quarterly installments include:

- If you earn income that doesnt have things like income tax or employment tax payments taken out, missing these deductions may leave you with a tax liability.

- If you earned more than the threshold of $3,000 or more or $1,800 or more in Québec, you will likely have to make quarterly payments.

- You may also owe if you have outstanding amounts from passing the thresholds in the previous tax years.

- These thresholds are applied based on the province or territory where you live.

If you receive a reminder, the one sent in February is for the March and June payments, while the one sent in August is for the September and December payments.

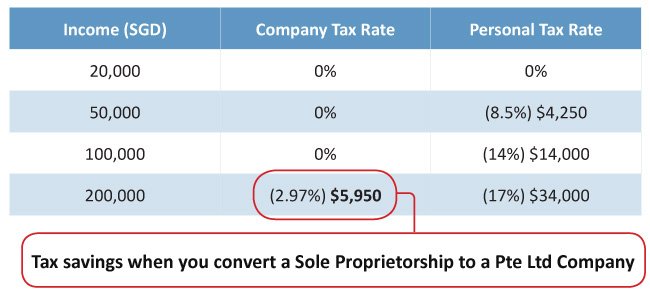

Sole Proprietor Or Company: What’s Best For Tax

Getting a new business venture off the ground is an equally exciting and stressful time. Youre enthusiastic about getting your new product or service out into the market, but you face quite an administrative process to get it off the ground legally.

A decision that often stumps many small business owners is whether to operate as a sole proprietor or as private company, a PTY Ltd. We receive many questions about this from entrepreneurs wanting to know the tax implications of each route.

So lets first have a look at an overall comparison of the two entities.

Recommended Reading: How Many Solar Panels For Rv

Tax On A Sole Proprietor

| Chantellsays:28 April 2016 at 19:13I have just opened a sole proprietor in my name. My questions is probably one of the most common ones but I would love to receive a clear answer. I would like to know:~How much Tax would I pay on my sole proprietor income?~Is it Tier related?~Or is it the same Tax doesn’t matter how little or much my sole proprietor earns?~Can I claim this tax back?~And final question How does my own income apart from the sole proprietor effect the taxes? |

| TaxTimsays:29 April 2016 at 11:24As a sole proprietor, you are taxed in your personal capacity. Your business income from your sole proprietor is added to the other income you earn, and then the total income is taxed per the normal tax tables for individuals. This table is a sliding scale and increases as your income increases. You would declare your business income within the “Local, Business Trade and Professional Income” section of your tax return. You can net off any business related expenditure to reduce the tax payable. You will only receive a refund from SARS if you file a tax return and on assessment by SARS, it is calculated that you have over paid tax for the year.You should also register as a Provisional Tax payerPlease Register for TaxTim and let us assist you with your tax return completion and submission to SARS. |

How Do I Withdraw Cash From A Sole Proprietorship

When you do pay your self, you simply write out a check to yourself for the amount of money you want to withdraw from the industry and symbolize it as owner’s equity or a disbursement. Then deposit the take a look at for your private checking or savings account. Remember that is benefit being withdrawn, now not a salary.

Also Check: Will A 5kw Solar System Run A House

What Is The Tax Bracket For A Small Business

Most small businesses are not taxed like corporations.

The Internal Revenue Service agency does not recognize the legality of a sole proprietorship, partnerships, limited liability companies and limited liability partnerships as taxable corporation they are instead considered pass through entities. This means that taxable income goes directly to the owners and members who report the income on their own personal income and pay taxes at the qualifying rate.

Since most small businesses are charged at an individual income tax level, here is the Federal tax brackets for 2019 for single taxpayers tax brackets:

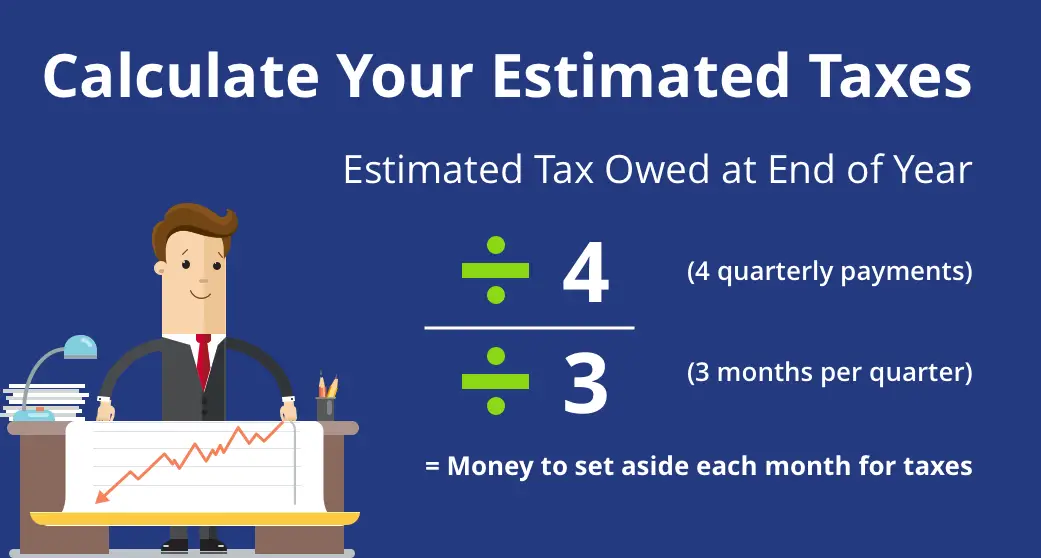

How Much Should I Set Aside For Taxes As A Sole Proprietor

Asked by: Miss Meghan Effertz IV

According to John Hewitt, founder of Liberty Tax Service, the total amount you should set aside to cover both federal and state taxes should be 30-40% of what you earn. Land somewhere between the 30-40% mark and you should have enough saved to cover your small business taxes each quarter.

Recommended Reading: How To Sell Solar Panels

System Of General Taxes

OSNO stands for whole taxation system. If you do not specify that you want to move to one of the special modes while registering as an individual entrepreneur, it will operate by default Sole Proprietor.

OSNO is appropriate for a wide range of businesses. You must pay value-added tax with OSNO, which is more complicated to compute and pay than other taxes. OSNO is appropriate for persons who must pay VAT and who receive income tax benefits .

Is it necessary to pay VAT? Yes, if you intend to work with VAT-paying organisations . Buying goods/services only from those who also work according to OSNO and pay VAT is sometimes much more advantageous for them, thus your VAT may be crucial for such partners of Sole Proprietor.

Split Your Income Tax Deductions For Sole Proprietors

Splitting your income is another great way to reduce the amount of taxes you owe for your small business . Generally, individuals with higher income are generally subject to a much larger marginal tax rate. Therefore, if you can offset some of that income to a family member, you can reduce your income enough to bring you into a lower tax bracket and pay less taxes.

This is a great strategy for small business owners with children of post-secondary school age. You can hire your daughter or son and pay them a salary, say $10,000, to a lower tax bracket. Because of the basic personal income tax exemption, your daughter or son, would pay very little income tax. Meanwhile, youve lopped $10,000 off your income for the year, decreasing the amount of income tax you personally owe.

This works best if your family member has very little or no other means of income during the year. Always ensure the amount you pay to your family member is justified. And always have paper work for hiring your family member and a description of the job they did/do.The rules for income splitting are complex and have been tightened recently, so be sure you know the current CRA guidelines before you plan on this deduction.

Don’t Miss: How To Hook Up Solar Panels To Your Home

If You Have Questions About Self

Depending on your specific needs, it can be very cost-effective to work with a professional accountant, bookkeeper or both. To contact the CRA, call the number for businesses and self-employed individuals at 1-800-959-5525.

Have a pen and paper ready as well as all your reference information, including your Social Insurance Number Business Identification Number and any other identifying pieces of information. Make sure your phone and patience are fully charged and maybe have a nice cup of tea or a coffee to enjoy if you have to wait on hold for a bit.

Do Sole Proprietors Pay Less Taxes

Fortunately, you do not pay taxes on the full amount of your sole proprietorship’s income. Instead, you’ll only pay sole proprietorship taxes on the profit of your business. Essentially, this means you’ll be taxed on all profitstotal income minus expensesregardless of how much money you withdraw from the business.

Read Also: What Is The Difference Between Sole Proprietorship And Corporation

Sole Proprietor Taxes In California

As a sole proprietor in California, youll pay state and federal income taxes as an individual. But its a little more complex than when youre an employee.

Youre responsible for the steps employers usually cover, including:

- Paying quarterly estimated taxes. Estimated taxes are due to both the California Franchise Tax Board and the IRS four times each year: April 15, June 15, September 15, and January 15. California requirements are different from federal for each deadline: April 15 , June 15 , September 15 , and January 15 .

- Owing the self-employment tax. Youll be responsible for the full Medicare and Social Security taxes that an employer would otherwise split with you. This amounts to 15.3% of your federal taxable income.

Report profit or loss from business. When you file income tax returns, youll have to fill a Schedule C along with your IRS Form 1040. Schedule C is where you report the money you earned and spent on your business for the tax year.

Incorporating Your Business May Cut Your Tax Bill

Unlike a sole proprietorship, a regular corporation is considered a separate entity from its owners for income tax purposes. Owners of C corporations don’t pay tax on the corporation’s earnings unless they actually receive the money as compensation for services or as dividends. The corporation itself pays taxes on all profits left in the business.

The Tax Cuts and Jobs Act dramatically changed the corporate tax rate to a single flat tax of 21%. This replaced tax rates ranging from 15% to 35% that corporations paid under prior law. The 21% rate is lower than individual rates at certain income levels. The top 37% individual rate applies to income over $600,000 for marrieds and $500,000 for singles. However, corporations do not benefit from the up to 20% pass-through tax deduction established by the Tax Cuts and Jobs Act, which can cut the effective tax rate for sole proprietors by 20%.

Corporate taxation is definitely more complicated than the pass-through taxation of a sole proprietorship, and the savings — probably a few thousand dollars — may not be worth the hassle of forming a corporation and filing a corporate tax return. To learn more about how incorporating can reduce your tax bill, see How Corporations are Taxed.

You May Like: How Much Value Does Solar Add

Annual Report License And Permit Renewals

- Corporations, limited liability companies, and limited partnerships must file an annual report. Profit corporations, nonprofit corporations, limited liability companies, and limited partnerships file their annual reports with the Secretary of State and all services are available online at www.sos.wa.gov/corps.

- Your states business license may have state or city endorsements that are renewed annually. Many specialty licenses, permits, local licenses and professional licenses also require annual renewal. Keep track of your renewal dates to ensure your licenses are current and to avoid extra fees. You may need to check with the individual state agency where the permit was issued.

- Renewal of contractor registration is required every two years, and cost $113.40. You renew your registration with L& I. L& I also renews specialty licenses related to trades .

- Health provider license and facility renewals.

- If you are now doing business in cities and towns where you werent licensed previously, you will need to get additional local licenses. Doing business can include sales, delivery, installation, or service. Contact the cities or towns for further information.

What Happens If A Sole Proprietor Doesnt Pay Estimated Taxes

The U.S. tax system is pay as you earn, and the IRS expects taxpayers to pay taxes on their income during the year they earn it, rather than waiting until they file their taxes early the following year. If you didnt pay enough tax on your business income during the year, you may have to pay a penalty for underpayment. You may also be charged a penalty if your estimated tax payments are late, even if you receive a refund.

You may be able to decrease the penalty if:

- You increase your withholding from employment income.

- You have uneven income during the year, so you annualize your income and make unequal payments during the year.

- You qualify for later payment due to a casualty or .

- You retire after age 62 or become disabled during the year and didnt make the payments due to reasonable cause.

Also Check: Do You Have To Register As A Sole Proprietor

All The Taxes A Sole Proprietor Pays

A proprietor is a business owner, and a sole proprietor is a solo business owner. Sole proprietorships are the most popular business type in the U.S. As of 2014, there were 23 million sole proprietorships in the U.S., compared to 1.7 million C corporations, and 7.4 million partnerships and S corporations.

If youre thinking about running this type of small business, its important to understand how a sole proprietorship operatesincluding how these businesses pay taxes.

How Do I Make My Quarterly Payments

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals PDF, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior years annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

You May Like: How Does Home Solar Energy System Work