How Does The Solar Tax Credit Work And How Much Will I Save

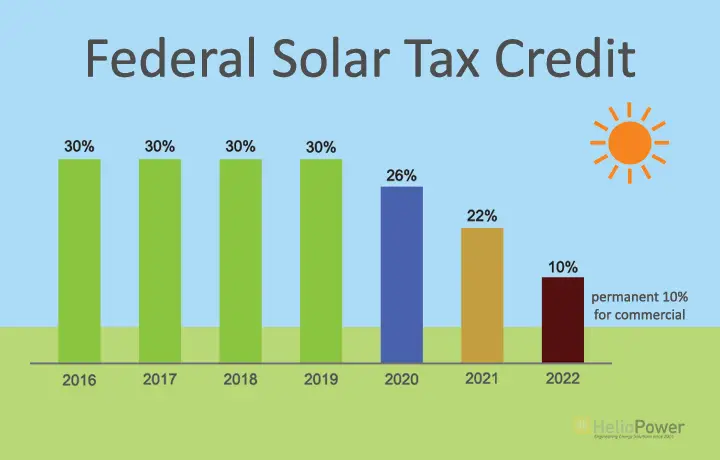

Right now, the Solar Investment Tax Credit is worth 26% of your total system cost. This includes the value of parts and contractor fees for the installation.

As mentioned before, if it costs $10,000 to buy and install your system, you would be owed a $2,600 credit.

You are only allowed to claim the credit if you own your system. This is why were strongly opposed to solar leasing if you can avoid it. If another company leases you the system, they still own the equipment, so they get to claim the incentives.

Youll still get the benefits of cheap, renewable energy if you lease. But missing out on the tax credit is a huge blow to getting a positive ROI from your system.

It makes more sense to take advantage of solar financing instead. Youre still on the hook for a loan, but you retain rights to the incentives that help make solar such a sound investment.

Is The Solar Tax Credit A One

At the moment, the solar investment tax credit is a one-time credit. However, one of its more appealing advantages is that you may carry over any surplus to the next year if you cannot utilize it all when you file.

For instance, suppose you owed $4,000 in taxes but got the previous examples $5,200 home solar credit. You would owe no taxes for the year you filed the claim. Additionally, youd get to deduct the remaining $1200 from your following years taxes.

How To Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . Your solar provider should supply the proper documentation and instructions upon your demand. We have listed the essential steps in claiming the credit here:

We recommend consulting a tax expert and your solar provider to ensure you are correctly claiming the ITC.

You can use the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits are available in your zip code.

Recommended Reading: Does Duke Energy Offer Solar Panels

Am I Eligible To Claim The Solar Investment Tax Credit In 2022

You might be eligible for the solar investment tax credit if you meet all of the following criteria:

- Your solar PV system was placed in service between January 1, 2006, and December 31, 2021.

- The solar PV system is located at a residential location in the U.S. .

- You own the solar PV system

- The solar PV system is new or being used for the first time. The ITC can only be claimed on the originalinstallation of the solar equipment.

Working As A Volunteer Team

Just about anyone can help us build a solar farm. It’s okay if you’re not a skilled electrician. It’s okay if you’re not a skilled engineer. We need excited individuals that are ready to donate a weekend and work on beautiful farmland. Everything you don’t know how to do can be learned.

Oh also… we do need a few electricians and engineers!

When we are ready to construct we will invite volunteers to the farm. The volunteers will be grouped together and given small tasks such as:

- Move mounting brackets from container to the field

- Bolt brackets together

A single acre of farmland can support 500 solar panels that produce 500 watts each.

You May Like: How Many Kwh Should Solar Panels Produce

How Long Is The Federal Solar Tax Credit Available For Use

Currently, the residential solar tax credit is set to expire in 2024. If youre thinking about adding solar energy to your home, now might be the right time to act. The tax credit expires unless Congress renews it.

There has never been a better time to take advantage of this credit. The Federal government wants to encourage Americans to invest in solar energy.

Solar Tax Credits At The State Level

Along with the federal tax credit, many states and Puerto Rico provide a number of state-level incentives. In New York, for example, you may be eligible for a 25% solar tax credit, which works similarly to the ITC. In California the state that gives the most rebates and incentives for renewable energy than any other you may be eligible for various state-administered incentives.

For instance, under the states property tax incentive, you may deduct the entire cost of your system from your property taxes. This implies that if you spend $20,000 on an average-sized system, you may deduct the total cost from your state property taxes.

Another significant sort of state-level incentive that you may come across is the Solar Renewable Energy Certificate , sometimes known as a Solar Renewable Energy Credit.

The method for acquiring SRECs varies by state. Still, youll typically need to register your solar system with the relevant SREC-granting body, which will then monitor your renewable energy output and offer you SRECs quarterly, depending on the amount of energy produced by your system.

The more energy generated by your system, the more SRECs you will get. You may then sell your SRECs to your local energy utility, which will utilize them to meet their renewable energy requirement under state law.

Read Also: How Many Solar Panels For Rv

Getting The Federal Tax Credit

With the Renewable Energy credit, you simply subtract your credit amount from the total tax the IRS says you must pay.

Its different from a tax deduction, which reduces the amount of income you pay taxes on. A $100 credit is worth $100 regardless of your tax rate, says Kevin Martin, principal tax research analyst at H& R Block in Kansas City, Mo.

If you cant use all of the credit in one year, you can carry it over into later years, Martin says. If, say, your federal taxes are $6,000 for 2020 and youre eligible for a $7,000 tax credit for installing a solar system at your house, you can claim the leftover $1,000 as a credit toward your 2021 taxes.

But not every type of solar installation or expense is eligible for the tax credit. Qualified solar systems that meet IRS guidelines and produce electricity and heat water are covered.

Important Update On The Solar Energy System Tax Credit

The Iowa Solar Energy System Tax Credit expires and is unavailable under Iowa law for residential installations completed after December 31, 2021. Therefore, any residential tax credit request that does not receive a tax credit award during the 2021 award year will expire under Iowa law and will not carry forward on the waitlist to future years. This result is required under Iowa Code section 422.11L and the version of the federal residential solar tax credit to which Iowa is conformed. Submitting an application before the residential tax credit expires at the end of 2021 is no guarantee a taxpayer will receive an award, as described below.

The Iowa solar energy system tax credit for business installations does not expire at the end of calendar year 2021, but Iowa law provides that it will only apply to installations that begin construction before calendar year 2022, so its availability will be limited in the future. Valid and timely business tax credit requests will not expire under Iowa law and may carry forward on the waitlist to future years.

2021 award year: The Department estimates that valid and complete business or residential applications with a submission date before , will be eligible to receive a tax credit award and certificate during the 2021 award year. The Department is in the process of issuing these tax credit certificates.

You May Like: How Much Is A Solar Attic Fan

Are Solar Batteries Covered By The Solar Investment Tax Credit

The Internal Revenue Service specifies that battery installations for which all energy that is used to charge the battery can be effectively assured to come from the Solar Energy System are eligible for the full solar tax credit.

In other words, yes, solar batteries like the Tesla Powerwall and the LG Chem are eligible for the solar tax credit if they are charged by solar energy more than 75% of the time.

This means that if you install a battery with a new solar system, you will save 26% on the total combined cost.

What Happens If Theres Leftover Credit

There are some situations where the solar ITC would not bring you a full refund, however. If we take the $5,200 amount from before and apply it to someone who only owes $3,000 in taxes, they will not get the additional $2,200 of value back in their pocket. Instead, the credit will reduce the amount owed to $0, giving you that $3,000 back, and then will go roll over to the next year when you can apply the remaining amount of the federal ITC to that years taxes.

This is a big difference compared to a refundable tax credit. With a refundable tax credit, if the $5,200 took you below $0 you would get your $3,000 back, but then the IRS would send you a check for the remaining $2,200 that same year.

To maximize your returns with the federal solar tax credit, you need to owe some amount of income taxes. If you do not owe any sort of income tax perhaps because you receive social security or your main source of income is from property then the federal solar tax credit will be completely worthless to you because of its non-refundable nature.

It is for this reason that Go Solar Group discourages you from going solar if you do not owe federal income taxes. The ITC is one of the main reasons why solar has gotten increasingly affordable over the past several years. Without that tax credit, your solar installation will become much more expensive than it would otherwise be.

Read Also: How Much Does It Cost To Switch To Solar Power

Solar Incentives And Rebates In California

There are many incentives in place to help reduce the cost of your solar panels. Options available to California homeowners include:

- The 26% federal solar tax credit available to all homeowners who install solar systems on their primary or secondary homes in 2021.

- Californias net metering program, which allows customers to credit their net excess energy generation back to their next bill at the current retail rate.

- Local government and utility programs that may be available in your area.

Important Facts About The Federal Solar Tax Credit

Its important to be aware that you can only claim the Federal Solar Tax Credit if you own your solar system. Homeowners who lease their systems are not eligible for the tax credit. This is why financing a solar project is often preferable to leasing: Financing allows you to maintain your rights to the solar incentive while avoiding the upfront costs of a solar investment.

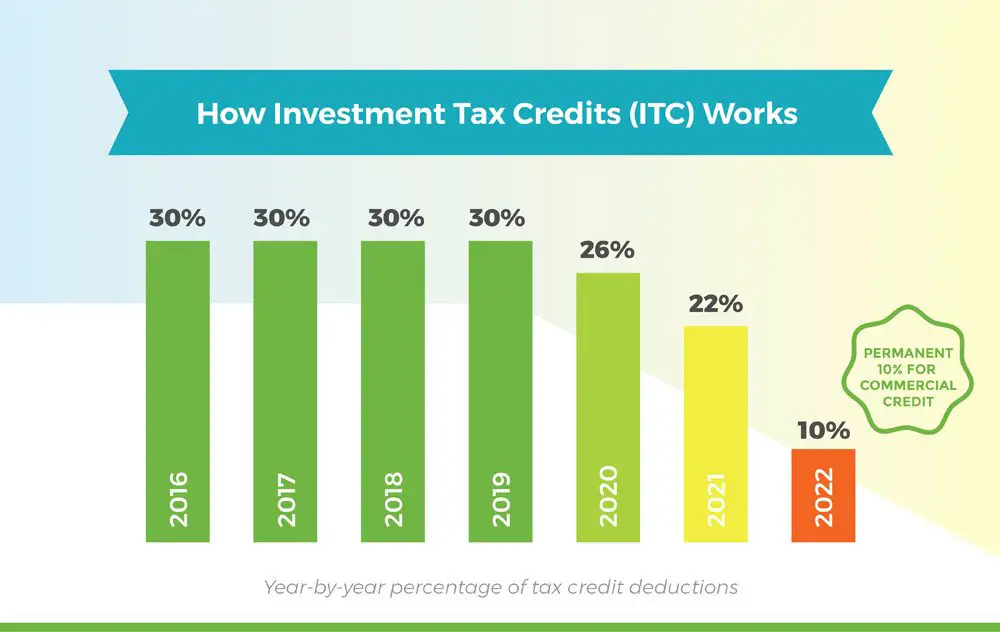

Another key fact to keep in mind is that the solar tax credit wont be around forever. The value of the tax credit is decreasing each year, and it will be phased out completely by 2022. Fortunately, you can claim your tax credit in the same year that you complete your solar project. If youve been hesitating about your decision to invest in solar energy, theres no time like the present to move forward.

Read Also: How To Ground Solar Panels

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

How Many Solar Panels Do I Need

Your energy needs determine how many panels you need, which affects the overall price of your solar system installation. To eliminate your electric bill entirely, you must generate 100% of the electricity your home needs. Most homeowners need between 25 and 35 panels to achieve complete energy independence.

Average households need867 kWh/monthin electrical power

A solar panel typically produces about one kilowatt-hour per day, so if your daily kWh usage is 30, you would need 30 solar panels to generate all of your energy needs. If you need to generate extra energy to heat a pool or run the air conditioning for most of the year, this adds to your energy costs.

To estimate the amount of energy youll need, you need to know your average kilowatt-hours . This number should be on your utility bill as kWh used. To get your monthly average, look at bills for the past year, add up the stated kWh used and divide by 12.

Next, divide your monthly kWh average by 30 to calculate your daily average. For instance, if your average monthly kWh is 900, then your average daily kWh is 30.

For a more accurate calculation, try to factor in times when there is not as much solar power available, like when its cloudy or in the evening. There are two main ways to account for this:

These additional calculations can be difficult, but they are necessary if you want the optimum solar power system for your home.

Also Check: How Much Can Solar Power Generate

What Will Happen When The Solar Tax Credit Steps Down

This is speculative, but we foresee a couple possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas to help the state achieve its RPS goals.

- Congress adjusts the step down

- There is a possibility that congress may delay or adjust the tax credit step down. The tax credit was initially passed under a Republican administration and extended under both Republican and Democratic administrations. There is potential bipartisan support for an extension.

- With the most recent extension, the very fact that legislators built in a step down makes us find it less likely to be extended at the current 26% level.

- Residential tax benefits are also going away entirely in 2024.

History Of The Solar Itc

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Don’t Miss: How Much To Install Solar Panels On A House

Guide To Solar Incentives By State

When it comes to buying solar panels for your home,weve got good news and better news: the cost of solarpower has fallen over 70 percent in the last 10 years,and there are still great solar rebates and incentivesout there to reduce the cost even further.

The first and most important solar incentive to knowabout is the federal solar tax credit, which can earnsolar owners 26% of the cost to install solar panels backon their income taxes in the year after installation.

States and utility companies also offer several types of solarincentives, and whether you qualify to claim them depends onwhere you live and other factors like your tax status.

On this page, you can learn about the different types of solarincentives available to homeowners. You can also choose yourlocation below to discover the exact mix of solar incentivesoffered by your state and utility companies in your area.