Is The Solar Tax Credit Going Away

Yes, but not for a while. In August 2022, the Inflation Reduction Act was signed into law. That legislation extended the credit through 2032 at an increased rate of 30%. In 2033, the rate drops back down to 26%. In 2034, it drops further, down to 22%. This is great news, making this a perfect time to go solar!

Here at ADT Solar, we provide high quality solar panels and installation service and do not lease solar panel systems. Our team of solar professionals will work with you to ensure you satisfy the requirements for this valuable federal solar tax credit. We will also provide you with a sample federal tax form to make filing easy.

Now is the time to take advantage of the solar investment tax credit. Contact our team of dedicated solar experts at ADT Solar today!

ADT Solar does not provide tax advice. Be sure to speak with your tax consultant if you have questions about your personal situation.

Disclaimer: This webpage provides an overview and does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making purchasing decisions, investment decisions, or tax decisions, or when executing other binding agreements.

**If you have taxable income and own the system, you may qualify for the federal investment tax credit . It is your responsibility to determine your eligibility and to apply. Consult a qualified tax professional for assistance and details.

Why Is The Solar Tax Credit Ending

Congress passed the Spending bill in December 2015, which meant that homeowners could enjoy the state tax credit on the residential solar panels. The duration of this tax credit was from 2016 to 2021.

Unfortunately, the tax credit may not be applicable for future solar panel installations unless the state has new recommendations.

The Federal Solar Tax Credit In 2022

For homeowners and business owners going solar in 2022, there are a variety of solar incentives available from the federal government, state agencies, and local governments to help reduce the upfront cost. One of the most significant ones is the Federal Solar Investment Tax Credit that has contributed to solar growth for over a decade.

Known to industry professionals simply as the Solar ITC, this incentive is a direct dollar-for-dollar tax credit from the U.S. government that is designed to drive down the cost of installing solar projects on residential and commercial properties. The Solar ITC allows solar customers to claim a one-time tax credit if they finance their solar photovoltaic systems with cash or loans.

The good news is that the solar ITC also benefits households and businesses that do not purchase a home solar system outright. Because it can apply to any system owner, including project financiers, it also translates to benefits for customers that enter a solar lease agreement or a solar power purchase agreement framework.

You May Like: How Much Power Produced By Solar Panels

How Does The Solar Panel Tax Credit Work

In addition, the House and Senate have passed legislation that would extend the credit through 2026. The House bill would provide a credit of up to $2,500 per system installed, while the Senate bill provides $1,000. Both bills would phase in the credits over a five-year period, starting in 2018.

New York City Real Property Tax Abatement Program

If you live in New York City, ask your participating contractor about the NYC Real Property Abatement Program, which New York City offers in lieu of the New York State Real Property Tax Exemption. Confirm your contractors process for submitting and handling the appropriate forms, as some contractors may do it on your behalf.

You May Like: How Does Power Home Solar Work

How Do I Claim The Federal Solar Tax Credit

You claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service . But, first, check with your solar provider to receive the proper documentation and instructions on exactly how to claim the ITC as part of your installation. We have listed some of the most critical steps in the process below:

We recommend that you consult a tax expert, as well as your solar provider, to ensure you are correctly claiming the federal solar tax. As a reminder, the tax credit only offsets the taxes you owe on your return. If the taxes you owe are less than the credit you earn, the credit will roll over year after year.

You may also file any sales and property tax exemptions that may be available in your state in addition to the ITC. Enter your zip code on the Database of State Incentives for Renewables & Efficiency to see what other rebates and state tax credits you can receive.

How Do I Claim My Tax Credit For Solar

The solar tax credit requires you to file irs form 5695 as part of your tax return. The credit will be calculated on Part I of the form and then entered in Part II. The credit is based on the amount of electricity you use to generate electricity.

If youre a small business owner or self-employed individual, your business is considered to be a small business if it has fewer than 50 full-time employees. See Small Business and Self-Employed Individuals, later, for information on how to determine whether you meet this threshold. If you file a joint return, each of you can claim a separate credit.

However, if you claim more than one credit in a tax year, only one of them can be used to reduce your federal income tax for that year. This means that you wont be able to take a credit for any portion of any tax you paid in the previous year that wasnt taken into account in this years credit calculation.

Don’t Miss: Can You Use Pine Sol To Wash A Car

Do I Qualify For The Federal Solar Tax Credit

The Office of Energy Efficiency & Renewable Energy states the following criteria determines whether you can qualify to claim the federal solar tax credit:

- Date of installation: You installed your solar system between Jan. 1, 2006, and Dec. 31, 2023.

- Original installation: The solar PV system is new. The credit can be claimed only on the original installation of solar equipment and not the repurposing or reuse of an existing system.

- Location: The solar system is located at your primary residence or secondary home in the United States. It may also be used for an off-site community project if the electricity generated is credited against your homes electricity consumption and does not exceed it.

- Ownership: You own the solar PV system. You cannot claim the credit if you are leasing or in an agreement to purchase electricity generated by the system, including a solar power purchase agreement .

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS Form 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount for up to 5 years.

Now that you have your very own solar system, the solar Investment Tax Credit is yours for the claiming. How exactly do you go about it?

Well walk you through the exact, step-by-step process of filing for the federal solar tax credit.

Of course, we recommend talking to a tax professional to make sure youre not missing anything. But if youre a do-it-yourselfer who knows your way around a tax form , this guide walks you through basic filing.

You May Like: Is Solar Panel Roof Worth It

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Looking To Go Solar In The San Francisco Bay Area Or Central Coast Were Here To Help

After more than 16 successful years, Sandbar Solar maintains its position as the most established, locally owned solar company in Santa Cruz.

Our solar panel installation projects reduce your energy bills and increase your propertys market value. Solar panels for your home or business also make you an important part of the green solutions that help preserve our planet.

Our Santa Cruz solar services include free estimates, custom design, and expert installation. Our portfolio features thousands of residential and commercial solar panel installations across the region. Were proud of our reputation for designing and installing the most efficient solar panels for the Central Coast including Santa Cruz and Monterey counties as well as San Jose and the Bay Area.

If youre thinking of going solar and you live on the Central Coast or in the South San Francisco Bay area, contact us today to get a quote for your project.

About the Author

Scott is the founder of Sandbar Solar & Electric. With a Bachelors Degree in Economics from UC San Diego, Scott has an NABCEP certification, and has lectured on and taught many high-tech construction practices and solar PV technical concepts to education institutions, including Stanford University and state-recognized electrician apprenticeship programs. Scott enjoys sharing his knowledge of the evolving renewable energy space and making a difference in his community.

Don’t Miss: Is Home Solar Power Worth It

How Will Solar Tax Credit Work In The Future

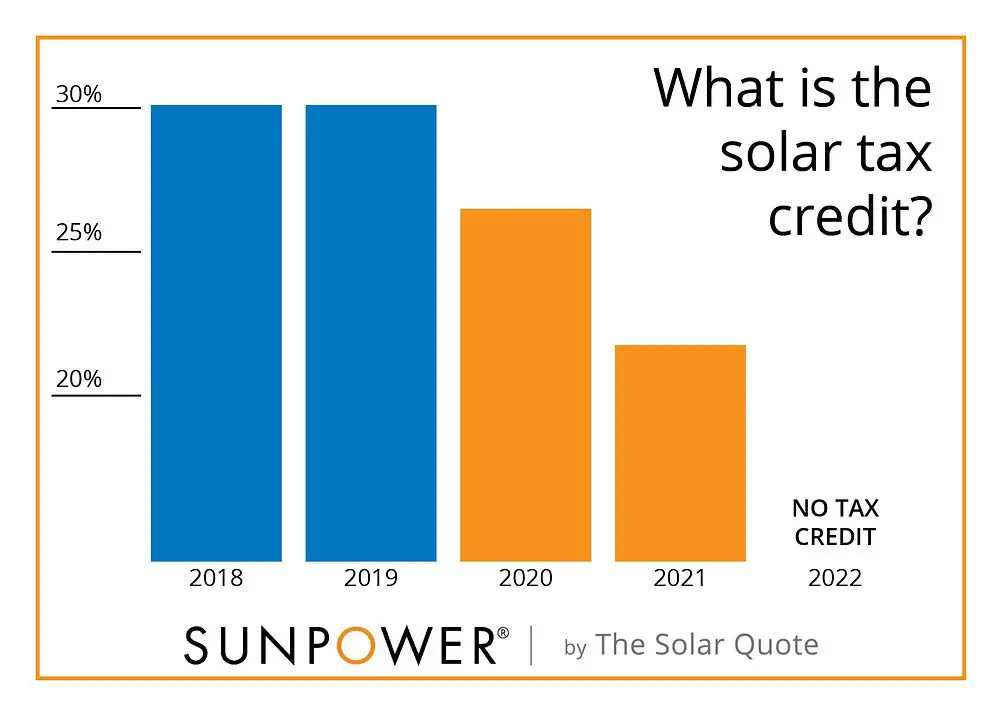

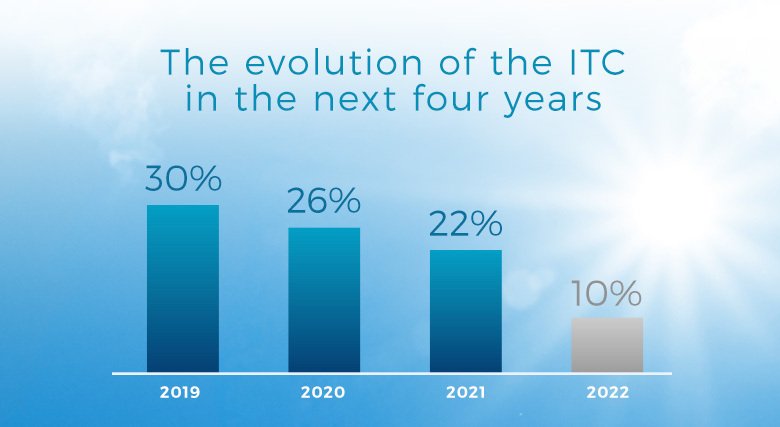

As we saw earlier, the solar tax credits will end soon, but there is something for those installing a new solar energy system in 2022 and 2o23. So, if your construction project begins in 2021 or 2022, you are still eligible for a 26% federal credit on your solar taxes.

Moreover, for constructions in 2023, there will be a 22% tax credit. Its important to note that there will be no residential tax credits after 2023. Also, commercial tax credits will drop to 10%.

This Means That You Must Owe Taxes In Order To Utilize The Tax Credit

Having a tax liability does not mean that you have to write a check when you submit your tax return. It means that the IRS keeps some of the income tax that was withheld or paid.

Getting a refund does not mean that you do not owe taxes. It means that more taxes were collected by the IRS than what you ended up owing.

Not having to write a check to the IRS when you submit your tax return to the IRS does not mean that you do not owe taxes.

The amount of any federal solar tax credit that is used cannot exceed the total tax liability for that year.

In other words, you cannot use a credit for more than what you owe.

You may be able to use some of your tax credit now, and some later.

You may be able to carry over the tax credit to another year and use it when you have a tax liability in a future year.

You May Like: How Much Energy Can Solar Panels Store

How Does The Solar Investment Tax Credit Work

Simply put, it gives homeowners a chance to recoup some of the investment that they made into installing solar panels and energy systems back as a tax credit. Initially, when it was introduced, the tax credit was capped at 30% of the total installation cost of solar. This was set to reduce to 26% in 2022 and 22% in 2023. Starting from 2024, the tax credit was proposed to be eliminated entirely. The new bill has now extended the period to 2032 at the current 30% rate, and then it will reduce to 26% in 2033 and 22% in 2034.

This is a tax credit and not a tax refund. This is how it essentially works. Say you spent $10,000 on installing solar panels and other systems in your home. As per the ITC, you are eligible for a tax credit of $3000. If you owe $4000 as taxes for the year, you can offset it by the tax credit and your total tax due would be just $1000.

However, if you owe just $2000 as taxes, you cannot get a refund of $1000 after the tax credit. Your total tax due will reduce to zero. However, the ITC can be rolled over to the next year. This means that you can use $1000 worth of credits the next year when you are paying federal taxes.

The 30% tax credit is applicable for energy storage systems as well. So if you are planning to get some battery storage systems installed in your home or your community as a whole, you are eligible for tax credits for the amount you have spent installing it

How Does The Federal Solar Tax Differ From A Refundable Tax

In case of a refundable tax credit, if your tax bill falls short of your tax credit, you can get a refund on the surplus credit. Suppose you qualify for a tax credit of $1,500, but the tax you owe is just $1,000. In such a case, you can have the unused $500 refunded back to you.

In contrast, as previously explained that if your tax credit were to exceed your tax bill for the federal solar tax credit, your only option would be to roll over the balance to the following year.

Also Check: How To Determine Number Of Solar Panels Needed

Why Should You Act Now

With the solar panel tax credit, you could save thousands of dollars on the cost of a solar system when compared with waiting a year and losing out on the chance for the incentive. In addition, switching to solar comes with many benefits. The costs of energy are lower, and you become less dependent on the power grid.

In addition, to qualify for the tax credit, your system must be installed by December 31, 2022. If you install it after that date, the percentage you get in tax credits will be smaller. Keep in mind, too, that installing a system can take some time.Get a Custom Quote Now

If you decide later in the year you want solar power, you may not have enough time to start the installation. In addition, other homeowners and business owners may be working to get their own panels and systems installed and it may be more difficult to find someone able to take on the work.

If you are ready to go solar and save money, contact us at KC Green Energy to talk about solar panel installation. We are a leader in the installation and design of solar electric energy systems. Started in 2008 as a division of the family-owned Kautz Construction, KC Green Energy is made up of experts dedicated to solar energy. We have accredited project engineers who will conduct a free site analysis at your property so we can custom design a system thats best suited for you.

Does The Residential Solar Tax Credit Apply To New Home Purchases

If you buy a new home that already has solar installed, you can still claim the Solar Investment Tax Credit in the year that you move in, regardless of when the house was originally built or sold. For example, if your home was built in 2020, and then you bought it in 2021, but didnt move in until 2022, then you would claim the ITC on your 2022 taxes.

Keep in mind, the ITC can only be claimed once, so youll want to check and make sure that your builder hasnt already claimed the credit. If your builder has claimed it, then you may be able to ask for a reasonable allocation for those costs, and factor that into the final purchase price.

Don’t Miss: What Is The Best Efficiency Of Solar Panels

How Does The Solar Tax Credit Work If I Dont Owe Any Taxes

The taxes that people pay are used to fund the government expenditures that ensure citizens have access to properly functioning and maintaining public services. Therefore, the government subjects the people to various forms of taxes, and each person and business must pay their due amount. Your tax liability is the amount of money you owe in taxes.

The amount of taxes you owe is determined based on a variety of factors, including your earnings from wages and salaries, as well as profits earned on the selling of assets. However, people who do not have any assets in their possession, have no source of income, or who have a very low source of income may be exempted from paying any taxes.

Seeing as how the tax credit program works by offering you a certain amount of reduction on your tax liability the amount of tax you owe the government if you qualify for a tax credit but do not owe any tax to the government, you wont have any liable amount to which the credit can be applied, and therefore, the solar tax credit program will be of no benefit to you.

To summarize, in order to avail the entire amount of the solar tax credit that you can potentially be eligible for, you must owe the government at least as much in taxes as the credit amount.