Goodlawyer Is Here To Help

Do you still have questions about which business structure is best for your company? Do you feel overwhelmed by the extra steps and paperwork required to incorporate? No worries. Goodlawyer is here to help.

There are so many positive advantages to incorporating a startup, and making sense of the process of incorporating is an excellent first step. You can connect with a lawyer and get the help you need for as little as $39 for a legal Advice Session.

What About Permits And Licenses

Even sole proprietors require a business license to run their business and you can get a fine if you try to operate without a license. Most businesses, no matter how small, will require this license just to open up a business account. In fact, depending on the kind of sole proprietorship you are running, there may be other licenses too.

You cant, for instance, be running some kind of food business without having the appropriate license such as a health permit for a food business. Does a sole proprietor need a business license for looking after children? Looking after young kids can be a daunting task because theres that part where you have to comply with certain regulations. You will require a business license.

When you are just looking after 3 or 4 kids do you need a license? Nothing is set in stone and each state differs. Some states allow you to have 7 children without a license while others say 4 or 12. You have to get answers in your state because some states will give you a massive fine for each day you operate without a license.

There is always the perhaps type of answer. This is because each state and city may have its own specific licensing regulations. Before opening up a daycare youll need to research your states licensing laws by contacting your local Child Care Resource and Referral agency and child care licensing office so that you know what licenses and permits are required.

Setting Up As A Sole Proprietor In California

If you are considering starting a new business in California, one of the first decisions you must make is what type of business entity you want to form. If you are the sole owner of the business, one option is a sole proprietorship.

Establishing a sole proprietorship in California is generally a simpler process than forming a corporation or an LLC. Sole proprietorships do not need to register with the state. You may need to obtain certain business licenses and permits, file tax and employer identification documents, and file a Fictitious Business Name Statement.

Before taking these steps, entrepreneurs should fully evaluate all options for forming their new businesses. While they are relatively easy to establish, other factors may make sole proprietorships unattractive.

Don’t Miss: Do Solar Panels Increase Your Property Value

Register Your Business Name

Sole proprietors have two options when it comes to a business name. Your business name can be the same as your personal name or you can file your business under a different name.

Youll need to use a fictitious business name or a doing business as name if you dont want to use your personal name for your business.

DBAs arent required in most states, however, they come in handy when you open a business banking account or business credit card since these institutions require you to separate your business and personal finances into two different categories.

Each state, county, and municipality has different DBA requirements and registration processes. You can check local government offices and websites for more information about registering your business.

Have You Prepared Your Business Plan

You wont want to start your business before you have completed your business plan! You may want to click the Planning box for business planning guidelines. For planning assistance and more in-depth information regarding any of the steps on this page, you may wish to check out the following resources:

Also Check: Does Removing Solar Panels Damage Roof

Running Your Business As A Sole Proprietorship Vs Llc

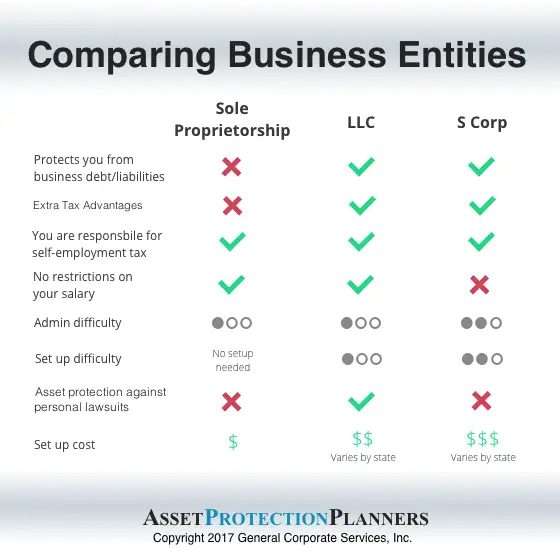

There are a few distinctions in operating a business as a sole proprietorship vs. an LLC. As a sole proprietor, theres no separation between you and your business. Youre not obligated to separate your personal and business bank accounts and credit cards. However, opening up a different checking account for your business will make it easier to identify business expenses when it comes time to file your taxes.

With an LLC, its important to keep your business finances completely separate from your personal ones. Youll need a business bank account, and youll sign documents and contracts on behalf of the business, not as yourself personally. Keeping things separate preserves your liability protection because it shows that the LLC truly has its own separate identity.

Taxwise, an LLC offers more options than a sole proprietorship. All sole proprietors are self-employed. Youll list your business income and expenses on Schedule C of your personal tax return and youll pay personal income tax on your profits. Youll also be responsible for paying your own Social Security and Medicare taxes, otherwise known as self-employment taxes.

How To Run A Sole Proprietorship Business

When you run the business as a sole proprietor, youâre on your own. You have complete authority to make decisions. You donât wait for approvals from partners or a board of directors.

You donât even need to open a different bank account for your business. However, keeping your personal and business finances apart is still a good practice and will make it easier to file your taxes.

Don’t Miss: How Much Does A Big Solar Panel Cost

How To Become A Georgia Sole Proprietor

When it comes to being a sole proprietor in the state of Georgia, there is no formal setup process. There are also no fees involved with forming or maintaining this business type. If you want to operate a Georgia sole proprietorship, all you need to do is start working.

However, just because its so easy to get started doesnt mean there arent some additional steps you should take along the way. While these parts of the process arent strictly required, many sole proprietors find that they are in their best interests.

Can You Run An Online Business Without A License

Your business is regulated by the laws of the state where its registered and the county or municipality where its physically located even if all of your operations happen online. Whether you require a license to operate the business depends on the state and locality. If you sell goods online or in person, most states require you to have a sellers permit or sales tax license.

Read Also: How To Start A Sole Proprietorship Llc

Here Are The Three Main Things You Need To Know:

Tax Responsibilities

Because theres no distinction between the owner and the business itself, sole proprietors dont need to file business tax returns they instead simply claim any business profits or losses on their personal tax returns.

Contracts

Sole proprietors are allowed to sign contracts using their personal name, and along those same lines, customers can write checks to the business by using the sole proprietors name.

More Flexible

The other big difference between sole proprietorships and more formal business structures is the fact that sole proprietors are allowed to commingle business and personal assets as much as they want to. With LLCs and corporations, ownership is required to keep their assets separate from those of the company. The downside of this aspect for sole proprietors is that if your business is sued, creditors are free to pursue your personal assets like your house, car, personal bank accounts, etc. For corporations and LLCs, creditors are limited to your business assets.

Sole Proprietorships In Florida

If youre looking to get your business off the ground as quickly and inexpensively as possible in Florida, then you should definitely consider operating as a sole proprietorship. Its one of the easiest ways to start a business, and one of the most common as of 2019, anestimated 73%of businesses in the United States are sole proprietorships.

Recommended Reading: How To Give Baby First Solid Food

Setting Up A Bank Account

Most financial institutions will require a secondary business bank account separating the business assets and obligations from those of the individual however, when tax account season arrives, the Sole Proprietorships revenues will be listed under the personal income tax return for the individual owner. The Master Business License in Ontario is valid for 5 years. The registration provides you with the ability to operate your business for several years before requiring renewal. When the 5 years approaches, you must complete a renewal of your business. If the company is not renewed, the Province of Ontario assumes the business is no longer active and allows the master business licence to expire.

Having a Sole Proprietorship gives you the freedom to make your mark. Still, it may provide limitations on the ways to obtain funding for your business unless you have cash, credit or the ability to leverage personal assets. Most funding available in Canada is limited to those entrepreneurs who have incorporated their businesses.

Registration And Licensure Of A Sole Proprietorship

When a sole proprietor conducts business under an assumed name, that name must be registered with the Utah Division of Corporations and Commercial Code using an application available from the Division. Also, be certain to obtain all required local and municipal business licenses before commencing business.

Also Check: Do You Need A Business License For Sole Proprietorship

Can A Sole Proprietor Write Off A Vehicle

If you use a vehicle for work, you can deduct vehicle expenses from your taxable income, regardless of the structure of your business . You can only deduct costs related to your business. If you use a car for business and personal use, you have to divide expenses based on mileage for each. As of 2021, the standard mileage rate for a federal tax deduction was 56 cents per mile . You can also deduct other vehicle costs, including depreciation, registration, loan interest, insurance and lease payments.

Also Check: How To Fund A Solo 401k

What Is The Meaning Of Sole Proprietorship

A sole proprietorship firm means a type of business entity that is owned, controlled and managed by a single person. The owner of the Business is called Sole Proprietor of the Firm. As the business is run by a natural person, there is no legal difference between the promoter and the business. The promoter himself receives all the profits. Sole Proprietorship firm does not require any formal registration.

The key feature of sole proprietorship firm is that it is very easy to start as there are less legal formalities and lesser formation costs involved.

Read Also: How To Wire In Solar Panel To Home

Also Check: Should Solar Panels Be Connected In Series Or Parallel

Business Address And Use Of Home Address

Many home businesses start as Sole Proprietorships, and your home address is available to use for your companys business address. The address must be a physical location where you are located. The address for both the business owner and the business itself cannot have a postal box including in the address. If you live in a rural community, you can provide the lot and concession number to register your business.

What Is A Business License

Business license is a broad term that refers to any kind of license or permit required to operate your business and provide your services in your location. Various types of business licenses are issued by federal, state, county and municipal agencies.

A business licenses purpose may be to register your business with the government for tax purposes or to ensure you follow industry regulations.

Recommended Reading: Can You Pressure Wash Solar Panels

Also Check: Do You Need Permission To Install Solar Panels

Purchase A Website Domain Name

Once youve settled on a business name and have registered it with your state, its time to purchase your website domain name. Your domain name is what identifies your site. It looks something like this: www.example.com.

Its best to set your domain name as the same name of your business to avoid any confusion. If the domain name you want isnt available, come up with a variation that is still similar to your business name. Its alright if youre not ready to build your website just yet. You can still reserve your domain to ensure no other business takes it.

Get a free Yelp Page

Promote your business to local customers.

Get Your Federal Tax Number And Consider Federal Tax Filing Options

If your business is a sole proprietorship or one-owner LLC and you wont have employees, you can use your Social Security Number as the businesss federal identification number, although many business owners choose not to for confidentiality reasons. Otherwise, you will need to obtain a federal ID number .

The federal tax form for sole proprietorships is 1040-Schedule C, and for partnerships, Form 1065. For standard corporations, tax filing is with Form 1120. If you wish to be treated as an S-corporation , you must complete Form 2553 Election by a Small Business Corporation within 75 days of forming your business . The IRS doesnt recognize LLCs as a classification for tax purposes. LLCs default to sole proprietorship taxation if one owner, and partnership taxation if more than one owner. However, LLCs can elect to be treated as standard or S-corporations for federal tax purposes through IRS Form 8832. Consult your tax professional for further information and advice.

Read Also: How Do You Make A Solar System

Can A Sole Proprietor Have Employees

Yes, they can, and they can have as many as they want. So to answer the question, can a sole proprietor have employees, you have to bear in mind that a sole proprietorship operates like any other business. It is a business that is owned and managed by just one person and the sole proprietor has no restriction on how many employees they want to have.

These kinds of business owners can hire employees and the sole proprietor will be responsible for filing taxes and handling the salaries of the people they hire. In fact, the person who owns the business will be responsible for all the financial obligations of the business.

Apply For Licenses Permits And Insurance

Once youve obtained your business name and registered your business, its time to apply for the required licenses, permits, and insurance your business needs to operate. Starting a business in Michigan, especially one that has employees or a physical location that sells products, requires a number of licenses.

Depending on your business type, you might also need permits to legally operate and comply with federal, state, and local regulations. For example, to renovate your space youll need a building permit, if you want to add a sign to the building youll need a signage permit, and restaurants will need health permits.

Business insurance is just like your personal health insurance. It covers you when something goes wrong. There are multiple types of business insurance you might need or want when starting a business in Michigan. Here are a few types:

-

General liability insurance: This catch-all insurance is great even for small, home-based businesses and covers certain losses that your business causes to another company, client, or vendor.

-

Workers compensation insurance: This is required for Michigan businesses with one or more employees and covers claims resulting from work-related injuries.

-

Professional liability insurance: This type of insurance is most important for Michigan businesses that are selling professional advice, consulting, or accounting services. It covers financial losses caused by your companys negligence or malpractice.

Don’t Miss: How Does Solar Save You Money

What Is A West Virginia Sole Proprietor

As opposed to a corporation or limited liability company , the sole proprietorship is not a legal business entity. The sole proprietorship is a one-person business that is not considered to be a distinct entity from the person who owns it, and it is frequently operated using the owners personal name.

Licensing Fees And Services

The annual fee for a Delaware business license varies however, the rate is generally $75.00 for a first location. A separate license is required for each separate business activity.

After the first year, Delaware businesses may additionally opt to buy a three-year business license. The cost of a three-year license is not discounted businesses will pay three times their regular yearly license fee for a three-year license.

Delaware also offers a 75% senior citizen discount on annual license fees for individuals 65 years of age or older on or before January 1st of the current license year. Businesses must meet specific requirements to be eligible for this discount.

Don’t Miss: How To Set Up A Small Solar Panel System

Business Certificate Application Process

This form is also known as a Doing Business As or a Fictitious Name registration. Business certificates are required under MGL Chapter 110 Section 5 as part of the Consumer Protection Laws. This is not a license to do business. A business certificate is required for listing the business name and owner with the Town if the business is a sole proprietor, a partnership or a corporation doing business in a different name as the corporate name. Even a corporation doing business under the corporate name may be requested to file with the Town by an attorney, accountant or a bank.

The owners signature or corporate officers signature must be notarized on the application form. If this is done in the office the signatures will be notarized for no charge as part of the process. There are three pages to this application. The second page is only filled in when a change is being requested. Retain page 2 for your records. Please fill out and return page 1 and 3 if doing this by mail.

Dont Miss: How To Mount Flexible Solar Panels