What You Should Know About Pace Financing In California

PACE financing is a pro-solar financing program that provides low-APR, no-money-down financing options for aspiring solar customers. PACE loans let you pay for your solar installation via your taxes, and the cost of financing is often significantly lower than if you chose to finance through your installer or a third party.

Ecowatchs Opinion On The Equity Resiliency Program In California

As mentioned above, the SASH program requires quite a lot of paperwork and verification, but its worth the time investment because of the payoff. The ERP is a phenomenal add-on to the SASH program since the perks come from the same company GRID Alternatives.

If you already qualify for the SASH program, then the additional paperwork required to take advantage of the ERP is minimal.

The ERP is the closest incentive that youll get to installing batteries for free, so we strongly recommend taking this perk if youve already qualified for SASH. The payoff is high for minimal extra work.

Is There A California Tax Credit For Solar Panels

Yes. The Federal government in California offers the best incentives to solar panel investors, making it more affordable for them to install panels on their roofs. In addition, this encourages the investors to go solar. TheCalifornia solar incentivescome in the form of rebates and tax benefits and can give you a 25-50 percent discount.

Solar in Orange Countyis your best option given the all-round sunny climate in Southern California. Enlightened Solar is the leading solar installation company in Orange County. We have supported homeowners transitioning into solar, and they have attested to the numerous benefits they continue to experience by working with our team.

2021 has seen remarkable changes in residential solar in the Golden State. For example, the building codes made in 2020 demanded the installation of solar in every new home.

The residents of Orange County are making big considerations for going solar. The COVID-19 effects and the continuous blackouts experienced across Northern and Central California in 2019 have influenced the move. Every homeowner in California yearns for the independence that comes with investing in solar panels and California solar panel rebatesare also something to look forward to as you go solar.

How do solar incentives work?

Lets focus on the following:

Read Also: How Much Equity Does Solar Add

What Is The New Law In California Regarding Solar Panels That Will Take Place In 2022

The following changes are only a proposed decision that will be voted on on February 24, 2022. The new monthly âGrid Participation Feeâ will be $8 per kilowatt of solar capacity installed on your property. That will become an average monthly fee of $48 for most California homes.

What is the new solar law in California?

In 2018, California mandated that new single-family homes, as well as multi-family homes up to three stories, must include solar panels starting in 2020. A second mandate was also passed into law, requiring new commercial buildings to have solar panels as well as battery storage .

Are solar panels going to be mandatory in California?

In 2018, California mandated that new single-family homes and multi-family homes up to three stories in height must install solar panels. The California Solar Mandate went into effect on January 1, 2020 and is part of the California Building Code.

Will there be new solar incentives in 2022?

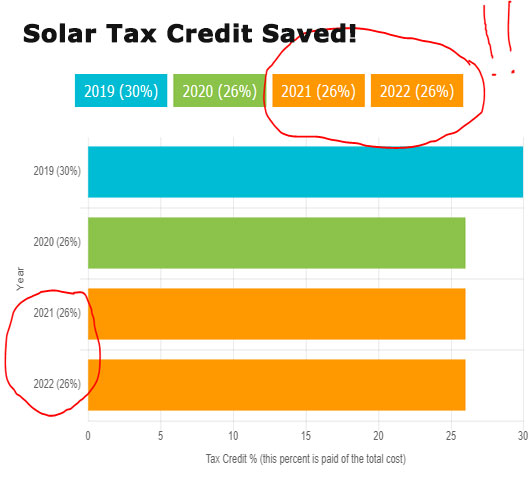

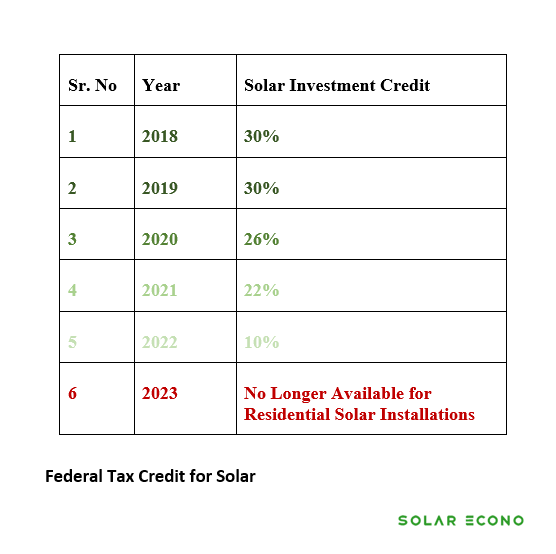

Solar PV systems installed in 2020 and 2021 qualify for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30%, which was required to be installed between 2022-2032.

Ecowatchs Opinion On The Pace Program In California

PACE loans can be an exceptional option for aspiring solar customers who cannot afford to take out a standard solar loan. It might be a suitable option for you if youre looking for the lowest APR possible or for an affordable loan with minimal down payment requirements.

Applying for the PACE program takes quite a bit of time and requires filing paperwork and discussing your options with a program administrator. While it is time-consuming, it can be great for customers who cannot afford other payment options and dont want to lease.

However, its important to note that PACE loans are attached to your home as a lien, which means they can be an issue if you plan to sell your home before the loan is paid off. It might not be worth the potential future headache if you think you might not be in your home for decades to come.

There are some other potential downsides to PACE loans, including:

- The risk of some improvements not being eligible for coverage

- An increase in property taxes

- Increased property taxes leading to tax sale or foreclosure if you cannot afford the bump

Also Check: How Much Does It Cost To Clean Solar Panels

Does California Have A Solar Tax Credit

Californians were long advocates of solar energy. Therefore, California is a pioneer and leader of the nation when it comes to sunbathing. Other states look to California to see the trail from which California Solar originated, a payment program in the world that is now there. However, each California can take advantage of the 26 percent Federal Tax Credit, which will allow you to pay 26 percent of your equipment AND your installation costs for an unlimited amount. So now will talk about does California have a solar tax credit?

Related To Does California Have a Solar Tax Credit:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

How To Claim The Property Tax Exemption In California

Thankfully, this tax exemption for going solar is automatically applied to all solar power systems in California. The value added by home improvements is typically taxed based on closed permits. Your municipality will automatically neglect to consider the value your system adds when assessing your home value.

Don’t Miss: Solar Power System For Homes

Loan And Financing Programs

Home Energy Renovation Opportunity

Intimidated by upfront installation costs? Check out Californias Home Energy Renovation Opportunity financing program, where Californians can finance a solar system through property taxes. This program uses a Property-Assessed Clean Energy program structure, which essentially allows homeowners to essentially lease their solar system over time. Your local government pays for the system on loan, which you pay back in increased property taxes over the course of about 20 years.

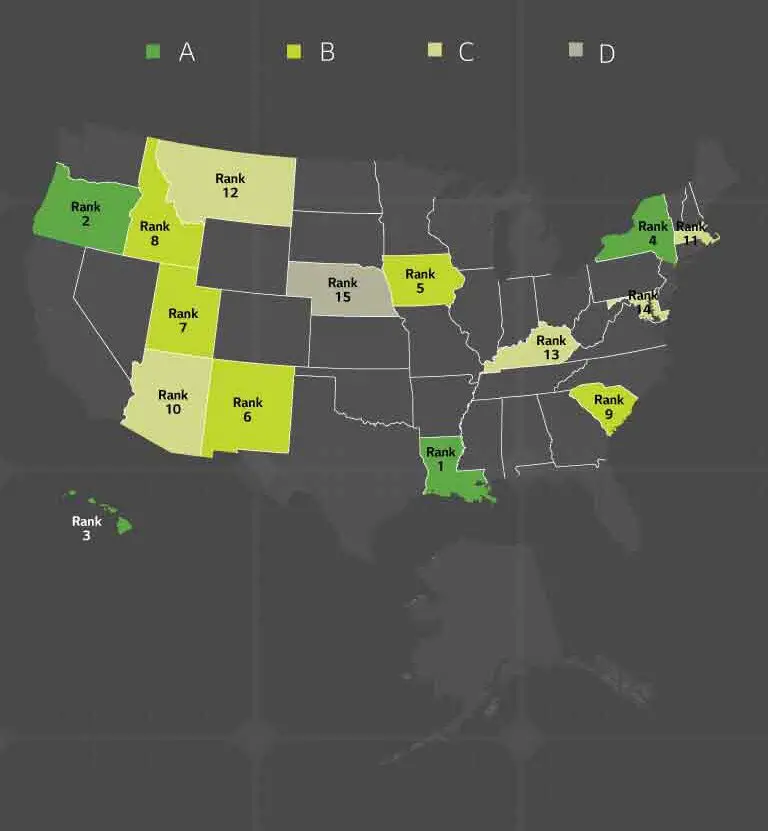

Disadvantaged Communities – Single-family Solar Homes

Solar should be available to everyone. Every year, California provides $8.5 million for the installation of solar systems in disadvantaged communities, via the Disadvantaged Communities – Single-family Solar Homes initiative. To qualify, homeowners must be a customer of PG& E, SCE, or SDG& E and live in one of the top 25% most disadvantaged communities according to CalEnviroScreen. Those who qualify are eligible for no-cost solar systems. For homeowners who qualify but do not have the means to install their own rooftop solar system, the DAC – Green Tariff program enables Californians to opt to receive all or a portion of their electricity from renewable resources and save money on their electric bill.

The Ultimate 2020 Guide For California Solar Tax Credit And Incentives

Getting the MAXIMUM California solar tax credit and incentives is better than receiving a lower amount.

2020 is the best time to go solar due to dwindling solar incentives. By following these simple steps below you can achieve the biggest bang for your buck.

In todays post Im going to show you how to get the maximum benefit for getting solar installed in California 2020.

You May Like: Are Solar Panels A Good Idea

What Is A Tax Credit

Tax credits are a powerful tool that can help you reduce your taxable income and directly impact your annual tax bill. A dollar-for-dollar reduction of the income tax you owe, a tax credit can reduce the amount of tax you owe or increase your tax refund. They also differ from deductions and exemptions.

Dont Miss: Government Program For Solar Panels

Ecowatchs Opinion On The Self

If youre interested in installing a solar energy storage solution in your home, then the Self-Generation Incentive Program is a no-brainer. Your installation company will do most of the work, so its well worth the minimal time and effort it will take you to find an eligible solar photovoltaic equipment provider.

However, the SGIP is a tiered incentive program, meaning that the rebates diminish with every new battery that is installed across the state. As such, its best to apply to the program as soon as you can. The exact rebate amount will depend on your utility provider.

If you are a customer with a pre-existing solar array and want to add a battery, we recommend that you wait until 2023 when the standalone energy storage tax credit goes into effect . Youll save more money that way than you would with the additional savings realized through acting early on this tiered rebate.

You May Like: How To Make Solar Panels In Minecraft

Ecowatchs Opinion On Net Metering In California

For most solar customers in California, enrolling in net metering wont cost any money and wont require any additional paperwork to be filled out. Even if you do need to submit an interconnection application, taking advantage of this perk will require minimal paperwork that is well worth the time youll spend filling it out.

We hope the net metering credits in California will stay at the retail rate it is currently. Unfortunately, this is unlikely, and the rate will probably drop in the future when utility companies have control over their own rates.

Even if the credit rate does drop, net metering is still wildly beneficial for all solar customers. It will still be a valuable perk thats worth applying for if you need to apply at all.

As we mentioned earlier, solar batteries will become extremely valuable in California should net metering drop to a lower rate . For that reason, we recommend paying special attention to the Self-Generation Incentive Program.

The Bottom Line: California Solar Tax Credits

With statewide solar incentives, utility company credits and the federal solar tax credit, California solar tax credits can save you a hefty sum on solar panel installation. You can even generate revenue depending on your energy consumption and local utility providers net-metering program.

If youre interested in starting the process of installing solar panels and saving more through energy independence, we recommend you use our tool below to get matched to reputable and reliable local solar providers.

You May Like: Post Cap Solar Lights 4×4

California Solar Tax Credits 2022

Thinking about finally making the transition to solar energy? Here in sunny California, solar energy systems are an incredible way to reduce your carbon footprint, save money on energy costs, reduce your dependence on the grid, and increase your property value.

As a trusted solar energy company, we often get asked Is there a California tax credit for solar? The answer is yes! Home and business owners alike can take advantage of Californias 2022 solar tax credits!

Federal Investment Tax Credit

One of the largest incentives available to California homeowners is the Federal Investment Tax Credit .

From now until 2021, the federal government is offering a 26% investment tax credit against the total cost of a home solar system. In 2021, the value of the tax credit will lower to 22%. And after 2022, the tax credit for residential solar systems will end. To reap the benefits of this major incentive, youll need to act fast.

How does it work?

If you purchase your solar system outright, you can apply 26% of the total cost of your system installation to your tax liability for the year.

For example, if your solar panel system costs $17,000, a 26% tax credit would be $4,420. So, if you owe $4,000 in taxes for 2020, your tax bill will be reduced to zero and youll receive $420 in tax credits for your return.

Also Check: Solar Powered Cell Phone Chargers

A Note On Californias Sash And Mash

California offered the SASH and MASH programs for more than a decade, with the last spots in the programs reserved at the end of 2021. Under these programs, low-income households could get an upfront incentive of up to $3 per watt of solar installed. This helped to pay for the entire installation cost of a 6 kW system in some cases.

SASH stands for the Single-Family Affordable Solar Homes program, while MASH is for multifamily properties. Both programs expired at the end of 2021, with the last few qualifying projects built in 2022. So far, theres no indication of plans to provide additional funding for SASH and MASH.

Am I Eligible For The Federal Solar Tax Credit

Any taxpayer who pays for a solar panel installation can claim the solar tax credit, as long as they have tax liability in the year of installation. You must be the owner of the solar panel system in order to qualify for the tax credit, meaning if you lease your system you are not eligible.

When leasing a system, the solar company will get the tax credit instead of you. We recommend you buy your system outright if you can afford to. The money you save in the long run is more. Leasing also makes it harder to sell your home, as buyers dont want to take over a 25-year lease.

Recommended Reading: Does Solar Increase Property Taxes

Recommended Reading: How To Figure Out What Size Solar System I Need

Net Metering In California

Net energy metering , or net metering, is an agreement you enter with a utility company. This agreement allows the utility company to track any excess energy generated by your solar panels and sends that energy back into the local power grid. The utility company takes the metered amount of excess energy and reduces your energy bill based on that amount.

Most solar PV systems generate more energy than a typical home consumes. Selling that surplus power back to a utility company provides you with savings on your electricity bills above and beyond the solar rebates and credits weve already listed. You also help your community move closer to clean, renewable energy and lower the demand for grid-supplied electricity from nonrenewable and finite energy sources.

Currently, California offers a statewide net-metering incentive for homeowners with solar panels, but the exact amount of credit you receive varies based on your local utility company. We have listed some of the major utility providers in the state of California below so you can investigate their net-metering retail rates:

Incentives Offered By The State Of California

Currently, the state of California does not offer incentives or refunds to install a solar panel system. The good news is that there is a discount to install an energy storage system called the Auto generation Incentive Program ! This can be claimed along with the California solar tax credits. California Governor Brown SB recently signed 700. This adds some $ 800 million of additional funds to SGIP and expands the program until 2025.

The California energy storage reimbursement program was established in 2001. Until recently, the application of SGIP has been a difficult process, especially for residential customers. The previous reimbursement worked by providing program funds on a specific day. With most of the funds allocated to large industrial energy storage projects. Leaving little available for homeowners looking to store their solar energy. For homeowners who are customers of GDS & E, PG& E, SCE and SCG are eligible for an incentive of up to $ 400 per kilowatt hour when sending a domestic battery. This great incentive has the potential to cover most of your battery costs. The battery size will determine the value you will get per kilowatt.

Before you go, I hope this summary about the question, California have a solar tax credit? is helpful for you.

You May Like: How To Stop Calls From Us Home Solar

How To Claim The Sash Program Incentives In California

Filing for the SASH Program can be a bit time-intensive. You need to confirm that you qualify, which can entail working with the program administrator and providing a slew of documents to verify income and residence in your home, as well as your affordable housing qualification.

You can start by seeing if you qualify on the Energy Program for All website. After you qualify, a representative from GRID Alternatives will discuss verification requirements and the next steps.

Eligibility For The Solar Tax Credit

You could be eligible to receive the ITC on your federal tax return if the following statements are true. Consult your tax accountant to ensure your eligibility and for exception information.

- The PV system is an original, new installation or is operational for the first time.

- You own the system outright or have financed the parts and installation with a loan.

- You arent leasing the system or paying anyone for the energy created by the system.

- Youre claiming the credit based on the cost of the PV system, its components, installation and fees. Items and appliances that operate on the created energy arent included in this tax credit.

Compare Quotes From Top-rated Solar Panel Installers

Select a State To Get Started With Your No Commitment, Free Estimate

Don’t Miss: What Can You Run With A 100 Watt Solar Panel

Does California Require Home Solar Panels

In 2018, California passed a mandate requiring new single-family homes and multifamily buildings up to three stories high to install solar panels. This mandate took effect in 2020 and requires new construction projects to include a solar system large enough to cover all of the household’s energy needs each year based on the climate and square footage of the home. If the system includes a solar battery, the builder can reduce the system size by up to 25%. If you live in a home built before 2020, you are not required to purchase solar panels.