Difference Between Llc And Sole Proprietorship

LLC is separate legal entity run by its members having limited liability and it is mandatory for an LLC to get registered whereas sole proprietorship is a sort of business arm of an individual which is not separate from its owner hence its liabilities are not limited and there is no need to register sole proprietor.

There are notable differences between them. When individuals start their businesses, they go for a sole proprietorship. LLC is an extension of sole proprietorship where there are many members who own the company.

In a sole proprietorship, theres no separate entity. Whatever the business earns is the owners responsibility. And as a result, the owner needs to pay personal income taxes. In the case of LLC, its a bit different. LLC and its members have a separate legal entity, but the members need to pay taxes as per the rates of taxes.

A sole proprietorship is managed by the owner himself. But in the case of LLC, sometimes the members run the business or they select few managers who run the business.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: LLC vs Sole Proprietorship

The biggest advantage of an LLC is that the liability of a member of the LLC is limited to the investments she has made. However, for a sole proprietorship, the total liability lies with the owner of the business.

Is An Llc Always A Better Choice Than A Sole Proprietorship

An LLC is a better option for many businesses due to the benefits and protections it offers. However, a sole proprietorship may be preferable in certain circumstances.

Mainly, you should consider a sole proprietorship if youre just starting your business out small and testing the waters. Thus, you might not expect much risk or a large volume of profits, so you wont need to worry about liability protection. Similarly, if youre expecting your business to generally be low-risk or low-profit long term, a sole proprietorship may be the better, simpler choice.

Outside of these specific cases, an LLC is the stronger choice for most business needs.

Who Pays More Taxes An Llc Or S Corp

It depends on how the business is established for tax purposes and how much profit is going to be generated. Both an LLC and S corp can be taxed at the personal income tax level. LLCs are often taxed using personal rates, but some LLC owners choose to be taxed as a separate entity with its own federal ID number. S corporation owners must be paid a salary in which they pay Social Security and Medicare taxes. However, dividend income or some of the remaining profits can be passed through to the owner, but not as an employee, meaning they won’t pay Social Security and Medicare taxes on those funds.

Recommended Reading: How Much Is The Sunflower Solar System

What To Know Before You Begin

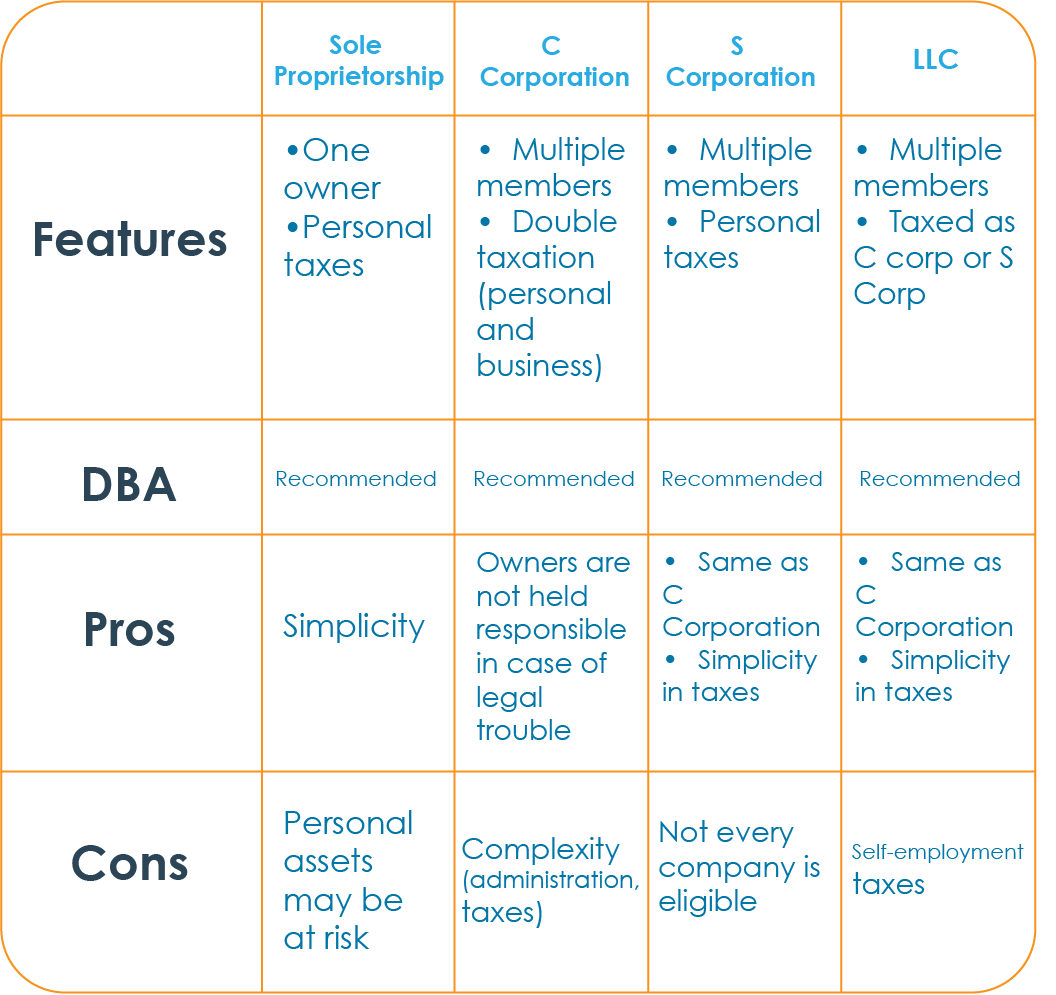

Deciding how you want to structure your business legally is one of the first and primary business decisions you will have to make. Depending on which type of business structure you choose, there are different levels of protection safeguarding your personal assets and shielding you from personal liability. There are also significant tax implications for each type of business structure.

There are several factors that you should take into consideration when making this decision, such as:

- The type of industry you are in.

- How many owners are involved.

- The size of your business.

One of the responsibilities of a business owner is to do his or her due diligence. This means you should objectively analyze the advantages and disadvantages of each business structure and make an informed decision that will be best for the business.

Become A Flight Attendant

Flight attendants are always on the move, and they get to travel the world for free. You do not need to worry about booking flights, hotels, or accommodations youll have a place to stay at your destination.

The downside is that flight attendant jobs are notoriously difficult to land, requiring an extensive application process and interview. The upside is that many airlines hire new flight attendants yearly, so all you have to do is keep trying.

Don’t Miss: Are Solar Powered Roof Vents Worth It

Whats The Difference Between A Sole Proprietor And An Llc

A sole proprietor is defined by the IRS as a person who owns an unincorporated business. Any person who does business but isnt registered as a corporation, partnership, or limited liability company is a sole proprietor by default.

A sole proprietor is personally liable for any debt accrued by the business, including lawsuits and other business obligations. If a sole proprietor owes money from a lawsuit judgment or any other debt and the business assets are not enough to cover it, creditors could go after personal assets.

A person who owns a business alone can also file for LLC status. If an LLC owes money that it cant pay, the owners personal assets are protected and creditors wont be able to reach them.

Only Llcs Can Choose Corporate Tax Status

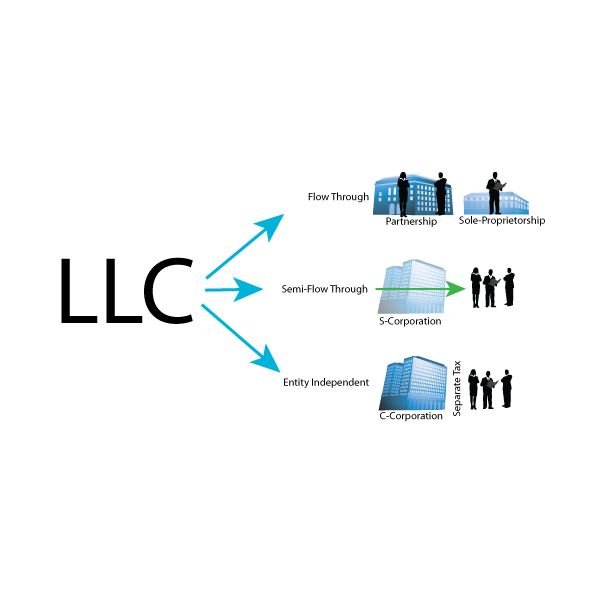

A key difference between LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can choose how they want their business to be taxed. They can either stick with the defaultpass-through taxationor elect for the LLC to be taxed as an S-corporation or C-corporation. An S-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a corporate income tax at the federal level .

LLCs can sometimes save money by electing corporate tax status. When a company is taxed as a corporation, dividends from the business are usually taxed at a lower rate than ordinary business income. Plus, retained earnings in a corporation arent subject to income tax. In contrast, LLC members cant treat income as dividends and must pay taxes on all profits of the business, whether retained in the company or not. A corporation is also eligible for more tax deductions and credits.

Recommended Reading: How Much Can Solar Power Generate

Which Is Better An Llc Or S Corp

An LLC is better for a single-owner and likely better for a partnership. An LLC is more appropriate for business owners whose primary concern is business management flexibility. This owner wants to avoid all, but a minimum of corporate paperwork does not project a need for extensive outside investment and does not plan on taking her company public and selling the stock.

In general, the smaller, simpler, and more personally managed the business is, the more appropriate the LLC structure would be for the owner. If your business is larger and more complex, an S corporation structure would likely be more appropriate.

Will I Have To Pay More Taxes As An Llc

A sole proprietor is only responsible for their personal income tax however, someone who operates as an LLC may also have to pay state business taxes and unemployment taxes. These additional steps depend on the state you live in and your businesss size. The costs for completing the tax return for an LLC may be higher and more complicated in your area than a sole proprietorship.

At the end of the day, the decision is yours as to whether an LLC or sole proprietorship is best for your business. You may want to start as a sole proprietor and eventually evolve into an LLCwhich is very common. Do your research and consult with an accounting professional if you still arent sure.

Also Check: How Much Is An Off Grid Solar System

Sole Proprietorship Vs Llc: Taxes

Sole proprietorships and LLCs are both âpass-throughâ entities, meaning they donât pay federal taxes at the business level. Instead, profits and losses from the business pass through to the ownerâs personal income tax return. That means, tax-wise, theyâre really about the same. The real advantage of forming an LLC instead of a sole proprietorship is the legal liability protection.

Hereâs how tax filing works for different types of legal entities.

What Should A Business Owner Consider Before Choosing An Llc Over A Sole Proprietorship

There are a variety of considerations when a business owner is choosing between a limited liability company and a sole proprietorship. Some of the most important considerations include:

- The legal protection of personal assets

- Formation of LLC or registering the business as a sole proprietorship

- Treatment of business income

Also Check: Are Ikea Cabinets Solid Wood

Llc Vs Sole Proprietorship: Formation

You might be surprised to learn that theres nothing specific you necessarily need to do to form a sole proprietorship. In fact, you might be operating a sole proprietorship without even knowing it. Any person selling goods and services without a partner is a sole proprietor by default. Depending on where your business is located, you might need to apply for business licenses or zoning permits to legally operate your sole proprietorship. And any business, including a sole proprietorship, that operates under a trade name, needs to apply for a fictitious business name, also known as a DBA or doing business as certificate. However, thats it as far as formation paperwork goes, making sole proprietorships the easiest and least expensive type of business to start.

An LLC might also need to file for business permits and a DBA . But the most important formation document for an LLC is called the articles of organization. This document establishes your LLCs existence and must be filed with the state in which youre operating. The cost to file articles of organization varies by state, but generally ranges between $50 to $200.

» MORE: Business insurance for LLCs

Registering With The State

Depending on your industry, you might require licenses to operate, regardless of your business structure . However, there are different requirements for registering your business if youre running an LLC or a sole proprietorship.

Sole proprietorship: Beyond attaining the appropriate licenses and registering a business name , no other registration is required to operate as a sole proprietor. Your proprietorship is established automatically as you start work, and it is your responsibility to ensure that you have the correct licenses to continue operations.

LLC: An LLC needs to be registered with the state, and this happens when you fileArticles of Organization. This document outlines the responsibilities of each member of the LLC, including their rights, powers, and obligations. As well as this, the articles should stipulate what the LLC will do for its members. The fees and rules around this registration will vary between states in New York, for example, LLCs are required to publish a notification of their formation in two newspapers designated by the county clerk within 120 days of filing the articles.

If youre running your LLC in more than one state, you must form the company in your domestic state, and then file for foreign qualification in other states of operation. To do this, you should file for a Certificate of Authority with the foreign state and you may be asked to provide a Certificate of Good Standing from your home state.

Also Check: Do Sole Proprietors Need A Dba

Similarities Between Llcs And Sole Proprietorships

When comparing LLCs and sole proprietorships side-by-side, its important to recognize that these two business structures share some commonalities.

Heres a quick list of the similarities between LLCs and sole proprietorships:

- Income and expenses must be reported in Schedule C Form 1040.

- Net income is taxable, regardless of whether or not cash is withdrawn from the business.

- They have similar rules for tax deductions .

- An EIN must be obtained if employees are hired.

- Any industry-specific business licenses and permits at the state and federal levels are still required.

- LLCs and sole proprietors both have the option to register a DBA name.

As you can see, from taxation to paperwork filing, LLCs and sole proprietorships do have a handful of things in common.

When Should A Sole Proprietor Become An Llc

The decision is ultimately yours. But keep in mind that as a new business, legal protection can be important to your well-being and the longevity of your endeavor. Forming an LLC early on can help protect you personally from business liability. It can also make your business appear more stable to lenders and vendors, as well as customers and business partners. In that sense, it can be an investment in your success.

Running a sole prop is as simple as getting to work and tracking your income and keeping it separate. You are the owner and the business, so all decisions are yours to make. That makes it easy to get started, but as your business grows you take on more risk.

Get your full credit picture in one spot

Nav brings your personal and business credit together in one FREE account so you can monitor your full credit picture.

Read Also: How Much To Register Sole Proprietorship

Should You Start An Llc Or Sole Proprietorship In Texas

Forming an LLC is often a great choice for businesses with employees, and for those with large incomes who wish to elect taxation. If you are just starting out with a minimal budget and want to keep your costs down, a sole-proprietorship may be a better choice.

In some states, single-member LLCs are not looked at as the same as multi-member LLCs. Texas is not one of these states, but if you wish to expand it is something to consider. Despite this, if you own assets, being a sole proprietor can be dangerous. Protect yourself and your progressing business with an LLC.

Related Topics

You May Like: Is It Better To Lease Or Buy Solar Panels

Advantages And Disadvantages Of Sole Proprietorships

Like the LLC or SMLLC, sole proprietorships have their own advantages and disadvantages as well.

- It is considered one of the easiest and least costly business types thanks to the absence of filing fees and the need for formal agreements.

- Sole proprietorships are popular for people who want to be their own boss.

- A potential disadvantage is that courts have ruled that doing business under another name does not qualify as creating a separate and distinct legal entity from the owner.

- Insurance coverage might be pricey for sole proprietors.

- Sole proprietorships do not have access to venture capital.

- Sole proprietorships can be limited in scope and their lifetime, which means they end if the business is discontinued or the owner passes away.

Don’t Miss: How Much Does Community Solar Cost

Is An Llc Always The Best Choice

Life is all about making choices and choosing to form an LLC can be a very important one. Asset protection consultants routinely market to business owners stating that an LLC is always a good idea, but I do not believe this to be true. Some entities are actually better suited for a sole proprietorship as the additional costs of an LLC do not provide any significant benefits over operating as a sole proprietor.

Also, understand that with the concept of an LLC providing liability protection against commercial acts of your business, a savvy attorney is going to try to find any loophole he can in your current setup to pierce the corporate veil and go after personal assets.

In addition, some courts may not look favorably upon sole member LLCs, and the question comes up in legal proceedings as to whose interests are you being protected against if technically, you are the only member of the LLC.

What Is The Difference Between An Llc And An S Corp

A limited liability company is easier to establish and has fewer regulatory requirements than other corporations. LLCs allow for personal liability protection, which means creditors cannot go after the owner’s personal assets. An LLC allows pass-through taxation, meaning business income or losses are recorded and taxed on the owner’s personal tax return. LLCs are beneficial for sole proprietorships and partnerships. An LLC with multiple owners would be taxed as a partnership, meaning each owner would report profit and losses on their personal tax return.

An S corporation’s structure also protects business owners’ personal assets from any corporate liability and passes through income, usually in the form of dividends, to avoid double corporate and personal taxation. S corporations help companies establish credibility as a corporation since they have more oversight. S corps must have a board of directors who oversee the management of the company. However, S corps can have100 shareholders and pay them dividends or cash payments from the company’s profits.

Read Also: What Is The California Solar Initiative

Selecting A Business Structure

The decision regarding business structure is a decision that a person should make, in consultation with an attorney and accountant, and taking into consideration issues regarding tax, liability, management, continuity, transferability of ownership interests, and formality of operation.

Generally, businesses are created and operated in one of the following forms:

The information on this page should not be considered a substitute for the advice and services of an attorney and tax specialist in deciding on the business structure.

Pros And Cons Of Llcs

Advantages:

- Much like a corporation, it protects the owners personal assets without requiring the same level of administrative oversight or paperwork to file.

- You have more tax flexibility: you can choose to pay taxes as a C Corporation, where the business files taxes separately, or as an S Corporation, where the profits pass through to the owner, who then reports them on their personal taxes.

- Every state has its own laws regarding forming an LLC however, no state requires a business to form an LLC. Rather, it is entirely voluntary.

- Owners are not considered employees but members. As such, they do not have to pay Social Security or Medicare taxes on their profits.

The Cons

- If you actively work in the business and earn a salary, then you will need to pay self-employment taxes on that income.

- If your small business employs paid staff and you commit to offering competitive benefits. ITs expected of an LLC will to pay taxes on certain benefits, such as health and life insurance.

Read Also: Where Are Eco Worthy Solar Panels Made