Do You Still Get The Federal Tax Credit If Your State Also Offers One

The new law doesnt reduce your federal credit if your state also offers one. But it will be up to your states taxing authority whether your state credit is reduced if you take advantage of the federal one. New York, for example, does not cut its solar incentives for people who take advantage of federal ones state residents can credit 25 percent of qualified solar energy system equipment expenditures from their state taxes, up to $5,000. You dont get a refund if that amount is more than what youd owe, but you can carry over the difference for up to five years.

Future Of The Solar Tax Incentive

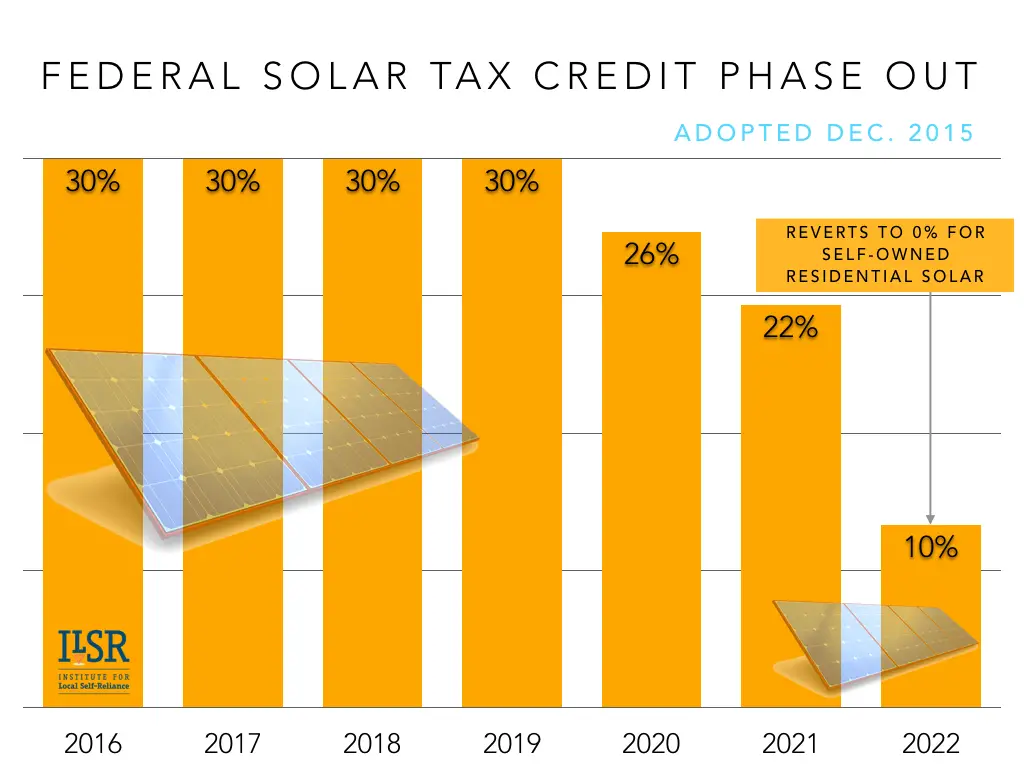

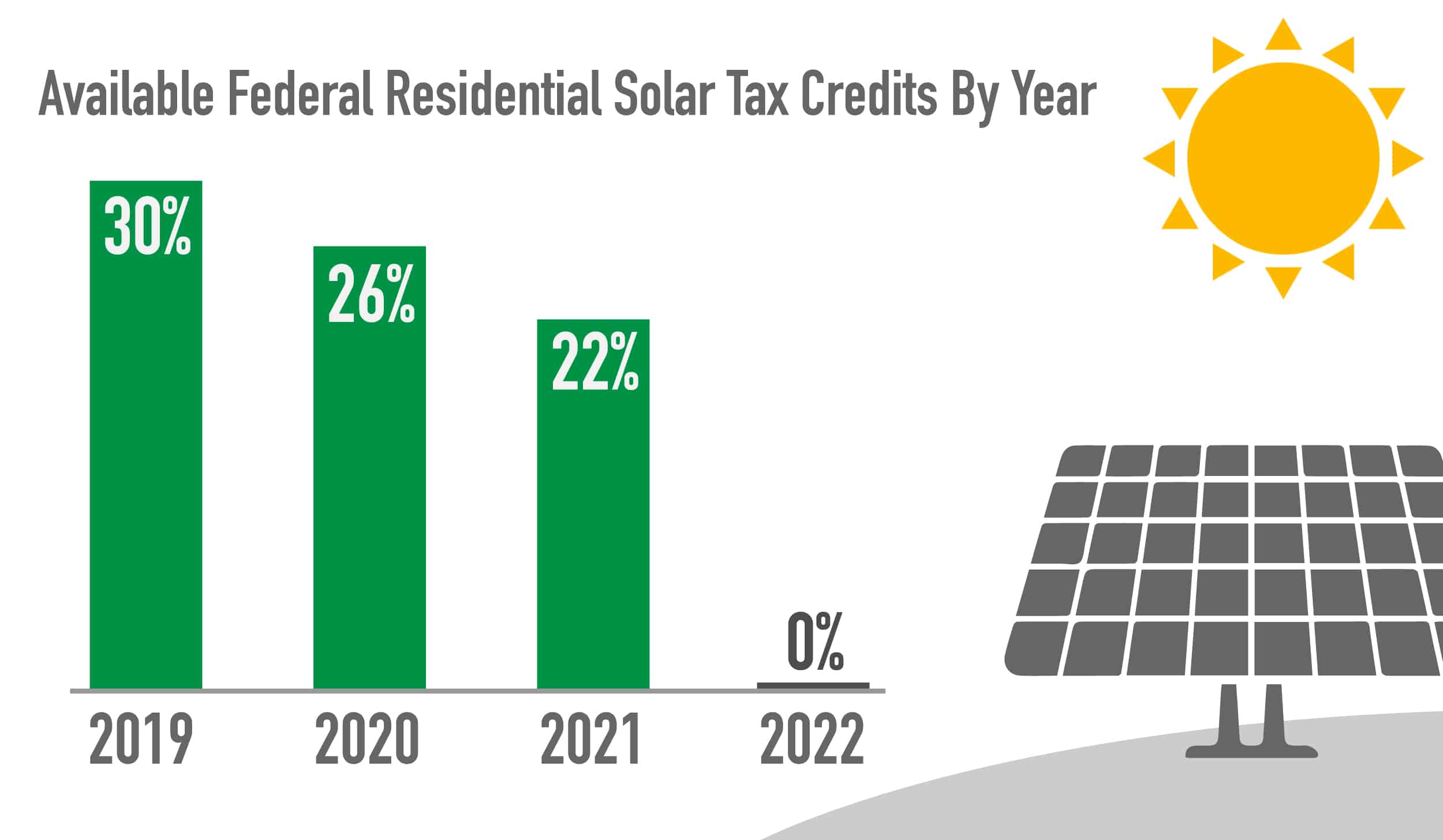

Right now, this solar incentive is being phased out, which means its value is steadily decreasing. Unless Congress renews the credit through the Build Back Better Act or other legislation, it will not be available to homeowners past 2023.

Heres an overview of what is currently planned for the future of the tax credit:

| Year Placed In Service |

| 10% |

Ner With A Solar Expert

The best way to find out how to maximize your federal solar tax credit is to work with a residential energy consulting firm that has helped customers like you prepare for such incentives. At Baker Electric Home Energy, we help you reap the benefits of going solar with our high-quality custom solar solutions, all of which include installation, consultation, repair, and maintenance services.

Baker Electric Home Energy has been providing solar energy solutions to South California homeowners for over 15 years. Our way of doing business, the Baker Way®, is known for building customer confidence through extraordinary service. Contact us to learn more about the federal solar tax credit, other California solar incentives, and to determine your eligibility for economic benefits as a solar power consumer.

You May Like: Is There A Government Grant For Solar Panels

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

Freedom Solar Is An Installer You Can Trust

A solar panel installation is a big project, so its important to work with a reliable and reputable team. Whether youre an average homeowner or a large business such as Whole Foods or Office Depot, Freedom Solar is dedicated to making your switch to solar an easy and affordable transition.

So if youre thinking about going solar, ready to make the switch to a lifetime of green energy or interested in reducing your tax burden by lowering your electric bill, were here to help. You can begin your journey with our 7 Steps to Solar process.

Well find every available financial incentive, practice COVID-19-conscious installation methods and offer lifetime service to meet your needs! Check out what our customers say about how we deliver on our promises.

Contact us to request a free, no-obligation virtual consultation with one of our energy consultants. If youd like to learn more about the ITC, visit Energy Sage and the Solar Energy Industries Association .

You May Like: How Much Are Solar Panels In California

Federal Tax Credit Solar News Homeowners Receive 30% Tax Credit With Sunergy Solar Panels

The MarketWatch News Department was not involved in the creation of this content.

August 31, 2022 – Port St. Lucie, FL – Sunergy, a Florida-based solar panel company, helps homeowners throughout Florida and Dallas, Texas take advantage of the increased Federal Solar Investment Tax Credit, which is up from 26% to 30%.

The Federal Solar Investment Tax Credit increase was passed with the signing of the Inflation Reduction Act. Under previous legislation, the Federal Solar Investment Tax Credit would drop from 26% in 2022 to 22% in 2023. Now, homeowners in the United States can claim 30% of residential solar installation costs until 2034, when the credit will drop to 22% before expiring.

Homeowners who installed solar panels in 2022 can retroactively take advantage of this credit.

As a top solar panel installation company, Sunergy has helped owners save money on taxes since the first iteration of the Federal Solar Investment Tax Credit. Now, they are proud to be able to save hardworking members of their community even more money.

According to the Department of Energy, the following expenses are considered in the tax credit:

Solar photovoltaic panels.

How To Claim The Tax Credit For Solar Panels

Note: Were solar experts at Palmetto, but everyones tax situation is unique, so please consult with a tax expert to determine whats best for you. That said, if youre looking for information on how to file for a solar panel tax credit, heres a general overview of how homeowners can claim their Solar Investment Tax Credit:

Recommended Reading: When Do You Give Babies Solid Food

What Is The Federal Investment Tax Credit

Think of the ITC like a coupon for 26% off your home solar installation, backed and funded by the federal government. In the year that you install solar, the ITC can greatly reduce or even eliminate the taxes that you would have otherwise owed to the federal government.

The ITC was originally created by the Energy Policy Act of 2005, and was set to expire just two years later at the end of 2007. Thanks to the ITC, the growth of the solar industry helped create hundreds of thousands of jobs, injected billions of dollars into the US economy, and was a significant step towards cutting down on greenhouse gases, so it was very popular.

According to the Solar Energy Industries Association , The ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006. As a result, Congress has extended the expiration date multiple times to continue supporting that growth, including the latest extension that was part of the COVID relief bill and sets the expiration date at the end of 2023.

State Local And Utility Incentives

Depending on your location, state and local utility incentives may be available for electric vehicles and solar systems. Most rebates can either be claimed after purchase or reflected as a reduction in the price of your purchase.

Many states also offer non-cash incentives for electric vehicles, such as carpool lane access and free municipal parking.

Some communities and utility companies also offer additional incentives through cash back, discounted rate plans and other credits.

Don’t Miss: How Efficient Is Solar Energy

Is The Solar Tax Credit Refundable

Everyone wants to get a check at the end of tax season, but some of us end up having to send a check instead. With the federal solar tax credit , you wont have to worry about sending in a check but does that mean youll be getting a check? It depends. While the federal solar ITC is technically non-refundable, there are ways that it can get you a check in your mailbox.

Contact The Kc Green Energy Team About Installing Or Updating Your Solar Panels

The KC Green Energy team specializes in the design and installation of solar electric energy systems. We custom-design each system to suit your needs and maximize your ROI. As a family-owned operation, who also specializes in roofs, you can trust us to focus on quality craftsmanship. Contact us for a free site analysis or to learn more about our services today!

Recommended Reading: How Much Does It Cost To Solar Power Your Home

History Of The Federal Solar Tax Credit

The first federal tax credit for solar was introduced under the Energy Policy Act of 2005, with an upper limit of 30%. The original version of the ITC was scheduled to expire in 2006. But Congress extended the program under the Tax Relief and Health Care Act of 2006. The ITC was extended again for another 8 years under the Emergency Economic Stabilization Act of 2008. And the program received a new extension until 2021, and then another until the end of 2023.

To understand why this solar incentive is still around more than 15 years after its introduction, it helps to look at the impact the ITC has had on both the industry and on society.

Solar Panel Tax Credit Faqs

WHAT IF THE SOLAR PANEL TAX CREDIT EXCEEDS MY TAX LIABILITY? WILL I GET A REFUND?

This is a nonrefundable tax credit, meaning you will not get a tax refund for the amount of the solar tax credit that exceeds your tax liability. However, you can carryover any unused amount of the solar tax credit to the next tax year.

CAN I USE THE SOLAR PANEL TAX CREDIT AGAINST THE ALTERNATIVE MINIMUM TAX?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax credit.

HOW DO I CLAIM THE SOLAR TAX CREDIT?

HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE?

Sadly, the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg. In 2022, the tax credit will be 26% and in 2023 it will step down to 22%. Starting in 2024, the tax credit is scheduled to be removed altogether.

The solar investment tax credit was extended once before in 2015, but that extra time is quickly running out. The table below details how much longer the tax credit is available for, and for how much.

|

Year |

Have more questions about the federal solar tax credit? Check out our TOP 10 FREQUENTLY ASKED QUESTIONS ABOUT THE FEDERAL SOLAR TAX CREDIT blog for additional information!

MORE QUESTIONS

Internal Revenue Service, located at 1111 Constitution Avenue, N.W., Washington, DC 20224, and phone at 829-1040.

Now is the time to take advantage of the solar investment tax credit. Contact our team of dedicated solar experts today!

Also Check: How Much Is A Solar Battery Bank

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

How The Federal Tax Credit Works

Disclaimer: This blog provides an overview of federal tax incentives for residential solar and alternative energy sources Were solar people, not tax professionals, and this blog does not constitute professional tax advice. It should not be used as the only source of information when making purchasing decisions related to residential energy or for tax filing. Consult a tax professional to determine what makes sense for you.

For many homeowners, going solar is a great opportunity to save on monthly energy bills and reduce your dependence on your utility company. The federal tax credit for going solar can make this investment an even more attractive option.

A tax credit is a reduction in the amount of taxes you owe, according to the IRS. And solar installations often qualify for the residential energy efficient property credit.

As of June 2021, the applicable credit percentages are:

For example, a homeowner who finances an 8 kilowatt solar installation for $30,000 could see a tax liability reduction of $7,800 if the credit is 26%. Taking advantage of this credit is easy as A-B-C, if you know the eligibility requirements and how to claim it.

Read Also: Does Tesla Manufacture Solar Panels

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Also Check: How To Calculate Solar Panel Needs

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC the company that leases the system or offers the PPA collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Kelly McCann, an attorney at a law firm that specializes in real estate and construction law in Portland, Oregon, said these tax credits can be a huge bonus for taxpayers when they understand how they work.

McCann offered the following example:

Suffice it to say, tax credits are better for the taxpayer than are tax deductions, McCann said.