After Starting Your Minnesota Llc

When you decided to start an LLC you completed the first step on your business journey and took control of your financial future. You should celebrate this business success while you have time. Go out and have a nice dinner in a fancy restaurant, throw a small celebration party with close family and friends, go out of town for the weekend, or simply enjoy a glass of champagne to toast the next chapter of your business.

But this relaxation is going to be short-lived. There are still things youll need to do to ensure that your LLC has the proper structural framework to function well as a business.

Here are the three most important steps you must complete after youve filed your Articles of Organization with the Minnesota Secretary of State:

Why Is It Important To Create A Business Plan

It defines a new business, supports a loan application , raises equity funding, pin-points business strategy, tracks responsibility performance and manages money goals for sales, costs, expenses and cash.

Researching your industry, future customers, and competitors , can only help when running your business. A business plan is a plan of action, giving investors confidence that everything has been thought through. A business plan should be a crystal clear plan, mapping future profitability and sustainability.

Affordable And Easy To Run

You dont have to form a separate legal entity like you would with an LLC or a corporation. And, you dont need to file articles of organization with the California Secretary of State.

You dont even need to draft an LLC operating agreement. You simply start doing business and- boom youre a sole proprietorship in California.

But do sole proprietors need a business license in California?

The answer is yes. Even as a California sole proprietor, youll likely need a business license from your city or county. But thats about all of the paperwork that youll need to get your business up and running.

Theres a lot that you dont need to worry about as a sole proprietor. California sole proprietors dont need to:

- Hold LLC or corporate meetings

- Periodically file paperwork with the Secretary of State.

- Pay any special state taxes or fees

Also Check: Are Solar Panels Legal In Alabama

Is An Alberta Nuans Name Search Required To Register An Alberta Sole Proprietorship

You are not required to provide a Nuans name search report to register an Alberta Sole Proprietorship. The Partnership Act has no requirement for a trade/partnership name to be unique. Any company, sole proprietorship or partnership can register the same business name at the same time in Alberta. This does not mean that you should just go ahead and register any name you wish. It is important that you make all attempts to have a distinct name that is very different from all names out there. The best way to ensure this is to do a preliminary name search before you register your sole proprietorship. If you just wish to find out if your name is available you can purchase a preliminary name search however if you purchase a sole proprietorship registration from us we will check as many names as you wish for free.

Just to clarify, Alberta company names are unique and no one can register a company with the exact same name as another company. It is only where a company carries on business under a business name that there is no protection for the name. Partnership names, business names and sole proprietorship names are not protected in Alberta.

It Consultant Or Computer/it Specialist

Have you ever run into IT problems? So do countless businesses. As an IT consultant running your own business, you would offer IT troubleshooting services to other companies, resolving issues with both the companys hardware and software solutions. Be open to traveling for this type of sole proprietor business.

Recommended Reading: Are Solar Panels Free In Nj

Management Control And Decision

Like a corporation, an LLC has centralized management. By state law, it is managed by a board of governors composed of one or more individuals. In addition, it must one or more people acting as chief manager and treasurer. As with a corporation, many of the rules governing management are set out in the articles of organization, bylaws, or by state law.

Also Check: How Much Energy From Solar Panels

What’s A Sole Proprietor

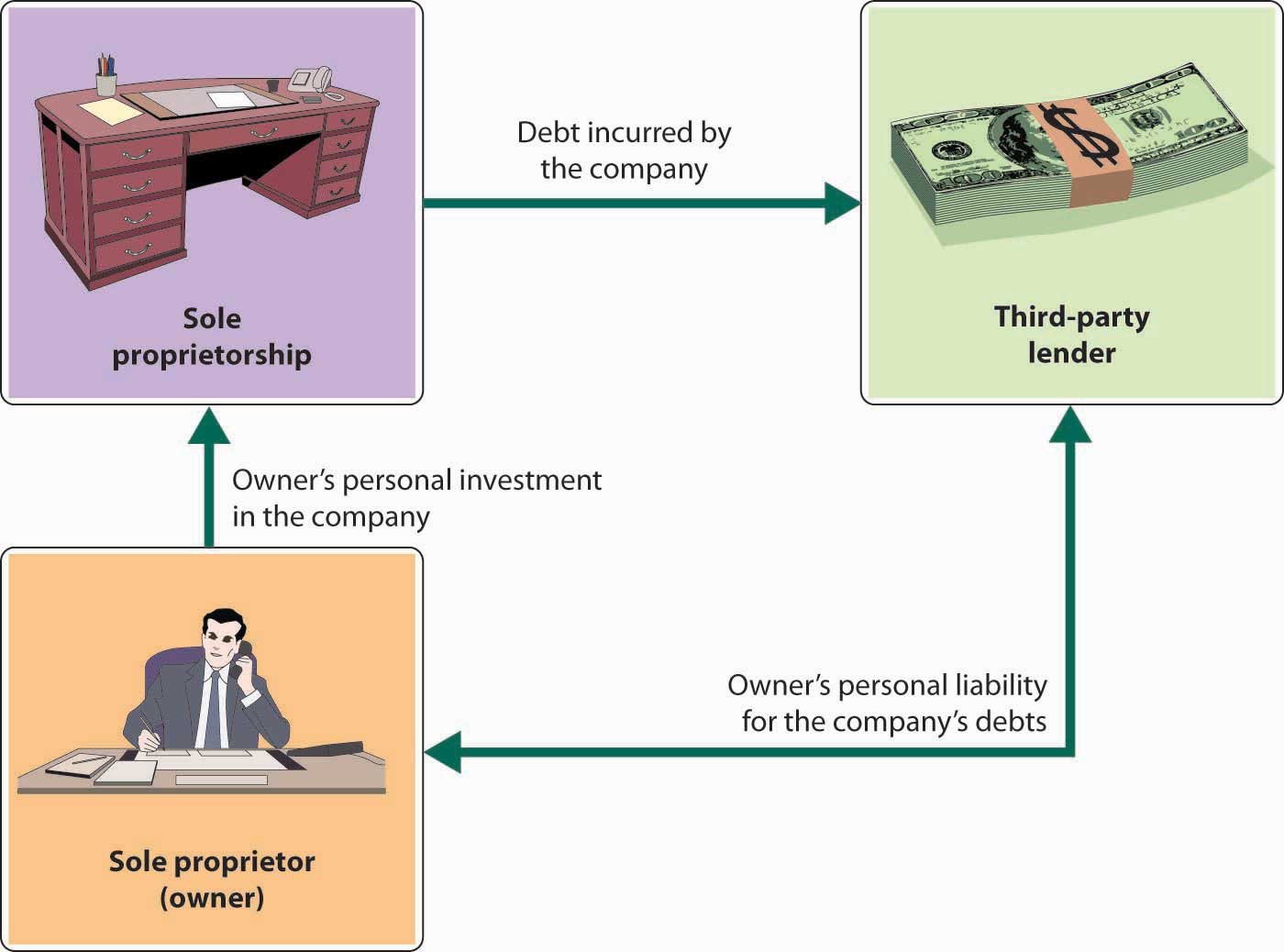

A sole proprietor has complete control over the revenue and operations of their business. However, the sole proprietor is also personally responsible for all debts, lawsuits, and taxes their company accrues. So, if their business is sued, personal assets like their home, credit score, and savings are unprotected.

Recommended Reading: How Do You Clean Solar Panels On Garden Lights

Follow These Steps To Quickly Launch Your Business

Freelancers. Independent contractors. Solopreneurs. Self-employed workers. What do they all have in common? They are all sole proprietorsbusiness owners who operate an unincorporated company. According to the IRS, more than 27 million businesses paid taxes as sole proprietors by filing Schedule C of Form 1040 for 2018.

Just how do entrepreneurs become sole proprietors? And what are the advantages and disadvantages of choosing this legal structure over a limited liability corporation or a corporation?

Becoming a sole proprietor is one of the most uncomplicated business structures to form legally. By following just a few steps, an entrepreneur can launch a sole proprietorship and begin serving clients.

Become A Alabama Sole Proprietor

Luckily! There is no setup fee and you would not face too much hassle while starting a sole proprietorship in comparison to the legalities and paperwork that people face in other business structures. To have a sole proprietorship in Alabama, you simply have to follow a few simple steps to keep things smooth. Here are five easy steps you need to follow to become Alabama sole proprietorship.

Don’t Miss: Will Pine Sol Kill Bed Bugs

Taxes And Sole Proprietorships

A sole proprietor pays federal and state income taxes on all the net income of the business , even if you don’t have cash on hand to pay these taxes.

Your business income is included with your personal income on your personal tax return. The tax rate you pay may on your business income can be hard to determine because it’s all combined. The corporate tax rate is a flat 21% for all corporate income levels, so your tax rate might be higher or lower, depending on your personal tax rate.

And don’t forget the self-employment tax. Sole proprietors must pay self-employment tax on the profits of their business. This withheld from your business income, so you’ll probably have to make quarterly estimated tax payments for this and your business income tax.

The IRS publishes a Tax Guide for Small Business, which you might find helpful in dealing with federal taxes.

Open Your Business Bank Account:

Even though its not important to have a different business account, it could save you some issues down the line. Keeping your business funds separate from your accounting records makes it simpler to hold an outline of benefits and misfortunes. You can start a different business account and get a committed business charge card, which you just use for your organizations expenses.

You May Like: How Much Does A Solar System Cost

Vigilance In Issues Of Taxes And License Issues

When it comes to filing license or permits request, dealing tax issues or even the name of your sole proprietorship you are required to be very vigilant and make sure nothing is overlooked. You need to protect yourself from identity theft and there is less room for mistake at the business place as your personal and business assets both are at stake.

Secure The Proper Paperwork Needed In Your State

Depending on your industry, you may need certain business licenses, permits or zoning clearance to operate legally. Check your state’s requirements for building permits or regulations for your type of business so that you remain compliant with all applicable laws and regulations.

Key takeaway: There aren’t mandatory steps you need to take to file as a sole proprietorship, but you may want to file a doing-business-as application and get an employer identification number to register as an official business.

You May Like: Where Can I Buy Solar Batteries

Types Of Sole Proprietorship:

There are three most common types of Sole Proprietorship:

- Independent Contractor: A self-employed proprietor who takes on projects on a contract basis with clients.

- Business Owner: Entrepreneurs can likewise act naturally utilized sole proprietors, yet not at all like the project worker, there is significantly more independence in how the work is finished for customers, and the actual activity may even be more intricate with representatives and additionally protected innovation.

- Franchisee: Franchise owners may likewise be sole owners. The franchisee profits by the direction, brand, plan of action, and so forth in return for sovereignties paid to the franchisor.

Are You Buying An Existing Business

If you are buying a business or even just some of the assets of a business, be aware that you may inadvertently be buying past liabilities in the form of unpaid taxes and experience ratings. Get competent legal advice before purchasing a business because these past liabilities are not necessarily part of the regular financial documents.

- For potential liabilities related to the Department of Revenue, you should require the owner to provide a Tax Status Letter with regard to any outstanding taxes by the business. You may also need to pay Use Tax to the Department of Revenue on the value of tangible assets included in the purchase, such as equipment, furnishings, supplies, etc. For more information, see our Tax Topics article titled Buying the assets of a business.

- For workers compensation, the purchaser of a business is potentially liable for premium owed, outstanding or pending audit assessments, as well as inheriting the claim responsibilities and their impact on future premium rates. Potential purchasers should request the seller for data and information listed on this Buyer Beware publication.

- For unemployment insurance, you may inadvertently be buying past liabilities and be held accountable for the predecessors debt.

Recommended Reading: What Are The Government Incentives For Solar

What Is A Sole Proprietorship And How To Start One

When starting a business, a sole proprietorship is the simplest structure to choose from. A sole proprietorship is a non-registered, unincorporated business run solely by one individual with no distinction between the business and the owner. This has its benefits and drawbacks. For example, as a sole proprietor, you are entitled to all profits, but youre also responsible for all the businesss debts, losses, and liabilities.

A sole proprietorship is a common business structure in the United States. In fact, BizFilingssmall business survey found that 59% of small business owners reportedly operate as a sole proprietorship.

If youre wondering whether you should start your business as a sole proprietorship, heres what you need to know to make the decision.

Gaining A Sole Proprietor Certificatein South Africa

The Sole Proprietorship Certificate registration costs between R 590- R990 . With this certificate, you obtain a registered trading name and a personal tax number.

As a registered taxpayer, you can sign up to use the SARS eFiling service, which allows you to file a tax return, make payments to SARS, request a tax clearance certificate, and access many other benefits.

Also Check: Is Financing Solar Panels Worth It

Obtaining An Unemployment Insurance Employer Account

Sole proprietors who have employees also need an unemployment insurance employer account number. Registration should be done as soon as possible after the first wages are paid for covered employment. It must be done before the due date of the first quarterly wage detail report the employer is required to submit.

Use Employer and Agents Self-Service System. You can register for an employer account with the states Unemployment Insurance system online or by phone. See step-by-step instructions to register a new account online.

The state prefers that the automated phone system be used only by employers who do not have access to the Internet. Call 651-296-6141 and press option 4. If the business is a result of a reorganization of, or acquisition from another business, additional information may be required before a tax rate can be assigned.

S To Starting A Sole Proprietorship

A sole proprietorship is very simple to get up and running. Because you don’t have to register your business with the state, there aren’t many formal steps. However, there are certain things you may want to apply for, depending on certain changes you might like to make to your business. Here are some steps you may want to take:

Recommended Reading: What Is The Best Retirement Plan For A Sole Proprietor

Is Sole Proprietorship Ideal For You

To begin with, is starting a sole proprietorship ideal for you? Or then again would it be a good idea for you to launch another kind of business?

Picking the correct business structure is vital to your endeavors success and prosperity. Sole proprietorship, organizations, Limited Liability Companies , partnerships, and cooperatives are only a couple of the manners in which you can structure your business. While sole ownerships and LLCs are two of the most widely recognized business structures. Once you have decided and you are pretty sure that sole proprietorship is ideal for you, now you need to talk to experts for further guidance.

Check On Other Permits Or Licenses

The fees associated with not having the correct licenses or permits can be debilitating to a young business. Be sure that youve gotten the correct federal licenses and permits and state licenses and permits. These might include:

- A health department permit for preparing or serving food

- A federal license for transporting animals

- A health and safety training for opening a daycare

- A certification exam to become a financial advisor

- A zoning permit to operate your business from home

- Registration with the state tax authority if you have employees or collect sales tax

Do the legwork up front and find out what licenses and permits you need. The fees youll pay during this process are nothing compared to the fines youll pay if you havent filed the right paperwork.

You May Like: How Much Does A 8kw Solar System Produce

How Does A Sole Proprietorship Get Started

A sole proprietorship is unique because it’s the only business that doesn’t have to register with a state. All other business types – partnerships, limited liability companies, and corporations – must file a registration form with each state in which they do business.

Starting a sole prop business is fairly simple. To start a sole proprietorship, all you need to do is:

- Create a business name and decide on a location for your business

- File for a business license with your city or county, and get permission from your locality if you want to operate your business from home.

- Set up a business checking account so you don’t mix up business and personal spending.

In addition, your sole proprietorship may have to register with federal or state entities :

- If you plan to sell taxable products or services, you must register with your state’s taxing authority.

- If you plan to hire employees, you’ll need an Employer Tax ID Number from the IRS. Your bank may also require this tax number.

Write A Business Plan

Even though you dont have to formally set up your business as a sole proprietorship, its still a business and, the more organized it is, the better your chances are of reaching success.

Noel Damacio, Certified Public Accountant, says, Write a business plan and projections this will force you to be familiar with the financial numbers so you can determine the profitability and viability of your business. It will also help you identify your market and competition and how you are going to position yourself to generate the revenues.

Francine Love, Founder and Principal Attorney at LOVE LAW FIRM added, If you dont have the patience and the ability to complete this full analysis of your market, your skills, your money, your pricing, your competitors, etc., then how will you ever run a money-making operation?

Read Also: How Long Can Solar Panels Last

Advantages Of A Sole Proprietorship

- Pass-through taxation: For most businesses, being able to pass profits through to personal income results in lower overall taxes.

- Simplicity: Sole proprietorships are by far the simplest business type to create and operate. You can start as small as you like and grow at your own pace without a huge commitment.

- Low costs: The simplicity of a sole proprietorship means you’ll spend less on legal fees and tax services.

What Are The Disadvantages Of A Sole Proprietorship

Although a sole proprietorship is one of the simpler business entities, it puts a lot of responsibility on business owners. It offers zero legal protection of your personal assets, and there can be only one owner.

“If a business owner was sued, the owners could literally lose their personal car and personal home because of a business liability,” Jensen told Business News Daily.

Sole proprietorship also poses some security risks. “Another con is that when a business identification number is needed, the owner has to give out their Social Security number, greatly increasing the chance of identity fraud,” Jensen said.

Another drawback is that sole proprietors are not eligible for certain business tax breaks and small business loans. They could, however, be eligible for certain tax deductions intended for self-employed individuals.

Key takeaway: Sole proprietorships provide no legal protection for business owners’ personal assets and aren’t eligible for certain business tax breaks or small business loans.

Recommended Reading: How To Measure Sunlight For Solar Panels