How To Claim The Solar Tax Credit

Report the solar energy property your business began using during the year on line 12b, 12c, or 12ddepending on when construction beganof Form 3468. The investment credit, once calculated on Form 3468, then goes on Form 3800, Part III, line 4a. Form 3800 computes the business credit, which for individuals flows to Schedule 3 of Form 1040.

Make sure not to confuse the solar tax credit for businesses and the residential solar tax credit. The residential credit operates under similar but not identical rules. Form 5695 calculates the residential solar tax credit as part of the nonbusiness energy property credit. The nonbusiness energy property credit then goes on schedule 3 of Form 1040.

The solar tax credit offers significant tax savings. The credit percentage reduces after 2022, so plan now to secure maximum savings for your business.

About the Author

Stephen Sylvester

Stephen Sylvester, CPA helps CPA and finance firms turn expertise into new clients. By transforming esoteric technical iRead more

How Is The Federal Solar Tax Credit Calculated

The Federal Investment Tax Credit is 26% of the gross system cost of your solar project. That means that if the gross system cost is $20,000, your tax credit would be $5,200 . If there is a utility rebate or another form of incentive, the IRS will consider the gross system cost to be the post-rebate amount.

The gross system cost can include any improvements needed to facilitate the solar installation. This includes any electrical work needed for the installation such as a panel box upgrade and roof work under the solar array. Please speak to your tax advisor for specific advice for your given circumstances.

The credit is a dollar for dollar income tax reduction. This means that the credit reduces the amount of taxes that you own. One of the chief concerns clients voice is they think that since they are expecting a return at the end of the year when they file their taxes that they will not qualify for the federal tax credit. That is not the case! If youve already withheld money on your paycheck you may be eligible for a refund. The 26% credit will remain until 12/31/2020. After that, it will be reduced to 22% in 2021, and reduced entirely to 0% in 2022.

Check this video to find more about solar tax credit.

The Federal Tax Credit For Solar Panels

First, lets take a second to break down the federal solar tax credit. This credit began in 2005 with the Energy Policy Act.

You can claim this on your income taxes and reduce your tax liability. Since 2005, this tax credit has consisted of 26% of the cost of solar panel systems. This percentage will decrease in 2023 to 22%.

Remember, the goal is to make solar energy more affordable for the average homeowner. You can estimate how much your solar panels will save you in several ways. One method is to use a zero commitment savings report.

Your solar energy system must begin service during the current tax year to qualify for this tax season. Once you determine that you qualify, request the IRS Form 5695, also known as the solar tax form. You can request this document from the IRS website and review their instructions.

Read Also: Does Pine Sol Have Ammonia

How Do Solar Loans Affect Solar Tax Credit

There are two types of loans in solar as it relates to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to them for this monthly payment. If you do not, this will initiate another loan in the tax credit amount at the same APR.

The second type of solar loan is where youll have a different payment for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit youll have the option to submit your federal tax credit which will re-amortize your loan to lower monthly payments. You can also keep the federal tax credit and your payments will remain the same. Solar.com can help you figure out which of these options are best for you.

Can You Take Solar Credit And Depreciation

A $20,000 solar system qualifies for a $6,000 federal tax credit, as well as a $6,000 bonus depreciation credit. The federal solar tax credit will expire in 2020. In fact, in 2019, the full 26% federal tax credit is due to expire, and it will be reduced to 26% in 2020 and 22% in 2021.

In the past six years, there has been a significant increase in solar power installed in the United States. An assets depreciation is the accounting for how long it will last. During a five- to seven-year period, the cost of a solar energy system will depreciate. Many tax credits and incentives are available to offset the cost of solar panels at the beginning of their installation. According to a study, homes with solar panels sell 20% faster than those without them. There are few maintenance issues with solar systems, and they are not required to be repaired on a regular basis. Solar panels for a residential home range in price from $17,000 to $24,00.

You can obtain state and federal tax breaks in addition to solar power tax breaks. Depreciation of solar panels can help you save money on your energy bills, increase the value of your home, and help the environment at the same time. True Construction in Omaha 874-4339 can assist you in determining if a solar system should be depreciated.

Recommended Reading: What Is The Solar System

Safe And Reliable Grid Integration

For solar technology to provide a reliable source of electricity for the national power grid, solar power plants must support power quality, stability, and cybersecurity. SETO is working to address these challenges by studying the integration of solar with energy storage, load control, and other distributed energy resources. PV and storage can work together to help the grid rapidly recover from a cyberattack or physical disruption.

Modern CSP plants can also contribute to a reliable power grid because of their built-in thermal energy storage. To help improve grid reliability, SETO aims to identify cost-effective long-duration thermal energy storage configurations for CSP plants and develop pumped TES systems having a round-trip energy efficiency greater than 50%.

Such advances, in combination with reductions in the cost of energy storage, could enable economically competitive solar to be widely deployed across the country while contributing to the reliability and resilience of the electricity grid. Learn more about our systems integration research.

When Does The Federal Solar Itc Expire

The federal ITC has been extended and increased as of August 16, 2022. A 30% tax credit is now available until the end of 2032 for residential solar installations.

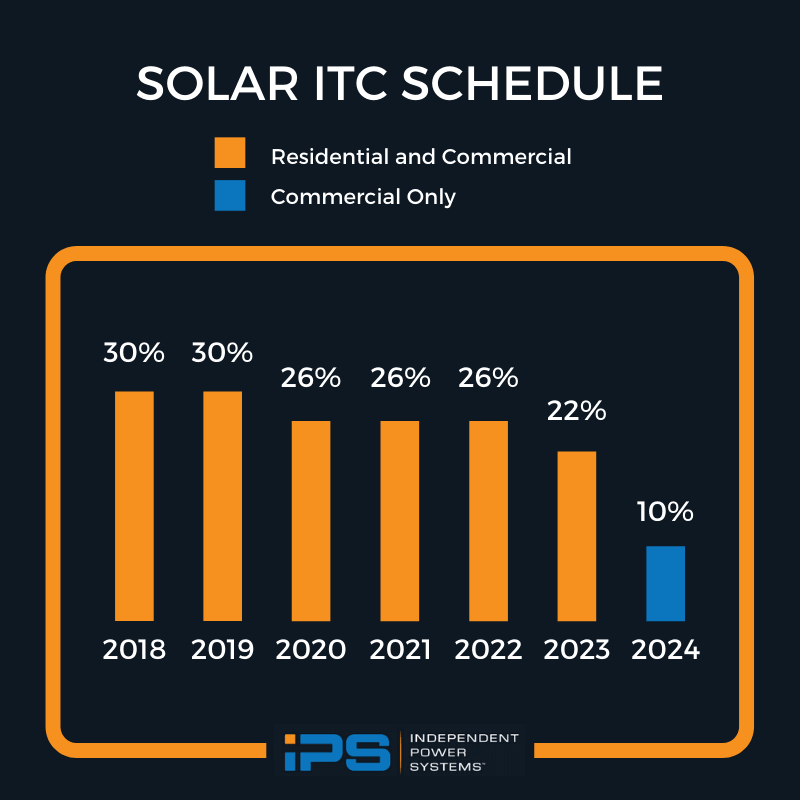

The federal solar tax credit was set to expire at the end of 2024, with some caveats. Under the old law, the ITC was:

- 26% for projects where construction starts in 2022

- 22% for projects where construction begins in 2023

- Set to expire for residential solar projects after December 31st, 2023

- Set to drop permanently to 10% for commercial projects beginning in 2024

Commercial and utility-scale projects that start construction after August 16, 2022, are now subject to the new law. This changes project eligibility significantly, involving requirements regarding labor and materials. Projects that began before the Inflation Reduction Act was signed into law may still qualify for the 22% or 26% ITC.

Recommended Reading: Solar Lights For Garden Lowes

Do Solar Panels Qualify For Tax Credit

Solar panels are a popular way to reduce energy costs and save on monthly utility bills. Many homeowners and businesses are looking to solar to lower their carbon footprint and help the environment. Solar panels can also provide an important tax credit. The federal government offers a tax credit for solar energy systems, and many states offer additional credits as well. To learn more about solar tax credits and how to take advantage of them, contact a solar energy specialist.

Between 2020 and 2022, the federal government will give you a 26% tax credit for installing a solar power system. If you spend $10,000 on your system in the following year, you will owe $2,600 less in taxes. The solar tax credit will reduce to 22% in 2023 and then expire for residential installations in 2024. The solar investment tax credit currently has a value of 26% of total system costs. If you purchase and install an $8,000 system, you would be entitled to a $2,300 credit. The tax credit, in addition to providing a significant return on investment from solar energy, has a significant impact on the return on investment. If you purchased a solar system before the end of the year, and you owe federal taxes in the United States, you may be eligible for the tax credit.

What Is The Solar Investment Tax Credit

The United States federal government subsidizes the purchase and installation of solar power generating systems with a general federal solar tax credit*. The renewable energy tax credit is available to both residential homeowners and commercial businesses. It also significantly reduces the payback time for solar power investments.

- The federal solar investment tax credit is a tax credit that can be claimed on federal income taxes for 30% of the cost of a solar photovoltaic system.

- The system must be placed in service during the tax year it is claimed and generate electricity for a home located in the U.S.

- Although the increased 30% tax credit was approved in August of 2022, that rate is retroactive to systems placed into service any time that calendar year.

- The 30% tax credit applies to the total cost of a residential solar energy system, including labor and equipment.

- The tax credit applies to solar panel batteries. As of January 1, 2023, that will include standalone backup batteries.

- There is no maximum amount that can be claimed.

- If you dont use all the tax credit the first year, the remaining amount can be rolled over to the following year.

Recommended Reading: What Is The Best Solar Generator For Home Use

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS From 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount over 5 years.

Check this video that walks you through the process for claiming the tax credit.

In conclusion, the federal tax credit is 30% of your gross system cost and is a great opportunity to go green, create clean energy, and save money on home improvement. Now is the time to go solar!

Take Control Of Your Electric Bills By Going Solar Now

Put the sun to work for you. When you purchase a Sunrun home solar system, the 26% federal solar tax credit is cut directly off the cost of your solar installation. Thats a reduction of thousands of dollars from the total price.

To receive the greatest tax credit benefit, go solar today. Youll lock in long-term lower electricity prices and make the earth a healthier place for everyone. Plus, you dont have to worry about researching incentives and filling out extra tax forms. Weve got you covered.

Additionally, Sunruns home solar service plan is designed for your home characteristics, lifestyle, energy use, and financial goals. Well guide you through the process every step of the way from the tax credit and installation to maintenance and monitoring.

Sunrun is the leading home solar installer in the United States. We’ve been providing renewable energy to homes for more than a decade, and every year the future gets brighter. Together, we’re building an affordable and sustainable energy system for the whole nation, and next generation.

When youre ready to talk about solar for your home, Sunruns team is here for you. Contact us for a complimentary quote. Make a brighter tomorrow by starting today.

See if you qualify for the26% federal tax credit

Read Also: Solar Lights To Use Indoors

Solar Tax Credit If I Get A Refund

Because this tax credit is nonrenewable, you will not be able to receive a refund for the entire amount of the solar tax credit that exceeds your tax liability. If you do not use all of your solar tax credit for the upcoming tax year, you can still claim it.

If you install a solar power system, you will be eligible for a federal tax credit that reduces your federal tax liability. The tax credit has assisted tens of thousands of homeowners in converting to solar power. A solar tax credit is not subject to a specific amount or maximum amount of credit. You should thoroughly understand the solar tax credit before purchasing a solar system. A tax credit allows you to subtract a certain amount from the amount you owe in taxes. The tax credit is a type of tax break, whereas the deduction is a tax break. The two most common types of tax credits are refundable and non-refundable.

What Is The Solar Tax Credit

The solar tax credit offers a dollar-for-dollar reduction in federal tax liability.

Internal Revenue Code Sections 48 and 48 grant businesses a tax credit for solar equipment as part of the energy credit. The energy credit, in turn, contributes to the investment tax credit. Finally, the investment tax credit comprises part of the general business credit.

The general business credit can only offset tax liability. However, any unused portion can go against tax from the prior year and up to twenty future years.

The amount of the solar tax credit equals a percentage of the cost of eligible propertycalled solar energy propertyplaced in service during the year. This percentage varies according to the year construction began:

- 30% in 2019 or earlier.

- 26% in 2020-2022.

- 10% in 2024 or later0% for fiber-optic solar energy property.

The credit automatically drops to 10% if your business doesn’t start using the solar equipment before January 1, 2026.

The IRS considers construction begun when physical work of a significant nature” starts. This test looks at all the facts and circumstances surrounding construction of the property. Alternatively, the IRS deems the requirement met after your company incurs at least 5% of the final project costs.

Don’t Miss: How To Heat Pool With Solar Panels

The Solar Tax Credit Program: Not As Beneficial As It Seems

An audit by the Treasury Departments tax administration inspector general recently found that the IRS does not have the ability to track and account for home energy tax credits. According to IRS regulations, taxpayers are not required to provide third-party documentation proving that qualifying home improvements were made or that improvements to the principal residence were made. The solar tax credit, which is intended to encourage solar installation, may not be available to taxpayers who are ineligible. The solar tax credit is only available to taxpayers who owe federal income taxes for the current fiscal year. You may not be able to claim the solar tax credit if you are on a fixed income, retired, or work part-time during the year. If you invest in solar panels, you may be eligible for a solar investment tax credit. This tax break cannot be claimed by the taxpayer. Instead of owing taxes, you will receive a reduction. This credit is available in the tax year for the installation of a solar photovoltaic system. Credit can be claimed as a deduction on your federal income tax return or as a credit against your tax liability depending on the credit. The Solar Tax Credit Program does not issue refunds to ITC recipients, but you may receive one if you overpay taxes due to the credit.

How To Claim The Solar Tax Credit Irs Form 5695

Disclaimer: This article provides an overview of the federal solar tax credit and other residential solar energy system incentives. Were solar experts, not tax professionals, and this article does not constitute professional tax advice.

Going solar is a great opportunity to save on monthly energy bills and reduce your dependence on your utility company. The federal tax credit for going solar is the best incentive offered by the government, and well go into more detail on how to claim it with IRS From 5695.

First of all, a tax credit is a reduction in the amount of taxes you owe, according to the IRS. All solar installations before the end of 2022 will qualify for this incentive.

The typical homeowner that goes solar energy pays about $20,000 for a typical solar energy system. So, in this example, with the solar ITC of 30%, It will reduce your tax liability by $6,000. Thats quite a bit back from your investment already! Taking advantage of this credit is easy as A-B-C if you know how to claim it.

Don’t Miss: Is There A Government Scheme For Free Solar Panels

State Of Hawaii Incentives

Hawaii Renewable Energy Technologies Income Tax Credit

The Hawaii Department of Taxation oversees the Hawaii Renewable Energy Technologies Income Tax Credit.

Database of STATE Renewable Energy and Energy Efficiency Incentives Available in Hawaii

The Database of State Incentives for Renewables & Efficiency , maintained by the North Carolina Clean Energy Technology Center and originally funded by the United States Department of Energy, is a free and open resource providing a searchable database of incentives and policies available for clean energy in each state.

Hawaii Enterprise Zones

Currently, wind energy producers may be eligible for this incentive that provides a 100% general excise tax exemption as well as reductions in state income taxes in exchange for demonstrated job growth. This incentive is available statewide in designated geographic areas.

Hawaii Foreign Trade Zone

Hawaiis Foreign Trade Zone Program supports manufacturing and small business activity in Hawaii by encouraging companies to compete in export markets and providing growth to new companies that import and export merchandise, including renewable energy and energy efficiency equipment.

Renewable Fuels Production Tax Credit

In June of 2022, Governor Ige signed Act 216, which reinstates the Renewable Fuels Production Tax Credit .