Are Solar Batteries Covered By The Solar Investment Tax Credit

The Internal Revenue Service specifies that battery installations for which all energy that is used to charge the battery can be effectively assured to come from the Solar Energy System are eligible for the full solar tax credit.

In other words, yes, solar batteries like the Tesla Powerwall and the LG Chem are eligible for the solar tax credit if they are charged by solar energy more than 75% of the time.

This means that if you install a battery with a new solar system, you will save 26% on the total combined cost.

Is The Solar Itc Refundable

The solar ITC is not a refundable credit it can only be used against your organizations U.S. federal income tax liability.

However, the solar ITC may be carried back one year and forward up to 20 years for companies that dont have sufficient tax liability to offset for the tax year their solar energy system was placed in service.

A deduction is allowed for 50% of any portion of the solar ITC that remains unused after the 20-year carry forward period.

Tax Incentive Extensions And Modifications

- Would extend the renewable energy production tax credit with a base credit rate of 0.5 cents/kilowatt hour and bonus credit rate of 2.5 cents/kilowatt hour through 2026 with a phasedown after that as specified below .

- Most facilities: The PTC for the following facilities would be extended through the end of 2026:

- Closed loop and open loop biomass,

- landfill gas ,

- trash ,

- geothermal.

Taxpayers could claim an increased credit for facilities placed into service after Dec. 31, 2021, if such facilities met domestic requirements described above. This provision would provide a base credit increase of 2% of the amount otherwise allowable with respect to such facility, or a bonus credit increase of 10% of the amount otherwise allowable with respect to such facility if prevailing wage and apprenticeship requirements are satisfied. After 2026, the incentive would transition to a technology-neutral PTC under Section 45BB after 2026 .

Taxpayers could claim an increased credit with respect to energy property placed into service after Dec. 31, 2021, if such property met the domestic requirements described above. This provision would provide an increase on the base credit rate of 2% or an increase in the bonus credit rate of 10% with respect to the credit percentage allowable for such facility.

You May Like: How To Estimate Solar System Size

Federal Solar Tax Credit Extension

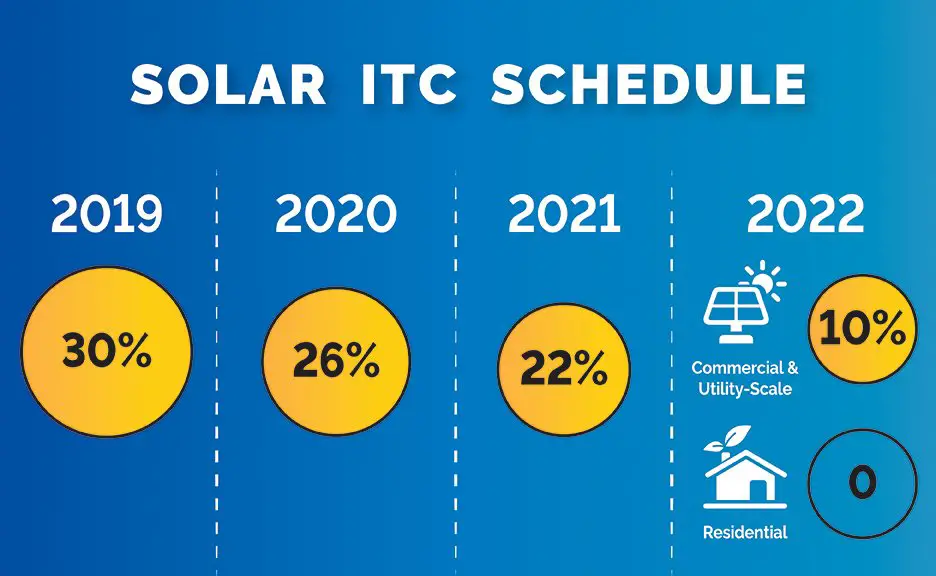

Perhaps the most important provision included in the Moving Forward Act is the extension of the federal solar tax credit, also known as the investment tax credit .

The federal tax credit has been a major player in the growth of the solar industry, allowing solar to have an impressive average annual growth rate of 49%. If passed, the Moving Forward Act would extend the federal tax credit for an additional five years.

The new incentive step down schedule would be as follows:

- Restore the federal tax credit to 30% until December 31, 2025

- Step down the tax credit to 26% in 2026

- Step down the tax credit to 22% in 2027

- Set the tax credit expiration date to January 1, 2028

When the Moving Forward Act was proposed, solar system owners could qualify for a tax credit thats equal to 26% of the costs of their solar installation. The tax credit was then set to drop down to 21% in 2021, and then expire on January 1, 2022. The starting date of the extension could not be determined until the bill has been passed.

This step down had solar installers nervous, as they feared less people would be willing to go solar without the tax credit. The approval of this extension could bring installers some peace of mind.

How Can I Claim The 26% Solar Tax Credit

To be eligible to claim the 26% tax credit, your solar energy system must be installed, paid for, and commissioned by your power utility in the year you wish to claim it on your taxes. Only purchased systems apply. If you’re leasing, the tax credit goes to the lease holder. To file your taxes claiming this incentive, you’ll need to complete the IRS form 5695 – Residential Energy Credits. We strongly recommend speaking with an accountant to cover the intricacies of filing and claiming your 2021 solar tax credits to ensure you’ve completed it properly.

Also Check: What Is Soft Solid Deodorant

Us Solar Federal Investment Tax Credit Cheat Sheet:

Before the ITC, those who owned new solar panels or combined those with storage systems were not allowed to claim Federal tax credits unless their system was fully operational. Due to the new 2020 extension of ITC tax credit, these are the new deadlines:

26% Tax Credit: Commence construction by 12/31/2022, complete project by 12/31/2023. 22% Tax Credit: Commence construction by 12/31/2023, complete project by 12/31/2025 10% Tax Credit: Anything built after 01/01/2026

*Safe Harbor qualifications and dates may change due to COVID-19.

Not only are there better incentives for commercial and residential solar, but also there are moves to extend the financial benefits from investing in batteries and other electric storage systems thanks to the ITC.

A bilateral bill titled the Energy Storage Tax Incentive and Deployment Act was launched on April 4th, 2019 as the latest update to a bill first introduced in 2016 by Sen. Martin Heinrich . This extension is basically offering the same incentives but at the same time decreasing percentages for solar.

Solar Tax Credit Extended For Two Years

May 2021

A federal tax credit for the purchase and installation costs of a residential solar system has been extended through 2023. The solar tax credit for 2021 and 2022 is 26% of the cost of the solar installation but drops to 22% for 2023, the final year of the credit .

How the Solar Tax Credit Works

When you see TV ads for home solar power, you may get the impression that Uncle Sam is going to pick up 26% of the cost, and you only have to come up with the other 74%. But that is not the whole picture. Its true that the federal government has a 26% tax credit for the cost of a qualified solar installation . However, the federal credit is non-refundable and can only be used to offset your current tax liability. Any excess carries over to future years, as long as the credit still applies in future years. Currently, the credit is allowed through 2023. This means that you may not get all the credit in the first year, as you might have been led to believe.

Is a Solar System Right for Me?

Compare the cost of the system to conventional electricity costs. How many years will it take to recover your cost? Do you plan to live in your home beyond that time? Is a solar system really worth the cost? Electricity costs can vary significantly according to locale.

If you plan to move forward with a solar installation, here are some of the tax issues you need to be aware of.

Qualifying Property for the Solar Tax Credit

Only the following solar power systems are eligible for the credit:

You May Like: Do I Need To Clean My Solar Panels

Reduce Before You Produce

Even after the extension, time is of the essence when it comes to saving on solar. Of course, the earlier you install solar the more you stand to save on your energy bill. But if you are hoping to reduce the energy demand in your home first, which is an extremely important aspect of energy management, you are going to want to get started now on any energy efficient upgrades to your home before starting and completing your solar installation. Having a smaller energy demand, means a small and cheaper solar energy system to offset your energy consumption.

Our solar and energy experts can perform a solar needs analysis to identify and plan your energy goals before going solar. Get your project on the calendar before the schedule fills up, and you miss out on these savings!

How To Qualify For The Solar Tax Credit

This all sounds great, but what do you need to know ahead of time about qualifying for these tax savings? In order to qualify for the Federal Investment Tax Credit, you must:

- Own your own solar panels

- Own your property

- System must be placed in service by Dec. 31, 2022

You must also have enough taxable income to utilize the allowed deduction. For commercial systems, all of the above qualify with the exception that the installation project is only required to begin construction by Dec. 31, 2022 or meet the 5% safe harbor qualifications and the project must be completed by the fourth calendar year.

Recommended Reading: Does My House Qualify For Solar Panels

The Federal Solar Tax Credit Has Been Extended Through 2023

Ecohouse Solar was excited to learn the federal solar investment tax credit was extended at the end of 2020. The ITC, which was initially going to begin phasing out at the end of 2020, received a much-needed two-year extension.

The extension will provide an extra incentive for going solar until 2023.

Here are a few core points you should know about the Investment Tax Credit :

- The ITC is the federal policy which allows solar system owners to be refunded some of their solar installations cost from their taxes.

- The solar ITC is the primary financial incentive to go solar in the U.S.

- In some cases, it can be used for battery storage as well.

The extension gives everyone more time to take advantage of the Federal solar tax credit.

Instead of dropping to 22% at the end of 2020, the tax credit has been frozen at 26% for all solar projects which commence construction between Jan. 1, 2021 and Dec. 31, 2022. This extension includes residential, commercial, industrial, and utility-scale arrays.

The current plan mandates that in 2023, the tax credit for all solar projects will drop to 22%.

Beginning in 2024, residential projects will no longer receive a tax credit. However, commercial and utility solar projects will retain a permanent 10% credit.

Please contact us for a free proposal

When Is The Credit Available

The credit may be claimed on the return the year that the installation was completed. For example, if you purchase/pay for a system completed in 2022, the credit will be 26% of the cost. But if the project isnt completed until 2023, the credit will only be 22%. This becomes a bigger issue for systems installed during 2023. This is because bigger solar systems take time to install. However, if the system isnt installed before 2024, there will be NO credit is available. So, if you plan to purchase a solar system in 2023, do it as early in the year as possible. This ensures the installation will be complete by 2024 in order to receive the tax credit.

Also Check: Can You Write Off Solar Panels On Your Taxes

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

% Solar Tax Credit Extended Through 2022

The $1.4 trillion federal spending package signed into law at the end of 2020 contained some good news for Americans looking to convert to solar energy. The 26% solar investment tax credit that was just a few days away from expiring got extended for another two years. So, any solar installation that begins construction before 2023 will still be eligible for the full 26% tax credit.

Though a lot of folks dont know about the ITC, its one of the most important actions congress has taken to encourage the growth of clean and renewable energy. And youll definitely want to factor it in when calculating your return on investment for going solar.

So, what is ITC and how does it work?

Also Check: How Much Does A Solar Panel Battery Cost

Moving Forward In The Solar Industry

Its important to keep in mind that this version of the Moving Forward Act is a starting point for the bill. As of right now, the bill largely has Democratic support, and Republican legislators are likely to call for changes to the bill.

But, the number of solar provisions included in this bill is a great starting point, and a huge success for the industry. Hopefully, at least a few of these proposals will make it through to the final bill.

Even if the solar provisions are removed from the Moving Forward Act, the solar industry is still on track to grow in the long run. Solar Energy Industries Association predicts that in 2023, over 5,000 megawatts of solar will be installed in the US.

Thats more new solar capacity than ever before! But, that number could be even higher with things like an ITC extension and low income solar programs.

To show your support for the Moving Forward Act, and to support other solar policy initiatives, you can sign SEIAs most recent letter to Congress.

Update: The Moving Forward Act did not pass. However, Congress did approve an extension of the federal solar tax credit in December 2020 as part of a coronavirus stimulus package. You can read more about the new ITC schedule here.

Find out how much you can save with solar

The Itc Extension: A New Opportunity

For motivated solar installers, the ITC extension gives a welcome chance to reach prospects with the message that these next two years are the time to go solar. And for the economy as a whole, its a much-needed shot in the arm.

All in all, its great news for the solar industry. If youre looking to take advantage of this opportunity, one great place to start is by watching Kenneth Williams free walkthrough on his how to sell storage using a consultative approach. By leveling up your sales skills for these and other ITC-eligible projects, youll have the tools to grow your business in 2021 and beyond.

You May Like: Can You Run Pool Pump With Solar Cover On

Tips When Looking Into Solar Energy Systems

Investing in solar energy is an important decision. Business owners must research as many options and providers as possible. For those organizations with less capital to invest, leasing or a Power Purchase Agreement may be a better option.

Get the most out of solar energy for your business with the Solar Federal Investment Tax Credit!Are you ready to find out how to get your solar project off the ground or want to talk to one of our solar energy expert advisors about ITC eligibility?

Moving Forward Act Pushes For Brighter Solar Industry Future

On June 22, 2020, members of the House Transportation and Infrastructure Committee approved a massive infrastructure investment package – aptly named the Moving Forward Act, designed to improve infrastructure in the wake of the coronavirus pandemic.

The Moving Forward Act expands the previously-introduced $500 billion INVEST America highway bill into a comprehensive $1.5 trillion bill, that addresses a myriad of issues, including expanding renewable energy in the US.

The Moving Forward Act seeks to extend the federal solar tax credit, which has been one of the driving forces for solar industry growth. Image source: Grist

Buried deep within the2,309 page bill is a proposed $70 billion investment in clean energy, which includes an extension of the federal solar tax credit, which is set to expire at the end of 2021.

The federal tax credit is one of the driving forces behind rapid solar growth in the US, as it makes solar more affordable for homeowners. When more people can afford solar, installers have more projects, leading to a healthier and bigger solar industry.

Approval of this bill could greatly change the future of the solar industry – for the better.

Also Check: How To Charge Your Electric Car With Solar Panels

What Solar Provisions Are Included In The Moving Forward Act

The Moving Forward Act proposes many different clean energy and technology investments, including:

- Funds for transmission planning with a requirement to account for renewable energy generation

- Grant program for solar installation in low-income and underserved communities

- Funds for renewable energy installation in community institutions, such as schools

- Improvements to public lands renewable energy development programs

Lets take a look at some of these provisions a little more closely.