Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home or rental property to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 30% credit would be $3,000, and you could claim 25% of that, or $900.

- $10,000 system cost x 0.30 = $3,000 credit amount

- $3,000 credit amount x 0.30 = $900 credit amount

What Are The Criteria To Claim The Solar Energy Credit

You can claim the credit once toward the original installation of the equipment. You must own the solar photovoltaic system and it must be located at your primary or secondary residence. If you are leasing solar panels, you dont get the tax incentives.

There is no maximum amount that can be claimed, though. In addition, if you financed the system through the manufacturer and are contractually obligated to pay for it in full, you can claim the credit based on the full cost of the system.

You dont even have to be connected to the electric grid to claim the federal solar tax credit, though there are definite financial incentives to being connected.

If Congress doesnt renew it, the Federal Solar Investment Tax Credit will vanish in 2024.

Read Also: How Much Is Sunrun Solar

Who Can Qualify For Solar Incentives

Whether you can qualify for a solar incentive program depends on a few factors, including:

- Incentive availability in your state

- Whether you have tax liability

- Your annual income

Yes, its true: some states dont offer incentives for solar. In these places,solar can still make financial sense, but not because of anything the statelegislature is doing to help homeowners go solar.

The good news is everyone can qualify for the federal tax credit as long as they have enough income to owe taxes.Tax liability is a fancy way of saying the amount that you pay in taxes.

Your annual income determines how much you owe, and if you make enough, youll be able to claim bothfederal and state solar tax credits. In many cases, you can claim thesecredits over multiple years if your tax liability is less than the totalamount of the credits.

Low-income solar incentives

Your annual income can also help you qualify for incentives in theopposite direction. If you make below the area median income inseveral states, you may qualify for low-income grants and rebatesthat can greatly reduce the cost to go solar even making solarbasically free in some places.

Learn more:Low-income solar incentives by state

Do solar leases and PPAs qualify you for incentives?

The good news is that people who choose a solar lease or PPA in a statethat offers incentives will likely find the per-kWh electricity pricefrom the solar installer lower than people in states without incentives.

Read Also: Can I Change Sole Proprietorship To Llc

What Is The Tax Allowance For 2021 22

The personal allowance is set at £12,570 for 2021/22. Both the allowance and the base rate cap have been increased in line with inflation from 2020/21. As a result the higher rate threshold the point at which individuals become liable to pay higher tax rates is £50,270 for 2021/22.

What is the tax allowance for 2021 2022?

The Personal Allowance rate is confirmed on each annual Budget and the trend is increasing every tax year. The numbers are the same in all four UK countries. Chancellor Sunak announced that the Personal Allowance for the fiscal year 2021-2022 is £12,570. It takes effect from April 6, 2021.

What is the personal tax allowance for 2021 22?

For the fiscal year 2021-22, the government increased the amount of the Personal Allowance by £70 to £12,570. This is common in the first Budget of the new tax year. What is different from this one, is that the Chancellor announced this would remain the same for five tax years.

Renewable Energy Production Tax Credit

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. 1, 2021, using a qualified energy resource.

A qualified energy generator is a facility that has at least 5 megawatts generating capacity located on land in Arizona that is owned or leased by the taxpayer, that produces electricity using a qualified energy resource and that sells electricity to an unrelated entity, unless the electricity is sold to a public service corporation.

Approval and certification from the Arizona Department of Revenue is required prior to claiming the tax credit. Applications must be submitted between January 2 and January 31 of the following calendar year of production. Applications not submitted in January will not be accepted. No more than $20 million can be approved by the department in a calendar year.

Read Also: Solar Panels On Your Home

What Does The Solar Tax Credit Cover

Taxpayers who installed and began using a solar PV system in 2022 can claim a federal tax credit that covers 30% of the following costs:

- Cost of solar panels

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries. Storage devices must have a capacity rating of at least 3 kilowatt-hours .

- Sales taxes paid for eligible solar installation expenses

Frequently Asked Questions About The Solar Tax Credit

Calculating the cost of going solar can be complicated as it is, let alone incorporating other financial incentives and tax credits into your estimate. Check out a few other commonly asked questions related to the ITC for more clarification:

How much is the federal solar tax credit for in 2022?

In 2022, the federal solar tax credit will deduct 30 percent of the cost of a system for eligible residential and commercial tax payers. The ITC will disappear for residential systems starting in 2035.

Is the solar tax credit a one-time credit?

Right now, the ITC is a one-time credit. But, you may carry over the excess credit to the next year if you cant use it all when you file. For example, if you only owed $6,000 in taxes but received the $6,200 solar tax credit, youd pay $0 in taxes for the tax year when you placed the claim. Then, youd also get to reduce next years taxes by the remaining $200.

Will the solar tax credit increase my tax refund?

The solar tax credit will not increase your tax refund. Rather, The ITC amount is applied against your tax liability, or the money you owe the IRS.

Recommended Reading: What Are The Pros And Cons Of Having Solar Panels

How Do I Claim The Federal 30 Tax Credit For Solar Installation

To claim the credit, you must file IRS Form 5695 as part of your tax return. You calculate the credit on Part I of the form, and then enter the result on your 1040.

How does the tax credit work for solar? The investment tax credit , also known as the federal solar tax credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and is not capped.

Are You Eligible To Claim This Federal Solar Incentive

Your eligibility to claim this federal solar incentive on your and receive your 30% tax credit is based on whether you meet the following criteria :

- Your solar PV system must have been installed and began operating at some point between January 1, 2022, and December 31 of 2032.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost. You wont be eligible if you opt for a solar lease or power purchase agreement .

- The solar system must have been used for the first time. You only get to claim this credit once, for the original installation of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you wont be able to claim a second credit.

You May Like: How Do Tesla Solar Panels Work

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

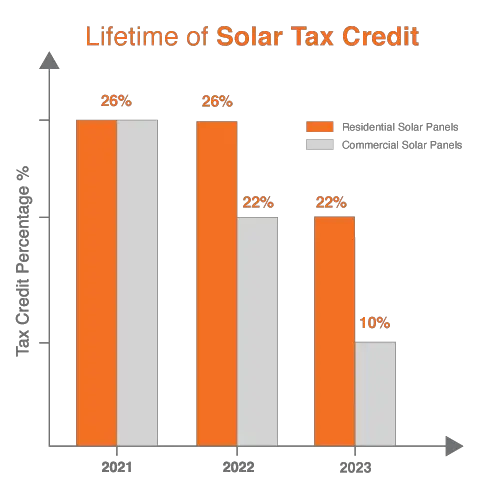

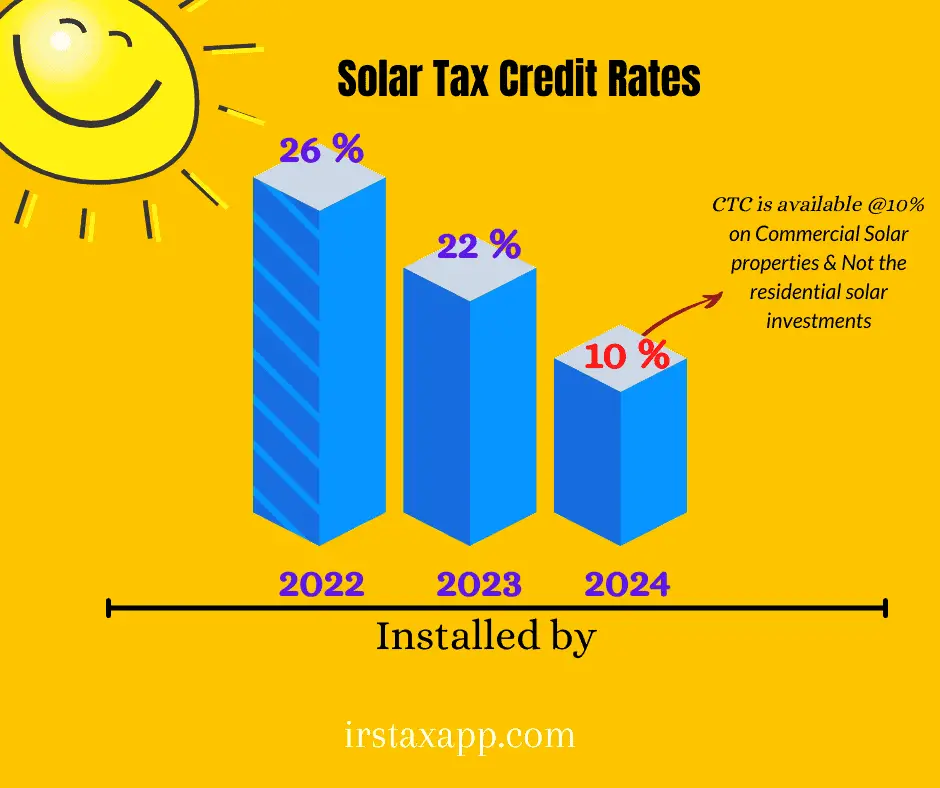

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC the company that leases the system or offers the PPA collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Kelly McCann, an attorney at a law firm that specializes in real estate and construction law in Portland, Oregon, said these tax credits can be a huge bonus for taxpayers when they understand how they work.

McCann offered the following example:

Suffice it to say, tax credits are better for the taxpayer than are tax deductions, McCann said.

What Will Happen When The Solar Tax Credit Steps Down

This is obviously speculative, but we foresee a couple of possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas.

- These incentives would ideally meet or exceed the federal tax credit as it goes away, but thats very uncertain.

Don’t Miss: Solar Panel Tax Credit 2021 California

What Is The Federal Solar Investment Tax Credit

The ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. Thanks to the popularity of the ITC, and its success in supporting the United States transition to a renewable energy economy, Congress has delayed its expiration date multiple times, including most recently in August 2022 as part of the Inflation Reduction Act, extending the ITC at 30 percent for 10 additional years. Now, the solar investment tax credit is available to homeowners in some form through 2034. Heres a timeline of the ITC:

- 2016 2019: the energy tax credit remained at 30 percent of the cost of the system.

- 2020 2021: owners of new residential and commercial solar could deduct 26 percent of the cost of the system from their federal income taxes.

- 2022 2032: owners of new residential solar can deduct 30 percent of the cost of the system from their taxes. Commercial solar systems will also be eligible for 30 percent until 2025, at which point the U.S. Department of Treasury will determine if the ITC will continue for commercial systems.

- 2033: owners of new residential solar can deduct 26 percent of the installation costs of the system from their taxes.

- 2034: owners of new residential solar can deduct 22 percent of the installation costs of the system from their taxes.

- 2035: there is no federal credit for residential solar energy systems starting this year.

How Much Of A Credit Can I Claim On My Tax Return For A New Solar Hot Water Heater

You could be eligible for an energy-efficient home improvement tax credit on as much as 30% of the cost, including installation, with no upper limit. But the value of the tax credit is scheduled to decrease over time.

- 30% for systems placed in service by 12/31/19

- 26% for systems placed in service after 12/31/19 and before 01/01/23

- 22% for systems placed in service after 12/31/22 and before 01/01/24

Other common questions about solar hot water heater tax credits:

- Is a solar water heater installed for a swimming pool or hot tub eligible for a tax credit? No.

- Do solar hot water repairs qualify for tax credits? No. They are considered maintenance expenses rather than home improvement expenses and therefore are not eligible.

- Will any ENERGY STAR® solar water heater qualify? Yes, all ENERGY STAR-certified solar hot water heaters are eligible for the tax credit.

Read Also: What Is Solar Home System

Read Also: How Much Do Solar Panels Cost In Arizona

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Q Is A Roof Eligible For The Residential Energy Efficient Property Tax Credit

A. In general, traditional roofing materials and structural components do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing, serving both the functions of solar electric generation and structural support and such items may qualify for the credit. Components such as a roof’s decking or rafters that serve only a roofing or structural function do not qualify for the credit.

Read Also: How Much Does A Solid Wood Interior Door Cost

Savings With The Federal Solar Tax Credit

The federal solar investment tax credit offers immense savings on photovoltaic system installation costs and the faster you begin your project, the more money you can save.

Each year, the federal incentive amount drops:

- In 2019, the credit is 30 percent of the system costs

- In 2020, the credit will be 26 percent of the system costs

- In 2021, the credit will be 26 percent of the system costs

- In 2022, the credit will be 26 percent of the system costs

- In 2023, the credit will be 22 percent of the system costs

- In 2024, the credit will be gone for residential and 10 percent of the system costs for commercial

As long as you own your solar energy system, you qualify for the federal ITC. And if you dont owe Uncle Sam enough to claim the entire credit, you can roll over the remainder.

Are Solar Batteries Covered By The Solar Investment Tax Credit

The Internal Revenue Service specifies that battery installations for which all energy that is used to charge the battery can be effectively assured to come from the Solar Energy System are eligible for the full solar tax credit.

In other words, yes, solar batteries like the Tesla Powerwall and the LG Chem are eligible for the solar tax credit if they are charged by solar energy more than 75% of the time.

This means that if you install a battery with a new solar system, you will save 26% on the total combined cost.

Also Check: Solar Light Caps For Posts

How Many Times Can You Claim Solar Tax Credit

7. Can you claim solar tax credit twice? You cannot technically claim the solar tax credit twice if you own a home however, you can carry over any unused amount from the credit to the next tax year for up to five years. Note: if you own more than one solar-powered home, you may qualify.

How many times can you claim the solar tax credit?

As a homeowner, you can claim a federal solar tax credit for the amount of money you pay toward solar installation, and reduce the amount you owe when you file your annual federal tax return. Solar Investment Tax Credit can be filed one time for the tax year in which you install your system using Tax Return 5695.

Can you claim solar tax credit every year?

The ITC is 26 per cent non-refundable. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried forward one year and forward 20 years. So, if you had a tax liability last year, but have none this year, you can still claim the credit.

Can you claim the solar credit more than once?

Can you claim solar tax credit twice? You cannot technically claim the solar tax credit twice if you own a home however, you can carry over any unused amount from the credit to the next tax year for up to five years. Note: if you own more than one solar-powered home, you may qualify.